Editor’s Note: Testifying before the House Committee on Small Business, Martin Baily discusses the outlook for the U.S. economy and its impact on small businesses. Baily examines small business and entrepreneur policies, as well as the possible effects of the Affordable Care Act, credit extensions for small businesses, the Startup Act of 2012, and employee skill development programs.

The Outlook for the U.S. Economy

[1]

- The recovery in the United States continues to be sluggish because of anchors weighing it down: The continued weakness in the housing market kept residential construction at depression levels. Historically, U.S. recoveries have always featured a lift from housing and it may be another couple of years before all of the foreclosures are worked through. The good news is that residential construction has stopped falling, but housing prices are still flat or declining slowly on average. The housing problems are not spread evenly around the country but rather are concentrated in five states, California, Nevada, New Mexico, Florida and Michigan. Policy efforts by both the Bush and Obama Administrations to mitigate the ongoing tide of foreclosures have had only modest impacts, but it is worthwhile to keep trying to speed up the gradual adjustment process in the housing market. One response to the housing crisis has been that fewer new households have been formed as people choose to live with parents or share housing with others. Another response has been a sharp increase in the demand for rental housing, which has in turn triggered construction of multifamily units. The preliminary report for GDP growth in the fourth quarter of 2011 suggested that residential construction is growing again, although from a low base.

- The weakness in the housing market has contributed to the loss of household wealth. The stock market has recovered much of the huge drop it took in the financial crisis as corporate profits have been good, but the volatility of markets has made it hard for consumers to take a lot of comfort from the partial recovery of financial wealth. The consumer deleveraging process continues as debt levels are reduced and borrowing remains subdued. Much of the reduction in household debt so far has come about through defaults and foreclosures rather than repaying debts.

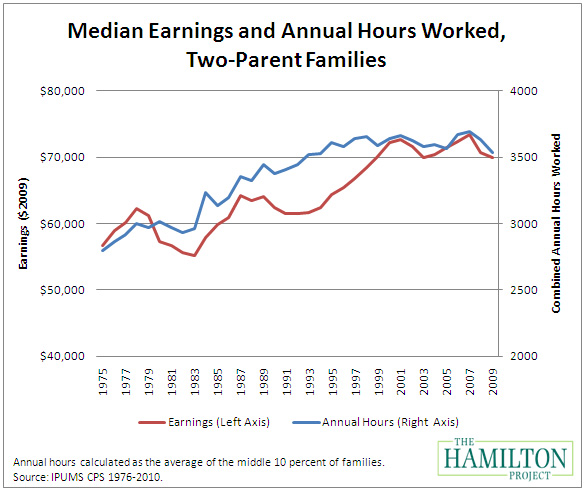

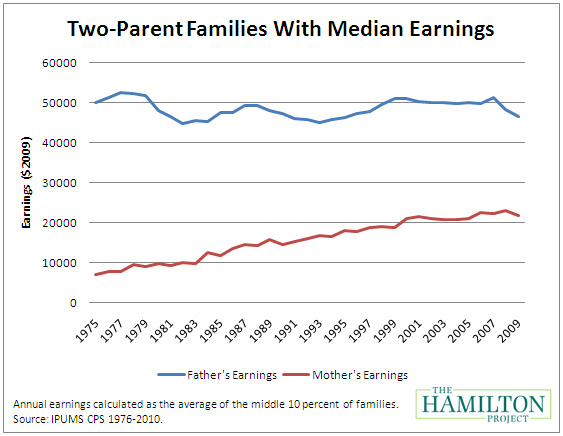

- Beyond housing, the other big anchor weighing down the economy is the weakness in household income that is driven primarily by the weakness in the labor market. In fact over the past several quarters, consumer spending has grown a little faster than disposable income, so the saving rate has declined slightly. Consumers are certainly cautious, but the big reason consumer spending growth is slow is that income growth is slow or negative.

- There is a view that businesses in the U.S. are holding back on investment and hiring because they are afraid of the impact of the huge budget deficits and by concerns about regulation. My own judgment is that by far the biggest reason for weak hiring is the lack of strong demand growth. However, it is important that Congress and the President put in place a comprehensive plan for reducing the budget deficit over the next ten years. And much could also be done to streamline regulation and make the decision-making process quicker. It is noteworthy that business investment, at present, is actually picking up quite well for equipment and software, and hiring is now looking stronger.

- The other pieces that go into aggregate demand include government purchases, net exports, and inventories. Of these three, government purchases are declining now because of cutbacks by both the federal government and by states and localities. Clearly there is a need for fiscal restraint but if federal spending is cut too quickly, this will have a short term negative impact on demand, something that is being demonstrated in the European setting. Net exports vary from quarter to quarter, but with a weakening global economy it will be surprising if there is much of a net positive effect of trade on U.S. demand. Inventories are pretty much impossible to forecast and often have a big impact on GDP for a given quarter. As long as U.S. production continues at a reasonable pace, inventory accumulation will help that growth but if growth were to weaken, an inventory cycle could easily be the catalyst for a double dip.

- Despite these problems, the mood on the U.S. economy here has improved in the past couple of months with many forecasters starting to revise up their forecasts instead of constantly revising them down. The stock market has done surprisingly well in the face of so much global uncertainty. In contrast, the likelihood of a recession in Europe is very high; indeed they may already be in a recession.

- Few economists are expecting strong U.S. growth this coming year but the chances of a double dip have diminished and growth in 2012 is likely to be in the range of 2 to 3 percent. There is some upside potential to this forecast if the European problems ease and consumer confidence builds. But there are also downside risks. A financial collapse or renewed crisis in Europe would take at least a percentage point off U.S. growth and would likely induce a double dip recession. Another risk to the recovery is political deadlock over the federal budget, which would undermine market stability.

- Concerns about Iran have pushed the price of oil to around $100 a barrel and a new spike in oil prices would pose a substantial risk to the U.S. recovery.

The State of the Small Business Economy

As all member of this committee know well, the small business sector is one of the great strengths of our economy, accounting for 64 percent of net new jobs historically. New and young businesses have generated 40 million jobs in the past 25 years representing 20 percent of gross job creation. Seventy six percent of high growth businesses are young businesses and these “gazelles” generate 88 new jobs a year compared to 2 to 3 jobs for all businesses on average. These numbers are from the Kauffman foundation. Unfortunately, the job creation prowess of small business has not been at the usual level in this recovery. The table below is drawn from the ADP employment survey[2] that breaks down employment into businesses that have 50 and over and those with fewer than 50. It shows that small business hiring in the second half of 2011 was pretty weak, although there was an encouraging jump in December.

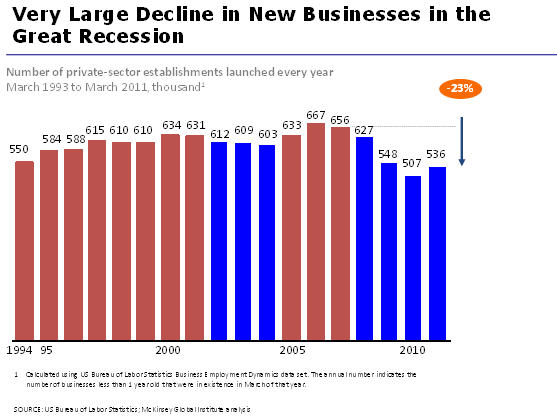

The Reduction in Startups

The financial crisis and the resulting deep recession have taken a big toll on small business. The chart below shows that the number of startup establishments has fallen off to a greater extent in this recession than in the 2001 recession. The ability of small business to generate employment depends heavily on a continuous flow of startups. A half of startups fail within five years as part of the uncertainty intrinsic to small business, and so there is bound to be a lot of job turnover in this sector. When there is an ample flow of new businesses getting started, this provides an extraordinary dynamism to the American economy. Economic recovery depends on a renewal of business startups.

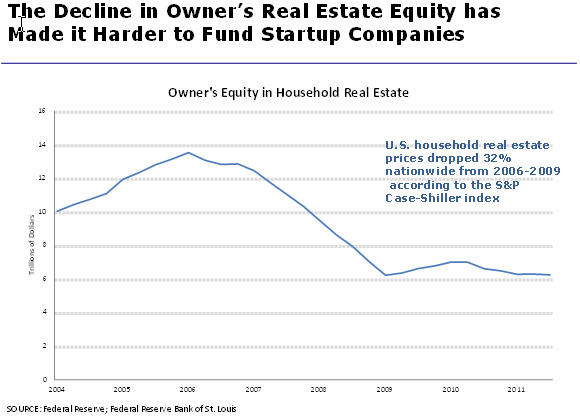

Why has the number of startups fallen so drastically? Certainly the general weakness in the economy and the lack of demand growth, but the sharp drop in startups has likely also been affected by the reduction in home equity and restrictions on lending. Many new companies are started by families or groups of friends that have an idea or decide to start a restaurant and get together to try how it works. In many cases the new company is funded by a pool of contributions from family members or from their own combined resources. As the chart below shows, there has been a very sharp drop in overall home-owners equity as house prices have declined over 30 percent with the bursting of the housing bubble. Only a small portion of homeowners were planning to start new businesses of course, but home equity has been a primary source of funds for startups. For many potential entrepreneurs, that money is no longer available.

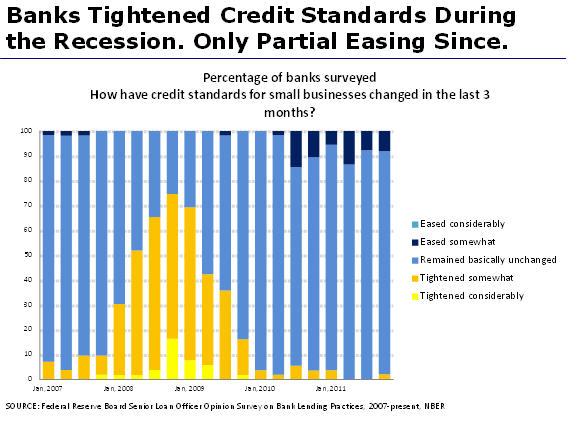

In addition to the problem posed by lack of home equity, current or potential entrepreneurs have faced a much more difficult bank borrowing environment. During the height of the housing boom financial institutions were lending money with too little regard to the chances of being repaid, and a lot of loans have gone into foreclosure. There was a need to tighten lending standards and this was done. Unfortunately, the pendulum may have swung back too far in the opposite direction, making it difficult for new companies and existing companies to get funds for inventory or to fund expansion. The chart below shows data from the Federal Reserve on the proportion of banks that were tightening lending standards, easing them or leaving them unchanged. There was a wave of tightening in 2008 and 2009. Some modest easing of standards has occurred since then, but overall standards are still much tighter than they were.

Lack of Sales and Optimism Among Existing Businesses

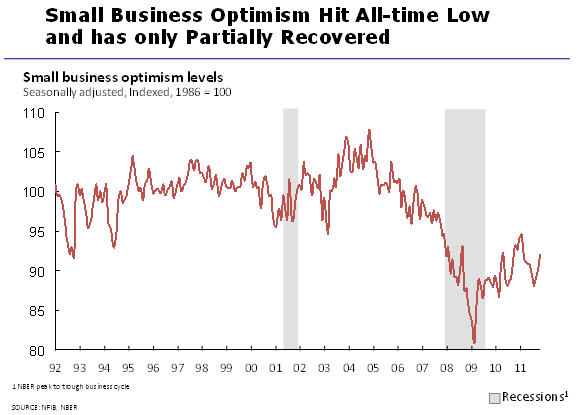

As well as a lack of new small businesses, there are also concerns about the health of existing small businesses. In the early stages of the recovery from the Great Recession there was some hiring by larger businesses, but very little from small business. This important part of the recovery was missing. The chart below shows that small business optimism peaked around 2004 and declined rapidly 2005-07. The financial crisis struck in 2007 and the recession hit with full force in the last half of 2008 and the first quarters of 2009. Small business optimism hit historical lows in the face of the Great Recession and has made only a partial recovery since then.

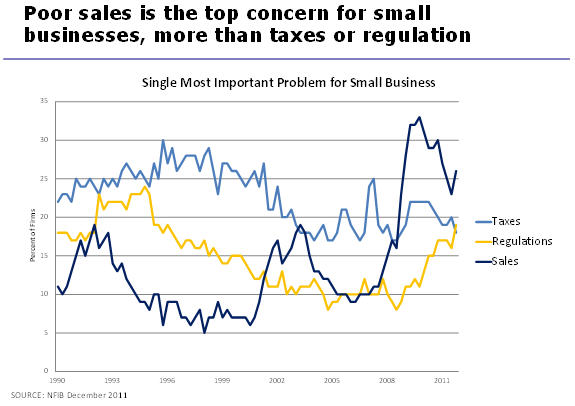

The National Federation of Independent Business has been surveying its members for many years and they provide a valuable reading on what small business owners see as their biggest problem. The chart below focuses on the pattern over time for three reasons that have been cited as among the most important, regulation, taxes and lack of sales. As the chart shows, lack of sales is the biggest problem in the current period, as it was in earlier recessions. This reinforces the view expressed earlier in this testimony that the biggest problem the small business economy faces is lack of demand. Taxes are a concern, but it is clear from the chart that this is a perennial concern. Concern about taxes has risen somewhat in the last few years, but it has not moved up sharply and has not reached the level it had in the 1990s. Regulation is an important concern among small business owners, understandably so, given the range of employment and other requirements they face, including many rules from state and local authorities. The chart does show that concern about regulation has also moved up since 2008. Much of that upward movement is surely associated with the introduction of the Affordable Care Act and I will talk more about that in a moment. Overall, however, it is noteworthy that both the concern about taxes and the concern about regulation among small businesses are lower now than they were in the mid 1990s. And of course the economy embarked on a terrific boom throughout the late 1990s.

The conclusion on small business seems clear. The state of small business, captured mostly clearly by the optimism index, has been deteriorating for nearly seven years. It took a particularly sharp dive in 2008 and is now gradually recovering. I am not certain of all the reasons for the decline in the state of small business, but certainly the Great Recession is at the heart of it. Probably the boom-bust cycle of the real estate market that preceded the recession was also important. Such a cycle is not a good way to foster sustainable small businesses.

Small Business and the Affordable Care Act

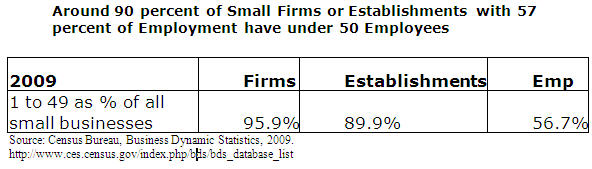

The impact of the ACA on small business has become a major political issue. The NFIB and the Chamber of Commerce have been strongly opposed to the provisions of the act as they relate to small businesses. The opposition seems to be out of proportion to the content of the act itself. Most importantly, there are no requirements on businesses with fifty or fewer employees to provide insurance, nor are they required to pay a penalty if they do not provide health insurance. The table below shows that around 90 percent of small businesses are under 50 employees, a group that accounts for nearly 57 percent of total employment in the segment.[3] Moreover, a high fraction of larger establishments are already providing health insurance to their workers. An independent report by the Urban Institute[4] said that in 2009 81.6 percent of establishments with 25-99 employees provide coverage and 94.3 percent of establishments with 100 to 999 employees. Even for employers with more than fifty employees that do not currently provide insurance coverage, the financial penalty would be small. In its summary, the Urban Institute report says that employers with fifty employees and under stand to benefit from the subsidies built into the ACA. For employers in the 51 to 100 size range, the ACA will result in a “very small increase in total costs”.

In short, it would be helpful if the public debate about health care and small business be more firmly grounded in the data. Small business men and women are indeed concerned about the impact of the ACA on their companies, but this may be largely the result of what they hear about it and not about the reality of how the act will affect their businesses.

Policies

Since the biggest problem that small businesses face is the lack of overall demand, the best policy remedy is to try and sustain and strengthen the slow recovery. The standard approach used to expand demand is for the Federal Reserve to adopt an easier monetary policy and for fiscal policy to become easier, either through tax cuts or expenditure increases, or both. Unfortunately, there are limits on the effectiveness of monetary and fiscal policy in the current economic environment. Risk free short interest rates are at or close to zero and even the 10-year Treasury is yielding only 1.9 percent. That is about as much as can be done. On the fiscal side, policy has been hampered by the legacy of deficits and by the global sovereign debt crisis. If the federal government had run budget surpluses or even balanced budgets during the growth years prior to the recession, we could afford to spend more money now on stimulating demand. As it is, the combination of the recession itself and the expansionary fiscal policies that were followed earlier have left us with large deficits and debt levels that are rising rapidly.

The best policy prescription for the economy today is for policymakers to agree on a plan to balance the budget, or get close to balance, over the next ten years. This plan should include a modest fiscal stimulus for 2012-I support the extension of the payroll tax cut for all of 2012-and a realistic framework for raising the level of tax revenues once the economy recovers and for controlling spending growth, particularly federal spending on health. If the President and Congress were to agree on such a plan, it would greatly enhance consumer confidence, business confidence and the stability of markets. Since the chances of this happening are very low, I would settle for the modest stimulus for 2012 and hope that reason prevails on the budget in 2013.

Policies Specifically for Small Business

Credit. The amount of borrowing by small businesses is still depressed and it is hard to know exactly the extent to which this is the result of lack of desire to borrow or inability to borrow. Surely both are at work. Many small businesses can fill their current orders without any expansion or investment and they are not looking to borrow. But there are many other small businesses that would like to borrow but cannot meet credit requirements, especially as they lack equity in their homes that would have provided collateral for a loan a few years back. One approach is to make sure that bank regulators are using reasonable standards as they assess the risks that banks are taking in loans to small business. No one wants to go back to a time of excessive lending, but the Federal Reserve and other regulators should make sure funds are available to promising small businesses with a good chance of paying the loan back. Some level of default is inevitable and is reasonable. Our economy must be willing to take some risks and regulators should not stand in the way of sound business loans.

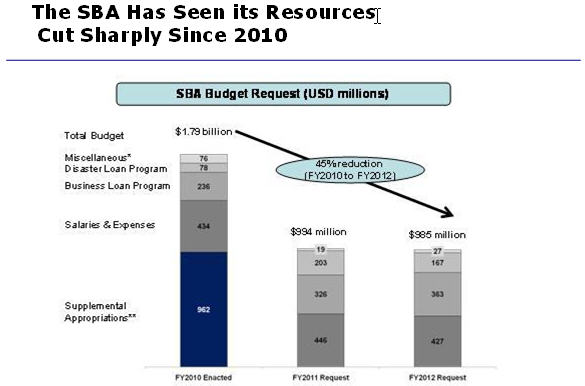

Another approach to expanded lending is through the Small Business Administration. In 2010, the SBA received supplemental appropriations to expand is support of small business lending. As I said earlier, there is a great need to move towards budget balance, but since the economy remains sluggish right now, there is a strong case for making more loans available this year and not fewer. Of course we should not waste taxpayers’ money on bad loans, but SBA has done an excellent job under Karen Mills and should have the opportunity to make a bigger contribution to economic recovery.

The Startup Act of 2012. With bipartisan sponsorship, the Startup Act, if passed, would provide a much needed boost to small business formation in the United States. The proposed act has a number of provisions that I believe would be very helpful, including easing the restrictions on visas for entrepreneurs; granting a permanent work visa to an employer that hires a minimum number of Americans; and providing green cards to students that graduate in STEM subjects. Also proposed in the act are patent reform and an easing of academic licensing restrictions. The Act also suggests ways to reduce the barriers to new business formation, reducing regulatory barriers and making sure regulatory rules pass a cost-benefit test. One of the biggest concerns in this area is the slowness of the permissions process for new establishments and this comes in part from the fact that federal, state and local officials do not coordinate their decisions. The regulatory process needs to be streamlined. The President has indicated his desire to do this and needs support from Congress in achieving this goal.

I do not agree with every provision in the Startup Act of 2012, but I strongly urge the House to consider this important legislative proposal. It could form the basis for a bipartisan bill that would provide substantive help to startups and hence to American economic growth.

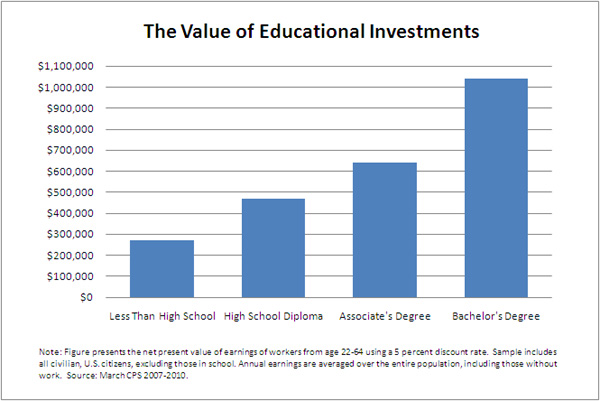

Skills. There are many employers that find they cannot find the skilled workers that they need. We need more demand in the economy in order to add to the number of jobs, but we are also missing out on jobs that are already available but that cannot be filled because workers lack the skills necessary. Improving skills and education of the workforce is a long term project that cannot be achieved quickly. But it is important to start, for example, by fostering partnerships between businesses and community colleges and by promoting the use of new technologies to make education and training more efficient. The Armed Forces have developed short term training programs for recruits so that they can master complex weapons systems, maintain equipment and other vital tasks. These successful military training programs can provide a model for private sector training.

Conclusion

I appreciate the opportunity to present my views to this committee. The small business sector is a vital one to our economy and a driver of economic growth and employment. The Great Recession has hit almost everyone hard and the small business sector is unfortunately still very much a work in progress in terms of its recovery. I am confident that this resilient part of the economy will recover and help America restore its vitality and optimism.

Footnotes

[1] The data charts presented in this testimony have benefitted from my position as an advisor to the McKinsey Global Institute. McKinsey & Company does not endorse specific policies and the views expressed here are solely my own.

[2] http://www.adpemploymentreport.com/indexsbr.aspx

[3] The data do not give a breakdown for 50 and under, so the table slightly understates the share of establishments that are unaffected by the ACA. The definition of small business is under 500 employees.

[4] Urban Institute, The Effects of Health Reform on Small Businesses and Their Workers, June 2011, Washington DC.

Commentary

TestimonyThe State of American Small Business

February 1, 2012