Rare earth elements—a group of 17 metals—are critical for both human and national security. They are used in electronics (computers, televisions and smart phones), in renewable energy technology (wind turbines, solar panels, and electric vehicle batteries), and in national defense (jet engines, missile guidance and defense systems, satellites, GPS equipment, and more). In 2021, global demand for rare earths reached 125,000 metric tons. By 2030, it is forecast to reach 315,000 tons.

Concerningly, production of these rare earth minerals has remained concentrated. China has a dominant hold on the market—with 60% of global production and 85% of processing capacity. In light of growing geopolitical tensions around China and Taiwan, the U.S, Australia, Canada, and other countries are seeking to reduce their reliance on China as a source of rare earths production and processing.

This opens up a window of opportunity for African countries. With their rich endowment of key commodities, African countries can leverage this search for new sources of rare earth elements to bring in much-needed revenue to finance core socioeconomic objectives and reduce poverty, utilize the African Continental Free Trade Area (AfCFTA) to improve value addition, and strengthen global trade partnerships.

The tip of the iceberg of African rare earth commodities

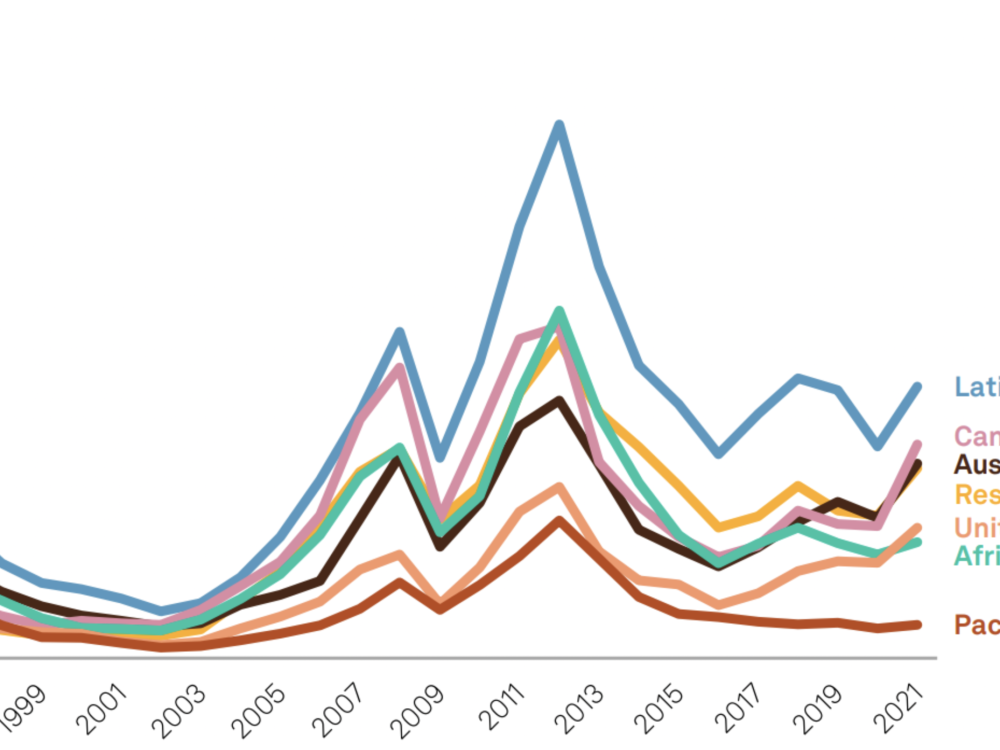

Africa’s full potential in rare earths is largely untapped given low levels of exploration. As Figure 1 shows, in 2021, the mining exploration budget in sub-Saharan Africa was the second lowest in the world—roughly half that of Latin America, Australia, and Canada—despite having triple the surface area of Canada and Australia. In 2021, on a yearly basis, Canada’s exploration budget rose by 62%, followed by 39% in Australia, 37% in the U.S., and 29% in Latin America. The budget for Africa grew only 12%, and the vast majority of exploration continues to be concentrated in gold, rather than rare earths or green metals critical to the clean energy transition (Figure 2).

Figure 1. Mining exploration budgets by region, 1997-2021 (Millions USD)

Source: “World Exploration Trends 2022,” S&P Global Market Intelligence.

Figure 2. Distribution of exploration budgets by commodities, 2012-2022

Source: “Africa – mining by the numbers, 2022,” S&P Global Market Intelligence.

Scaling up exploration is critical for enabling Africa to identify and extract rare earth elements. Already, several rich deposits have been found. In 2022, Mkango Resources, a Canadian explorations firm, announced that its Songwe Hill rare earths mine in Malawi is expected to commence production in 2025. Bannerman Energy, an Australian firm, announced that it has acquired a 41.8% stake in Namibia Critical Metals, which owns 95% of the Lofdal heavy rare earths operation. The mine produces 2,000 tons per year of rare earth oxides and has rich deposits of two of the most valuable heavy rare earth metals—dysprosium and terbium. South Africa’s Steenkampskraal Mine has one of the highest grades of rare earth elements in the world. It contains 15 elements and 86,900 tons of total rare earth oxides, with large deposits of neodymium and praseodymium. In 2020, the Angolan subsidiary of Pensana Rare Earths, a British firm, received exclusive mining rights for the Longonjo Mine, a rare earths operation, for a 35-year-time period. These deposits are not insignificant considering Africa’s small share of global exploration.

How to maximize Africa’s benefits from rare earth minerals

Beyond increasing exploration, there are three ways African countries can maximize the benefits of rare earths for their economies:

- Because there has been a shift from labor-intensive to capital-intensive mining, the primary benefit of these resources is the revenue they bring in rather than job creation. Governments need to strengthen tax policy to maximize revenue collection, while keeping stable fiscal policy to prevent volatilities that can deter investments. For example in 2017, South Africa’s mining and quarrying sector accounted for just 1.3% of total revenue collected, compared to its 7.3% of GDP, partially owing to tax incentives and provision payments. Good governance is required to ensure that these revenues—in the form of production taxes, regulatory taxes, and royalties—are used to reduce reliance on external debt and to finance core socioeconomic objectives. This is particularly important given that Africa may be home to 90% of the world’s poor by 2030, as countries have less fiscal space to spend on pro-poor policies.

- African countries should leverage the African Continental Free Trade Area to maximize value addition. The process of extraction and value addition is difficult to do within a single country due to the high cost of rare earths separation facilities. The U.S. set aside $156 million for a single facility to extract and separate rare earths—a sum out of reach for most African countries. Yet without continental separation facilities, African countries will export ores and miss out on the benefits of local processing and manufacturing. If implemented effectively, the AfCFTA would enable countries to enhance value addition within the bloc before exporting. We have already seen the power of cooperation—Zambia and the Democratic Republic of Congo signed an agreement to build a regional value chain by manufacturing electric batteries using the minerals found in both countries. It’s time for more such efforts.

- Africa should use resources strategically to build strong trade partnerships and strengthen its presence in global value chains, particularly with the U.S., EU, and Australia. U.S. Treasury Secretary Janet Yellen has called for “friend-shoring,” or building supply chain networks with allies and friendly countries, to reduce exposure to political disruptions. Canada recently invested $162 million to help position Quebec as a center of excellence for critical minerals processing, with the specific intent of building strong global supply chains and strengthening trade relationships with allies. African countries can, as a bloc, forge long-term trade partnerships with these countries who are seeking to build more resilient rare earths value chains.

Still, countries need to manage the challenges associated with mining by developing and enforcing policies that ensure firms cover all of their social and environmental costs, from mine exploration through to mine closure. Mining can generate significant negative externalities, including pollution, health consequences, and damage to land and infrastructure. Covering these costs should be built into the agreements between firms and governments.

If African countries heed these recommendations, they will be well-positioned to leverage their rich endowments of resources to join strategic global value chains and utilize revenue inflows to support equitable economic growth.

Commentary

Could Africa replace China as the world’s source of rare earth elements?

December 29, 2022