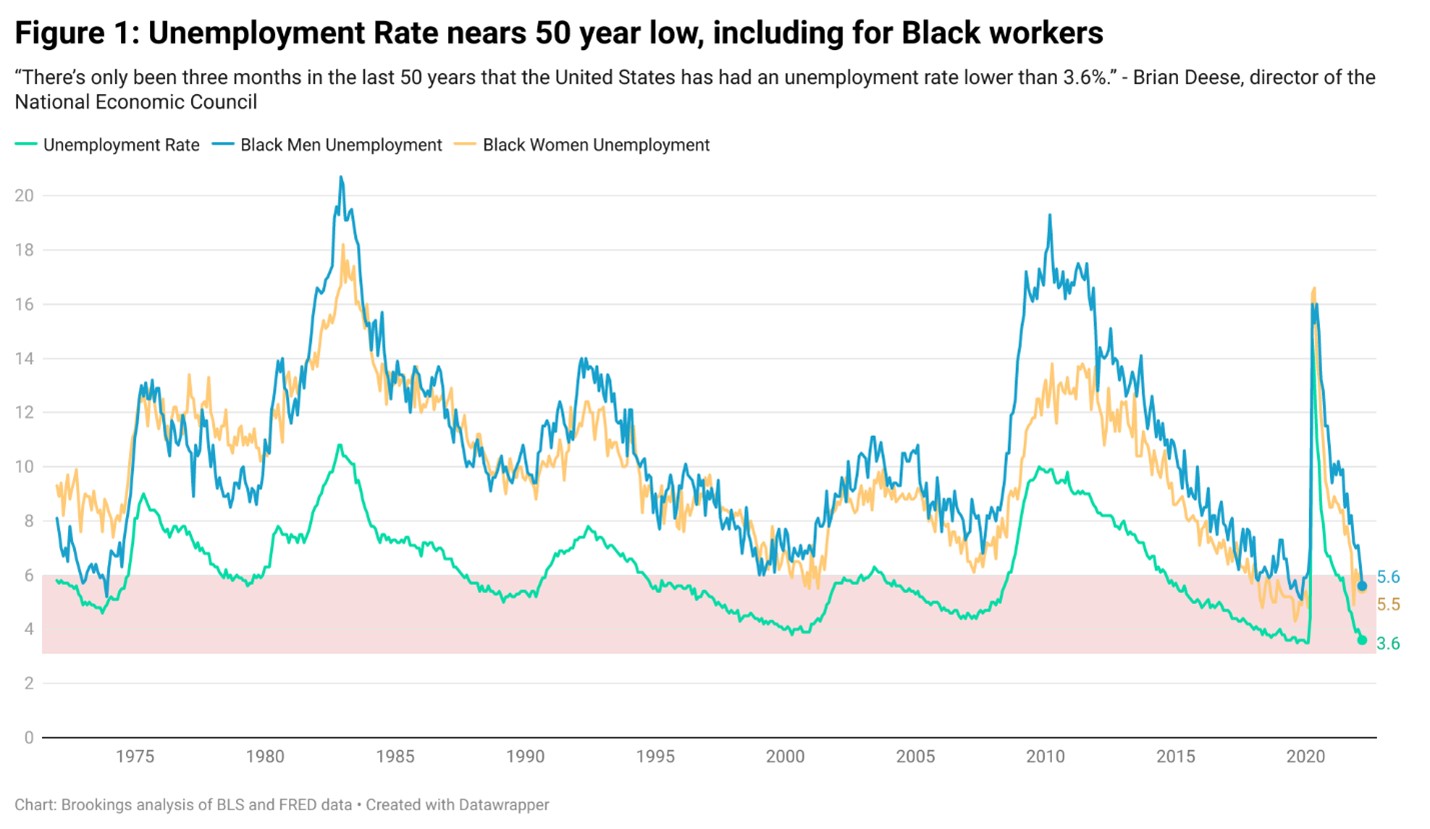

The economy added 431,000 jobs in March, according to the Bureau of Labor Statistics, while the unemployment rate fell to a historic low of 3.6% that has only been matched three times in the past 50 years (See Figure 1). The job numbers paint a positive story of economic recovery from the COVID-19 recession. However, persistent racial gaps, job gains accruing mostly to lower-paying industries, and rising prices call for continued support to ensure all workers have quality jobs with decent pay and benefits.

Who benefitted most from the jobs gains in March?

Although unemployment rates fell for most race and gender groups, Black unemployment rates continue to be almost the twice the national rate at 6.2%. Disaggregated further by gender, Black men and women have the highest unemployment rates (5.6% and 5.5%), followed by Hispanic women and men (4.2% and 3.8%).

Most job gains accrued to women, but Black women gained the least

Most of the job gains in March accrued to women who outmaneuvered men in the scuffle to match to better job opportunities. Women clutched a total of 271,000 jobs in March and that is roughly two of out every three jobs employers created during March, leaving men with just about 160,000 or 37% of the job gain. Most of these women-earned jobs (161,000) were concentrated in three primary sectors: Leisure and Hospitality (24.7%), Education and Health Services (19.2%), and Professional Business Services (15.5%).

A healthy upthrust in women’s labor force participation supports the notion that the promise of higher wages and plentiful jobs are encouraging women to return to work. Nearly 250,000 women entered the labor force in March but the participation rates across racial groups were markedly skewed. Asian women made significant progress in their labor market participation with approximately 174,000 Asian women entering the labor force. 64,000 white women and 74,000 Hispanic women entered the labor force, compared to a mere 32,000 Black women. In a prior analysis, we identified several structural barriers to female employment including misalignment between job schedules and care needs. Policymakers should address these hurdles that women face working to regain their pre-pandemic progress.

Black and Hispanic men are exiting the workforce

The March job landscape was especially daunting for minority men. Roughly 230,000 Black and Hispanic men exited the labor force, with the former accounting for 65% of these exits. What sectors were most affected? Cross-referencing Hispanic and Black men’s labor force contraction to industry-level job changes provides some insight into the potential drivers of this dynamic. For example, while the transportation and warehousing sector shed 500 jobs in the aggregate, trucking transportation was among the six subsectors within transportation that posted net job losses. Black men and Hispanic men are overrepresented in the transportation sector, especially in the truck transportation subsector which was the largest driver of job loss in the transportation sector.

Why did Black and Hispanic men fare so poorly? These countervailing job losses in select male-dominated sectors could explain why the employment fortunes of Black and Hispanic men seemed to reverse course. Numerous reports and studies have also examined how racism in the labor market crowds minority men into select occupations that expose them to volatility in the business cycle. Part of the decline in their labor force participation may also be due to men of color taking on more roles in dependent care as our survey with SaverLife suggested. Our colleague has pointed out that the decline in labor force participation accounted for most of the decline in employment. Missing men from the labor force is a concern because prime-age men that are out of the labor force are more likely to have poorer health and experience lower well-being compared to their female counterparts.

Most Job Gains Accrued to Lower-Paying Industries

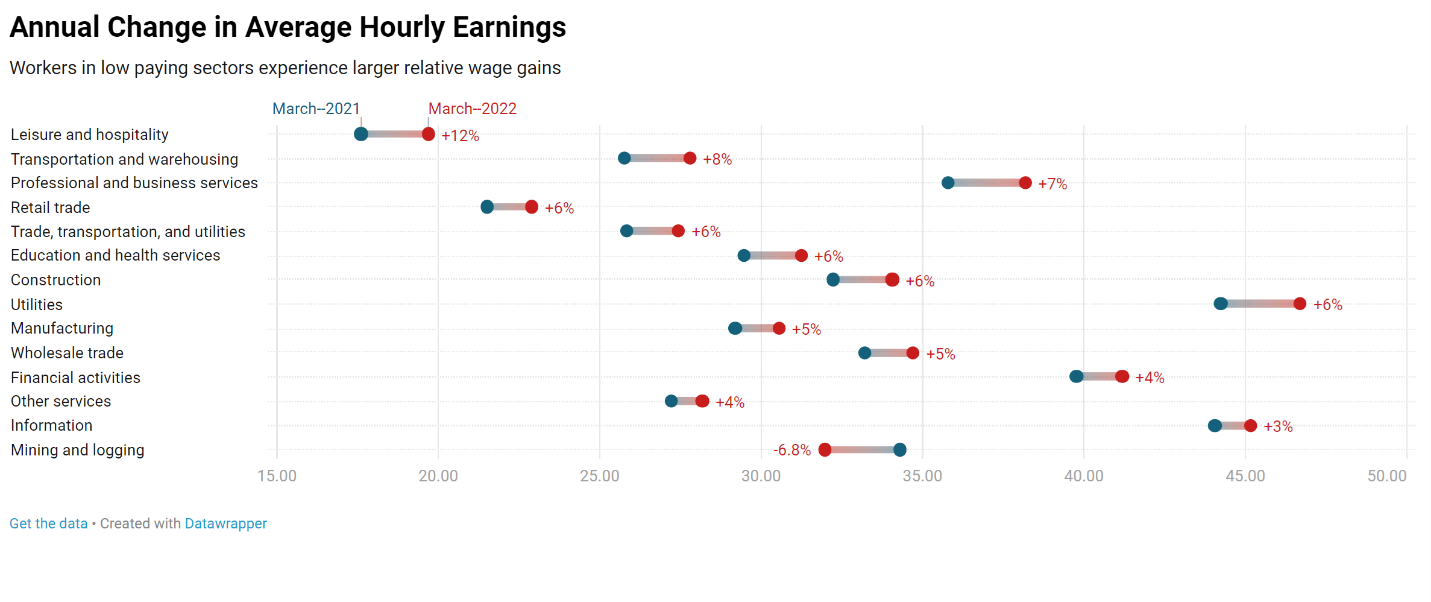

Most of the job gains in March came from industries that pay lower wages compared to the national average in the private sector. While the average hourly earnings for total private industries was $31.70, the average hourly earnings for leisure and hospitality, retail trade and manufacturing were below the national average at $19.70, $22.90, and $30.60 respectively. Notably, Hispanic and female workers are overrepresented in the leisure and hospitality sector, while Black, Hispanic, and female workers are overrepresented in the retail trade sector.

While leisure and hospitality is the lowest paying industry, it has seen the highest wage gains relative to last year — an encouraging indication that labor market tightness is generating substantial financial benefits for low-wage workers. Undoubtedly, anxious employers increasing their demand for workers and strong wage growth in these sectors are compelling factors to drawing women in from the sidelines into the Great Workforce Shuffle in search of higher-paying jobs. Leisure and hospitality employers continue to compete on wages to rebuild already strained workforces. According to Figure 2, average earnings in the sector rose 11.8% from a year ago. But the fact remains that job gains were most dominant in low-paying sectors.

According to the Bureau of Labor Statistics, only 2.7% of workers in the leisure and hospitality industry are represented by a union. The lack of unionization may have further implications for wages: workers in the industry who are represented by a union have median weekly earnings that are a little over a $100 than the median earned by those not represented by a union. In addition, the low rate of unionization likely contributes to the lack of employer-provided benefits. The Bureau of Labor Statistics reports that 68% of workers in the leisure and hospitality industry do not have access to employer-sponsored healthcare, and 70% of workers do not currently have access to a retirement plan through their employer.

Policy recommendations to support workers with low pay and few benefits

The consumer price index increased by 8.5% in the last 12 months, erasing real gains in wages. Inflation can disproportionately hurt Black households who spend a higher share of their income on necessity goods with shorter price durations such as electricity, utilities, and groceries compared to discretionary items that white households devote a higher income share on such as full-service restaurant meals, hospital services, and dental services. It is crucial to support low-paid workers to keep up with the rising prices of necessity goods.

As an effort to address low wages in tipped occupations mostly in the leisure and hospitality sector, new regulations from the Department of Labor went into effect in December requiring employers to pay tip-based workers at least the federal minimum wage for any labor that is not work that produces tips or work that directly supports tip-producing work. The Labor Department and Congress should look to implement additional policies to ensure workers in this industry are properly compensated. In addition, federal policies that ensure better benefits for part-time workers such as expediting their access to 401(k) plans or making matching contributions on employees’ student loan payments are needed to address the absence of employer-sponsored benefits in the lowest paying industries.

Commentary

As the jobs recovery nears completion, it’s time to talk about job quality

April 19, 2022