What’s happening in fiscal and monetary policy right now? The Hutchins Roundup is a new feature from the Hutchins Center on Fiscal and Monetary Policy to help keep you informed on the latest research, charts, and speeches. Sign up to have the Hutchins Roundup delivered to your inbox, or email us with your suggestions for items to include in the next Roundup.

Variations in state-level health care spending don’t tell us much about quality

In a new paper for this week’s Brookings Panel on Economic Activity (BPEA), Hutchins’ own Louise Sheiner finds that geographic variation in health care spending can largely be accounted for by underlying health characteristics of states. This finding is counter to one suggested by researchers at Dartmouth and elsewhere that attributes the variation in spending to differences in efficiency or quality. Sheiner’s paper is one of six new BPEA papers now available on the Brookings website.

Extended unemployment benefits have a modest impact on the unemployment rate

Regis Barnichon of the Universitat Pompeu Fabra and Andrew Figura of the Federal Reserve Board find that over the past 35 years emergency and extended unemployment benefits have had only a small impact on the unemployment and participation rates in the United States. According to their findings, extended benefits increased the unemployment rate by only one-third of a percentage point during the Great Recession and had next to no impact on the participation rate.

The Beige Book remains a useful tool

Using data collected from businesses in a survey conducted in conjunction with gathering anecdotes for the Federal Reserve’s Beige Book, the Federal Reserve Bank of Chicago has constructed an index to illuminate current and future economic conditions—particularly at the regional level.

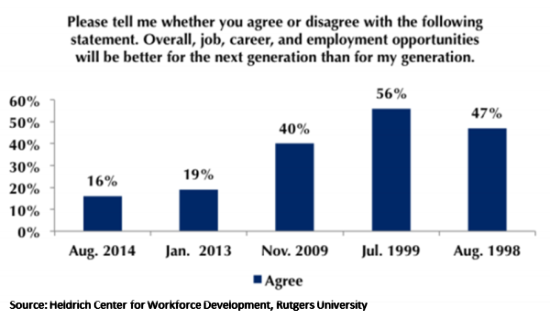

Chart of the Week

In the aftermath of the Great Recession, Americans are more pessimistic about the future.

Quote of the Week: Wholesale short-term funding remains a risk

“We believe that more needs to be done to guard against short-term wholesale funding risks. While the total amount of short-term wholesale funding is lower today than immediately before the crisis, volumes are still large relative to the size of the financial system. Furthermore, some of the factors that account for the reduction in short-term wholesale funding volumes, such as the unusually flat yield curve environment and lingering risk aversion from the crisis, are likely to prove transitory.” – Daniel K. Tarullo, member, Federal Reserve Board

Commentary

Hutchins Roundup: Health Care Spending by State, How Unemployment Benefits Impact Joblessness, the Beige Book

September 11, 2014