Editor’s Note: Clifford Gaddy and Barry Ickes article “Can Sanctions Stop Putin?” is also available to read in Russian. Learn more»

As the Ukraine crisis continues, further rounds of sanctions on Russia are being discussed. But the question that still hasn’t been answered is, do sanctions work? For some, the question seems unnecessary. Clearly, sanctions work. Capital is flowing out of Russia, the ruble is losing value, Russian companies have less access to foreign credits, and the country’s GDP is falling.

The problem is that such facts — even if they could all be attributed to the sanctions — still don’t tell us whether sanctions are working. We need to distinguish between effectiveness and impact. Figures about economic negatives such as reduced trade, foreign investment, credit flows, technology transfer, GDP growth, incomes, and so on — these measure impact. They do not, however, tell us how likely the sanctions are to cause Russia to change its behavior — that is, how effective they will be.

To put it another way, impact tells us how much pain we can cause. Effectiveness depends also on how able and willing Russians are to endure the pain. To answer that question, we need to understand, first, the peculiarities of the Russian economy and past Russian experience with economic hardship, and second, Russians’ motivations for the behavior we want to change.

The last point is crucial. It is a fallacy to assume that Russia will respond to sanctions the same way that we would. We cannot simply project our own preferences onto Russians. (After all, if Russians had our preference structure, they would not have annexed Crimea in the first place.) Whether it is the idea that Vladimir Putin cares more about his personal wealth than Russia’s national security, or that ordinary Russians who see their living standards decline as a result of sanctions will mechanistically direct their anger against Putin rather than the West — many of the assumptions underlying the West’s sanctions policy are flawed, to say the least.

Our sanctions will be costly to Russia; there is no disputing that. If the primary goal of Putin and Russian decision makers were to maximize Russian economic welfare, then the costs would, at some point, become unacceptable. But if the motivation is defense of vital national interests and survival, Russia — like any state — will resort to import substitution and even more radical sorts of interventions to defend itself, no matter what the cost.

A Resilient Russia

The motivation for sanctions is to impose hardship in order to change behavior. But the likelihood that this would apply to Russia is very weak.

History tells us that Russians can endure enormous hardship. Coping and survival are part of Russian history and the Russian national identity. We do not need to go back to dramatic events like the Siege of Leningrad in World War II to understand that Russians can survive difficult situations. Less than two decades ago, during the 1990s, Russia suffered one of the biggest negative economic shocks ever by a country in peacetime. National and household incomes dropped by at least 40 percent. That experience shows that Russia’s households and enterprises can endure significant dislocation thanks to bottom-up, informal mechanisms of mutual help and self-survival.

This can be repeated. Russia still today is a more primitive economy than generally recognized. Yes, there is a veneer of modernity, a “new economy” that has emerged. And that part of the economy is fragile and vulnerable. But the core of the economy, the part inherited from the Soviet Union, is an economic structure that is highly robust to negative shocks. Much is made of the alleged weakness of today’s Russian economy. This notion that the Russian economy is somehow fragile is the backbone of the sanctions argument. But inefficiency — which definitely does characterize Russia’s economy — is not the same as fragility. The very features of the Russian economy that account for its inefficiency and lack of competitiveness in the global economy are also its strengths in terms of robustness to shocks. Were it not so likely to be considered disrespectful, we might describe Russia as the cockroach of economies — primitive and inelegant in many respects but possessing a remarkable ability to survive in the most adverse and varying conditions. Perhaps a more appropriate metaphor is Russia’s own Kalashnikov automatic rifle — low-tech and cheap but almost indestructible.

For all this, we would not deny that sanctions and the pain they cause may result in some shifts in Russia’s behavior with respect to Ukraine. But the changes will affect only tactics and timing, not Putin’s overall strategic goals and resolve to achieve those goals. For that, sanctions would have to reduce Russia to its condition of the 1990s, when it was simply too weak and dependent on the West to oppose the international order created by the West after the Cold War. It is clear to us that no feasible actions by the West today can re-create the weak and compliant Russia of the 1990s. To explain why we say that, we turn to what we regard as the keys for understanding the entire Russian economic system, the concepts of rent and rent management.

The Importance of Resource Rent

From the period of the tsars onward, Russia’s fortunes have always been dependent on its natural resources. In modern Russia, that boils down to the value of its oil and gas.

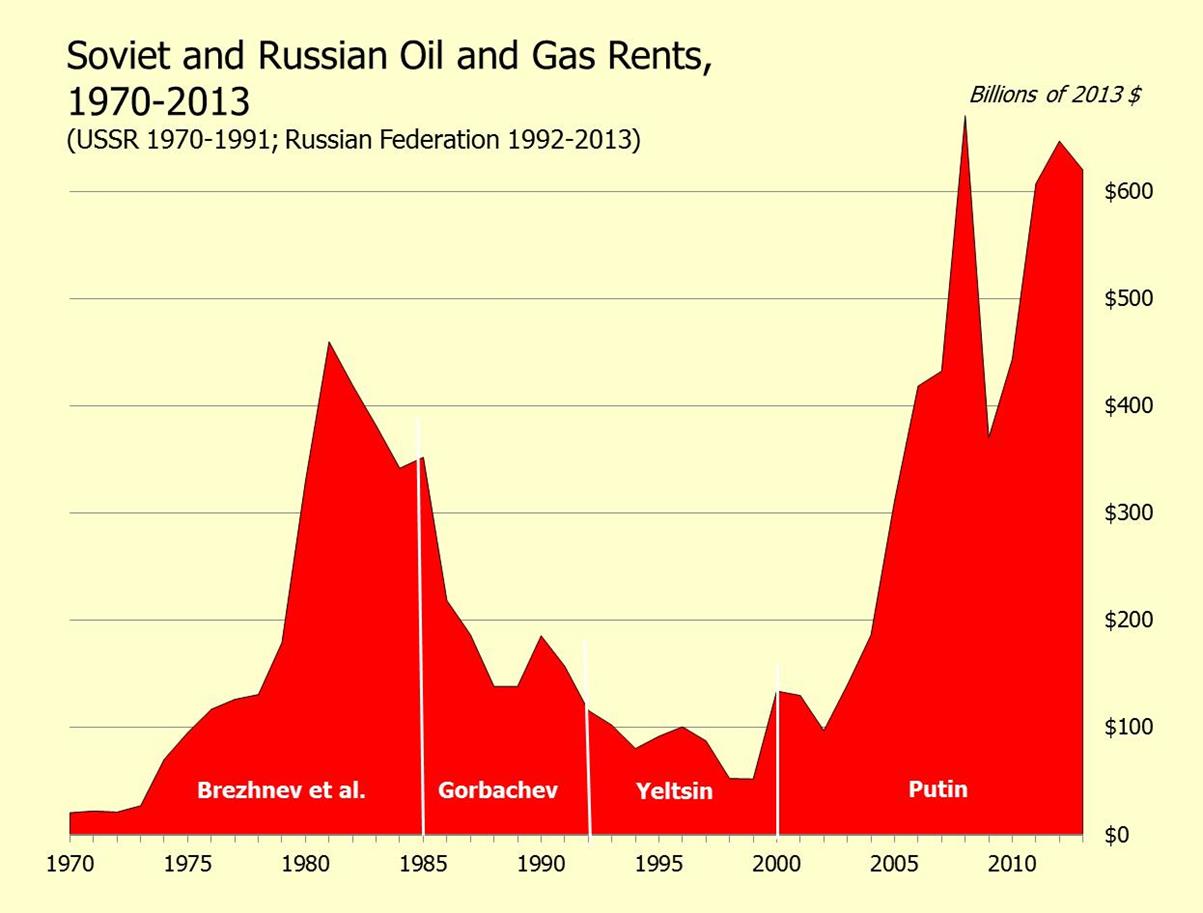

There are two key questions: how much of this value — so-called resource rent — is there, and who controls how it is produced, collected, and distributed in the economy? On both counts, Russia today is far different than it was in the 1990s. As the chart below shows, by the end of the 1990s, Russia had seen its resource rents decline for nearly two decades. They were a fraction of what they had been around 1980.

That decline in rents — combined with the collapse of the heavily integrated market of the Soviet Union — was what caused Russia’s weakness. Rent flows today are far greater than in the 1990s. To reduce them to the 1990s level would require drastic reductions of either the world oil price or the quantities of oil and gas produced and exported by Russia, or both. (It would take, for example, a simultaneous drop in the world oil price to under $40 a barrel and an output cut of over 60 percent of both oil and gas — over a sustained period — to produce that effect.)

This is not the end of the story. It is not just the volume of rents that matter. It is how they are controlled. In the 1990s the relatively small amount of rent available in the economy was not under the control of the center. Rents were redistributed through a chaotic and bottom-up system that did, admittedly, ensure the survival of households. But it did not serve the interests of key strategic sectors, especially those vital for state power. The situation today is different. Putin has put in place a strong, centralized system of rent management that permits him to channel the rents to groups and sectors of the economy he deems most important. A top priority for him is defense industry and the security apparatus. In an environment of a Russia under siege, his control will be tighter than ever. That control extends especially to the oligarchs, who play a key role in distributing the rents.

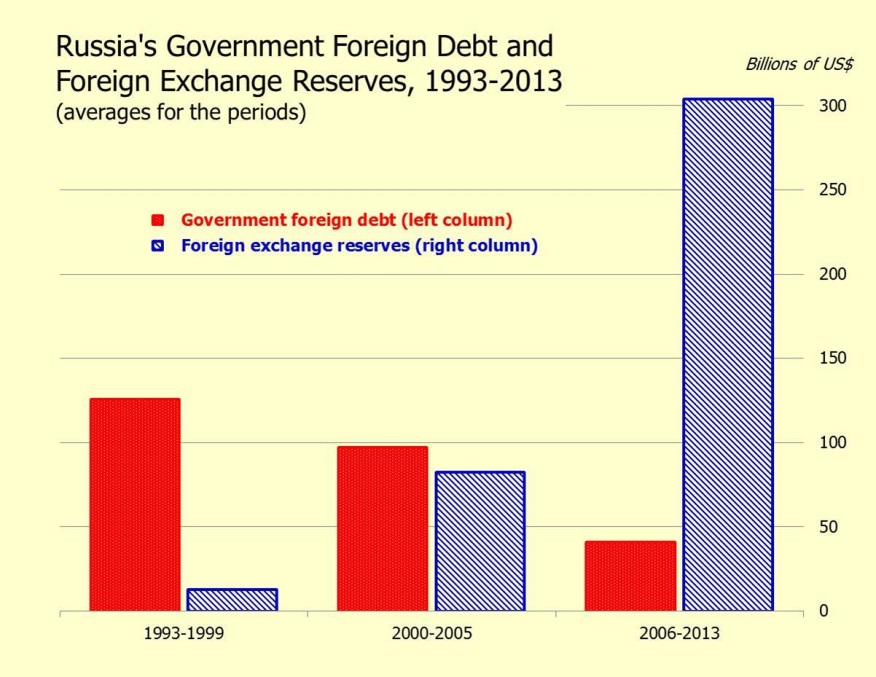

One of the most important reasons why Russia today is different than the Russia of the 1990s is that during his period in power, Putin has used the rent to make sure Russia has no debt to foreign governments or supranational institutions. As the figure shows, in the 1990s the Russian government’s foreign debt was well over ten times greater than its foreign currency reserves. Today that ratio is reversed.

Russia Is Not Iran

To reduce Russia’s oil and gas rents to the 1990s levels would require sanctions that would end Russia’s status as an energy exporter. That is, the West would have to impose and enforce an Iran-style set of sanctions that would entail an embargo on oil and gas exports. Let us consider, however, how unrealistic such a move is. The precedent of sanctions against Iran is not relevant for the Russian case.

Russia exports much more than Iran did prior to heavy sanctions. Iran was exporting a bit more than 2.5 million barrels per day (mbd) before heavy sanctions were imposed. Russia’s net exports are over 7 mbd. When the Soviet Union collapsed and Russian oil production fell by 5 mbd, OPEC production expanded to offset the loss. Today, by contrast, there is no spare capacity to absorb such a shock. How would the world economy replace 7.2 mbd? Prices would have to rise significantly to balance supply and demand, perhaps by as much as $80 per barrel. And this calculation ignores any impact of a cutoff of Russian gas. Of course, such a shock would no doubt cause a severe global recession that would cut oil demand, thereby reducing the pressure on prices. But it is not much of an argument to say we can absorb the oil price shock that sanctions will impose by creating a world economic crisis to absorb the cut in supply.

In short, the only kind of sanctions that might have a deep enough impact to force Russia to abandon its strategic objectives are ones that we would never implement.

Russia Beyond the Confrontation

There is no doubt that the West can take actions that harm the Russian economy. We can weaken Russian state finances and make Russian citizens poorer. Neither effect will cause Putin to back down. Putin is not going to be deterred from aggressive behavior by economic weakness, whether caused by the global economy, his own policy, or sanctions. Russia can weather all those. And even though the economy can become smaller and poorer, Russia will still have its financial independence and freedom of action.

But we ought also to ask, what happens to Russia in the longer term? There are several points to note. First, the direct effects of sanctions on Russia may be severe. Economic growth is likely to turn negative. Notice, however, that economic growth was already slowing before this confrontation began. Sanctions will only provide an excuse for a worsening economy and slow the search for reform. This would be worse for economic performance, but probably good for Putin politically.

Nonetheless, it is important to recognize that Russia will rebound after the confrontation, as it always does after a crisis. In general we can expect fast post-conflict growth. Indeed, the deeper the drop, the faster the rebound growth. What level of income Russia attains in the short term is a different matter. Depending on how long the confrontation lasts, it will take longer for Russia to regain its current prosperity level once the conflict is over.

Russia also has the potential to rapidly bring back foreign investors who may have been frightened away or deterred from entering Russia during the conflict. The great magnet is, as always, its resource sector. Examples from recent and more remote Russian history tell us that Russia’s natural wealth will always attract foreign investors, almost irrespective of how they were treated in the past. We refer to this as the “Lena Goldfields” principle. Lena Goldfields was a British-owned mining company that was appropriated by the Bolsheviks after the 1917 revolution and then sold back in the mid-1920s to the very same investor group — who, despite their previous ill-treatment, could not resist the lure of a monopoly on the Russian gold sector — only to again be appropriated by Stalin a few years later.

The slightest signs of openness brought investment even to Bolshevik Russia. Investment will flow today because the potential upside in Russia is huge and comparable alternatives elsewhere in the world are few. Thanks to oil, Russia does not need costly reforms to attract capital. And thanks also to the oil, it has rich consumers. Once sanctions are lifted, the postponed consumer demand that might result from a sanction-induced recession will be unleashed and help accelerate the rebound. Both domestic retail and imports will benefit.

None of this, however, should cause us to ignore some very serious concerns about Russia’s future that this crisis raises. The real worry is that a prolonged confrontation with the West, even without direct conflict, will make the prospects for Russia’s evolution as a modern society more remote.

Putin himself began the pullback from modernization in 2012 with his launching of political war on Russia’s creative class and his “mobilization economy” programs, which will shift resources to the most inefficient parts of the economy — defense industries and remote regions in the eastern part of the country. The Ukraine conflict — both Putin’s actions and the Western reaction to them — pushes Russia further along the political and economic trajectories that Putin had begun and therefore moves him — and Russia — further away from modernization.

The tendency towards import substitution was already underway before the Ukraine crisis. Heavy sanctions by the West will accelerate the movement in this direction. Even more important, the sanctions may cause an especially damaging qualitative shift in the nature of import substitution. Previously, import substitution was a policy limited to core manufacturing sectors, the “old economy.” Russia’s so-called new economy was to a large extent allowed to continue its integration into and dependence on the global marketplace. Now the process of important substitution will reach beyond the manufacturing sector to sectors that were previously integrated with the modern economy, such as banking. This is what will happen, for example, if Russia creates its own credit card payments system to replace the system previously developed by Visa and MasterCard, now banned by U.S. sanctions.

These tendencies to import substitution in the relatively modern sectors will be especially costly. When Russian dinosaur manufacturing plants take over market share from Ukrainian dinosaurs, the cost is minimal. (On this point, see our previous paper, “Ukraine: A Prize Neither Russia nor the West Can Afford to Win”) When modern foreign companies are ousted in favor of Russian ones, the loss is much bigger. Companies in Russia’s “new economy,” whether foreign-owned or Russian, were driven by the forces of international competition. Their replacements will be directly under Putin’s control. This is a general conclusion: more import substitution and more reliance on rent distribution to cover the excess cost of such activities mean that more of the economy will dominated by Putin’s rent management system.

Sanctions thus lead to greater control by Putin over the economy. They weaken the relatively independent and modern part of Russia’s economy. They also reinforce Putin’s political power. They rally the public around Putin. Indeed, it is hard to see how sanctions do anything but weaken the liberals as a political force in Russia. This means that our current approach of dealing with Russia by sanctions and isolation will not only fail to accomplish its immediate goal of stopping Putin in Ukraine, but it will also be counterproductive to the more important, long-term objective of Russia’s evolution as a normal, modern, globally integrated country. With the approach we now have, not only do we lose the battle. We make it harder to win the war.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Can Sanctions Stop Putin?

June 3, 2014