Nellie Liang presented the following remarks on a panel at the American Enterprise Institute on October 10, 2017.

Some have argued that the extraordinary monetary policies developed in the wake of the financial crisis have harmed banks. Today I will respond to this critique by taking a broader financial stability perspective, because healthy banks are needed to provide credit to support economic growth, and to reduce systemic risk.

I will make two main points: First, by supporting growth, extraordinary monetary policies have improved financial stability, not undermined it. Second, despite the long period of low interest rates, banks are strong and viable, and financial stability risks are not high, though they are increasing given high asset valuations and the imminent start of exit from unconventional policies.

To make my points, it is useful to define financial stability. A common operational definition says that a financial system is stable if it does not amplify adverse shocks and generate negative spillovers, which then would significantly put economic growth at risk. That is, financial stability is a resilient financial sector that can continue to perform its functions even if it has been hit by reasonably large negative shocks.

This definition highlights the interaction of two factors: shocks and financial vulnerabilities, the amplification mechanisms. Small shocks with large vulnerabilities, or large shocks even with small vulnerabilities, can lead to significant financial stability risks. In terms of shocks, they are always possible, but likely unpredictable and uncontrollable. Oil price spikes, eruptions of geopolitical tensions, the Greek debt crisis, and the like are all examples. As shocks hit, they transmit quickly to financial conditions and then to growth in the near-term. But the effects of negative shocks can be sharper, larger and prolonged at times if they are amplified by financial vulnerabilities. When vulnerabilities such as bank leverage or maturity mismatch are high, they can lead to fire sales or investor runs, which have negative externalities. The investor runs on Lehman when it could not even repo Treasuries to finance its balance sheet revealed the fragilities of highly-levered dealers, and led to sharp falls in asset prices from the fire sales that followed.

This framework implies that financial stability is not the same as low market volatility. In addition, the framework highlights that macroprudential policies do not aspire to tame asset price movements, but to reduce negative externalities. Moreover, research that supports the volatility paradox—in which periods of low volatility can, through endogenous risk-taking, lead to higher volatility in the future—is consistent with this framework.

My assessment of the current state is that risks to financial stability are not high. This is the case despite the use of extraordinary monetary policy measures, including quantitative easing and forward guidance. I view financial vulnerabilities in the core of the financial system to be low to moderate. This view is consistent with that expressed recently by the Fed in its Monetary Policy Report in July and minutes from the July FOMC meeting.1 First, financial leverage is low. Bank capital ratios have risen, and other financial institutions do not appear to have substantially increased leverage. Non-performing loans and projected losses from the stress tests have declined substantially, as banks have dealt quickly with legacy assets and the economy gained strength. Second, banks have ample liquid assets, and short-term wholesale funding markets are not posing significant run risks, suggesting vulnerabilities from maturity mismatch is low.

Even with higher capital and liquidity requirements, as shown in the first chart below, banks’ ROAs have held steady at about 1 percent in recent years.2 Net interest margins are low by historical standards, but they have been falling for decades—not just during the period of extraordinary monetary policy.3 Yield curves have become less steep as inflation and inflation risk premiums have shrunk. On the credit side, bank loan growth has been solid, averaging about 6 percent in the past few years.

Looking at credit growth more broadly, the next charts show total borrowing by households and businesses. On the left side, the credit-to-GDP ratio for households (orange) has stopped falling, and it has been rising for businesses (blue).4 The right chart shows the growth rates measured over the past three years.5 Business credit has been rising fairly quickly relative to GDP. In addition, some parts of the business sector have substantially increased their debt ratios, suggesting their vulnerability has risen to a moderate level.

What has attracted attention in recent months is the continued rise in asset prices, and the Fed’s assessment that asset valuation pressures now are elevated by historical standards. Many observers, including some notable academics and policymakers, have been critical of extraordinary policy measures taken by central banks because it could lead to financial excesses that do not contribute to spending and growth. In particular, reach for yield behavior by investors with minimum nominal return targets could cause asset price valuations to climb to unsustainable levels.

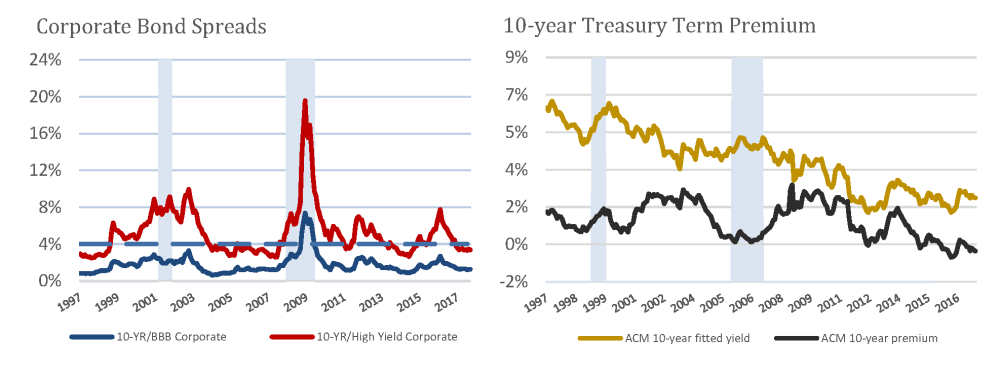

Two valuation measures are shown in the next charts. Corporate bond spreads are narrow, and for junk bonds (red), they are near historic lows.6 In addition, Treasury yields remain low, reflecting very low term premiums (black), which currently are below zero.7 Low term premiums and low risk spreads suggest that potential losses to fixed-income investors could be higher than expected, because price responses to any shocks could be sharper. If investors are highly-leveraged or otherwise surprised by losses, there could be additional prolonged effects from fire sales.

Putting all this together, I see that the US financial system is much stronger and credit is growing, but asset valuations are high. In response to the initial question of whether or not the extraordinary monetary policy actions of the past decade have harmed financial stability, I would answer no. Rather, monetary policy has reduced risks to financial stability by strengthening banks and borrowers. It has lowered interest payments and increased collateral values, and these effects have reduced debt burdens and improved bank balance sheets. Of course, more stringent financial regulations, as well as changes to risk management practices that firms have made on their own, have played an important part. Combined with monetary policies, they have achieved a positive feedback loop between strong banks and strong growth.

That said, I think there are possible factors that could increase financial stability risks in coming quarters. While raising the prices of risky assets was an objective of monetary policies, exit from those policies carries a risk of a large overshoot given current high valuations. While the Fed is doing what it can to make exit smooth and seamless, shocks by definition are unexpected. In addition, high asset prices and low volatility could lead investors to increase leverage or maturity or liquidity mismatches, and in ways that are hard to detect, in which case vulnerabilities are not as low as they appear to be. Finally, increased pressures to significantly scale back financial regulations could jeopardize the resilience of the financial sector.

Nevertheless, to summarize, the evidence indicates that extraordinary monetary policies have improved financial stability, including the resilience of banks, not undermined it.

-

Footnotes

- Board of Governors of the Federal Reserve System. Monetary Policy Report, July 2017, pp. 24. https://www.federalreserve.gov/monetarypolicy/files/20170707_mprfullreport.pdf and Minutes of the Federal Open Market Committee, July 25-26, 2017, pp. 5. https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20170726.pdf

- Federal Financial Institutions Examination Council (US), Return on Average Assets for all U.S. Banks [USROA], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USROA.

- Federal Financial Institutions Examination Council (US), Net Interest Margin for all U.S. Banks [USNIM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/USNIM.

- Board of Governors of the Federal Reserve System, Financial Accounts of the United States (Z.1), https://www.federalreserve.gov/apps/fof/FOFTables.aspx.

- Board of Governors of the Federal Reserve System, Financial Accounts of the United States (Z.1), https://www.federalreserve.gov/apps/fof/FOFTables.aspx.

- 10-year and BofA Merrill Lynch corporate bond yields retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/categories/32348.

- Tobias Adrian, Richard Crump, Benjamin Mills, and Emanuel Moench, Treasury Term Premia, 1961-Present; https://www.newyorkfed.org/research/data_indicators/term_premia.html.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Financial stability and a decade of unconventional monetary policy

October 19, 2017