Below is the written testimony of Samantha Gross, Fellow, Cross-Brookings Initiative on Energy and Climate, to the U.S. House of Representatives Committee on Foreign Affairs Subcommittee on Terrorism, Nonproliferation, and Trade hearing on the “Geopolitical Implications of U.S. Oil and Gas Competitiveness in the Global Market” on May 22, 2018.

Subcommittee Chair Poe, Ranking Member Keating, and members of the subcommittee, thank you for the invitation to testify today about how growing U.S. oil and gas production affects energy security and trade.

The renaissance in U.S. oil and gas production over the past decade has been nothing short of remarkable. Technological advances unlocked new resources and brought about significant changes in global energy markets. However, we must remember that the United States is a major oil and gas consumer as well. Particularly for oil, our energy security depends on a global market with prices set based on global market conditions. Supply disruptions do not only happen abroad—hurricanes and floods have brought about large disruptions in domestic energy supply. Our interconnections with the world are key to our energy security—a source of strength and resilience, rather than weakness.

The new energy abundance

As recently as the mid-2000s, when you heard talk of “peak oil,” that meant peak oil supply—the idea that the world was running out of oil. Today that phrase generally means peak oil demand, as new technology, greater efficiency, and concerns about climate change are beginning to move the transportation sector away from oil as a primary fuel. At the same time, advances in oil and gas extraction technology here in the United States have brought online entirely new sources of supply. The combination of long-lateral horizontal wells and hydraulic fracturing led to oil and gas production from resources that had never been economic before. Today we recognize that the oil age won’t end because the world ran out of oil.

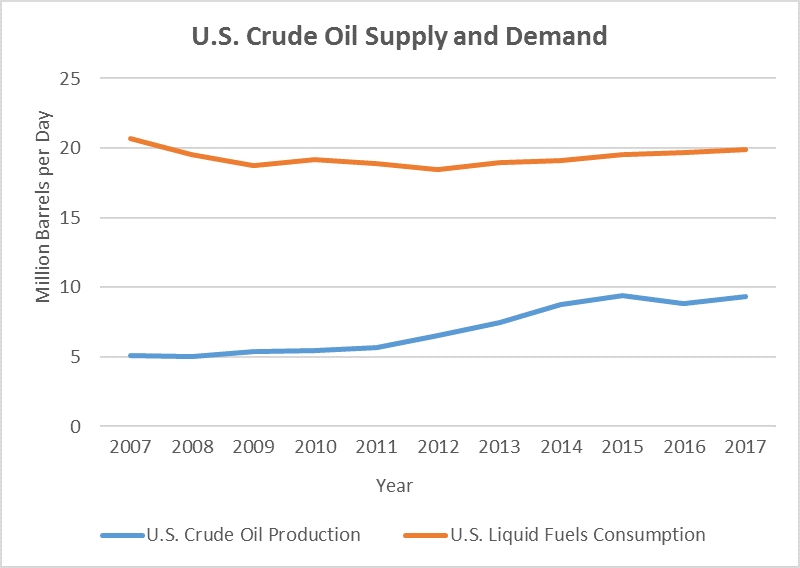

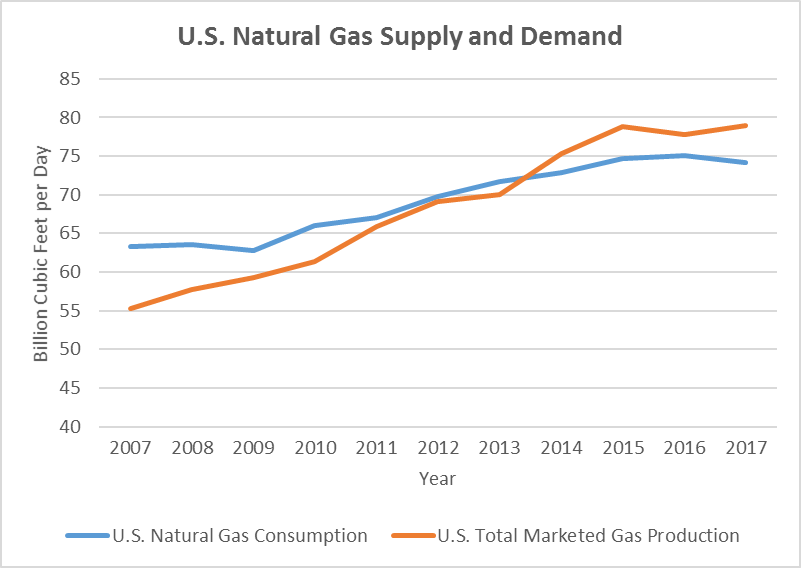

U.S. oil and gas production has grown tremendously over the last decade. The United States became the world’s largest producer of petroleum hydrocarbons in 2013 and has been the world’s largest producer of natural gas since 2009. In crude oil production, the United States is in a dead heat with Russia and Saudi Arabia to lead the world.

The boom in U.S. oil and natural gas production has brought clear economic benefits, improving our balance of trade and industrial competitiveness, especially in certain industries. For example, the United States is now one of the world’s most attractive locations for petrochemical investments, an unthinkable prospect a decade ago.

Even though it is now the among the world’s leading oil producers, the United States still imports about 10 million barrels of oil each day. Thus, the United States is not insulated from the ups and downs of the oil price and its reaction to global events. For example, gasoline prices at the pump today reflect the upcoming re-imposition of sanctions on Iran and Venezuela’s plummeting oil production.

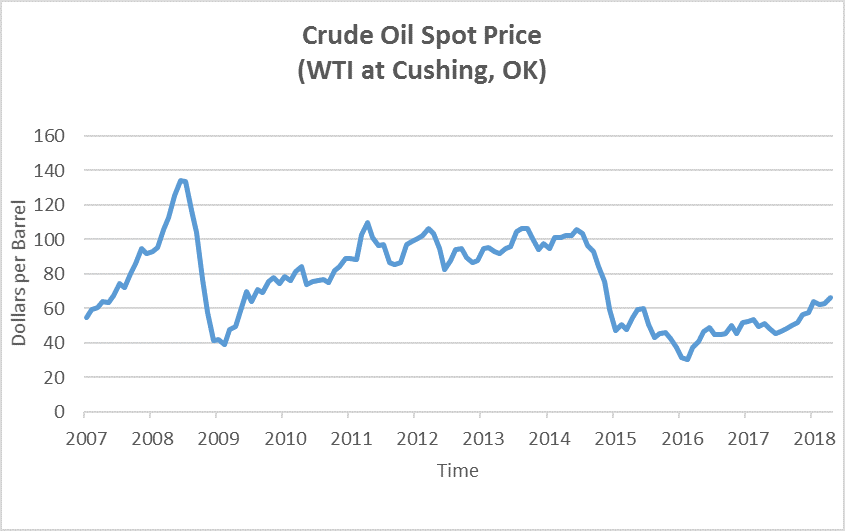

Recent events demonstrate how the age of abundance and growing U.S. production are changing the balance of power in oil markets. Oil prices stayed above $80 per barrel for four years in 2010 to 2014, an exceptional run of high prices. However, expanding supply caught up with high oil prices and they declined rapidly in late 2014, sinking to as low as $30 per barrel by February of 2016.

The boom in U.S. oil and natural gas production has brought clear economic benefits, improving our balance of trade and industrial competitiveness, especially in certain industries. For example, the United States is now one of the world’s most attractive locations for petrochemical investments, an unthinkable prospect a decade ago.

Even though it is now the among the world’s leading oil producers, the United States still imports about 10 million barrels of oil each day. Thus, the United States is not insulated from the ups and downs of the oil price and its reaction to global events. For example, gasoline prices at the pump today reflect the upcoming re-imposition of sanctions on Iran and Venezuela’s plummeting oil production.

Recent events demonstrate how the age of abundance and growing U.S. production are changing the balance of power in oil markets. Oil prices stayed above $80 per barrel for four years in 2010 to 2014, an exceptional run of high prices. However, expanding supply caught up with high oil prices and they declined rapidly in late 2014, sinking to as low as $30 per barrel by February of 2016.

OPEC maintained steady production through the early years of the price collapse. Some argue that OPEC was trying to push U.S. producers out of business by keeping prices low for an extended time; others believe it was more focused on maintaining market share in a well-supplied market. Either way, U.S. producers focused on efficiency and cost reduction and weathered the low-price storm. U.S. production dipped only slightly in 2016 when prices bottomed out.

OPEC changed its strategy at the end of 2016. In an unprecedented move, OPEC teamed up with Russia and a few other oil producers to cut production in an attempt to raise prices and reduce global oil inventories. This strategy was effective and oil prices have risen over the last year and a half. But the need for OPEC to bring Russia into the fold to increase its leverage demonstrates just how much the world has changed. OPEC and Russia have extended their agreement through the end of 2018, but it remains to be seen how long this partnership will hold.

Although growing U.S. oil production has changed the balance of power in oil markets, the U.S. industry is not structured to use its production toward geopolitical ends. Unlike the national oil companies of OPEC, the U.S. industry is made up of dozens of companies that make individual investment and production decisions based on their own costs, financial positions, and appetites for risk. The OPEC producers can work together to move oil prices, an action that would be illegal for U.S. producers under anti-trust laws. Saudi Arabia also holds significant oil production capacity in reserve to deal with oil supply disruptions, an action that would not make economic sense for a for-profit company.

The shift toward natural gas

Unlike for oil, the United States is a net exporter of natural gas. Our largest natural gas customers are Canada and Mexico, receiving gas through pipelines. Liquefied natural gas, or LNG, is becoming a larger portion of U.S. natural gas exports, reaching 22 percent in 2017. The largest U.S. LNG customers in 2017 included China, South Korea, and Japan in Asia; Mexico and Chile in the Americas; and Spain and Portugal in Europe.

Natural gas trade differs significantly from that for oil. Natural gas is more difficult than oil to transport and store, and for this reason, expensive infrastructure and long-term contracts often tie customers and suppliers together. There is no global natural gas market or price, although growing global LNG supply is beginning to globalize natural gas trade.

In some ways, U.S. natural gas exports can have more geopolitical influence than oil exports. The structure of the U.S. industry is no different—producers make decisions based on profit, not politics—but the nature of natural gas markets, with less fungible supply and the predominance of long-term contracts, makes natural gas trade more inherently political.

Natural gas exports provide clear environmental benefits to our trading partners. Natural gas has the lowest carbon emissions of any fossil fuel and creates much less local air pollution than coal. When used to generate power, natural gas also compliments renewable power sources like wind and solar. Natural gas-fired power can start up quickly and rapidly ramp production up and down in response to changes in wind and solar production, allowing the grid to meet demand at all times. For these reasons, natural gas is becoming a preferred fuel globally, playing into U.S. strength in gas production.

Mexico has become the most important export market for U.S. natural gas, providing benefits on both sides of the border. More than half of 2017 U.S. natural gas exports went to Mexico. We now have a trade surplus with Mexico in energy products—in 2017 the value of energy exports to Mexico was more than twice the value of imports. U.S. natural gas is bringing lower priced and lower carbon electricity for Mexico, along with power system flexibility that allows integration of more renewable power generation.

Additionally, U.S. LNG is one supply source that can reduce Europe’s reliance on pipeline gas from Russia. Russian disputes with Ukraine over gas transport in the late 2000s made Russian gas supply to Europe a matter of great concern. Growing LNG supply from the United States and others gives Europeans options, helping them lessen their dependence on Russian gas while still enjoying the benefits of gas as they strive to reduce the carbon emissions from their power supply. U.S. LNG exports are still in the ramp-up phase and exports to Europe (except for the Iberian Peninsula) are tiny today, but the promise of more supply to come strengthens Europe’s position.

Closing thoughts

The United States has become an indispensable source of oil and gas supply, but the term “energy dominance” is somewhat misleading. To me, “dominance” implies an ability to move markets, whereas the U.S. energy industry, while strong and increasingly important to global energy security, is not structured to achieve that end or other geopolitical goals. U.S. supply of price-responsive, non-political oil and gas contributes to well-functioning global energy markets, providing benefits to energy consumers everywhere.

[1] The views expressed in this statement are my own and do not necessarily reflect those of staff members, officers, or trustees of the Brookings Institution.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

TestimonyGeopolitical implications of U.S. oil and gas in the global market

May 22, 2018