The following brief is part of Brookings Big Ideas for America—an institution-wide initiative in which Brookings scholars have identified the biggest issues facing the country and provide ideas for how to address them. (Updated February 2, 2017)

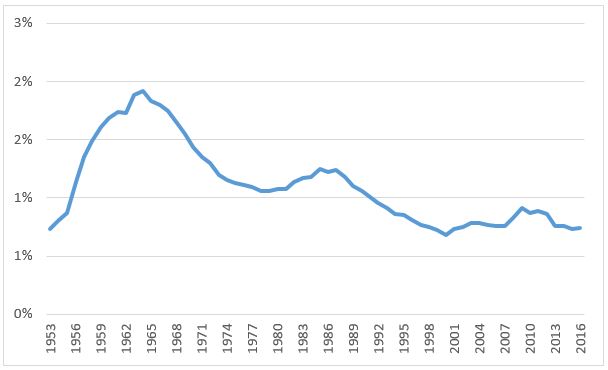

Despite the critical nature of scientific discovery, federal R&D is under siege. As a share of GDP it is less than half what it was in the mid-1960s,1 and, while the United States once led the world in government-funded R&D intensity, we now rank 12th.2

Despite the critical nature of scientific discovery, federal R&D is under siege. As a share of GDP it is less than half what it was in the mid-1960s,1 and, while the United States once led the world in government-funded R&D intensity, we now rank 12th.2

Even at historically low levels, current federal R&D may face greater cuts in the future. As mounting debt and mandatory spending squeeze discretionary spending across the federal budget, federal R&D is likely to come under increased scrutiny. According to Congressional Budget Office projections, discretionary spending will shrink from one-third of the federal budget to 22 percent by 2026.3

Federal expenditures on R&D as a percent of GDP, 1953-2016

In the middle of the 20th century, members of Congress and the voters who elected them saw federal R&D as a necessary condition for achieving important national objectives like space exploration, disease eradication, and addressing looming energy crises. Today, for many Americans, these missions have taken a back seat to the growing demand for high economic returns-on-investment. State legislators, mayors, governors, and members of Congress rally when the possibility of a military base closure threatens jobs, but they are silent or perhaps clueless when cuts in research funds for the national laboratories and universities within their jurisdiction undermine regional innovation, jobs, and growth.

To maximize and make apparent the economic returns from R&D, the next administration should seek to improve the local economic impact of federal R&D.

In the United States and around the world, scientific and R&D-intensive firms situate themselves in proximity to universities and national laboratories to enjoy myriad “ecosystem” benefits. Local economic clusters, often anchored by cities and urbanized research parks, emerge to concentrate knowledge flows, specialized workers, and supply chains in a way that encourages innovation and leads to higher productivity.4

The next administration should direct the largest federal R&D funding agencies—the Department of Defense (DOD), the Department of Health and Human Services (DHHS), and the Department of Energy (DOE)—to adopt policies to better support local economic development. Not only do these departments represent the majority of federal investments in R&D, but they also have unique investment vehicles that can be leveraged by cities at different points in the development process and through different mechanisms.

DOD, through its own efforts and those that flow from partnerships and procurement, consumes technology to meet its mission objectives. No other federal agency has such a quasifiduciary relationship with the commercial outcomes of its own R&D funding, and DOD can better solve battlefield challenges by taking greater advantage of regional clusters of knowledge flows, specialized workers, and dense supply chains. In contrast to DOD, DHHS invests almost all its R&D funds externally through competitive grants distributed around the country. Its geographically diverse portfolio is ideally suited for blending regional economic development with its primary mission of improving health. DOE invests heavily in its 17 national laboratories around the country. Few are located in dense regional technology clusters and cities, but these labs could bring the frontiers of science to market more quickly by strategically locating and linking parts of their core competencies in the vicinity of large and small firms, venture capitalists, and other research institutions. In sum, each of these three agencies has unique potential to improve the economic return on investment of federal R&D by capitalizing on relationships with local economic clusters.

For DOD—a network of applied R&D facilities

At over $70 billion invested annually, DOD is far and away the largest funder of federal R&D. And because it invests in research that it will deploy throughout its own operations, DOD maintains strong private-sector relationships. According to its own accounting, between 2000 and 2014 DOD paid private companies that had licensing arrangements with its labs $3.4 billion for military technology; during the same period, companies that licensed technology from DOD labs generated $20 billion in sales outside of DOD.5 In other words, companies pay to use technology generated by DOD and then develop products and services around the technological discovery to meet defense as well as market needs. This continuous cycle of development well positions the department’s R&D to impact the broader economy in general and regional clusters in particular.

While DOD has long-standing partnerships with the private sector to meet its mission, it can do more to increase the economic impact of R&D and technology procurement. First, procurements that flow from DOD R&D revolve around a few large defense contractors, leaving many regions without big defense contractors out of the game. Of the military sales resulting from DOD licenses, 58 percent were from large corporations because, according to a DOD study, “large defense contractors are the primary holders of munitions technologies developed in DOD laboratories.”6But DOD has demands beyond munitions that include new technical competencies in software, material science, automation, batteries, medical devices, and robotics. For these, the department could look beyond its traditional suppliers.

The next administration should create a network of applied defense R&D facilities around regional technology clusters.

To increase the breadth of R&D-based procurement, the next administration should create a network of applied defense R&D facilities around regional technology clusters. The network would be similar to the National Network for Manufacturing Innovation but with a greater number of smaller centers that are highly focused around the virtuous cycle of firms working with DOD labs and creating products and services that meet military needs. Given that DOD already operates dozens of laboratories across 22 states, in many cases existing labs could shift their research and commercialization strategies to better align with adjacent technology clusters. In other cities, the department would need to develop new assets.

DOD is already moving in this direction. For example, the Defense Innovation Unit Experimental (DIUx) seeks to create bridges between the Pentagon and the commercial technology sector. Currently, DIUx has locations in Silicon Valley, Boston, and Austin, Texas; last year it awarded 12 contracts worth $36.3 million.7 While DIUx is a good start, its budget is paltry compared to the changing demands for new technologies within the military. DOD should invest $500 million to develop 50 similar centers in technology platforms across the country.

The new regional network for applied research labs could also serve as a testbed for new partnerships. Historically, the most profound way the military has affected the economy has been to identify mission-critical demands and then convene universities, companies, and independent inventors around these issues. For the half century following World War II the model worked extremely well, creating the semiconductor industry, the internet, and other technologies that have redefined the economy. Today, firms and markets are more global, and the military has less ability to dictate R&D at universities and firms; this is particularly true in robotics and software, where large companies like Google have hundreds of lines of business globally.

To take full advantage of local technology clusters in new platform technologies like genomics, material science, and next-generation energy, DoD needs partnership models that leverage regional intermediaries and non-traditional actors. Here again, the department has pilot projects that are moving in the right direction. For example, the Naval Surface Warfare Center has partnered with Ball State University in Indiana in its Military to Market program, which allows undergraduates in the university’s entrepreneurial program to use military technologies to create new companies.8 In Rhode Island, the Naval Undersea Warfare Center Newport established the country’s first Center of Excellence in undersea technology at the University of Rhode Island.9 Similarly, in New York the Griffiss Institute, a nonprofit business accelerator and training center, serves as an intermediary between the Air Force Research Laboratory and private companies, helping to develop research contracts, review patents, and perform commercial test agreements.10 Under a network of urban applied research labs, these pilots could be scaled across the country.

For DHHS—regional consortia and ‘entrepreneurs in residence’

DHHS invests over $32 billion every year in research, the vast majority of which is conducted by and through the National Institutes of Health (NIH). The primary vehicle for NIH R&D is competitive grants: currently more than 80 percent of NIH funding is awarded through 50,000 grants to more than 300,000 researchers at universities, medical schools, and other research institutions. NIH research dollars touch every state and almost every city, and so the agency is ideally situated to play an important role in improving the return on investment of federal R&D at the local level. Also, because the lion’s share of investment comes from NIH’s grants to research universities and medical schools, as opposed to being spent at its own labs, NIH is in a unique position to incentivize commercialization across the U.S. university system. However, a number of constraints limit the local impact of NIH funding.

The next administration should support regional pre-competitive consortia to address national health concerns.

First, few research grants incentivize partnerships that lead to commercialization. While Program Project/Center Grants promote collaboration, research grants such as R01’s could be structured to meet their scientific discovery mission while also supporting regional economies. Unlike many technology areas, in the life sciences there is often no clear line between basic science and product development; this is especially true in cutting-edge areas such as gene therapy, where lab discoveries can be directly relevant to drug developers. Connecting the dots between research and commercialization early will improve the economic impact of R&D locally since life science companies, academic medical centers, and research universities often cluster in close proximity to one another.

To improve the commercial impact of research grants, the next administration should support regional pre-competitive consortia to address national health concerns. When applying for NIH grants, research institutions should be incentivized to coordinate with regional peers to solve national issues. Making the consortia pre-competitive (i.e., uninvolved in patent development) will help to avoid intellectual property disputes and allow their efforts to dovetail more closely with the academic missions of NIH research grants. One way to further incentivize partnerships would be to give grant proposals extra weight if multiple technology transfer offices, private-sector actors, and others within a city are designated as principle investigators.

NIH already supports similar programs at the national level. To promote new drug discovery, the Accelerating Medicines Partnership (AMP) brings together the NIH and 10 biotechnology companies and nonprofit research institutions to identify issues around compound collections. NIH could leverage its grant-awarding power to incentivize such partnerships locally. A number of pre-competitive arrangements exist at the regional level, but these efforts are not consistently encouraged or rewarded by federal funders.

The second constraint limiting the impact of NIH funding is grants don’t necessarily promote medical entrepreneurship. Universities and academic medical centers that receive funding from NIH often follow the narrow and traditional path to commercializing research that revolves around patenting and licensing. In the “classic” model of technology transfer, researchers at universities and medical centers apply for NIH and other federal funds to pursue basic science and then patent their discoveries. The technology transfer office at the university/med center then takes these patents and licenses their use to biotechnology and pharmaceutical firms for the development of products. While the classic model can be an appropriate vehicle for commercialization, it often lacks strong connections between firms and research organizations. On the other hand, successfully scaling a life science startup requires social and capital networks, mentorship, public-private partnerships, and access to both scientific and managerial talent. Developing, recruiting, and coordinating these disparate pieces of the medical entrepreneurial ecosystem is difficult but once achieved can spur new economic clusters, firms, and employment.

The next administration should establish a NIH entrepreneurs-in-residence program.

To increase medical entrepreneurship, the next administration should establish a NIH entrepreneurs-in-residence program that locates entrepreneurs in medical technologies within NIH-funded research institutions or among NIH Small Business Innovation Research (SBIR) recipients. HHS currently has an entrepreneurs-in-residence program but its focus in on improving efficiency in the non-research areas of the department than creating startups around NIH grants. Creating a revolving door between national medical entrepreneurs (many of whom were once recipients of NIH funding) and local life science clusters would help disseminate best practices.

The program could be structured based on the Department of Energy’s i-Corp program that places mentors at universities and national laboratories to help researchers build their own companies. As the largest federal R&D funder of U.S. universities and medical schools, NIH has enormous sway over medical discovery. Coupling its research grants with an entrepreneurship-in-residence program would help the agency cover the full commercialization spectrum.

For DOE—microlabs and vouchers

The primary vehicle for the deployment of R&D from the Department of Energy is its system of 17 national labs representing over $12 billion in federally funded R&D. The lab network constitutes much of the country’s core technical capabilities in clean energy, weapons development, nuclear cleanup, new materials, and atomic energy. Few federal assets have the ability to influence technology-based economic growth as the DOE lab system.

Despite the economic opportunity of the lab system, two major factors have historically constrained DOE’s ability to maximize the system’s impact in cities.

First, many of the national laboratories are located in isolated regions of the country, far from urban technology clusters. The national lab system grew out of the Manhattan Project, and so safety and security justified the seclusion of many of the labs in highly isolated regions. But the labs specialize in technologies such as lightweight materials, energy storage, and additive manufacturing, which are highly relevant to the private sector.

To connect remote labs with cities, the next administration should encourage labs to create off-campus “microlabs”.

To connect remote labs with cities, the next administration should encourage labs to create off-campus “microlabs”—co-located within or near universities or private-sector clusters—that would cultivate key strategic alliances with regional innovation clusters.11 Microlabs would help overcome the twin problems that most labs are located outside of major metropolitan areas and that most lab research occurs “behind the fence” of main campuses. Microlabs could take the form of additional joint research institutes or new facilities that allow access to lab expertise for untapped regional economic clusters. Accessible, off-campus lab space would also help labs engage with small and medium-size enterprises (SMEs). Congress should legislate the creation of microlabs and require state buy-in, or state governments or regional consortia could create voucher programs in concert with DOE and particular labs.

Several national labs already operate external microlabs. ORNL operates the Manufacturing Development Facility (MDF) in Knoxville, TN (away from its main campus). The facility has worked with over a hundred small and large companies to develop new manufacturing materials and new methods for 3D printing and energy storage. ORNL is also in the early stages of opening an office in Chattanooga, TN to work with local firms on smart grid technology.12 In Chicago, Argonne National Laboratory and Fermilab are working with the University of Chicago to further the mission of the Polsky Center for Entrepreneurship and Innovation in its efforts to develop new research-based startups in the city.13

The second factor constraining national labs from having local impact is the rules that govern private-sector partnerships. It is extremely difficult for a small business that needs research or technical assistance to partner with a lab outside its geographic area. Just getting a contract with a lab to signature—a standard cooperative research and development agreement (CRADA)—takes on average 110 days, nearly half of which are spent negotiating terms and conditions. Small businesses grow based on attracting short-and-moderate term business contracts, and they generally don’t have the cash reserves to wait five months to solve technical problems. Moreover, few small businesses have in-house legal departments to address the terms and conditions of signing a CRADA. Without greater access for these small companies, which generally operate in or near urban tech clusters, DOE labs will not be able to fully connect with cities.

The next administration should expand the Innovation Small Business Voucher Pilot to all DoE labs.

To better connect small firms with DOE labs, the next administration should expand the Innovation Small Business Voucher Pilot to all DOE labs. The pilot, created by DOE’s Office of Energy Efficiency and Renewable Energy in 2015, has awarded $15 million to help small businesses access technical assistance at DOE labs.14 Innovation vouchers are low-dollar grants that allow SMEs to purchase consulting services from labs. Because no financial exchange occurs, the time spent on terms and contracts is far less than for traditional user agreements. Currently five DOE labs participate in the pilot, but the voucher should receive significantly more funding and be expanded across the lab system.

In addition to expanding the SBV pilot, the next administration should support state governments to work with national labs within their borders to fund their own programs. Three national labs currently run innovation voucher programs with their state governments. Tennessee’s RevV! program, run by Oak Ridge, the University of Tennessee, and the state Office of Community and Economic Development, is funded by a $2.5 million tax credit from the state to the lab. Oak Ridge and the university jointly review applications from SMEs, and vouchers, in amounts ranging from $10,000 to $50,000, are targeted to in-state manufacturers facing technical constraints that lab researchers can investigate in a short timeframe.

The New Mexico Small Business Assistance program is structured similarly to the Tennessee voucher. The program had a $4.8 million budget in 2015 and is run by Sandia National Laboratory and Los Alamos National Laboratory. Voucher amounts are smaller than in Tennessee—$10,000 for firms located in Bernalillo County and $20,000 for those located elsewhere. To date 2,500 small businesses have received assistance.15

By increasing programming and locations of the national labs through microlabs and by better connecting with small firms through innovation vouchers, the Department of Energy can go a long way to linking its vast technological capabilities to a region’s urban technology clusters.

Conclusion

The Departments of Defense, Health and Human Services, and Energy have not only unique missions but also unique R&D portfolios, funding vehicles, and geographic footprints. And for over 50 years these strengths have propelled core American values around defense, health, and energy. Today, economic growth is at historic lows, and federal R&D spending by these agencies could have a multiplier effect throughout local economies.

The recommendations in this brief for each agency —applied R&D centers for Defense, entrepreneurs in residence for Health and Human Services, microlabs and vouchers for Energy—are not mutually exclusive. The Defense Department could create an innovation voucher program, and NIH could move resources out of its remote Maryland campus and into microlabs. In any case, all funding agencies can do more to make working with small companies and entrepreneurs easier. These policies and many others, if adopted by the next administration, will help bring federal R&D to ground and boost its impact on the entire U.S. economy.

-

Footnotes

- “National Center for Science and Engineering Statistics,” (Washington: National Science Foundation, 2016) https://ncsesdata.nsf.gov/fedfunds/2014/.

- As of 2014, the United States fell behind Australia, South Korea, Denmark, Sweden, Finland, Germany, Russia, Estonia, Singapore, France, and Norway; see Organization for Economic Cooperation and Development, “Science, Technology, and R&D Statistics” (2016), http://stats.oecd.org/BrandedView.aspx?oecd_bv_id=strd-data-en&doi=data-00182-en.

- Congressional Budget Office (CBO), “Summary of the Budget and Economic Outlook: 2016-2026” (Washington: CBO, 2016).

- See, for example, Mark Muro and Bruce Katz, “The New Cluster Moment: How Regional Innovation Clusters Can Foster the Next Economy” (Washington: Brookings Institution, 2010). See also S. Rosenthal and W. Strange, “Evidence on the Nature and Sources of Agglomeration Economies,” in J.V. Henderson and J.F. Thisse, eds., Handbook of Regional and Urban Economics, Vol. 4 (Amsterdam: North-Holland, 2004); MaryAnn Feldman and David Audretsch, “Innovation in Cities: Science-Based Diversity, Specialization, and Localized Competition,” European Economic Review 43 (1999): 409–29; and Greg Tassey, “Competing in Advanced Manufacturing: The Need for Improving Growth Models and Policies,” The Journal of Economic Perspectives, 28 [1], 2014.”

- “National Economic Impacts from DoD License Agreements with U.S. Industry: 2000-2014″, (Washington: Department of Defense, 2016).

- Department of Defense (2016).

- Aaron Mehta, “DIUx Offers $36 million in FY2016 Contracts,” Defense News, October 14, 2016.

- Susannah Howieson et. al., “Exemplar Practices for Department of Defense Technology Transfer” (Washington: Institute of Defense Analyses, 2013).

- “Naval Undersea Warfare Center Newport Establishes Center of Excellence in Undersea Technology with URI,” University of Rhode Island, April, 2007: https://today.uri.edu/news/naval-undersea-warfare-center-newport-establishes-center-of-excellence-in-undersea-technology-with-uri/.

- Ibid.

- For more information on microlabs see: Scott Andes, Mark Muro, and Matt Stepp, “Going Local: Connecting the National Labs to their Regions to Maximize Innovation and Growth,” (Washington: Brookings, 2014).

- Mike Pare, “Oak Ridge National Laboratory opening one-of-a-kind office in Chattanooga,” Times Free Press, October 20, 2016.

- See “Polskey Center for Entrepreneurship and Innovation: Industry Partners & Investors,” http://polsky.uchicago.edu/page/industry-partners-investors.

- “The Small Business Voucher Pilot,” The U.S. Department of Energy, 2016: https://www.sbv.org/.

- See “The New Mexico Small Business Assistance Program,” http://www.nmsbaprogram.org/