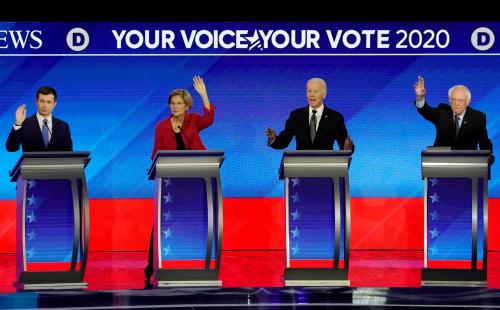

Republicans and Democrats didn’t agree on much in 2019, with one exception: that a high U.S. dollar is bad for America. President Trump repeatedly called on the Federal Reserve to cut interest rates to devalue the dollar, while presidential hopeful Senator Elizabeth Warren, promised to “produce a currency value that’s better for our workers and our industries.”

It’s good to see a glimmer of bipartisanship. But it is disappointing that it had to be on such a terrible idea. In our new working paper, we model what might happen if their wish was granted. We show that at best, this policy delivers only temporary benefits but unfortunately with long-term costs. It could trigger a currency war with dangerous consequences, and is likely to achieve the opposite of many of Trump and Warren’s stated objectives.

First, it’s useful to consider the rationale for wanting a weaker U.S. dollar in the first place. For President Trump, it is a belief that the United States is getting a raw deal in global trade, evidenced by the U.S. trade deficit and alleged competitive currency devaluations by U.S. trading partners. For Senator Warren, it is a belief that a high U.S. dollar is bad for American households and businesses.

None of these arguments withstand scrutiny. The U.S. runs a trade deficit because its economy has more investment than savings to finance it. This shortfall in savings is borrowed from overseas, causing the U.S. dollar to appreciate as foreign savings pour in, resulting in a trade deficit. The reason the trade deficit increased sharply in recent years is because more foreign savings are needed to finance President Trump’s big and unsustainable fiscal deficit. The reason there has been an improvement in the trade deficit in recent months is because investors are moving funds back into emerging economies and away from a slowing U.S. economy.

The argument that the rest of the world is competitively devaluing its currencies is also baseless. The U.S. dollar is between 6 and 12 percent higher than it ought to be, according to the IMF. But this is true for most G-20 economies. And those which have had consistently undervalued exchange rates—such as the Euro area, Germany, Japan, Korea, and Mexico—show no evidence of competitive devaluations, according to the U.S. Treasury’s assessments.

Senator Warren’s claim that a high U.S. dollar is bad for American households and businesses is similarly simplistic. A high U.S. dollar increases the purchasing power of American households, benefiting the poorest households the most. American exporters may lament a high U.S. dollar, but American businesses that import inputs for their production processes, such as car manufacturers, or participate in global production networks, such as those integrated with Canadian and Mexican firms, benefit from a higher dollar through reduced input costs.

There’s also the tricky question of how the administration would achieve a depreciated dollar if it wanted to. The Exchange Rate Stabilization Fund is too small to have much effect, meaning that, for any substantive devaluation, the Fed would need to be involved: reducing interest rates to reduce the value of the dollar while ultimately tolerating higher inflation. Such a policy, our paper shows, would have several unintended consequences.

The first is a larger U.S. trade deficit, not a smaller one. This is economically inconsequential but runs counter to Trump’s stated objectives. Lowering interest rates depreciates the U.S. dollar which acts to reduce the trade deficit, but it also stimulates domestic consumption and investment that more than offset this effect. Consumers buy both domestic and imported goods as they increase their consumption, favoring imported goods because higher U.S. inflation increases the relative price of domestic goods relative to foreign goods. And some of the savings needed to finance the large increase in U.S. investment comes from overseas, which further offsets the depreciated dollar, resulting in the trade deficit increasing.

The second consequence is to boost the trade balances of most U.S. trading partners. If the objective was to claw back demand from other countries, this policy achieves the opposite. The largest trading partners with the U.S. benefit the most—Canada, Mexico, Germany, the United Kingdom, and Japan—with their trade balances improving.

The third consequence relates specifically to China. This policy boosts Chinese GDP and devalues the Chinese currency, the opposite of what President Trump appears to want. China manages its exchange rate against a basket of currencies, which is dominated by the U.S. dollar. As the U.S. dollar depreciates, China’s renminbi follows suit. The boost in investment and consumption from lower interest rates sees China’s GDP increase relative to the baseline.

The fourth consequence is that this policy risks triggering a currency war. Seven of the G-20 economies already have overvalued exchange rates. A lower U.S. dollar makes their predicament even worse. If these countries were to retaliate and devalue their own exchange rates, it becomes harder for the U.S. to achieve its own devaluation. When these countries are all seeking to do the same thing at the same time, the net benefit to each country is minimal, while the increase in global risk, uncertainty, and volatility is substantial, necessitating a substantial adjustment in global trade and capital flows.

There are positive effects for the U.S. economy from this policy, provided other countries don’t retaliate, but the boost to consumption, investment, and GDP are only temporary. Exchange rates, prices, wages, and other variables adjust quickly to the policy, returning to the baseline within just two or three years. The net effect of this policy, therefore, is nothing more than a short-term sugar hit for the U.S. economy, with potentially substantial costs in the long term.

Given China is a key beneficiary of such a policy, President Trump and Senator Warren would be wise to heed the Chinese proverb: Be careful what you wish for, lest it come true.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Unintended consequences: Trump and Warren’s bipartisan plan for the US dollar

February 20, 2020