Content from the Brookings Institution India Center is now archived. After seven years of an impactful partnership, as of September 11, 2020, Brookings India is now the Centre for Social and Economic Progress, an independent public policy institution based in India.

By John Villasenor, Darrell M. West and Robin Lewis

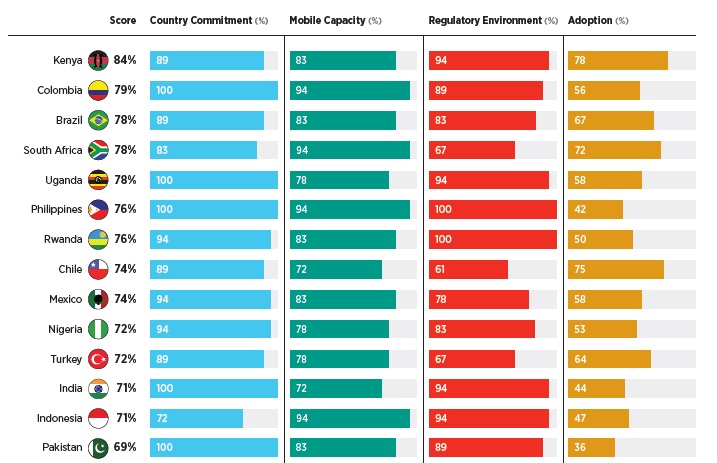

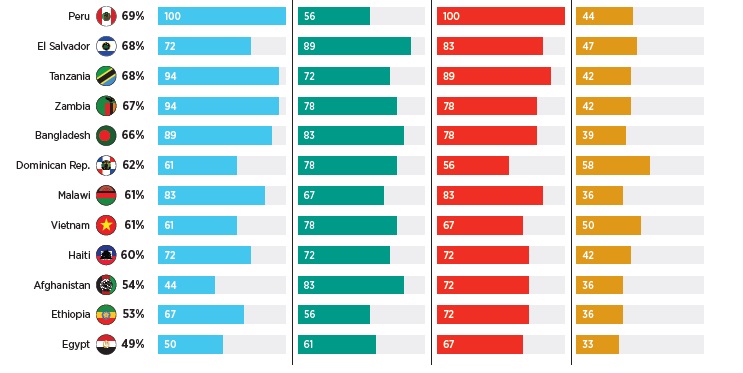

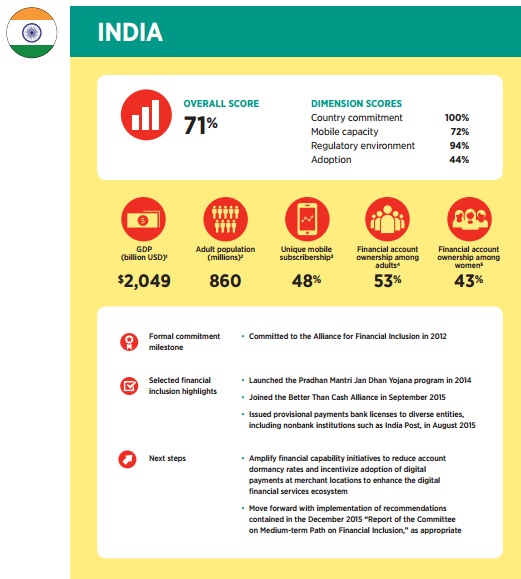

The 2016 Brookings Financial and Digital Inclusion Project (FDIP) evaluates access to and usage of affordable financial services by underserved people across 26 geographically, politically, and economically diverse countries.

The 2016 report assesses these countries’ financial inclusion ecosystems based on four dimensions of financial inclusion: country commitment, mobile capacity, regulatory environment, and adoption of selected traditional and digital financial services.

The 2016 report builds upon the first annual FDIP report, published by the Brookings Institution, Washington D.C., in August 2015. The 2016 report analyses key changes in the global financial inclusion landscape over the previous year, broadens its scope by adding five new countries to the study, and provides recommendations aimed at advancing financial inclusion among marginalised groups, such as women, migrants, refugees, and youth.

The 2016 report builds upon the first annual FDIP report, published by the Brookings Institution, Washington D.C., in August 2015. The 2016 report analyses key changes in the global financial inclusion landscape over the previous year, broadens its scope by adding five new countries to the study, and provides recommendations aimed at advancing financial inclusion among marginalised groups, such as women, migrants, refugees, and youth.

To learn more about the FDIP scores and methodology, download the 2016 report. Comments and feedback can be sent to [email protected].

Overview of financial inclusion ecosystem

Overview of financial inclusion ecosystem

India has accelerated its efforts to promote financial inclusion through implementation of the historic Pradhan Mantri Jan Dhan Yojana (PMJDY) programme, launched in 2014.[1] The programme has demonstrated considerable impact with respect to expanding financial access, although dormancy rates indicate that efforts to promote financial capability and enhance the utility of financial products and services are still needed.[2] Government efforts to advance shared public infrastructure have contributed to the success of the PMJDY programme.

As of 2014, India contained about 21 percent of the world’s unbanked population.[3] Recognising the opportunity to envelop underserved individuals into the formal financial sector, India has amplified its commitment to financial inclusion through a number of policy and regulatory initiatives. One of the key objectives of the PMJDY initiative was to provide all households in the country with banking facilities by January 26, 2015.[4] As of January 2015, approximately 100 percent of households were considered financially included, according to the government of India.[5] By May 2016, a PMJDY progress report noted that about 200 million[6] bank accounts had been opened under the PMJDY programme.[7]

Other assessments have found less widespread account penetration—for example, an InterMedia survey of adults age 15 and older conducted from June to October 2015 found that 63 percent of adults had a “full-service” account[8] at a bank.[9] While the exact account adoption figures vary, the PMJDY programme has certainly helped drive access to formal financial services across India and amplify the discourse surrounding financial inclusion among public and private sector stakeholders.

The PMJDY programme features a number of key pillars that build upon its aim of fostering universal access to banking facilities, including providing basic bank accounts with overdraft facilities and a debit card (called an RuPay card) to all households, promoting financial literacy, advancing the development of a credit guarantee fund to mitigate risks from overdraft facilities, and offering opportunities for microinsurance and pensions.[10]

In terms of international financial inclusion commitments, while India has not made commitments under the Maya Declaration, it is a member of the Alliance for Financial Inclusion.[11] The Reserve Bank of India (RBI) has served as a principal member of the Alliance for Financial Inclusion since 2012.[12] Moreover, in September 2015, the government of India joined the Better Than Cash Alliance.[13]

Digital mechanisms are key components of India’s financial inclusion drive. For example, the PMJDY programme seeks to channel all government benefits to beneficiaries’ accounts and promote its Direct Benefits Transfer (DBT) scheme.[14] The programme explicitly notes a desire to reach out to youth and to leverage non-traditional mechanisms, such as mobile devices and telecommunications companies’ cash-out-points.[15] In this vein, the Jan Dhan Yojana, Aadhaar and Mobile numbers initiative (also known as the “JAM trinity”) was developed to combine biometric identification initiatives with mobile access to financial services in order to directly transfer subsidies to beneficiaries and consequently advance efficiency and reduce leakages.[16]

On the regulatory side, both mobile wallets and mobile banking are offered in India.[17] The 2007 Payments Act served as the relevant regulation for electronic wallets.[18] More recently, in 2014, the government of India issued guidelines regarding specialized “payments banks.”[19] Although payments banks are not permitted to extend loans, these entities can accept deposits and sell third party products.[20] The payments banks guidelines opened up the market to nonbank providers by permitting entities such as mobile operators, retail chains, and current agent managers to apply for licences to provide payments and deposit accounts, which will be eligible for risk-proportionate know-your-customer (KYC) processes.[21] The RBI also undertook other enabling regulation in 2014, such as removing a requirement for any banking correspondent[22] to be within a 30 km range of a bank branch.[23]

While efforts to improve financial access and promote usage have brought a staggering number of individuals into the formal financial services sector within a relatively brief period of time, as of May 2016 the percentage of accounts with no balance was at 26 percent across public sector, regional, and private banks.[24] Thus, concerted efforts to reduce dormancy rates are needed in order for individuals to reap the full benefits of financial inclusion.

With respect to nonbank financial access points, the Helix Institute’s 2015 “Agent Network Accelerator Survey” found that agent networks[25] in India were still quite nascent.[26] Still, India features a considerable number of agent outlets overall, with annual growth of urban and rural agent outlets in the range of 50-60 percent as of 2015.[27] While agent locations are relatively prolific, sustainability is a challenge: Key issues for agents include constraints regarding profitability, agent capacity, and dormancy rates.[28] Moreover, the prevalence of agent exclusivity (i.e., agents who only work for one service provider) and dedication (i.e., agents whose only income source is through digital financial services) are high compared with most other countries, which render it challenging for agent outlets to maintain a viable business model.[29] Agents are also often inexperienced, with more than half of agents in India having operated for less than two years as of 2015.[30]

The transition to digital financial channels has proved an often challenging one within India’s cash-centric culture.[31] A recent United States Agency for International Development (USAID) study found that about 97 percent of retail transactions in India were conducted in cash or check.[32] Part of the challenge is the lack of a digital ecosystem—for example, the USAID study found that less than 10 percent of merchants accepted digital payments, and only about 10 percent of consumers in India had used a debit card for payments within the previous year.[33]

Financial inclusion updates

In August 2015, the RBI issued provisional payments bank licenses to eleven different entities, including select mobile network operators and other nonbank entities such as India Post.[34] Involving mobile network operators and postal centres more directly in the financial services market should help enhance financial inclusion by facilitating greater convenience for, and confidence among, customers. For example, India Post boasts about 155,000 branches, with about 90 percent of those branches located in rural areas; moreover, given that the Post has offered services such as basic accounts, remittance services, and even life insurance in the past, the brand has already built awareness and trust among many customers.[35] As of January 2016, India Post was expected to begin its operations as a payments bank around December 2016.[36]

Findings from a November 2015 USAID publication regarding digital payments in India highlighted low levels of awareness and adoption of digital financial services. For example, only about 30 percent of individuals who did not hold debit cards were aware of debit cards,[37] and among those who did not use mobile money, only about 20 percent were aware of mobile money or e-wallets.[38]

However, the survey also found that those who did use digital payments were generally satisfied with these services.[39] Among merchants, the top-ranked reasons for not accepting payments via mobile phones were “not knowing anyone who had one” and security concerns.[40] (Interestingly, the top-ranked reason for interest in accepting payments through mobile phones was that it was perceived as safer to handle than cash.[41])

While digital merchant payments are limited, there has been a trend of increased adoption of debit cards, spurred by the government’s financial inclusion drive. For example, as of January 2016 about 75 percent of RUPay card holders were first-time users.[42] Additionally, a November 2015 article noted that the value of electronic payments in India had continued a trend of surpassing the value of cash-based transactions.[43]

In December 2015, the “Report of the Committee on Medium-term Path on Financial Inclusion” was released by the RBI.[44] The report included a series of recommendations for improving financial inclusion, including enhancing utilisation of digital government-to-person payments, creating a geographical information system to map all banking access points, and accelerating development of a multi-lingual mobile application for customers using non-smartphones.[45]

Finally, a significant development in terms of strengthening the digital ecosystem occurred in April 2016, when the National Payments Corporation of India (NPCI) launched the unified payments interface (UPI), a common platform through which consumers can transfer money from one bank account to any other bank account instantly. The UPI is based on India’s Immediate Payment Service platform.[46] This platform is expected to enhance convenience and utility for consumers by promoting efficiency and interoperability of digital payments.[47]

The UPI interface is a component of India’s increasingly complex and interconnected digital ecosystem, which features an identity and payments infrastructure referred to as the “India Stack.”[48] [49] The four layers of the “stack” include a presence-less layer, paperless layer, cashless layer, and consent layer.[50] The first layer comprises Aadhaar authentication, a process in which a 12-digit identification number (Aadhaar number) is issued based on biometric data[51] and e-KYC (in which customers can enter their Aadhaar number and biometric information to identify themselves at banking agents).[52] Another layer features e-sign (in which customers can request a secure digital signature from a central government server to sign documents remotely) and DigiLocker (a “digital locker” that permits customers to store and retrieve legal and other official documents) capabilities.[53] [54]

The third layer, of which the UPI is a part, comprises interoperable payments infrastructure, including the Immediate Payment Service (which enables mobile account holders to transfer funds to/from any domestic account), the Aadhaar Payments Bridge (which links an individual’s Aadhaar number to his/her bank’s routing code and thus enables payments to a recipient’s Aadhaar number to be routed to his/her bank), the National Unified USSD Platform (which enables customers to enter a USSD short-code on any handset with any mobile network to launch their bank’s mobile banking menu), and the UPI.[55] The final layer permits customers to authorize sharing of their personal information with service providers digitally.[56]

Moving forward

The Helix Institute survey highlighted that the largest barrier perceived by agents with respect to conducting more business was a lack of awareness of the service among customers.[57] Thus, coordination among government entities and financial service providers to increase awareness of financial access points and services could help improve adoption of formal financial services.

The RBI has recognised the need for improved financial literacy, dedicating a portion of the PMJDY initiative to this objective.[58] A number of financial literacy initiatives are in development or underway. For example, in January 2016, NABARD Bank and J&K Bank agreed to launch a financial literacy campaign affecting an estimated 50,000 households in India.[59]

While advancing access to formal financial services is a key priority of the government, financial inclusion authorities recognise that the quality of these services is critical to promoting financial health. The RBI recognized systemic concerns regarding over-indebtedness in its “Report of the Committee on Medium-Term Path on Financial Inclusion,”[60] which underscores the fact that ongoing efforts to promote financial access must be complemented with due attention to consumer protection.

Over the coming months, payments banks must surmount logistical challenges involving the setup of subsidiaries and hiring staff, as well as determining a viable business model, in order to expand access to financial products and services among marginalised communities.[61] Mobile-enabled payments bank accounts are expected to be included in the UPI, which should facilitate account interoperability.

Additionally, government and private sector stakeholders must work together to address barriers to financial inclusion among women,[62] migrants, and other underserved populations.[63] Ensuring that risk-based KYC requirements are implemented effectively is one necessary step to reducing barriers surrounding financial access and usage.[64] Increasing adoption of digital financial services in particular could help drive financial inclusion among these groups.[65] USAID has provided several recommendations for increasing takeup of digital financial services among non-users in India, including better training of agents and more clearly communicating specific use cases to prospective customers.[66] [67] Additionally, accelerating interoperability of electronic wallets could advance usage of these services by promoting convenience for customers.

Footnotes

[1] “Pradhan Mantri Jan Dhan Yojana,” PMJDY, Undated, Accessed May 2016, http://www.pmjdy.gov.in/about

[2] Asli Demirguc-Kunt, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden, “The Global Findex Database 2014: Measuring Financial Inclusion around the World,” Policy Research Working Paper 7255, World Bank, April 2015, 26, http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/ IB/2015/04/15/090224b082dca3aa/1_0/Rendered/PDF/ The0Global0Fin0ion0around0the0world.pdf#page=3.

[3] Asli Demirguc-Kunt, Leora Klapper, Dorothe Singer, and Peter Van Oudheusden, “The Global Findex 2014: Measuring Financial Inclusion around the World,” The World Bank Group, April 2015, 59, http://www-wds.worldbank.org/external/default/WDSContentServer/WDSP/ IB/2015/04/15/090224b082dca3aa/1_0/Rendered/PDF/ The0Global0Fin0ion0around0the0world.pdf#page=3.

[4] Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 17, http://www.helix-institute.com/sites/default/files/Publications/Agent%20Network%20Accelerator%20Survey%20-%20India%20Country%20 Report%202015_0.pdf.

[5] “FM: Record Number of 11.50 Crore Bank Accounts Opened Under Pradhan Mantri Jan Dhan Yojana (PMJDY) as on 17th January 2015 against the original Target of 7.5 Crore by 26th January, 2015,” Press Information Bureau, 20 January 2015, http://pib.nic.in/newsite/PrintRelease.aspx?relid=114810.

[6] Vrishti Beniwal, “India Goes Postal in Bid to Give Bank Accounts to the Masses,” Bloomberg, 6 January 2016, http://www.bloomberg.com/news/articles/2016-01-06/india-goes-postalin-quest-to-open-bank-accounts-for-the-masses

[7] “Progress Report: Accounts Opened as on 11 May 2016,” PMJDY, 11 May 2016, http://pmjdy.gov.in/account

[8] A “full-service bank account” in this context refers to accounts with banks that offer a full suite of financial services, including formal savings. See “India: Wave Report FII Tracker Survey: Conducted June-October 2015,” Financial Inclusion Insights, InterMedia, March 2016, 19, http://finclusion.org/uploads/file/reports/InterMedia%20FII%20Wave%203%202015%20India.pdf.

[9] “India: Wave Report FII Tracker Survey: Conducted JuneOctober 2015,” Financial Inclusion Insights, InterMedia, March 2016, 19, http://finclusion.org/uploads/file/reports/InterMedia%20FII%20Wave%203%202015%20India.pdf.

[10] “Scheme Details,” PMJDY, Undated, Accessed May 2016, http://www.pmjdy.gov.in/scheme.

[11] “Financial Inclusion Strategy Peer Learning Group,” Alliance for Financial Inclusion (AFI), 2014, http://www.afiglobal.org/aboutus/how-we-work/about-working-groups/financial-inclusionstrategy-peer-learning-group-fisplg.

[12] “AFI members,” Alliance for Financial Inclusion, Undated, Accessed May 2016, http://www.afi-global.org/afi-members.

[13] “India Announces New Partnership to Accelerate Financial Inclusion for Everyone,” Better Than Cash Alliance, 1 September 2015, https://www.betterthancash.org/news/media-releases/india-announces-new-partnership-to-accelerate-financialinclusion-for-everyone.

[14] “Pradhan Mantri Jan Dhan Yojana ,” Undated, Accessed May 2016, http://www.pmjdy.gov.in/about.

[15] Ibid.

[16] Asit Ranjan Mishra, “India has started linking Jan Dhan scheme, Aadhaar and mobile numbers: Arun Jaitley,” Livemint, 2 April 2016, http://www.livemint.com/Politics/PRmaclHkzL6fGJEUIVLo3H/India-has-started-linking-Jan-Dhanscheme-Aadhaar-and-mobil.html.

[17] “IFC Mobile Money Scoping Country Report: India,” International Finance Corporation, June 2013, 36, http://www.ifc.org/wps/wcm/connect/49a11580407b921190f790cdd0ee9c33/India+Scoping+report+063013+for+publication.pdf?MOD=AJPERES.

[18] IFC Mobile Money Scoping Country Report: India,” International Finance Corporation, June 2013, 8, http://www.ifc.org/wps/wcm/connect/49a11580407b921190f790cdd0ee9c33/India+Scoping+report+063013+for+publication.pdf?MOD=AJPERES.

[19] “RBI releases Guidelines for Licensing of Payments Banks,” Reserve Bank of India, 27 November 2014, https://rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=32615

[20] “Guidelines for Licensing of Payments Banks,” Reserve Bank of India, 27 November 2014, https://rbi.org.in/scripts/bs_viewcontent.aspx?Id=2900.

[21] Kabir Kumar and Dan Radcliffe, “2015 Set to Be Big Year for Digital Financial Inclusion in India,” CGAP, 15 January 2015, http://www.cgap.org/blog/2015-set-be-big-year-digitalfinancial-inclusion-india

[22] According to a 2013 report by the International Finance Corporation, business correspondents (BCs) are defined as “representative[s] authorised to offer services such as cash transactions where the lender does not have a branch.” See “IFC Mobile Money Scoping Country Report: India,” International Finance Corporation, June 2013, 32, http://www.ifc.org/wps/wcm/connect/49a11580407b921190f790cdd0ee9c33/India+Scoping+report+063013+for+publication.pdf?MOD=AJPERES.

[23] “Financial Inclusion by Extension of Banking Services – Use of Business Correspondents,” Reserve Bank of India, 24 June 2014, https://www.rbi.org.in/scripts/BS_CircularIndexDisplay.aspx?Id=8955

[24] “Progress Report: Accounts Opened as on 11 May 2016,” PMJDY, 11 May 2016, http://pmjdy.gov.in/account.

[25] There are three major agent network models, including banks that directly manage agent networks, business correspondent network managers, and MNOs that manage agent networks. See Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 6, http://www.helix-institute.com/sites/default/files/Publications/Agent%20Network%20 Accelerator%20Survey%20-%20India%20Country%20Report%202015_0.pdf.

[26] Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 4, http://www.helix-institute. com/sites/default/files/Publications/Agent%20Network%20Accelerator%20Survey%20-%20India%20Country%20 Report%202015_0.pdf.

[27] Graham Wright, “Digital Financial Inclusion In India – A Long Road To Take-Off?,” MicroSave, September 2015, http://blog.microsave.net/digital-financial-inclusion-in-india-a-long-roadto-take-off/.

[28] Akhand Tiwari, Lokesh K Singh, Mukesh Sadana and Puneet Chopra, “The Curious Case of Missing Agents in Rural India,” MicroSave India Focus Note 105, January 2014, http://www.microsave.net/files/pdf/IFN_105_The_Curious_Case_of_Missing_Agents_in_Rural_India_MicroSave.pdf.

[29] Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 10, 42, http://www.helix-institute.com/sites/default/files/Publications/Agent%20Network%20Accelerator%20Survey%20-%20India%20Country%20Report%202015_0.pdf.

[30] Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 10, 42, http://www.helix-institute.com/sites/default/files/Publications/Agent%20Network%20Accelerator%20Survey%20-%20India%20Country%20Report%202015_0.pdf.

[31] “India: Driving Digital Financial Inclusion Wave 2,” Financial Inclusion Insights, InterMedia, June 2015, 45, http://finclusion.org/wp-content/uploads/2014/05/FII-India-2014-Wave-2-Wave-Report.pdf.

[32] “Beyond Cash: Why India Loves Cash and Why That Matters for Financial Inclusion,” USAID and the U.S. Global Development Lab, January 2016, https://www.globalinnovationexchange.org/beyond-cash.

[33] Ibid.

[34] “RBI grants ‘in-principle’ approval to 11 Applicants for Payments Banks,” Reserve Bank of India, 19 August 2015, https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=34754.

[35] Nils Clotteau, “Can India Post rise up to the digital payments and financial inclusion challenge?,” Better Than Cash Alliance, 8 October 2015, https://www.betterthancash.org/news/blogsstories/can-india-post-rise-up-to-the-digital-payments-andfinancial-inclusion-challenge.

[36] Vrishti Beniwal, “India Goes Postal in Bid to Give Bank Accounts to the Masses,” Bloomberg, 6 January 2016, http://www.bloomberg.com/news/articles/2016-01-06/india-goes-postalin-quest-to-open-bank-accounts-for-the-masses.

[37] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Compendium of merchant and consumer quantitative survey insights,” USAID, 17 November 2015, 11, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/1.%20USAID%20India%20 Digital%20Payments%20Quantitative%20Research%20 Findings_1.pdf?MRNJjETeewvi3m9sjZA2lzH0xGjAMIuC.

[38] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Compendium of merchant and consumer quantitative survey insights,” USAID, 17 November 2015, 11, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/1.%20USAID%20India%20 Digital%20Payments%20Quantitative%20Research%20 Findings_1.pdf?MRNJjETeewvi3m9sjZA2lzH0xGjAMIuC.

[39] Ibid.

[40] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Compendium of merchant and consumer quantitative survey insights,” USAID, 17 November 2015, 76, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/1.%20USAID%20India%20 Digital%20Payments%20Quantitative%20Research%20 Findings_1.pdf?MRNJjETeewvi3m9sjZA2lzH0xGjAMIuC.

[41] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Compendium of merchant and consumer quantitative survey insights,” USAID, 17 November 2015, 76, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/1.%20USAID%20India%20 Digital%20Payments%20Quantitative%20Research%20 Findings_1.pdf?MRNJjETeewvi3m9sjZA2lzH0xGjAMIuC.

[42] Rachel Chitra, “NPCI aims at financial inclusion: 74% of RuPay card-holders first-time users,” The Times of India, 12 January 2016, http://timesofindia.indiatimes.com/business/indiabusiness/NPCI-aims-at-financial-inclusion-74-of-RuPay-cardholders-first-time-users/articleshow/50551312.cms.

[43] Saurabh Kumar, “E-payments surpass paper clearances,” Livemint, 14 January 2016, http://www.livemint.com/Industry/bmXMIPwPmL7RfEwaijAXQP/Epayments-surpass-paperclearances.html.

[44] “Report of the Committee on Medium-term Path on Financial Inclusion,” Reserve Bank of India, 28 December 2015, https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=836.

[45] Ibid.

[46] Pranay Lakshminarasimhan, “NPCI’s interface to not include wallet accounts,” The Financial Express, 1 April 2016, http://www.financialexpress.com/article/markets/indian-markets/npcisinterface-to-not-include-wallet-accounts/231449/.

[47] Ibid.

[48] See http://www.indiastack.org/About-Digital-India for more information.

[49] Kabir Kumar and Sanjay Jain, “India Stack to bridge the digital divide in our country,” The Economic Times, 29 February 2016, http://blogs.economictimes.indiatimes.com/et-commentary/india-stack-to-bridge-the-digital-divide-in-our-country/.

[50] “What is the India Stack?,” CGAP, 15 March 2016, 12, http://www.slideshare.net/CGAP/what-is-the-india-stack.

[51] See https://uidai.gov.in/what-is-aadhaar.html for more information.

[52] Kabir Kumar and Sanjay Jain, “India Stack to bridge the digital divide in our country,” The Economic Times, 29 February 2016, http://blogs.economictimes.indiatimes.com/et-commentary/india-stack-to-bridge-the-digital-divide-in-our-country/

[53] Jay Pullar, “India Stack takes the Digital India campaign to a whole new level,” ProductNation, 21 December 2015, http://pn.ispirt.in/india-stack-takes-the-digital-india-campaign-to-awhole-new-level/

[54] “What is the India Stack?,” CGAP, 15 March 2016, 12, http://www.slideshare.net/CGAP/what-is-the-india-stack

[55] Kabir Kumar and Dan Radcliffe, “Can India Achieve Universal Digital Financial Inclusion?,” CGAP, 20 January 2015, http://www.cgap.org/blog/can-india-achieve-universal-digital-financialinclusion.

[56] Kabir Kumar and Sanjay Jain, “India Stack to bridge the digital divide in our country,” The Economic Times, 29 February 2016, http://blogs.economictimes.indiatimes.com/et-commentary/india-stack-to-bridge-the-digital-divide-in-our-country/

[57] Aakash Mehrotra and Denny George, “Agent Network Accelerator Survey: India Country Report 2015,” Helix Institute of Digital Finance, August 2015, 16, http://www.helix-institute.com/sites/default/files/Publications/Agent%20Network%20Accelerator%20Survey%20%20India%20Country%20Report%202015_0.pdf.

[58] “Financial Literacy,” PMJDY, Undated, Accessed May 2016, http://www.pmjdy.gov.in/literacy

[59] “NABARD, J&K Bank to Join Hands for Financial Literacy Campaign,” Daily Excelsior, 21 January 2016, http://www.dailyexcelsior.com/nabard-jk-bank-to-join-hands-for-financialliteracy-campaign/

[60] “Report of the Committee on Medium-term Path on Financial Inclusion,” Reserve Bank of India, 28 December 2015, https://rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=836

[61] Nils Clotteau, “Can India Post rise up to the digital payments and financial inclusion challenge?,” Better Than Cash Alliance, 8 October 2015, https://www.betterthancash.org/news/blogsstories/can-india-post-rise-up-to-the-digital-payments-andfinancial-inclusion-challenge

[62] “Fifty-Eight Percent of Women in India Report Difficulty Accessing Credit, Savings, or Jobs Because of their Gender,” The Center for Financial Inclusion, 22 May 2015, http://cfi-blog.org/2015/05/22/fifty-eight-percent-of-women-in-india-reportdifficulty-accessing-credit-savings-or-jobs-because-of-theirgender/

[63] “Govt policies fail to protect migrants: Gandihigram VC,” The Times of India, 11 February 2016, http://timesofindia.indiatimes.com/city/madurai/Govt-policies-fail-to-protect-migrantsGandhigram-VC/articleshow/50940559.cms

[64] TNN, “No ID proof prevents many from opening Jan Dhan accounts,” The Times of India, 28 October 2015, http://timesofindia.indiatimes.com/city/pune/No-ID-proof-preventsmany-from-opening-Jan-Dhan-accounts/articleshow/49560538.cms.

[65] Leora Klapper, “The gender gap in financial inclusion and the 2014 Global Findex,” Reuters, 21 April 2015, http://news.trust.org//item/20150421184902-4usvh/.

[66] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Compendium of merchant and consumer quantitative survey insights,” United States Agency For International Development (USAID), 17 November 2015, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/1.%20USAID%20India%20Digital%20Payments%20Quantitative%20Research%20Findings_1.pdf?MRNJjETeewvi3m9sjZA2lzH0xGjAMIuC

[67] “A Partnership to Support Financial Inclusion Through Expanded Payments Acceptance Networks and Other Efforts: Research findings from human-centered design (HCD) research,” USAID, 20 October 2015, https://giexchange-www.s3.amazonaws.com/s3fs-public/asset/document/2.%20USAID%20India%20Digital%20Payments%20Qualitative%20Research%20Findings_2.pdf?YG2PVrlfjf91CXiFlYCmclqiy2N3kbso

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).