Please download PDF for appendix.

Executive Summary

Public universities typically charge students less than the full cost of education, using funds from state and local government and other sources to cover the difference. This indirect subsidy is one of the largest forms of aid in America’s higher education system but is less understood in the policy community than grants and loans, which are provided directly to students in visible amounts, making them easier to analyze. Researchers and journalists aim to understand these indirect subsidies through proxies such as per-student spending, or per-student state appropriations. These simple analyses have led many to conclude that indirect subsidies at public universities favor students from affluent families. However, neither of these measures provides accurate information about the subsidy a student receives because they do not account for the tuition that students pay.

Combining data from multiple sources allows us to explore the relationship between university spending on education and what their students pay in tuition, more accurately estimating the average subsidies that students at public four-year universities receive. We use these estimates to examine how subsidies differ by family income and find that subsidies for education expenditures actually decline on average as student and family incomes increase.

This finding stems from two key trends that are often overlooked. First, selective state universities are not enrolling primarily high-income students—a key part of the claims critics make. In fact, low-income students are well represented at public four-year universities. Even at the most elite state universities they make up about 25 percent of the student body.

Second, low-income students tend to pay lower tuition than their high-income peers, even at the same type of universities, because they receive tuition discounts and grant aid from their school. That increases the public subsidy they receive relative to their peers, even before accounting for federal grants and other direct aid. At the same time, high-income students are much more likely to attend an out-of-state school, where tuition can be as much as three times the in-state rate, effectively bringing their public subsidy to zero.

Summary of Key Findings

Many people consider scholarships, grants, and loans the major sources of student aid for college. But public universities themselves are a form of student aid. The tuition and fees that they charge undergraduates do not cover the full cost of education. Appropriations from state and local government and other revenue sources offset a portion of these costs and schools pass the savings on to students through lower tuition. In other words, they provide a subsidy to the student. We call this the “indirect subsidy,” as it is different from grants and loans that a student receives directly as a nominal amount of aid.

Indirect subsidies at public universities are inherently opaque and less understood than grants and loans. It is far easier to know how grant aid is distributed among different students because schools or government provide the aid directly to individuals, usually through an application process, and generate a record of the transaction. Moreover, grants are visible subsidies. A $5,000 grant is worth just that, and it typically follows the student to her choice of school.

Understanding the value of indirect subsidies and how they are distributed among different students and schools is more difficult and bound to be less precise. The indirect subsidy varies by the school, and it is not contingent on eligibility criteria; students receive the subsidy just by enrolling. Moreover, universities and state governments generally do not calculate or disclose indirect subsidies.

Policy experts and journalists look to state funding for public universities for clues about indirect subsidies. That approach appears to show that indirect subsidies favor high-income students because state lawmakers provide larger per-student appropriations to elite universities, and students from high-income families are more likely to attend those schools. Those schools also spend more per student. Meanwhile, lower-income students disproportionately attend less-selective schools, which receive smaller per-student appropriations and spend less per student. Therefore, this conventional wisdom suggests, among students attending public universities, high-income families receive more public money than their low-income peers.[i] (Oftentimes, but not always, this argument refers to indirect subsidies at four-year public universities and two-year community colleges as a combined group. In this study, we analyze indirect subsidies only at public universities but plan to expand the work to include community colleges in the near future.)

The conventional wisdom is, however, more inference than analysis. A more rigorous approach requires student-level data about family income and the finances of the school each student attends. That is no easy feat, as student- and school-level information is generally not available all in one place. To overcome that limitation, we link two datasets, the National Postsecondary Student Aid Study (NPSAS) and the Integrated Postsecondary Education Data System (IPEDS).

We use these data to develop a more refined measure of indirect subsidies. Instead of the appropriation that state lawmakers provide to public universities, we measure the indirect subsidy as the difference between what a student pays in tuition and what the university spends on the education. These data also allow us to generate student-level estimates of indirect subsidies. Due to data limitations, we are not able to develop state-level estimates of subsidies, only national averages. Since public universities are deeply affected by state policies, this limitation likely masks substantial variation in indirect subsidies from one state to the next, and some systems may indeed fit the conventional narrative. Yet, the national averages tell us that those states are the exception, not the rule.

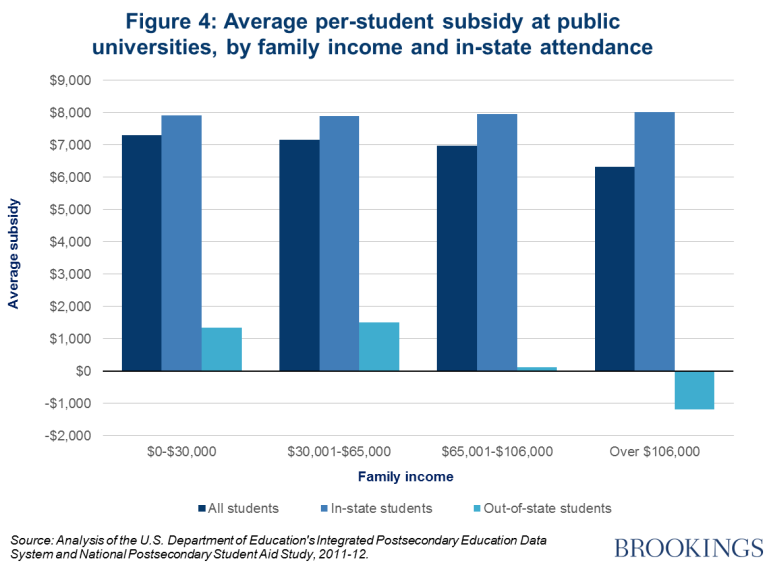

We find that the conventional wisdom is wrong about indirect subsidies at public universities. For students attending school in-state, there is no difference in the indirect subsidy among different income groups. Among all students regardless of in-state status, per-student subsidies actually decline as income rises, such that the highest-income students receive the smallest subsidies.

Looking at indirect subsidies in aggregate rather than per student, we find that the total distribution of indirect subsidies largely mirrors enrollment. That is, high-income students do not receive a disproportionate share of indirect subsidies provided to students attending public universities.

Finally, using a broader measure of indirect subsidy that includes spending on non-education services, mainly research, we find that high-income students do come out ahead in the distribution of indirect subsidies. However, it is debatable whether research spending represents an indirect subsidy to undergraduate students and it is difficult to determine what share of research spending might be directly or indirectly supported by state and local appropriations.

Discussion

To create the dataset for our analysis, we merge the NPSAS for the 2011-12 academic year with data from IPEDS for the same year. The NPSAS provides nationally-representative information about college students—including family income, tuition, and grant aid—but does not include information about schools’ revenues or expenditures, which we use to estimate indirect subsidies. IPEDS, on the other hand, does not provide information about individual students, but does include information about the finances of nearly every public university, including appropriations from state government and what each school spends on instruction and research. Combining these two sources thus allows for a complete picture of public universities’ spending on educational services, as well as what students pay in tuition to offset those costs. We use this data to measure indirect subsidies by the gap between what a university spends on a student’s education and what the school charges him in tuition.

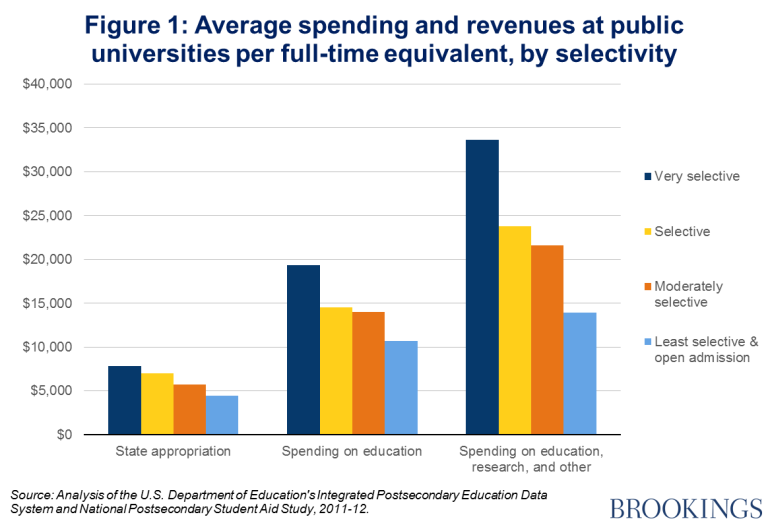

It is easy to see why many believe that indirect subsidies at public universities are skewed toward high-income students. At first glance, even our data appear to confirm that view. The data show that the more selective a university, the larger the per-student appropriation from state and local government. The amount that universities spend on key categories is also higher at more selective universities. And high-income students do indeed attend the most selective universities at greater rates than their low-income peers.

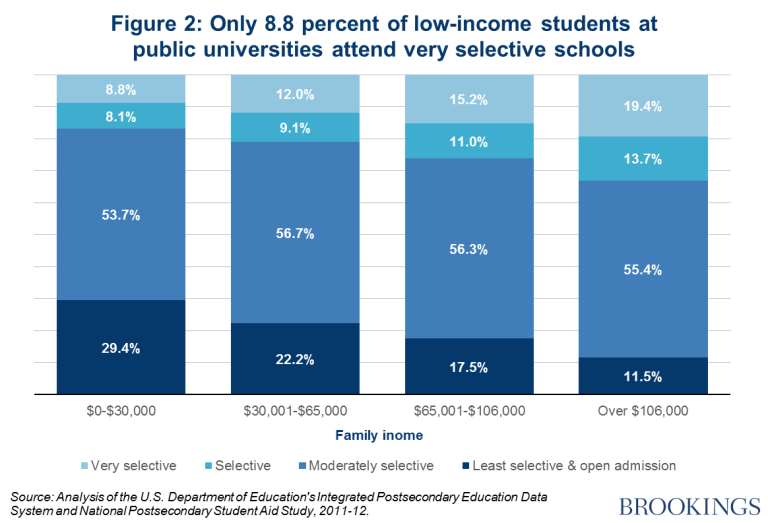

Figure 1 shows the average per-student appropriation that state and local governments provide to universities, the amount that universities spend per student on costs related to providing education services, and what they spend per student on a broader set of operating costs, including research.[ii] On all three measures, spending is higher at more selective schools. Figure 2 shows the share of students in each income group attending universities in each selectivity category. Nearly 20 percent of high-income students attending a public university enroll in a school in the very selective category compared with only 8.8 percent of low-income students. Meanwhile, 29.4 percent of low-income students who attend public universities attend the least-selective category of schools, but that is the case for only 11.5 percent of their high-income peers.

Typically, the argument that subsidies for public universities are skewed toward high-income students does not go any further than those points. But there are good reasons why state appropriations and gross university spending do not measure indirect subsidies accurately.

The per-student appropriation that a state government provides to a public university is not perfectly linked to the difference between what the university charges students and what it spends on undergraduate education, which we define as the indirect subsidy. University functions include undergraduate education, but also extend to research, hospitals, and much more. These complex activities make it difficult to draw a clear relationship between the per-student appropriation and spending on undergraduate education. Therefore, indirect subsidies for undergraduates are unlikely to match dollar-for-dollar the appropriations legislatures make to universities.

Similarly, measuring indirect subsidies by gross spending per student overlooks a key factor. Students pay tuition that covers some portion of the cost of their educations, so not all spending at a university reflects an indirect subsidy. Importantly, tuition varies significantly among selective and less-selective universities, between in-state and out-of-state students, and, critically, by student need.

Our measure of indirect subsidies reflects the amount universities spend that is not covered by tuition. We subtract the tuition and fees that a student pays from what the university spends on that student’s education. We use two measures of spending to estimate two separate indirect subsidies, one broader than the other. The first includes expenditures specifically related to education, including instruction, and a portion of spending on academic services and student services. The second measure is broader, and includes all spending on instruction, research, public service, and more.[iii]

As a further step in estimating the indirect subsidy, we reduce the tuition universities charge by any grant aid (merit or need-based) or discounts students receive from the schools themselves. That better reflects the actual revenue the school collected from the student.[iv] We do not, however, subtract other forms of direct aid to the student from the tuition a student pays, such as federal Pell Grants, because universities collect those sources of aid as tuition, albeit from a third party. Focusing on the tuition that a school actually collects from each student it enrolls isolates the indirect subsidy each student receives.

Similarly, we do not count grant aid provided by states as part of the indirect subsidy. Even though grants are another form of aid states provide to students attending public universities, they are a direct subsidy. The state provides them directly to students, who can take the aid to different schools such that the amount of the grant is generally not conditional on enrollment in a particular public university.[v]

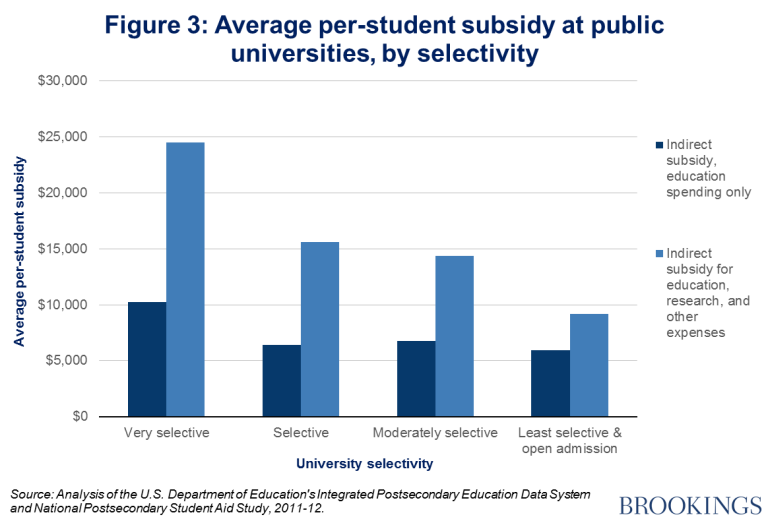

Figure 3 shows the two measures of indirect subsidy by the selectivity of the university. Even after reducing the amount universities spend per student by the net tuition students pay, the most selective universities still provide the largest indirect subsidies to their students by a wide margin. Universities in the very selective category provide an average indirect subsidy of $10,218 per student, about 50 percent more than moderately selective universities, and nearly double what the least selective schools provide.

Indirect subsidies by each income group

So far we have shown that more selective universities provide larger indirect subsidies, and that a large share of high-income students enrolls at these schools. However, when we measure these subsidies by student income, these same data show a surprising result. The average indirect subsidy among each income group declines as income rises. Low-income students receive the largest subsidy ($7,305), and high-income students receive the smallest subsidy ($6,318) among all students at public universities. Those figures reflect per-student indirect subsidies measured relative to what universities spend on education services, not the broader measure of spending that includes research, public service, and other activities. We will return to that broader measure in the final section of this analysis.

In-state and out-of-state tuition policies are a key factor that influences the differences in net tuition prices universities charge low- and high-income students. High-income students are far more likely to attend school out of state, where they generally pay much higher tuition and effectively forfeit the indirect subsidy they would receive if they stayed in their home states. In fact, the out-of-state tuition that high-income students pay, even after accounting for any scholarships or other aid provided by the school, is more than what the universities spend on education services on average. That means the indirect subsidy is negative for many out-of-state students. Per-student subsidies for in-state students are, on the other hand, the same across all income groups. In other words, differences in indirect subsidies among income groups are due to differences in in-state and out-of-state tuition.

But even for in-state students, per-student subsidies are unrelated to a student’s family income. Why? Put simply, low-income students pay lower tuition than their high-income peers, even when they attend the same schools. While high-income students generally do attend schools that spend more per student—about $2,000 more on average than the schools that low-income students attend—high-income students pay higher tuition, which more than offsets the difference in what universities spend.[vi] The per-student indirect subsidies that high-income students receive are therefore lower on average among all students at public universities.[vii]

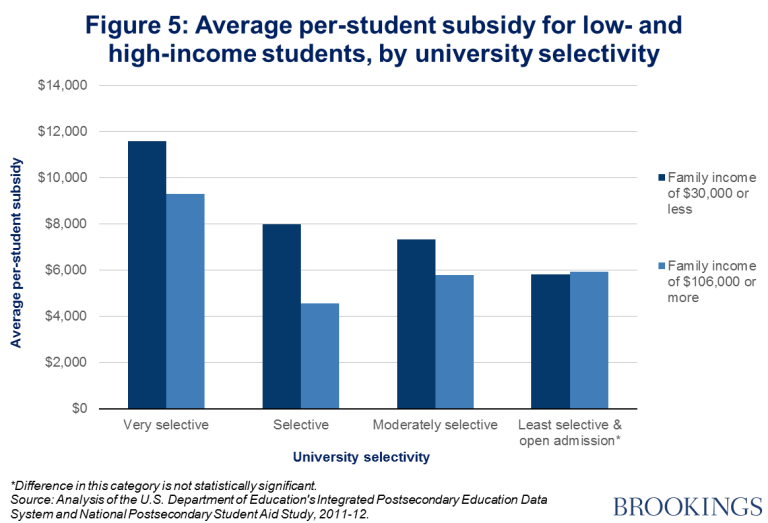

At the most selective universities, the average indirect subsidy is nearly 25 percent larger ($2,286 more) for a low-income student than for a high-income student. That gap is even wider in the second-most selective category, where low-income students receive an average $7,995 indirect subsidy and high-income students receive just $4,546. On average, in every category of selectivity, low-income students receive larger indirect subsidies because universities charge them lower net prices.[viii]

Student population and distribution of total indirect subsidies

Another version of the conventional wisdom holds that the sum total of indirect subsidies state governments provide at public universities disproportionately goes to high-income students. That is different from the discussion so far, which has focused on per-student subsidies, not the aggregate distribution of those subsidies among students who attend public universities. We tested this view on the distribution of public funds by looking at the total amount of indirect subsidies each income group receives among all students attending public universities.

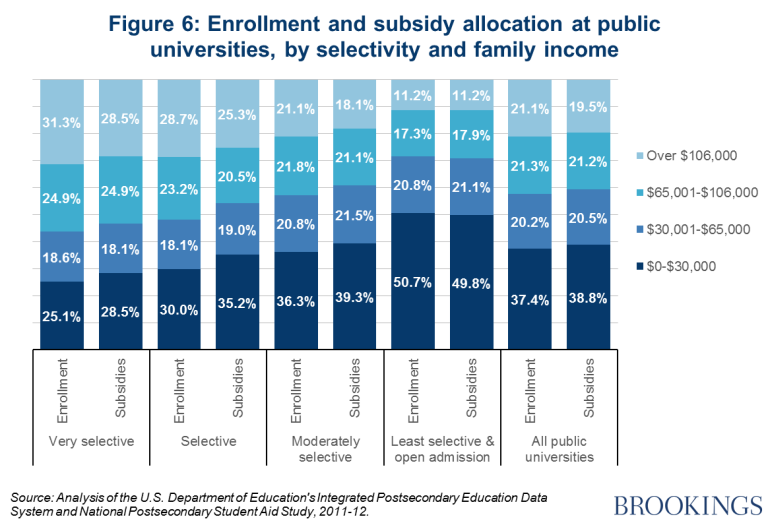

Again, the data reveal surprising findings. Among all of the dollars that support indirect subsidies at public universities, low-income students actually receive a slightly larger share than their enrollment alone would suggest. As shown in Figure 6, low-income students account for 37.4 percent of students enrolled in public universities and receive 38.8 percent of all indirect subsidies. High-income students, who the conventional wisdom says receive a larger share of the subsidies, actually receive a slightly smaller share (19.5 percent) than their enrollment (21.1 percent). That does not support what the conventional wisdom says we would find.

Two trends explain this key finding. First, low-income students make up a large share of students enrolled at public universities in all of the selectivity categories, even the most selective schools where indirect subsidies are highest. They account for 25.1 percent of students at very selective public universities and 30.0 percent at selective universities. High-income students account for 31.3 percent and 28.7 percent of enrollment at those schools, respectively. Furthermore, the per-student indirect subsidies that low-income students receive are larger than what their high-income peers receive within each selectivity category.

At first glance, the fact that low-income students comprise a sizeable share of enrollment at even the most selective institutions (25.1 percent) contradicts what we showed earlier, that most low-income students do not attend highly selective universities and a large share of high-income students do. As we showed earlier, only 8.8 percent of low-income students attending a public university enroll in a school in the very selective category. The difference in those two statistics is the denominator. The latter uses the income group as the denominator and the former uses very selective universities as the denominator. Because low-income students make up a large share of all students enrolled at all public universities (numerically, there are nearly twice as many low-income as high-income students at public universities), even if a small share of them attend the relatively small number of very selective universities, they can still account for a large share of students at those schools.

Looking only at students who attend in-state universities reveals effectively the same trend. Thus, even after excluding students who forego much or all of their indirect subsidies by attending out-of-state universities, many of whom are high-income students, we find that the total amount of indirect subsidies states provide is still not skewed toward high-income students. Low-income students make up 38.7 percent of in-state students enrolled at public universities and receive 38.6 percent of all indirect subsidies. High-income students make up 19.6 percent of in-state students enrolled at public universities and receive 19.8 percent of all indirect subsidies.

Research spending correlates with student income

So far we have explored indirect subsidies based on how much universities spend on education services, after factoring out tuition that students pay. As mentioned before, we also measured indirect subsidies using a broader measure of spending at public universities, which includes spending on education services along with other activities, including research.

Since this broader measure includes spending not directly related to undergraduate instruction, it is less clear whether the full amount of this spending (less tuition) is an indirect subsidy to students. In some cases, research may indeed benefit undergraduates through exposure to prominent faculty, or other means. Still, it is difficult to assess how often this is the case and to what extent.

With that caveat in mind, we use the broader measure of indirect subsidy to explore how research spending compares with our measure of indirect subsidy based on education services. We find that the broader indirect subsidy is correlated with family income: low-income students receive the smallest subsidy ($13,780) versus high-income students, who receive the most ($15,972), as shown in Figure 7. In terms of the overall distribution of indirect subsidies, the difference is less stark but still shows high-income students coming out ahead. High-income students make up 21.1 percent of students at public universities but receive 22.9 percent of indirect subsidies that include research. Low-income students make up 37.4 of enrollment and receive 35.0 percent of indirect subsidies that include research.

This is explained by the fact that high-income students attend schools that spend more per student on education services and research, but the range of spending on education services alone is relatively narrow, so differences in what students pay in tuition can more than offset those differences. However, spending on research varies widely among universities, since some support little or no research, while others support substantial research efforts. We find that differences in research spending are large enough to more than cancel out the effect of schools charging low-income students lower tuition. Conversely, differences in what universities spend on education services are not large enough to cancel out the effect lower tuition has on the indirect subsidy low-income students receive.

Policy implications

It is a popular belief in the policy community and among journalists that state subsidies for public universities are a regressive benefit. Our analysis uncovers that indirect subsidies are actually relatively flat, if not slightly progressive. How subsidies should be allocated is, however, still open for debate and our findings offer new perspective on that topic.

In absolute terms, high-income families receive what some may see as overly generous indirect subsidies. While high-income students receive smaller indirect subsidies than their low-income peers, the subsidies still reach nearly $10,000 per student at the most selective public universities. Some of these high-income families opt out of receiving indirect subsidies by enrolling out of state or at a private university, but policymakers and universities might redirect a portion of the subsidies provided to in-state students toward more disadvantaged students, making the distribution of indirect subsidies much more progressive than it is now.

At the same time, our findings reinforce that universities have a good reason for enrolling high-income students: these students cover more of the cost of the education than their-low income peers. Because of that dynamic, high-income students at universities in our second-most selective category receive an indirect subsidy that is some 40 percent lower than their low-income peers. Moreover, our findings suggest that recruiting more out-of-state students can actually make the distribution of indirect subsidies more progressive. While many have criticized universities for chasing out-of-state students, our analysis casts that strategy in a different light. High-income students who enroll in an out-of-state university actually receive a negative indirect subsidy, and in a macro sense, those excess tuition payments appear to be redirected at low-income students. Of course, enrolling out-of-state students can limit the available seats for in-state students, and our study is silent on those effects.

This analysis also has implications for the merit aid that public universities use to recruit high-income students. Merit aid for high-income students is widely criticized in the policy community. Many claim that it is another way in which taxpayers subsidies at public universities favor the affluent. Because our analysis treats all aid offered by the school as part of the indirect subsidy that students receive, it includes merit aid. Therefore, our findings indicate that despite public universities using merit aid to attract high-income students, that practice has not reached a level sufficient to skew the distribution of total indirect subsidies toward high-income students, nor has it resulted in high-income students receiving more aid per student at any type of public university. And given that our findings suggest out-of-state students help make the distribution of indirect subsidies slightly progressive, to the extent merit aid entices high-income students to attend out-of-state, merit aid might actually be a progressive rather than regressive policy on the whole.

This paper raises another question with respect to a major trend in higher education finance. Following the economic recession that began in 2007, state governments have generally not provided appropriations sufficient to keep per-student indirect subsidies at pre-recession levels. Our study shows that this “disinvestment” has not skewed indirect subsidies at public universities such that they disproportionately benefit high-income students. We were unable to include a time-series element in this study, which would provide context on how indirect subsidies were distributed historically, but plan to expand this work to examine how indirect subsidies have changed over time.

Bad news about state universities is commonplace these days. States are cutting funding, universities are raising tuition, and students are going deeper into debt. It is tempting then to believe that funding for state universities is also flawed and must also be rigged to serve well-off students, but that claim does not stand up to analysis. We have shown that, at least among students who attend public four-year universities, indirect subsidies do not disproportionately benefit high-income students. On a per-student basis, indirect subsidies are smaller for high-income students at public universities than for low-income students, even at the most selective schools. Furthermore, low-income students are well represented at public universities across the selectivity spectrum such that they receive a total amount of indirect subsidies that is slightly greater than their share of enrollment.

[i] A 2014 op-ed by the Washington Post’s Fred Hiatt titled “In-state College Tuition: A Handout to the Rich” is a good example of this thinking. Hiatt quotes student aid expert Sandy Baum of the Urban Institute saying that students from high-income families are more likely to go to college and are more likely to attend flagship universities to boot. Hiatt then adds, “flagship colleges are where the [state] subsidy is largest.” See https://www.washingtonpost.com/opinions/fred-hiatt-subsidized-college-tuition-amounts-to-a-handout-to-the-rich/2014/11/02/af5e2222-6111-11e4-8b9e-2ccdac31a031_story.html.

[ii] Indirect subsidies are based on Delta Cost Project’s definition of education and related spending, but we do not use data provided by Delta Cost, due to concerns with institutional groupings. See our methodological appendix for a more detailed explanation.

[iii] For a full explanation of these spending categories, see Delta Cost Project’s data dictionary, or our description in notes iv and v.

[iv] In the rare case that a student’s institutional grants more than offset the cost of his tuition, we assign him a higher indirect subsidy accordingly, even though the excess amount covers his living expenses.

[v] Nationally, state grant aid among students attending public universities is on average skewed heavily toward low-income students. Therefore, if we were to include it in a measure of state subsidies—both direct and indirect—it would not alter our overall findings. We leave it out, however, to isolate the size and distribution of indirect subsidies for students attending public universities. Among students attending in-state universities, low-income students receive an average state grant of $1,293 and high-income students receive $574.

[vi] Education and related spending per student among high-income students is $15,173. Among low-income students it is $13,208.

[vii] A stylized example illustrates how a university’s tuition pricing influences the amount of indirect subsidy low- and high-income students receive. Suppose a public university spends $10,000 per student, but charges only $6,000 in annual tuition. Under our methodology, we assume that the indirect subsidy provided by the university is $4,000 in that case. Now assume the university uses its own funds to provide a $2,000 grant to low-income students but none to high-income students. Because the university’s funds are fungible, that grant to low-income students effectively reduces what the school charges the students by $2,000. Therefore, the indirect public subsidy is $2,000 higher for the low-income students.

[viii] Universities in the open enrollment category are an exception to this trend, but that is not a statistically reliable finding due to the small sample size of high-income students in this selectivity category.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).