Ten years after the onset of the worst financial crisis in generations, the first-person “we were there” accounts by the those who led the rescue have been published, journalistic accounts have been written—and even turned into made-for-TV movies—and the Financial Crisis Inquiry Commission has disbanded after publishing its report on the causes of the crisis.

But in one important respect the record is incomplete: There is no coherent and detailed explanation of the dozens of design decisions the first responders made as they crafted the many rescue and stabilization programs. Why, for instance, did the Federal Reserve conduct auctions for its Term Auction Facility on Mondays, but provide winning banks the cash on Thursdays instead of immediately? (So no one would conclude that a bank that borrowed this way was so desperate that it needed the cash to open the next morning.) More generally, what options were rejected and why? In hindsight, what worked as anticipated and what did not? Besides completing the historical record, answers to such questions may clear up some lingering controversies and may prove useful the next time the U.S. or any other country confronts a severe financial crisis.

To fill that gap, the Hutchins Center on Fiscal and Monetary Policy at Brookings has teamed up with the Yale Program on Financial Stability to commission papers from those who crafted the rescues in the Bush and Obama administrations and the Federal Reserve.

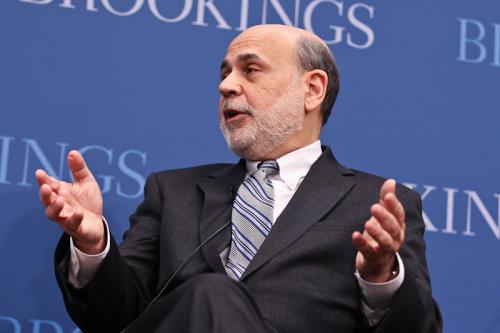

The project will be led by former Treasury secretaries Tim Geithner and Hank Paulson and former Fed Chair Ben Bernanke, and will culminate in the presenting of research at a Brookings conference close to the tenth anniversary of the crisis on September 11 and 12, 2018. The conference will end with reflections by Messrs. Bernanke, Geithner and Paulson. My colleague, J. Nellie Liang, Miriam K. Carliner Senior Fellow in Economic Studies at Brookings and former director of the Fed’s Division of Financial Stability, will serve as editor for the papers.

Scholars will be studying and writing about the causes and consequences of the global financial crisis and the Great Recession for decades to come. We hope the unique nature of this project—the first-hand accounts by those who were in the trenches—will inform that work.

Commentary

Bernanke, Geithner, Paulson to lead new project explaining decisions of financial crisis first responders

November 9, 2017