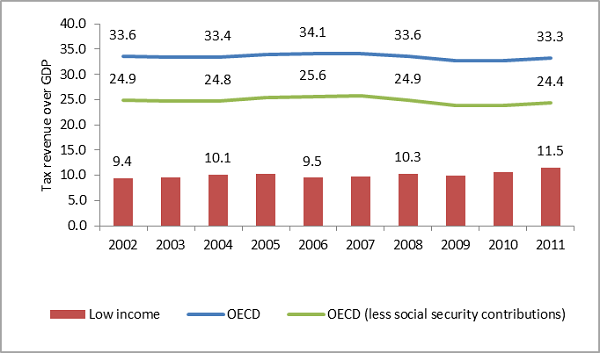

Paying taxes doesn’t come naturally. Many citizens do it, but a lot try to avoid it—especially in developing countries. Indeed, there is a strong correlation between prosperity and tax compliance. The richer countries that belong to the OECD collect about 33 percent of their GDP in taxes (or a bit less if you discount social security contributions), while low-income economies collect only 12 percent.

Figure 1. Little signs of convergence between poor and rich countries’ tax collection

Source: World Bank for low-income countries and OECD.

There is no well-defined optimal taxation level, but common sense suggests that tax revenues should at least finance a country’s needs in infrastructure, social services, and public goods. Unfortunately, the modest level of collection in many low-income countries is putting economic development at risk.

Take Tanzania, which is collecting about $6 billion (or 12 percent of its GDP) in revenues per year. This covers approximately half of the government’s expenses, but it is not enough—particularly when other sources of funding are declining (such as aid) or limited (borrowing and private sector finance).

Tanzania’s needs are projected to increase dramatically in the coming years, partly due to a rapidly growing population. To keep pace with its current expenses per student, Tanzania’s budget for secondary education will have to grow tenfold, from $51 million in 2011 to over $550 million in 2020, given that the number of secondary schools students is projected to increase by 30 percent every year during this period. Simultaneously, infrastructure expenses will need to be accelerated to address existing and future demands.

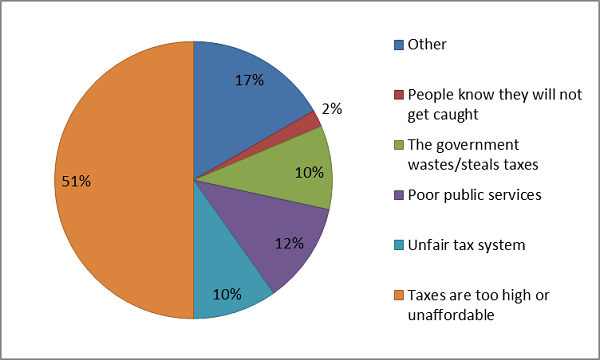

Thus it seems clear that low-income countries, including Tanzania, must collect more tax. The limited convergence of tax performance between poor and rich economies is rooted in three interrelated factors. A recent survey indicates that many citizens in Southern and Eastern Africa are reluctant to pay taxes because they see them as (1) unfair, (2) burdensome, and (3) non-transparent.

Figure 2. Why aren’t Africans paying taxes?

Source: Ali, Fjeldstad & Sjursen, “To pay or not to pay? Attitudes towards taxation in Kenya, Tanzania, Uganda and South Africa.” World Development, Vol.64, 2014. Note: Average of responses for Tanzania, Uganda, Kenya, and South Africa.

How low-income countries could boost tax collection

To meet these three challenges, bold and innovative action that goes beyond the traditional administrative measures is needed. Tax systems should adapt to the reality in low-income countries. This adaptation should go in three directions.

- First, the system must be perceived as fair. The solution here is well-known but hard to implement: it is to broaden the tax base. Today tax collection is often very narrow in low-income economies. In Tanzania, close to 90 percent of tax revenues are generated by Dar es Salaam, yet the city accounts for less than 30 percent of national GDP. Almost half of Tanzanian VAT revenues on domestic transactions are collected from three sectors (telecommunications, beverages, and cigarettes). There is a huge imbalance between the taxation of labor and capital income. Tax collection should be diversified to undertaxed sectors and regions. Property taxed should be appropriately used to boost government revenues but also to improve land management. Smart innovations can also modify taxpayers’ behavior. The introduction of so-called tax lotteries—where the tax receipt is also a lottery ticket—in China and Mauritius has been successful. Similarly, public recognition to high tax payers can also incentivize payment. Of course, stronger and effective sanctions against tax evaders are inevitable.

- Second, the system must be affordable. Since tax rates are usually only high on paper, there should be room for introducing lower and more attractive rates whilst collecting more through better enforcement. In Tanzania, the effective tax rates of VAT and import duties are only one-fifth of the existing statutory rates. Furthermore, the cost of paying taxes is often higher than the tax itself as reflected by the poor ranking of most low-income countries in the “ease of paying taxes” measure in the World Bank’s Doing Business indicators. Here the solution is simplicity. Countries should streamline numerous small taxes which impose a high burden on businesses. They must also reduce their use of tax exemption regimes. Only once the policy framework is simplified, will administrative measures be effective in reducing transaction costs. The explosion of mobile devices in low-income economies represents a wonderful opportunity for tax administration to facilitate payments.

- The third and last direction has to focus on transparency. Governments need to report tax collection comprehensively. A close articulation of the use of collected taxes is also critical. The private sector can play a role. Some major telecoms companies in Tanzania have just voluntarily decided to report publicly their tax payments. Such transparency should be mandatory for all public enterprises and agencies. The successful Extractive Industries Transparency Initiative could be replicated in other sectors, especially in those dominated by a few operators such as tourism, finance, and communications.

Implementing these actions ultimately relies on political commitment. While these actions will provide gains for countries as a whole, those gains may occur at the detriment of a few. Yet while the losers might be few, they may be powerful.

In any event, sooner rather than later, paying taxes, like “death,” is inevitable and necessary for any citizen who wants to help finance his or her country’s way out of poverty.

Commentary

Why isn’t anyone paying taxes in low-income countries?

April 30, 2015