Expectations for the U.S.-China Strategic and Economic Dialogue meeting are muted—perhaps a good sign as it shows a maturing in the U.S.-China relationship. The focus has shifted to making methodical if slow progress rather than on resolving major conflicts or arriving at dramatic breakthroughs. There are of course differences in the objectives of the two sides and different perceptions of what constitutes progress. This enhances the value of the U.S.-China dialogue even if there are few high-profile successes to trumpet.

The rhetoric on both sides has ratcheted down as progress has been made on some of the most visible points of tension. The currency issue continues to fester but recent developments have transformed this into a problem for the rest of the world rather than just for the U.S.-China relationship. However, there are storm clouds gathering on the horizon as more fundamental and contentious issues, with high stakes on both sides, come to the fore.

In the coming months, discussions on economic policy will be increasingly overshadowed by the political calendars in the two countries, which herald a gradual hardening of positions and less room for maneuver on both sides. This makes it unlikely we will see any major policy shifts in the bilateral relationship, unless dictated largely by domestic political and economic circumstances.

The two countries are increasingly dealing with each other on an even footing and recognize that collaboration is in their mutual long-term interests. However, there lies a rocky road ahead, as domestic economic and political priorities and constraints drive the short-term dynamics of this relationship.

Do not count on any surprises or major breakthroughs next week.

The U.S. Spells Out Its Position

In a speech earlier this week, U.S. Treasury Secretary Geithner reiterated a clear quid pro quo that defines the overall parameters of the bilateral economic relationship [1]. The speech makes the U.S. position clear that in order to attain China’s objectives in the bilateral relationship, China must adequately satisfy U.S. interests. China’s objectives are seen as including access to high technology products, investment opportunities in the U.S. and market economy status.

For its part, U.S. interests lie in greater market access for its companies, including in government procurement; stronger protection of intellectual property rights; and other reforms that would ensure a level playing field within China for domestic and foreign producers. Secretary Geithner’s speech acknowledges the commitments made on some of these issues during President Hu’s visit to Washington in January but, with good reason, reserves judgment on China’s implementation of these commitments.

Secretary Geithner also urges faster implementation of China’s own reform agenda—financial market reforms, a more flexible exchange rate regime, and growth rebalancing to stoke private consumption and make the economy less dependent on exports or investment. While there are differences in opinion about the desired pace of these reforms, there is agreement on both sides that such reforms would promote the sustainability and durability of China’s growth and also contribute to the global rebalancing effort.

The U.S. has also been quite supportive of China’s increasingly ascendant role in international financial institutions. At a recent G-20 conference, Secretary Geithner was explicit in his support for eventually including the renminbi in the basket for the IMF’s Special Drawing Rights (SDR), subject to certain conditions like currency convertibility being met.

Trade and Currency—A Bilateral Perspective

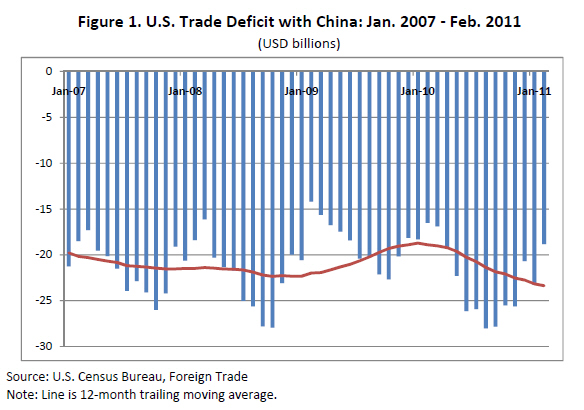

The ebbs and flows of the U.S.-China relationship have turned largely on trade flows although bilateral financial flows have become increasingly important [2]. Indeed, the bilateral trade deficit gets far more attention than it rightly deserves. This bilateral deficit shrank to $227 billion in 2009, compared to $266 billion in 2008. In 2010, it rebounded to an all-time high of $273 billion. The 12-month moving average and the rising import demand from a recovering U.S. economy portend a continued high bilateral deficit in 2011 (Figure 1).

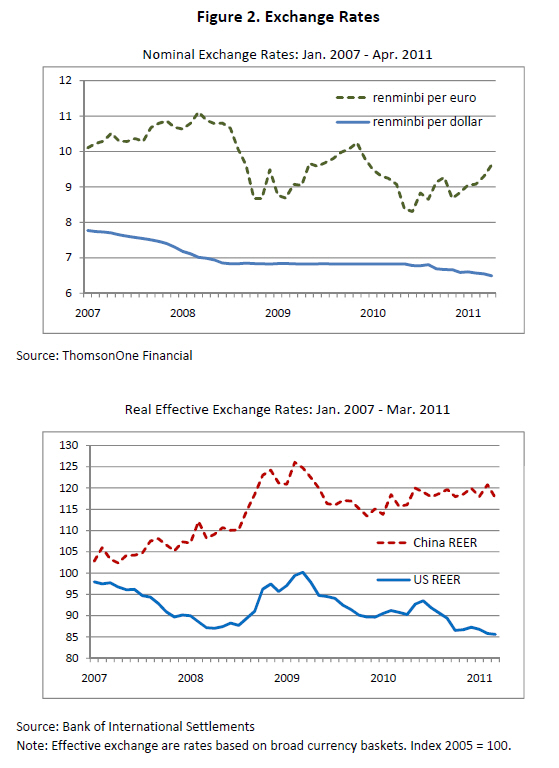

This will no doubt direct further attention to China’s currency policy. Following its re-depegging from the dollar in June 2010, the renminbi has appreciated by about 5 percent in nominal terms against the dollar (Figure 2). On an inflation-adjusted basis, this implies that the renminbi is appreciating at a rate of about 8 percent a year in real terms relative to the dollar. Quibbles about the pace of appreciation aside, this means that the currency issue is no longer front and center in the bilateral dialogue.

China’s Currency Policy—A Broader Perspective

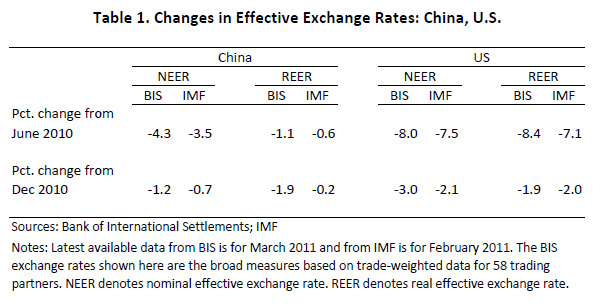

While China’s currency has been appreciating against the dollar, the dollar has of course been in retreat against other major currencies. Since June 2010, the dollar has depreciated in trade-weighted inflation-adjusted terms by about 8 percent (last two columns of Table 1). Consequently, despite its nominal appreciation against the dollar and the high inflation rate in China, the renminbi’s real effective exchange rate has actually depreciated modestly over the past year (Table 1).

This creates a difficult situation for the rest of the world as the two largest economies now have depreciating currencies. But it is no longer a U.S. problem and in principle it should foster an alliance among the U.S. and China’s major trading partners, especially other emerging markets, to push China to allow its currency to appreciate more rapidly. This is not a slam-dunk, however, as the rest of the world has still not quite forgiven the U.S. for QE2 and the damage it ostensibly wrought on their economies. So the battle between these two superpowers for the hearts of other countries rages on.

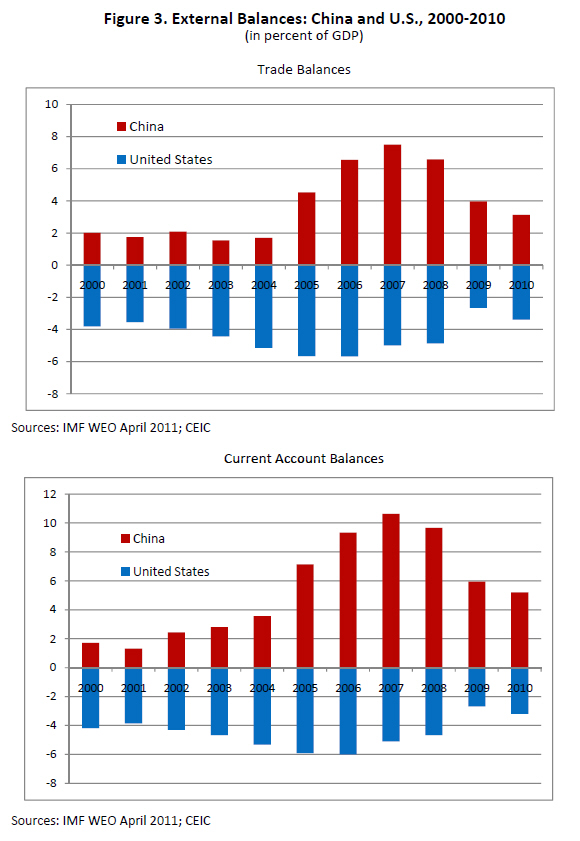

The broader battle has been muddied by the fact that China’s trade and current account surpluses relative to GDP have continued to shrunk since their peaks in 2007 (Figure 3). There is a sharp divergence of views among analysts about the direction in which these surpluses are headed. One view is that China has made durable progress in rebalancing its economy and reducing its dependence on exports. An alternative view is that China’s shrinking trade surplus is largely a cyclical phenomenon. China has grown strongly, sucking in huge quantities of imports, while its major export markets in the euro zone and the U.S. are just getting back on their feet after the global financial crisis.

This spills over into a raging debate about whether China has actually made significant progress on rebalancing its economy and contributing less to global imbalances. This is summarized by the stark difference between two key institutions in their forecasts for China’s current account to GDP ratio—the IMF pegs it at over 6 percent in 2012 while the World Bank puts it a shade under 4 percent (Table 2). My view is that both China’s trade and current account surpluses will rebound sharply as cyclical factors unwind, especially if China manages to clamp down on credit growth while the U.S. and Europe solidify their recoveries (all of which remain slightly dubious propositions at this stage).

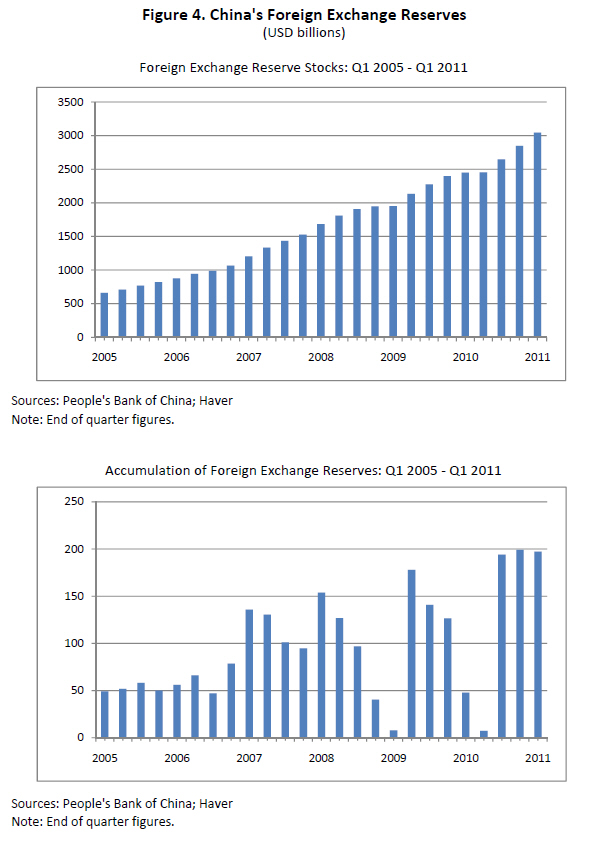

In any event, currency dynamics show that China continues to intervene massively in foreign exchange markets to counter pressures for renminbi appreciation. China accumulated $448 billion of foreign exchange reserves in 2010, matching the pace in 2009 (Figure 4). The merchandise trade surplus of $185 billion (goods trade) accounts for less than half of this reserve accumulation in 2010 (the overall trade surplus on goods and services was lower at about $165 billion). It is also unlikely that valuation effects can account for the rapid pace of accumulation in 2010 [3].

China’s torrid pace of reserve accumulation continued in the first quarter of 2011, when it accumulated another $196 billion of foreign exchange reserves (Figure 4, lower panel). Valuation effects could account for about $50-60 billion of this increase [4]. On the other hand, China recorded a marginal deficit on its trade account in this quarter.

Even assuming significant returns on its existing stock of reserves, the implication is that capital continues to seep into China through a variety of channels despite all the controls on inflows. Managing capital flows and their impact on domestic liquidity and inflation will be a major challenge for the Chinese government during 2011, especially if it continues to strongly resist currency appreciation.

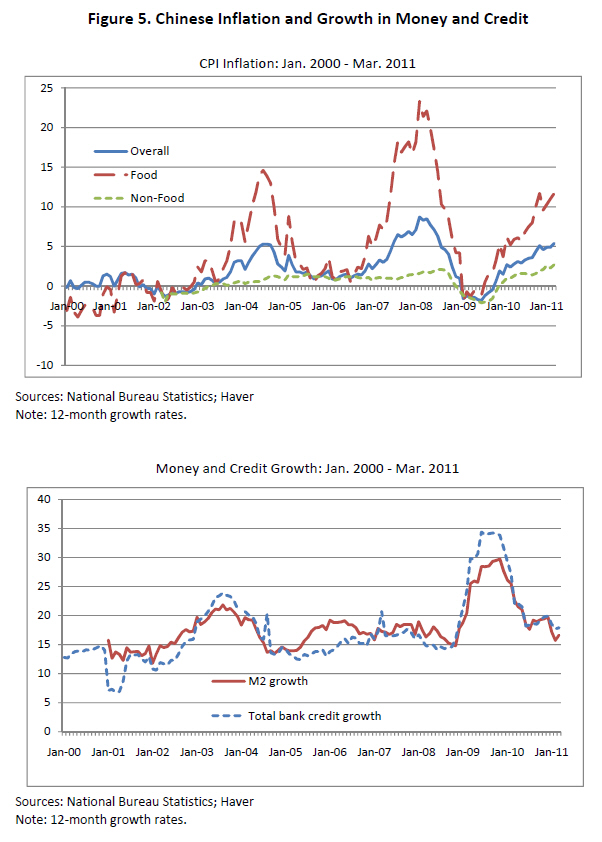

All of this makes it perplexing that China has not used currency appreciation more aggressively as a tool in the fight against inflation. Indeed, inflation in China has continued to rise despite modest increases in interest rates and sharp increases in reserve requirements, both of which have helped moderate credit growth (Figure 5). It seems that a huge political bar has to be crossed before the Chinese leadership accepts the use of currency policy as a tool against inflation.

China’s Concerns

During the dialogue, China will not be on the defensive. Its delegation will bring two concerns to the table–the more immediate issue of the prospect for a U.S. debt default and the longer-term issue of U.S. policy toward Chinese investment.

The Chinese delegation will certainly have some tough questions for the U.S. Treasury about the possibility and implications of a technical default on government debt if gridlock on Capitol Hill doesn’t get resolved before the U.S. hits its legal debt ceiling. But the tough questions don’t translate into a credible threat or a strong bargaining position. China has few alternatives and simply cannot take a significant fraction of its Treasury holdings elsewhere. Indeed, for all its worries and aggressiveness on the issue, the stark reality is that China has little choice but to accumulate even more U.S. government debt if it continues to pile up reserves at the rate of $150-200 billion dollars each quarter.

The U.S. has effectively countered the aggressive approach that China has taken on its purchases of U.S. debt. The Obama administration has quite clearly shifted the narrative around from the perspective that China has the upper hand in this relationship due to its ownership of U.S. Treasuries. Indeed, the administration has made it quite clear that it encourages China to reduce its intervention in currency markets, which would result in less reserve accumulation and reduced purchases of U.S. government debt. Fears that Chinese expressions of concern about U.S. public finances are a cloaked threat to dump U.S. debt are hyperbole.

China now has a massive stash of cash that it wants to use to purchase high-quality hard assets, especially foreign firms with strong R&D and technology that will help Chinese industries move up the value-added chain. The U.S. is prime hunting ground for such assets but there are major political constraints to Chinese investments in the U.S. An investment treaty would break down many of these barriers and uncertainties, and is eagerly sought by the Chinese. But it remains a prize that the U.S. will extract a significant price for and it is unlikely that the U.S. will substantially lower the safeguards against foreign investment in key sectors of its economy.

The Political Context

With the unemployment rate now below 9 percent and job growth modestly positive, next week’s meetings will take place against a more benign economic backdrop in the U.S. Moreover, Republicans in Congress have made it clear that currency legislation against China is not a priority. This gives the administration a little more leeway (and perhaps a little less bargaining power) in its dealings with the Chinese.

The political calendars of the two countries will drive the debate on economic issues. The Chinese leadership transition that begins in early 2012 and the U.S. presidential elections in the fall of 2012 could lead to a hardening of positions on both sides and also to some degree of policy paralysis, especially on bilateral issues.

China is keen to ensure a smooth transition to its new leadership in early 2012, making it unlikely that there will be significant policy shifts or initiatives in the latter half of 2011. The reformist credentials of the presumed heirs to President Hu Jintao and Premier Wen Jiabao are unclear and untested. In any event, the jockeying for senior positions and the work the new leadership needs to do to consolidate its power all point to the low probability of any major policy shifts during the first half of 2012.

The waters will appear calm and friendly at next week’s discussions but there remain deep and difficult tensions hidden beneath the surface.

Footnotes:

[1] The text of Mr. Geithner’s remarks is available at (http://www.treasury.gov/press-center/press-releases/Pages/tg1160.aspx). These remarks essentially carry over from his speech in January 2011, ahead of President Hu’s visit to Washington, where this explicit quid pro quo was introduced (http://www.treasury.gov/press-center/press-releases/Pages/tg1019.aspx).

[2] For a more detailed analysis of different facets of the bilateral economic relationship, see “Rebalancing the China-U.S. Relationship” by Eswar Prasad and Grace Gu, Brookings Institution Report, January 2011.

[3] Indeed, the dollar appreciated slightly relative to the euro during the year. The dollar-euro rate was 1.43 on Dec. 31, 2009 and 1.34 on Dec. 31, 2010. Assuming that most of China’s foreign exchange reserves are held in instruments denominated in dollars or euros, this means that the valuation effects in fact held down the pace of reserve accumulation in dollar terms.

[4] The euro appreciated relative to the dollar by about 6 percent during the first quarter. Assuming that about one-third of China’s reserves are held in euro-denominated investments, the valuation effects in dollar terms could account for about $55 billion (2.84 trillion * 1/3 * 0.06). The Japanese yen, by contrast, depreciated slightly relative to the dollar during the quarter.

Commentary

Op-edThe U.S.-China Strategic and Economic Dialogue: A Preview of Key Economic Issues

May 6, 2011