Introduction

Throughout the West, the triumphalism of the 1990s has given way to deep anxiety. The particulars differ from country to country, of course. But beneath these differences is the shared fear that an epoch is coming to an end.

The policies and institutions that far-sighted statesmen put in place after World War II enabled Europe and Japan to rise from the ashes of war, embrace democracy, and preside over the greatest period of liberty, broad-based prosperity, and peace in human history. But the continuing effectiveness of these institutions is in doubt. The Great Recession shattered complacent assumptions on both sides of the Atlantic. Two decades of economic stagnation, now exacerbated by demographic decline, have left Japan wondering about its future. (Prime Minister Abe’s economic renewal program represents a last throw of the dice for the Land of the Rising Sun.) At the same time, the startling rise of China and equally startling success of Singapore offer alternative models of state capitalism decoupled from democratic governance. As a result, the West has become uncertain of its future.

At first glance, this mood reflects the economic situation rather than broader misgivings about liberal democracy. No doubt the economy is an important part of the story. But the centrality of economic well-being in our politics reflects long-held assumptions about the purposes of our politics. If economic growth and well-being are in jeopardy, so are our political arrangements.

At first glance, this mood reflects the economic situation rather than broader misgivings about liberal democracy. No doubt the economy is an important part of the story. But the centrality of economic well-being in our politics reflects long-held assumptions about the purposes of our politics. If economic growth and well-being are in jeopardy, so are our political arrangements.

We have known since Aristotle that stable constitutional democracy rests on a large, self-confident middle class in an economic order not riven by extremes of wealth and poverty. For Aristotle, these conditions were a matter of chance good fortune. In modernity, they have become objectives of economic and social policy.

What I will call the liberal democratic bargain has defined the era since the end of World War II. The terms of this bargain are clear: working with elite bureaucracies, popularly elected governments will deliver economic growth with steady reductions in poverty, rising standards of living for all, expanding physical and economic security, and—not least, health care that increases longevity and works toward Descartes’ dream of defeating death with science.

For some, liberal democracy may be an intrinsic good, an end in itself. For the majority, however, it is a means to peaceful, commodious, ever-progressing lives. It is a tree known by its fruit. If it ceases to produce the expected crop, season after season, all bets are off. For a substantial period after WWII, the bargain held, and public support for liberal democracy and its leaders remained high. More recently, the bargain has been called into question, and public support and confidence have waned.

The bargain is being challenged from without: Competition from rising economies outside Europe and North America—some embedded in democratic institutions, others not—has reduced the ability of established economies to maintain high levels of growth and employment. In the 18 nations that make up the eurozone, growth remains anemic, and unemployment stood at 11.5 percent in August 2014, and recent events have triggered fears of a triple-dip recession.

The bargain is being challenged from within as well. Two tensions lurk at its heart. First: taken too far, well-intentioned social guarantees can end up undermining growth and fostering stagnation. For example, countries that make it difficult to fire workers have made it almost impossible for young adults to find jobs. Unemployment in that cohort has risen to depression-era levels—more than 50 percent in Greece and Spain, 43 percent in Italy, and 23.5 percent in the eurozone as a whole. Extended unemployment among young adults has long-term effects on their productivity and earnings. And young adults without occupations—especially those with higher education and rising expectations—are a classic source of political instability.

The bargain is being challenged from within as well. Two tensions lurk at its heart. First: taken too far, well-intentioned social guarantees can end up undermining growth and fostering stagnation. For example, countries that make it difficult to fire workers have made it almost impossible for young adults to find jobs. Unemployment in that cohort has risen to depression-era levels—more than 50 percent in Greece and Spain, 43 percent in Italy, and 23.5 percent in the eurozone as a whole. Extended unemployment among young adults has long-term effects on their productivity and earnings. And young adults without occupations—especially those with higher education and rising expectations—are a classic source of political instability.

Consistent with its traditions, Japanese economic policy has focused on maintaining social stability. Subsidies and protectionist barriers protect rural interests. Banks have kept bad loans on their books, locking up capital and sustaining inefficient, unprofitable ventures. The result is weak demand, slow growth, and confidence-sapping deflation. It remains to be seen whether Abe’s reforms will be enough to break this cycle.

On the surface, anyway, the United States is doing somewhat better than either Europe or Japan. After a deep downturn, modest growth resumed in mid-2009, 8 million new jobs have been created since the trough, and unemployment has declined by nearly than four percentage points.

But the United States exemplifies the second tension in the liberal democratic bargain: when most workers fail to share in the fruits of economic growth, the public sector will be hard-pressed to lean against the inegalitarian tide. In the five years since the official end of the Great Recession, wages have only kept up with inflation, while family and household incomes have barely budged off their recessionary lows and remain far below their pre-recession peak. The share of national income going to wages and salaries is at its lowest point in nearly half a century, and businesses have found ways of raising production without hiring more workers, at least in the United States. The majority of workers who have found new jobs are earning less than they did prior to the recession, and the number of people working part-time who want full-time jobs remains very high. Relatively few jobs now being created offer incomes in the middle range: most are in lower-wage services, and most of the rest are in the high-skilled professions that require advanced training. These trends bode ill for the future of the middle class; many parents now doubt that their children will enjoy the same opportunities that they did.

Economic growth and its vicissitudes

There are four principal necessary conditions for economic growth in modern market economies: private investment, public investment, innovation, and a skilled and growing workforce.

Private investment requires an adequate pool of capital available for this purpose. This may sound trivial, even tautological, but it is not. If governments run large deficits and must borrow to fill the gap, it may consume the capital that otherwise would be available for the private sector. Even if adequate private capital exists, investors may hesitate to make long-term commitments if the context—which includes economic policy—is unpredictable. So nations that run persistently large deficits and cannot reach agreement on how to reduce them may weaken a key precondition for economic growth. Because they must be responsive to public opinion, and because the steps needed to rein in budget deficits are unpopular, democracies may find it harder than do authoritarian regimes to adopt such policies.

Throughout human history, governments have mobilized resources for public investments. Basic economic theory explains why: some kinds of investments—public goods—produce general benefits that private investors cannot adequately capture for themselves. Classic examples include infrastructure and scientific research. Without public goods, commerce becomes more difficult, and growth slows.

Although justified in theory, public investment often goes wrong in practice. Governments often use public projects to deliver benefits for key constituencies whether or not the general public good warrants the expenditures (recall the notorious “bridge to nowhere”). Conversely, because public investments compete with other government programs, they may lose out in the competition for resources. As spending in the United States for programs such as Medicare, Medicaid, and Social Security has soared and preferences have honey-combed the tax code, the share of the economy devoted to public investment has declined—to a level, many analysts believe, that will impede economic growth. As our system of roads, bridges, railways, and ports becomes antiquated and overburdened, the movement of goods slows and the price of transporting them increases.

Many factors determine the pace of innovation. Public and private investments are important, but so is the willingness of society to accept the consequences of innovation. New products can render established products obsolete, reducing demand and throwing people out of work. New processes can reduce the number of workers needed to produce the output the market demands. Innovation typically spurs what Joseph Schumpeter famously called “creative destruction.” But while society as a whole may benefit from this process without knowing, individuals and groups in danger of losing out are acutely aware of what is happening and will mobilize to resist it.

Authoritarian regimes can override this resistance. In democracies, intense and mobilized minorities who fear losses often get their way, especially when the gains accruing to the majority are diffuse. The more sensitive democracies become to such minorities, the greater the social costs over time. Minorities make the valid point that they are shouldering the entire burden of processes that benefit society as a whole and that fairness demands compensation for the disruption they endure. Far-sighted governments will make provision for such compensation. All too often, however, the claims of those who have drawn the short straw are disregarded, fostering resentment and resistance that can slow the pace of innovation.

Workforces can contribute to growth in two ways—size and skill. Countries with growing workforces (through high birth rates, high rates of immigration, or both) have an advantage over those that do not. Japan’s combination of low fertility and restrictive immigration policies will impede growth as long as it continues. As is the case with Japan, low fertility rates in much of Europe eventually will produce shrinking populations and workforces unless immigration offsets these losses. Economic downturns often intensify anti-immigrant sentiments, however, and that is what is happening in Europe today. Many native-born workers see immigrants as competitors for shares of a shrinking pie. In the short term they may be right, especially in sectors that require only modest skills and pay lower wages. In the long term, though, immigration contributes to a growing economy that yields broad-based gains. Here as elsewhere, the more responsive governments are to immediate public concerns, the harder it becomes to implement policies that promote the long-term public good.

Workforces can contribute to growth in two ways—size and skill. Countries with growing workforces (through high birth rates, high rates of immigration, or both) have an advantage over those that do not. Japan’s combination of low fertility and restrictive immigration policies will impede growth as long as it continues. As is the case with Japan, low fertility rates in much of Europe eventually will produce shrinking populations and workforces unless immigration offsets these losses. Economic downturns often intensify anti-immigrant sentiments, however, and that is what is happening in Europe today. Many native-born workers see immigrants as competitors for shares of a shrinking pie. In the short term they may be right, especially in sectors that require only modest skills and pay lower wages. In the long term, though, immigration contributes to a growing economy that yields broad-based gains. Here as elsewhere, the more responsive governments are to immediate public concerns, the harder it becomes to implement policies that promote the long-term public good.

The skills workers bring to their jobs flow principally from education and training. The former is a crucial public investment: countries that have invested heavily in high-quality systems of elementary and secondary education have seen rapid gains in GDP and per capita income. The United States once led the world in this area, but during the past two decades a number of countries have surged ahead. During this same period, a concerted effort to reform U.S. public education has yielded only modest gains in academic achievement and graduation rates. The reasons for these disappointing results include economic inequality, a ramshackle system of federalism, weaker family structures, and a culture that gives lower priority to primary and secondary education than do many others.

Some training occurs on the job. But there are limits: because companies fear that skilled workers will leave for better opportunities with their competitors, they are reluctant to make an investment the gains from which may accrue to others. Skills training, then, is largely a public good that the market will under-supply, which is why the public sector must step in. But training divorced from the requirements of the workplace is not productive. The most effective systems rest on a partnership in which the private sector helps shape the content of training while government enforces standards and provides the bulk of the funding.

It is often thought that the principal effect of technology in the workplace is to replace labor with capital. That is part of the story, but it also increases the demand for higher-skilled workers while reducing the number of openings for those with lower skills. Not only does a skilled workforce boost productivity and growth; it also raises wages and living standards. That is why it is so important for 21st century market economies to get training right.

From growth to broadly shared prosperity

Although vigorous economic growth is necessary for broadly shared prosperity, it is not sufficient. We thought otherwise during the three decades after World War II because we overlooked the special circumstances that translated growth into an expanding middle class.

The war had destroyed the economies of Europe and Japan, leaving the United States in a position of preeminence without parallel in modern history. Domestic production accounted for nearly all the goods and services consumed during that period, and consumption for nearly all the revenues flowing into corporate coffers. In this quasi-closed economy, labor, capital, and government could combine to shape wages and prices. President John F. Kennedy could compel steel companies to retract what the government regarded as destabilizing price increases, and powerful unions could bargain industry-wide to boost wages and benefits. U.S. consumers had little choice but to accept the prices that flowed from this quasi-corporatist process, rising real wages made it palatable, and rising productivity help ward off a wage-price spiral.

The war had destroyed the economies of Europe and Japan, leaving the United States in a position of preeminence without parallel in modern history. Domestic production accounted for nearly all the goods and services consumed during that period, and consumption for nearly all the revenues flowing into corporate coffers. In this quasi-closed economy, labor, capital, and government could combine to shape wages and prices. President John F. Kennedy could compel steel companies to retract what the government regarded as destabilizing price increases, and powerful unions could bargain industry-wide to boost wages and benefits. U.S. consumers had little choice but to accept the prices that flowed from this quasi-corporatist process, rising real wages made it palatable, and rising productivity help ward off a wage-price spiral.

The slow collapse of these post-war economic arrangements is an oft-told tale. Suffice it to say that as the economies of America’s Second World War allies and adversaries recovered, U.S. firms encountered increasing competition, at first from basic consumer goods that could be produced more cheaply abroad using low-cost labor, and then from products higher up the value chain. This new challenge changed the game for U.S. producers, who faced new incentives to restrain costs. They responded by locating production facilities in lower-wage jurisdictions, at home and then abroad, and also by replacing human labor with productivity-boosting technology. These moves had the effect of reducing the size and influence of the large private-sector unions. The collapse of the USSR and the emergence of China and India integrated 2 billion new workers into the global economy, ratcheting up the pressure still further.

As U.S. firms became increasingly global, they derived a higher share of their revenues from consumers outside the United States, and they came to care less about their relations with the U.S. cities and communities within which their headquarters were located. When Charles Wilson, CEO of GM and President Eisenhower’s nominee for secretary of defense, appeared before the Senate Armed Services Committee in 1953 for his confirmation hearing, he explained his past conduct with an often-misquoted sentence: “For years I thought what was good for the country was good for General Motors, and vice versa.” There is no reason to doubt his sincerity, and much evidence in favor of the linkage he discerned.

Half a century later, the relationship between corporate interests and the national interest is much more tenuous. The interplay of globalization and technological change fundamentally shifted the balance between labor and capital, setting in motion the slow erosion of the post-war middle class. As labor economists have shown, what had been an occupational bell curve shifted toward a more bifurcated pattern, with high-skilled workers at one end and low-paid workers in retail, food, and personal services at the other. Jobs requiring mid-level skills and offering mid-level compensation became relatively scarcer. The Great Recession and its aftermath accelerated this “hollowing-out” of the U.S. workforce.

Meanwhile, the now-famous 1 percent was breaking away from the pack. The gap between the compensation of corporate leaders and the wages of their workers increased many times over, and the surge of the financial sector produced a new tranche of packagers, traders, and managers who enjoy almost unimaginable wealth. (The advertisements in the New York Times Sunday Magazine convey some sense of how the new class of super-rich spends this wealth.) All the while, middle class families have been treading water, and many parents fear that their children will do worse.

What is to be done?

In these circumstances, there is no reason to expect that the fruits of growth will be widely shared or that the middle class will rebound. Although trained and educated workers do better relative to those who are less prepared, education and training no longer guarantee a rising standard of living. (Allowing for inflation, median annual earnings of workers with BAs have not increased in the past three decades.) In these circumstances, public policy has no choice but to lean against the economic wind. Here are three initial steps.

To begin, the second half on the 1990s was the last time that all economic groups from top to bottom progressed together at roughly the same rate. It is no coincidence that during this period, the labor market reached and then sustained full employment, improving workers’ bargaining power and bringing previously neglected individuals back into the workforce. This history suggests that we should adopt full employment as a high-priority goal of economic policy and welcome the wage increases that it would generate. Because businesses will find it difficult to raise prices, higher wages would likely come out of profits, which now stand at a record share of national income. This might prove problematic if businesses were short of capital for investment. But the reverse is now the case, at least for the large firms who are accumulating huge stocks of retained earnings that languish on the sidelines or are used to fund mergers and stock buy-backs.

To begin, the second half on the 1990s was the last time that all economic groups from top to bottom progressed together at roughly the same rate. It is no coincidence that during this period, the labor market reached and then sustained full employment, improving workers’ bargaining power and bringing previously neglected individuals back into the workforce. This history suggests that we should adopt full employment as a high-priority goal of economic policy and welcome the wage increases that it would generate. Because businesses will find it difficult to raise prices, higher wages would likely come out of profits, which now stand at a record share of national income. This might prove problematic if businesses were short of capital for investment. But the reverse is now the case, at least for the large firms who are accumulating huge stocks of retained earnings that languish on the sidelines or are used to fund mergers and stock buy-backs.

Second, we should use the tax code to restore the relationship between wage increases and productivity gains. The profits of firms that share the benefits of productivity increases with their workers should be taxed at lower rates than are firms whose executives and shareholders pocket the gains while ignoring their workforce.

The balance between wages and profits affects growth as well as distribution. In the long run, workers cannot purchase more than they are paid. As wage growth slowed in recent decades, middle class families took on additional debt, in part by drawing down the equity they had accumulated from rising home prices. When the housing bubble burst, these families suffered an economic shock that drove many into bankruptcy and induced the entire middle class to reduce debt and live on earned income. Because household and family incomes have stagnated since the end of the Great Recession, the recovery has been the weakest of the entire postwar period. Only wage increases can generate more vigorous growth. And if market mechanisms fail to produce that growth, public policy should step in.

Third, there is no reason why the tax code should give additional advantages to the wealthy, whom the market is treating extremely well already. We should adopt a strong presumption against provisions of the tax code that treat some sources of income more favorably than wages and salaries. Tax expenditures that disproportionately benefit upper-income investors should be scrapped or at least redirected toward the middle class. It is hard to understand why the winner of a bet about the future value of existing equity or debt should be treated better than ordinary wage earner. Capital gains should be treated preferentially only when they are the result of transactions that increase the aggregate of productively invested capital.

Economics and culture in market democracies

To recapitulate: the liberal democratic bargain of the post-war years rested on the premise that elected governments could manage market economies to deliver broadly shared prosperity.

The bargain held for the first three decades after World War II but waned during the next three decades as the standard formula for success—growth, private and public investment, innovation, an educated and trained workforce—lost much of its efficacy. During the 1920s and 1930s, the failure of market economies and democratic political institutions boosted the credibility of totalitarian governance and central planning. Today, after the Great Recession eroded the “Washington Consensus,” Chinese-style authoritarian state capitalism is becoming more attractive to developing countries seeking ways to advance. (A joke making the rounds is that the ideology of the PRC is “market-Leninism.”)

But—to pile complexity on complexity—it has taken more than globalization, technological change, and the increasingly advantaged position of the wealthy to breach the post-war bargain. Another process has been at work as well: when market economies interact with democratic politics, public demands can slow growth in the name of other goods. For example, security is a basic human desire, but innovation is almost always disruptive, so people seek protection against the insecurity it creates. What begins as a safeguard against the downside of innovation can end up impeding the process of innovation itself. Rigid rules forcing employers to retain workers they no longer need may discourage them from hiring at all, forcing new entrants into the labor force to bear the brunt of change. And by giving employers incentives to prefer contingent workers who can be fired at will, these rules can end up increasing insecurity for everyone.

Social insurance is another source of security in market economies. During the past century, liberal democracies have created programs to provide income supplements during periods of unemployment, ensure an income stream during retirement, and protect against the economic consequences of illness. But in aging societies, maintaining promised funding for these programs can come at the cost of the public investments needed for long-term economic growth.

Social insurance is another source of security in market economies. During the past century, liberal democracies have created programs to provide income supplements during periods of unemployment, ensure an income stream during retirement, and protect against the economic consequences of illness. But in aging societies, maintaining promised funding for these programs can come at the cost of the public investments needed for long-term economic growth.

Even when public spending is robust, high levels of private consumption are needed to maintain economic vitality. Few individuals resist this, and why should they? Consumption can yield convenience and pleasure. This generates another tension: the desire to live comfortable lives is one of the forces suppressing birthrates in developed market economies. And when the population stagnates, growth slows.

In the mostly rural societies of the 18th and early 19th centuries, children were net economic assets. While still very young, they began working the land alongside their parents, contributing to household income. Today, children are expensive, and few adolescents can make significant economic contributions to their families, even when they are legally able to work. In the space of two centuries, child-rearing has moved from a private good to a public good: while it yields emotional rewards, from a strictly economic standpoint it benefits society as a whole rather than the parents who bear most of the financial burden. Absent massive public subsidies, it is predictable that fewer adults will choose to bear children at the expense of the liberties and comforts they can enjoy as consumers in modern societies.

At bottom, the challenge facing modern democracies is to establish a workable balance among the past, present, and future. We must do our best to honor the promises we have made, whether to those who purchase public debt or to those who rely on established programs for security in old age. We must provide enough buffers against economic shocks so that public discontent does not spill over into social disorder. But as we do so, we must ensure that enough remains to make the investments and implement the innovations without which the future will be worse, not better, than the present.

Doing this while strengthening the middle class will require the wealthy to bear more of the burden of funding these programs and to receive lower benefits from them. It is difficult to understand why Social Security is funded through a regressive tax, or why upper-income Americans do not finance the full value of their Medicare benefits through market-based premiums.

But it will require something else as well—the delay of gratification, not in the name of moral limits, but in the name of a brighter future.

The delay of gratification is a tough sell in democratic politics. In the Gorgias, Socrates compares the politician counseling restraint to a physician who prescribes diet and exercise. The doctor’s regimen may be good for the patient in the long run, but in the here and now the doctor will lose every popularity contest to the pastry chef. And so it is in politics: those who pander will always enjoy an advantage over those who urge deferred consumption in the name of future improvement.

Restraint can often be justified as the path to a better future for those who are being asked to restrain themselves. But one wonders whether the appeal to self-interest rightly understood will prove powerful enough in the absence of a sense of responsibility for future generations. The Preamble to the U.S. Constitution declares that the fundamental purpose of the union is to secure the blessings of liberty to our posterity, not just ourselves. Edmund Burke famously defined society as a partnership “not only between those who are living, but between those who are living, those who are dead, and those who are to be born.” I think Burke was right about that. But more to the point, it is hard to believe that far-sighted policy will be accepted and effective unless democratic peoples believe it to be true. Without some felt connection to posterity, democracies are bound to lose their balance. “In the long run we are all dead” may seem a reasonable credo for a man who lived and died childless. But for society as a whole, it is a formula for slow-motion suicide.

What happens when growth slows: the moral and political stakes

The distribution of economic surpluses is the daily business of normal politics in liberal democracies. While the process is never free of conflict, it is usually conducive to compromise. Political life is very different when growth halts and the challenge becomes the allocation of losses in a zero-sum or negative-sum environment. Human experience suggests (and behavioral economics confirms) that the pain of loss exceeds the pleasure of gain. While failing to improve one’s well-being is disappointing, losing what one has enjoyed is productive of bitterness and anger. The pathologies we see today are the consequences of these sentiments.

First comes the politics of blame: if something has gone wrong, someone (else) must be responsible—wealthy malefactors, corrupt government officials, immigrants, even foreign conspiracies. Enough examples always exist to lend the color of plausibility to these charges. But the search for scapegoats diverts attention from the underlying problems and impedes the development of effective solutions; all the more so when all of us are in some measure responsible for our country’s plight.

The politics of blame provides fertile ground for demagogues who know how to play on people’s hopes and fears. Their message is typically some form of populism: the people are virtuous; the elites are corrupt; we should set aside the subtleties of experts and rely on the common sense of ordinary citizens. And no matter how profound our problems may be, we should reject all proposals that call for sacrifice.

Demagogues often begin by working within the political system. But all too often, they and their followers come to regard democratic institutions as part of the problem, not the means for solving it. When times are hard, the varied social and economic groups in modern polities struggle with one another, each striving to minimize its losses at the expense of others. Elected governments mirror these divisions, which makes it hard for them to act effectively. Temporizing and dithering are the order of the day, further stoking public discontent.

Demagogues often begin by working within the political system. But all too often, they and their followers come to regard democratic institutions as part of the problem, not the means for solving it. When times are hard, the varied social and economic groups in modern polities struggle with one another, each striving to minimize its losses at the expense of others. Elected governments mirror these divisions, which makes it hard for them to act effectively. Temporizing and dithering are the order of the day, further stoking public discontent.

One consequence is the growth of extremist parties, a trend most visible today in Greece. The far left and far right have surged while the long-dominant center-left and center-right parties have suffered huge losses. There is a certain rough justice to this, of course; the established parties presided over a decade of recklessness and mendacity that had to end badly. But neither of the extremist groups offers a way forward, and the far-right Golden Dawn party is an unabashed throw-back to the fascist movements that flourished prior to World War II.

In the Europe of the 1930s, these phenomena led to contempt for parliamentary democracy and a willingness to consider non-democratic alternatives. Prominent intellectuals praised fascism, communism, and Nazism, not least for their capacity to act boldly. Liberal democracy is far more robust today than it was between the two world wars. Still, it is not hard to detect a rising admiration for China’s ability to mobilize resources for transformative public investments. The Chinese government can build entire cities faster than the U.S. government can complete the required environmental impact studies.

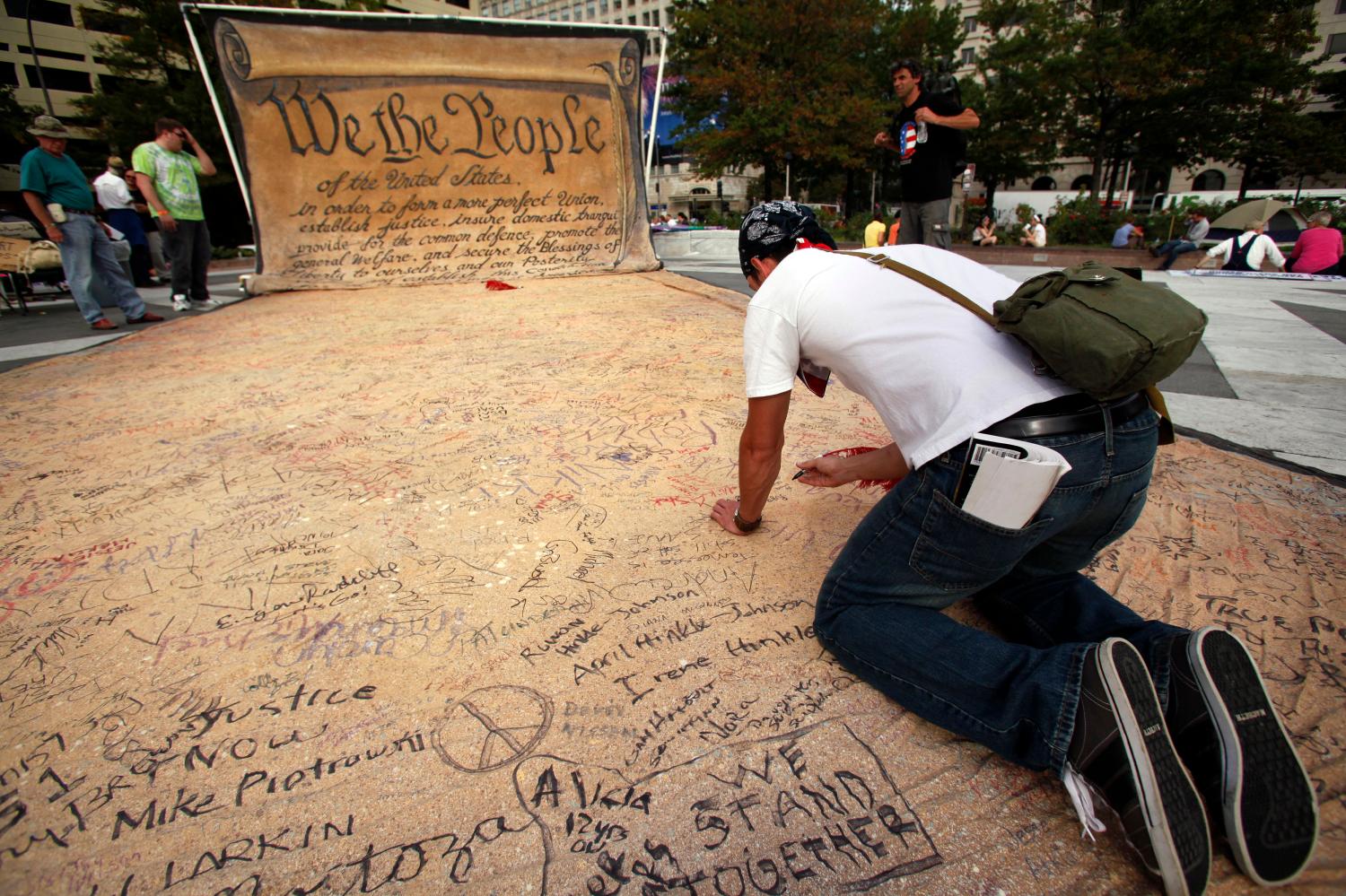

Unlike the totalitarian ideologies of the 20th century, the Chinese model has no roots in Western culture and little resonance as a replacement for liberal democracy, at least in countries with established systems. (The developing world may be more open to it.) But in the West, rather than alternative models of politics, we are witnessing the rise of purported alternatives to politics. This impulse assumes diverse forms: technocrats rather than career politicians to administer programs of economic reform; the increasing authority of institutions such as central banks that are designed to be insulated from popular pressure; and even social movements, such as Occupy, that deliberately refuse to engage with established institutions and seek to create non-hierarchical networks as alternatives to normal politics.

None of these efforts is likely to evade the abiding imperatives of politics. Their significance lies in the inchoate hopes they encode rather than in the specific solutions they offer. They help us interpret the pathologies of contemporary liberal democracies. But in the end, the only alternative to bad politics is better politics.

Conclusion: reconsidering the link between economic growth and liberal democracy

One may argue, as have some environmentalists and traditional conservatives, that all these difficulties can be traced back to the liberal democratic promise that popular governments can manage market economies so as to unleash unending material progress. Once that becomes the accepted metric of success, periods of economic distress are bound to weaken public support, not just for markets, but for liberal democracy itself.

There is some truth to this. But it is not a useful truth, because there is no possibility of turning back. I am hardly the first to observe that at the core of what we call modernity is the legitimation of the very human desire for a secure and commodious existence. Because nature offers at most the raw materials for such a life, realizing that desire requires the ceaseless employment of effort and ingenuity in the service of material improvement. As Aristotle observed in the Politics, there is in principle no limit to such striving: “the desire for life being unlimited, [people] also desire in unlimited amount what is conducive to life.”

Only conceptions of good lives can limit boundless material striving in principle, and only professions shaped by such conceptions can make the limits effective in practice. Warriors who prize courage and loyalty are less concerned with material acquisition; so are scholars who seek truth and pious individuals who seek God.

But democracies have a hard time defining moral limits—not just modern democracies, all democracies. There is an inherent link between democracy and liberty, and between liberty and variety. In a democracy, Plato said in the Republic, one can speak freely and “do anything one pleases.” The result is a wide variety of human characters and ways of life, “like a cloak embroidered with every kind of ornament.” Social norms are needed to secure peaceful coexistence among different ways of life, but these norms are not those that would be needed to limit desire. Democracy is about expressing desire, not restraining it.

If Plato is correct, then the liberal democratic bargain as I have defined it is nothing but the modern means for fulfilling the inherent thrust of democracy itself. Abandoning the bargain will not bring about a more austere “steady-state” democracy. It will mean the end of democracy and its replacement by systems of government that are bound to be worse. In the end, we have no choice but to make the best of the bargain—to do what we can to restore public support for the means most conducive in the long run to the ends they seek. But without a public that feels responsible for the future—to posterity—our efforts are bound to fall short.

If Plato is correct, then the liberal democratic bargain as I have defined it is nothing but the modern means for fulfilling the inherent thrust of democracy itself. Abandoning the bargain will not bring about a more austere “steady-state” democracy. It will mean the end of democracy and its replacement by systems of government that are bound to be worse. In the end, we have no choice but to make the best of the bargain—to do what we can to restore public support for the means most conducive in the long run to the ends they seek. But without a public that feels responsible for the future—to posterity—our efforts are bound to fall short.

In modern circumstances, then, economic growth is more than a material goal; it is a moral enterprise as well. Because I cannot improve on the economist Benjamin Friedman’s formulation of this proposition, I conclude by quoting a passage that summarizes his magisterial book, The Moral Consequences of Economic Growth.

“The value of a rising standard of living lies not just in the concrete improvements it brings to how individuals live but in how it shapes the social, political and, ultimately, the moral character of a people. Economic growth—meaning a rising standard of living for the clear majority of citizens—more often than not fosters greater opportunity, tolerance of diversity, social mobility, commitment to fairness, and dedication to democracy. . . . Even societies that have already made great advances in these very dimensions, for example, most of today’s Western democracies, are more likely to make still further progress when their living standards rise. But when living standards stagnate or decline, most societies make little or more progress toward any of these goals, and in all too many instances they plainly retrogress.”

That is why, as Friedman insists, the central question the United States now faces is whether the next generation will again achieve broadly shared prosperity or rather experience the stagnation of living standards. Broad prosperity is both the oil that lubricates the machinery of government and the glue that binds our society together. Economic stagnation means a continuation of gridlocked, zero-sum politics and a turn away from the spirit of generosity that only a people confident of its future can sustain.

At long last, our leaders must turn away from peripheral squabbles and attend to the one issue that more than any other will define our country’s prospects. The stakes could not be higher, and we have waited long enough.

William A. Galston holds the Ezra K. Zilkha Chair in the Brookings Institution’s Governance Studies Program, where he serves as a senior fellow.

For Further Reading

Saving Horatio Alger: Equality, Opportunity, and the American Dream

August 2014, Richard Reeves

Superpowers Don’t Get to Retire: What Our Tired Country Still Owes the World

May 2014, Robert Kagan

The Common Good: Theoretical Content, Practical Utility

April 2013, William Galston

The Moral Consequences of Economic Growth

2005, Benjamin Friedman

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).