My friend Bert Hofman, director of the East Asian Institute at the National University of Singapore, has just written an insightful account of the East Asian financial crisis. On July 2, 1997, exactly 25 years ago, the Thai authorities devalued the baht, triggering a wave of economic crises in East Asia with ripple effects onto other emerging economies including Russia and Brazil.

Much has been written about the causes of the East Asian crisis and the policy responses of different countries. The crisis triggered a wave of structural reforms that undoubtedly strengthened East Asian economies to the point where they were relatively unaffected by the Great Recession in 2008 and 2009 great financial recession. It also seems to have spurred a learning culture that spread to other areas: Asian experiences in managing the SARS and avian flu outbreaks in 2003 helped them set up public health systems that were effective in managing the coronavirus.

Yet there are two lessons of the East Asian financial crisis that seem to have been forgotten, but that are relevant to today’s economic concerns.

The first lesson is that when economies are built on a faulty foundation, growth is not always beneficial. It can simply lead to an accumulation of risk. In the case of East Asia, the crack in the foundation was the assumption that pegging currency to the U.S. dollar through fixed exchange rate would not change much. These pegs were not formal but institutionalized into norms of behavior. East Asian policymakers, with their export orientation and strong links into global supply chains were commonly described as having a “fear of floating.” Banks, businesses, and government policymakers acted for years on the presumption that any deviations in bilateral exchange rates of their currency versus the U.S. dollar would be minimal.

For all the talk and warnings of “stranded assets,” businesses, financial institutions, and many governments—including in the developing world—are still increasing exposure to fossil fuels. This is dangerous.

The result was a huge buildup of currency mismatches on balance sheets. Large property and construction companies in the region developed real estate assets financed by borrowing in U.S. dollars. Banks and financial institutions used credit from abroad to expand loans to domestic businesses and small and medium enterprises. Governments used transactions in forward markets to disguise the size of their net foreign exchange reserves against which domestic credit was being issued.

The consequence of these currency mismatches on so many balance sheets is that, when currencies were adjusted in the face of dollar shortages, the economic damage was devastating. The exact timing of the crisis origin in Thailand, and the spread to other countries, is still a matter of considerable academic debate. I personally favor explanations that revolve around the depreciation of the yen after 1995 causing Japanese banks to shrink their balance sheets and reduce dollar loan exposure—a $100 billion flight of capital out of the region in a few months. But the real point I am making is that an external shock had a huge economic impact even in economies that had long been seen as strong performers.

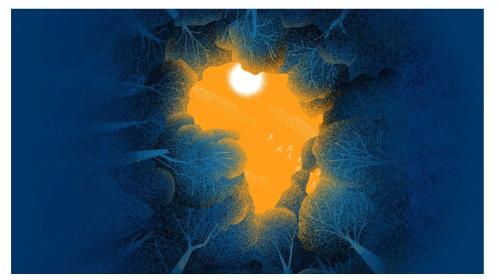

What’s the relevance to today? Again, we see economies built on a faulty foundation—fossil fuels. We are in the throes of another energy crisis, but the response in advanced economies is to double down on oil and coal production, rather than accelerating the structural reforms to transition economies onto a more sustainable basis. For all the talk and warnings of “stranded assets,” businesses, financial institutions, and many governments—including in the developing world—are still increasing exposure to fossil fuels. This is dangerous.

The second forgotten lesson from the East Asia crisis is that the onset of debt crises has more to do with weak institutions and low resilience than with debt indicators. Each of the affected East Asian countries had relatively strong macroeconomic fundamentals—low public debt levels, high growth, reasonable fiscal and current account balances, low inflation. Yet governments had to take on large debts to bail out banks and businesses (and in some instances to preserve a safety net for the poorest) when the crisis hit. Their finances were not resilient.

Today, we hear concerns that investments in resilience to climate risks by developing country governments are not affordable because of their high level of indebtedness. Transitions from disaster response to disaster risk reduction are being put on hold. Nature-based solutions and human capital investments that build resilience are being postponed. This is backwards economics. The risks of a debt crisis in developing countries are growing not because of excessive spending by governments, but because access to financing for key projects to build resilience is shrinking.

So, 25 years after the East Asian crisis, let’s remember two things. When economic foundations are faulty, it’s never too early to start to transition to a sustainable structure. Doing otherwise might support growth for a few years but exposes it to much larger downturns when a crisis hits. And let’s pay more attention to public institutions and the resilience of public finance when thinking about creditworthiness, and less attention to numerical debt thresholds with little explanatory power in predicting debt crises, when we assess the size and allocation of public spending. Ignoring these lessons is making the global economy weaker today than it need be.

Commentary

25 years since the East Asian financial crisis: 2 forgotten lessons

July 7, 2022