In two recent reports, Brookings experts identify the problem of some U.S. states that rely too much on revenues from the volatile energy sector, and explore solutions to address this challenge. The papers—”The challenge of state reliance on revenue from fossil fuel production,” by Adele Morris, and “Permanent trust funds: Funding economic change with fracking revenues,” by Devashree Saha and Mark Muro—offer detailed analyses of how changes in the energy sector pose risks to some states’ budgets, and propose solutions to not only address the risks but to help states innovate and move away from such reliance on carbon economies.

Despite the “efficiency and distributional advantages” of taxes on oil, natural gas, and coal, Morris writes, “relying too much on them poses real downside risks for states.” She describes three risks in particular:

- “mineral-related revenues are subject to wide swings resulting from fluctuations in energy markets”

- ” coal and natural gas markets in particular are undergoing rapid structural changes that could affect the tax capacity of some states”

- “In the long run, policies to control the risk of climatic disruption and ocean acidification could shrink fossil fuel consumption further.”

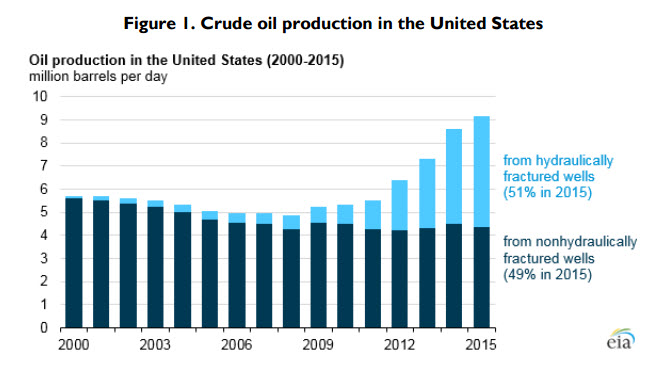

In her paper, Morris details the market fluctuations in crude oil, natural gas, and coal extraction since 2000, with the practice of hydraulic fracturing, a.k.a. “fracking,” now accounting for 51 percent of crude oil production in the U.S. As oil and gas production has increased, prices have dropped; as coal production has declined, coal prices “have remained steady relative to those of oil and gas.”

“The swings in prices and quantities of fossil fuels produced in the United States, along with huge booms and busts in drilling activities, have made for volatile revenue streams for some state and local governments,” Morris notes.

Saha and Muro chart the “supply glut and a crash in oil prices that has in recent months upended the economies of U.S. states with heavy oil exposure.” One consequence of this crash is that oil and gas drillers have slashed drilling, as evidenced in the declining U.S. rig count. Saha and Muro cite a drop in the active rig count from 1,931 two years ago to 489 in March 2016.

The decline in rigs means fewer jobs in extractive industries, and thus also fewer workers spending money in local economies, which, in addition to the decline in severance taxes, is a further hit on state budgets. As Saha and Muro write, “significant layoffs have begun to spread, underscoring the fact that the boom and bust cycle of unconventional oil and gas development is already prompting significant economic disruption as well as dire revenue gyrations in states that are dependent on oil and gas revenues for balancing their budgets.”

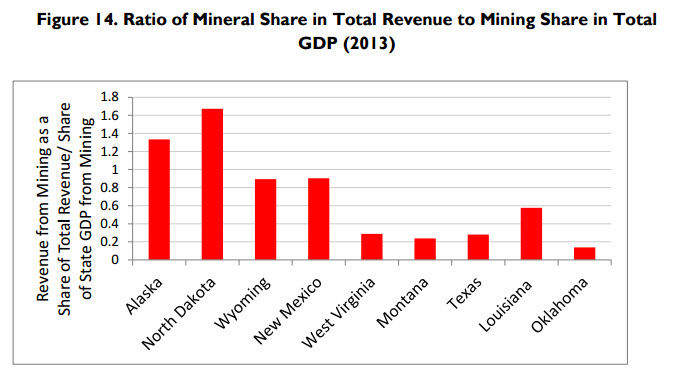

In both papers, the authors note that a few of the states with the largest extractive activities have more diversified economies, allowing them to better manage the volatility of the energy sector. These include Texas, Pennsylvania, and Ohio. Morris’ data on severance taxes and state budgets show the extent to which certain states’ budgets rely on mineral-related revenue, finding that “four states appear to rely disproportionately more than others on mineral extraction in their state revenue systems: Alaska, North Dakota, Wyoming, and New Mexico.”

But as Morris argues: “Beyond a certain level of economic instability, revenue diversification cannot help improve revenue stability. This means that the undeniably best longrun strategy for some state and local governments, particularly for the most coal-reliant areas, is to diversify their overall economy, not just their tax portfolio.”

Saha and Muro propose a trust fund solution for these states “that will essentially convert volatile near-term revenues from shale gas and oil development into a stable, longer-term source of investment funds for building a sustainable economy.” They point to the experience of more economically diversified states such as Texas, which has a permanent public education fund financed by oil and gas revenues, royalties, and land sales. Saha and Muro also argue that “severance taxes linked to well-managed permanent trust funds offer a significant economic development option for states” and that states should “put in place the tools and management to channel oil and gas-related revenue targeted investment to bolster innovation activity, cultivate a skilled workforce, and help accelerate the decarbonization of their economies.”

For detail and data, download both papers:

“The challenge of state reliance on revenue from fossil fuel production,” by Adele Morris

“Permanent trust funds: Funding economic change with fracking revenues,” by Devashree Saha and Mark Muro

Also, listen to a Brookings Cafeteria podcast with Muro in which he talked about the permanent trust funds idea.

Commentary

Two papers explore solutions to energy sector volatility risks to state budgets

August 17, 2016