The Vitals

While some tax expenditures help society achieve auspicious goals—by encouraging charitable giving or helping families who face costly health situations, for example—others are poorly targeted, inappropriate, and disproportionately benefit high-income households. Reforms could simplify taxes, make the distribution of income less unequal, and bring in billions of dollars for government revenues annually.

-

In 2018, deductions, credits, exclusions and other tax expenditures cost the government more than $1.3 trillion in revenue, which is about 6.3% of GDP.

-

High income households are more likely to use tax expenditures, creating “upside-down” subsidies that disproportionately benefit the well-off.

-

The Tax Cuts and Jobs Act of 2017 reduced the federal revenue loss via tax expenditures by about 10% for 2018-2020.

A Closer Look

In principle, an income tax could apply the same progressive

rate schedule to all the income a person earns in the year. In practice, our

system falls far short of this notion. Largely, this is due to the significant

presence of “tax expenditures”—deductions, credits, and other preferences that can

reduce people’s tax burdens. People often call tax expenditures “loopholes,”

suggesting that taxpayers are exploiting some unintended or narrowly offered

benefit. But many of them serve millions of households across most income

levels. These preferences are the equivalent of government spending that occurs

through tax rules —which is where the term “tax expenditure” comes from.

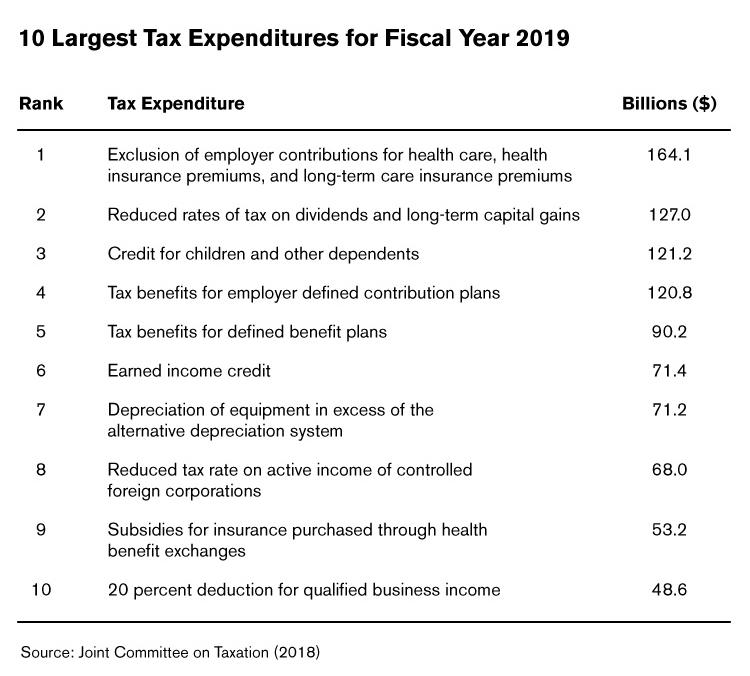

Tax expenditures substantially reduce government revenue. In 2018, they cost the government more than $1.3 trillion in lost revenue, which is about 6.3% of GDP, almost 80% of actual income tax revenue, and more than outlays for Social Security or Medicare and Medicaid combined.

While there are some narrowly targeted provisions (for professional sports stadiums, for example), the costliest tax preferences offer benefits to millions of households. These include subsidies for certain pass-through businesses (those that do not face the corporate tax), employer-provided health insurance, mortgage interest, charitable gifts, state and local taxes, retirement saving, capital gains (profit from asset sales), child-rearing, work, and education.

Tax

expenditures are tilted toward high-income households. In 2019, a

tenth of the pre-tax income of the top 1% of earners came from non-business

income tax expenditures, compared to only around 5% of the income of households

in the middle quintile. That’s because high-income households are likelier to

use these provisions and because exemptions and deductions create “upside-down”

subsidies that disproportionately benefit the well-off. Even if tax

expenditures reduce taxable income by the same amount for different

beneficiaries, they reduce taxes more for higher-income households that face

higher marginal tax rates. In contrast, a dollar’s worth of credit reduces

everyone’s taxes by the same amount (provided the credit is fully refundable).

The Tax

Cuts and Jobs Act of 2017 (TCJA) will reduce federal revenue lost to

tax expenditures by about 10% for 2018–20. Most of the increased revenue comes

from limiting the deduction for state and local taxes, raising the standard

deduction (which reduces the share of tax filers who itemize), and lowering

marginal income tax rates (which reduces the value of a given deduction). At

the same time, the TCJA expanded the child tax credit and created a new 20%

deduction for certain pass-through business income.

So, what are the options for changing our treatment of tax expenditures?

Broadening the tax base and taxing all forms of income at the same rate—that is, closing tax expenditures—is generally the right direction for tax reform, and it has much to offer. It raises efficiency by eliminating the need to choose based on tax considerations. It improves fairness by not playing favorites across different sources or uses of income. It simplifies taxes by reducing the number of artificial distinctions between taxpayers. Reforming tax expenditures raises revenues in a progressive and efficient way that cuts de facto government spending, so it can appeal to both conservatives and liberals.

Capping tax expenditures

One approach to reforming tax expenditures is to cap an individual’s overall tax expenditures at either a dollar amount or a percentage of income. During his 2012 presidential election campaign, Mitt Romney proposed various caps on itemized deductions, including $17,000, $25,000, and $50,000. Alternatively, Feldstein, Feenberg, and MacGuineas (2011) proposed a cap equal to 2% of a taxpayer’s adjusted gross income (AGI) for all tax expenditures. Capping overall deductions has the political advantage of not explicitly limiting any particular subsidy, but also means that charitable contributions—the most “discretionary” component of itemized deductions—are likely to be most affected. Moreover, questions inevitably arise over which tax expenditures should be included in the cap.

Converting itemized deductions to 15 percent tax credits

A second approach is to convert all itemized deductions to 15% credits. This would eliminate the “upside down” feature that gives larger benefits per dollar spent to high-income households compared to low-income households. But neither this approach, nor capping the overall level of tax expenditures, distinguishes enough between effective and ineffective tax expenditures.

Not all tax expenditures are equal

While many policy discussions tend to lump tax expenditures

together, several of the major tax expenditures make sense. The deduction for

medical expenses, for example, helps families that face extremely expensive

health situations. The deduction for charitable contributions encourages people

to contribute directly to charity and is based on the reasonable premise that

givers shouldn’t pay tax on the funds they give away. Nevertheless, several tax

expenditures are poorly targeted or inappropriate. Many small tax expenditures deserve

the pejorative term “loopholes” and should be eliminated, including, but not

limited to, preferential capital gains treatment of coal royalties, income from

certain timber sales, deductions for bonds used to finance sports stadiums, and

special rules for certain film and television production expenses. Eliminating

these types of tax expenditures would

save at least $10 billion per year.

In

my recent book, I discuss several tax expenditure programs that

could usefully be reformed. First, capital gains that are held until death are

never taxed under the income tax. The inheritor receives them at their current

value. Taxing these gains at death would raise revenue, eliminate a major

loophole in the tax system, and make taxes fairer.

Second, the exclusion of employer-provided health insurance

subsidizes the purchases of expensive and excessive health insurance plans

during a time when controlling health costs is a major priority. Treating such

plans as taxable income for middle- and higher-income households would raise

revenue, reduce health care costs, and close another distortion in the economy.

The recent movement to repeal the Affordable Care Act’s so-called “Cadillac

tax” on high-cost employer-provided health plans moves in the

opposite direction.

Third, the mortgage interest deduction (MID) has little

effect on homeownership, contrary to popular belief. Only

8% of households currently use the deduction, and most of those

households are in the highest tax brackets. Instead, the deduction encourages

the construction of larger, more expensive houses, which leads to higher energy

costs, urban sprawl, and fewer investment funds available for businesses.

Phasing out the deduction and replacing it with a refundable tax credit of

$10,000 for each of the approximately 2 million first-time homeowners each year

would encourage homeownership, not home indebtedness. It would also be less

expensive, more progressive, and far more effective than the MID in boosting

homeownership rates.

Finally, the rules regarding the new deduction for pass-through businesses will cause numerous problems. The benefits of the policy, which allows an individual to deduct up to 20% of their income from pass-through entities (e.g., sole proprietorships and partnerships), are inequitable—about 44% of the benefits go to taxpayers with incomes greater than $1 million per year. This deduction provides windfall gains to owners who made investments in the past without increasing current investment. Moreover, these rules create enormous opportunities to game the tax system and create incentives for people to relabel wage income as business income. Repealing the pass-through deduction would restore the long-standing notion that wages and business income should be taxed at the same rate.

I would like to thank Grace Enda, Claire Haldeman, and Aaron Krupkin for providing valuable assistance.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

What are tax expenditures and loopholes?

October 15, 2019