Recently I read that World Bank staff were

unhappy about major cuts

to the institution’s budget. This prompted me to try to figure out what the Bank’s proper budget should be to meet its goal of ending extreme poverty by 2030. I applied a variety of empirical techniques, but in the end realized that the question could not actually be answered because the Bank’s policies and institutional structures are the thing that matter most. It is the wrong question to ask what the World Bank’s budget should be. The right question to ask is: “If extreme poverty is eliminated, what should the Bank’s budget have been?” I am somewhat embarrassed to have tried to answer the budget question since attempting to do so might perpetuate misunderstandings among World Bank staff who believe their work is affected by the presence of a predictable salary….

This logic might seem far-fetched, but it came to mind as a surprisingly apt analogue when I was reading my friend Shanta Devarajan’s rhetorical flourishes while reflecting on his old MDG financing paper in a blog post earlier this week on Future Development. Like my colleague Homi Kharas, I think Shanta’s blog is too self-flagellating, although for different reasons.

1. It blurs the historical context

The Millennium Development Goals (MDGs) were launched in the early 2000s as a global response to many years of structural adjustment programs and Washington Consensus-style efforts that focused on policy reforms while scaling back public resources. In sub-Saharan Africa, the consequences ranged from a missed generation of investments in agriculture to an extended period of economic stagnation to widespread health outcome catastrophes. The raging AIDS pandemic was pushing down life expectancies in many countries, famously including Botswana despite the country’s strong economic policies.

In the lead up to the seminal March 2002 Monterrey conference on Financing for Development, provisional costing studies were crucial for shifting the resource-policy pendulum back in to balance. These included the high-profile 2001 Zedillo report (which included heavyweights like Jacques Delors and Manmohan Singh); the in-depth 2001 Commission on Macroeconomics and Health; and, yes, the World Bank’s 2002 paper, which was filled with caveats on the primacy of institutions and policies.

2. It confuses regarding the purpose, strengths, and limits of different costing exercises

I spent many years in the middle of the professional MDG policy debates and can’t recall a single occasion where the 2002 World Bank study was referenced as a definitive assessment of MDG financing needs. It was always appreciated as a “quick-and-dirty” assessment prepared for a specific political moment. More rigorous, although still explicitly indicative, costing exercises were published in 2005. One was presented by my own U.N. Millennium Project team, a product of roughly 18 months of bottom-up work in synthesizing supply and demand-side fiscal actions for a series of low-income countries. The other was presented by the Commission for Africa, where Nicholas Stern’s research team produced very consistent results for one region.

In more recent years, many prominent studies have continued to advance our understanding of global development financing needs. For example, the 2013 Lancet Commission on Investing in Health, led by Larry Summers and Dean Jamison, assessed the investments required to achieve a “grand convergence” in health outcomes by 2035. At a more operational level, GAVI’s medium-term analysis helped inform its highly successful recent replenishment to roll out a new wave of global immunizations programs that will directly save millions of lives over the next five years.

One of the most under-appreciated tools for assessing goal-oriented, cross-sector, country-level investments remains the Maquette for MDG Simulations (MAMS), first developed under François Bourguignon when he was a World Bank chief economist. In a funny wrinkle of MDG history, the Bank’s operational side consistently resisted requests to support more rigorous country-level MDG costings, although this was a primary recommendation in the original paper by Shanta and colleagues. Even after the G-8’s high-profile 2005 aid commitments to Africa, it was left to the IMF and UNDP to write up the macroeconomics of “Gleneagles Scenarios.“

3. Many of the best MDG successes are linked to aid increases

The health sphere has seen the most dramatic MDG breakthroughs. The most clear cut example is the advent of global AIDS treatment programs. In 2000, more than 25 million Africans were infected with HIV and there was no international effort—none at all—to make antiretroviral therapy available. Roughly 2 million people were estimated to be dying every year, simply because they could not afford medicine. This was a low-level global political equilibrium, not a domestic one. Total development assistance for health was worth only around $2 per African, according to the Institute for Health Metrics and Evaluation.

Today there are more than 8 million Africans on life-saving AIDS treatment thanks to the aid-financed launch of the Global Fund to Fight AIDS, tubercolosis, and malaria and the U.S. Presidential Emergency Program for AIDS Relief. These institutions were not launched by economic growth in Africa, although they have probably helped to boost growth. Their scale-up was the product of discernible global policy efforts and resource allocations, backed by MDG mobilization. For the average African country, health aid has increased more than fivefold, to around $13 per capita in 2011.

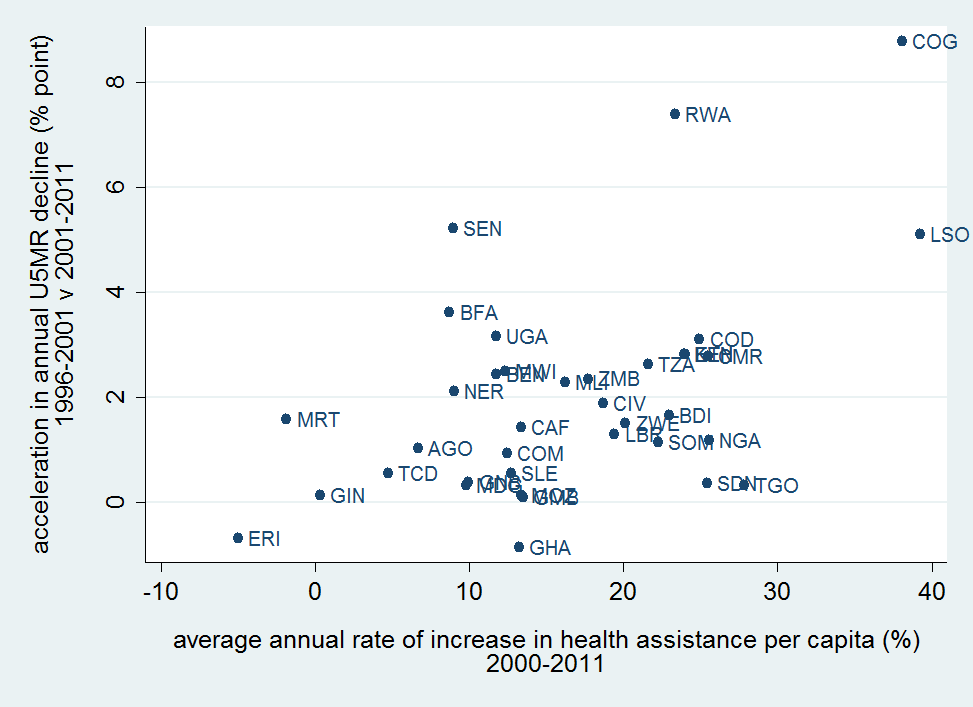

Figure 1: Africa’s gains in child survival are positively correlated with increased health assistance

Africa’s child survival story is equally historic, if more complex, since mortality has many underlying causes. As a rough proxy for health system outcomes, Figure 1 shows that accelerations in under-5 mortality rate declines before and after 2001 are positively correlated with increases in health aid across low-income African countries. The correlation coefficient is 0.52 and all of the major accelerations were accompanied by major aid increases. No serious analyst suggests money “buys” outcomes. But no serious analysis suggests these outcomes would have arrived in the absence of money.

What does this mean for the SDGs?

Financing for the SDGs entails much greater complexity than the MDGs. There are more issues, countries, and forms of financing to consider. One understandable response is to feel overwhelmed and deem the task impractical. This yields the paradox of more complexity prompting less analysis. A better response is to break the challenge down in to manageable problems—separating out those that we already understand from those that we might figure out with a bit more work, and those that might need a better framing in order to make a first dent.

Even the U.N.’s provisional recent summary of sectoral costings has already played a useful policy role. Intergovernmental negotiators now commonly refer to the need for “at least a trillion dollars” of incremental annual investment, with the big numbers driven by infrastructure costs. The figure represents a small fraction of total global investment, but it is big enough to prompt a new outlook for those accustomed to thinking in terms of millions and billions. And although the $1 trillion number is extremely rough in its composition, it quickly helped governments realize that even if all OECD donor countries reached the 0.7 percent aid target then the total would only add up to some $300-350 billion per year. This quickly consolidated the understanding that SDG financing will hinge hugely on domestic resources and private investment in addition to aid.

Kudos deserved for the 2002 costing paper

Costing exercises need to build thoughtfully and carefully on the caveats and lessons of past assessments. Thankfully, many do. In retrospect, early analyses were pivotal to raising and guiding resources that drove subsequent MDG successes. Shanta and colleagues’ quick study might fall short of contemporary analytical standards, but it added a helpful assessment at a key juncture. Considering the extraordinary number of incremental lives saved and improved since, Shanta and his co-authors can be rightly proud of their contribution.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Kudos for Shanta: How to appreciate the 2002 costing paper

March 6, 2015