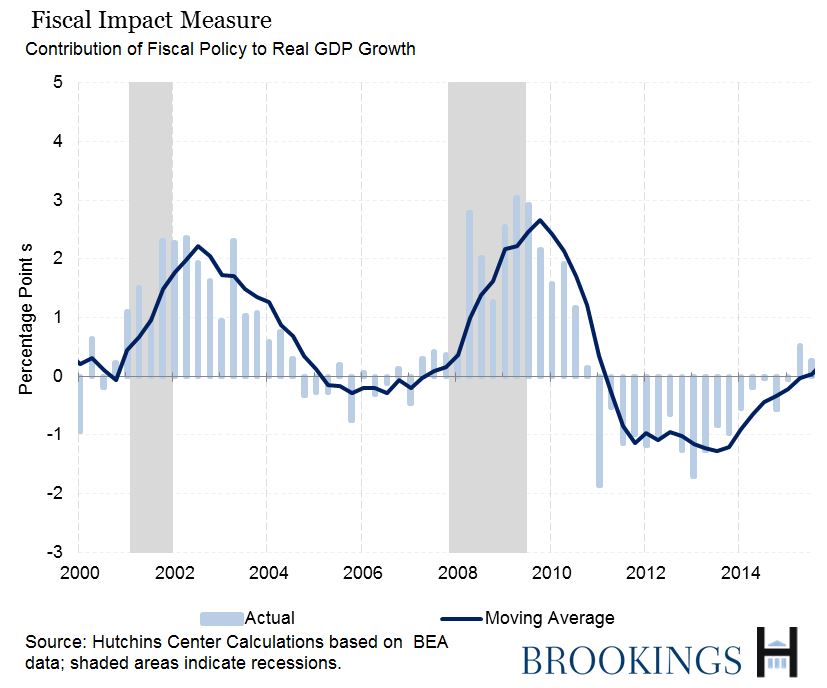

For much of the past five years, local, state and federal governments have been a drag on U.S. economic growth. The combination of scattered tax increases and tight-fisted spending—including the across the board spending cuts of the “sequester”— restrained growth when the economy was still struggling to recover from the Great Recession. That restraint has abated now, and the budget deal pending in Congress will lessen it further.

The latest update to the Hutchins Center’s Fiscal Impact Measure, a measure that reflects the economic effects of both spending and revenues, shows the trend well. Only in the past two quarters have local, state and federal governments given the Gross Domestic Product a near-term boost.

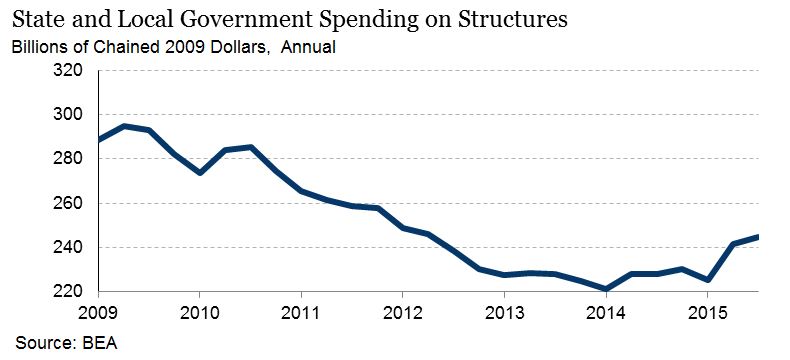

At the state and local level, one can see the recent uptick both in employment and in spending on physical infrastructure.

The two-year budget deal pending in Congress means Washington will spend more money in the current and next fiscal years than would have been allowed under the spending caps previously written into law. The White House Council of Economic Advisers estimates that declining government spending subtracted an average of 0.5 percentage point from GDP growth per year from 2011 to 2013. The CEA argues that the 2013 Murray-Ryan spending agreement diminished what’s known as “fiscal drag” and the latest agreement will “avoid unnecessary fiscal drag in the years to come while also increasing certainty for businesses and consumers.

Goldman Sachs economists estimate that, because of the deal, federal spending in 2016 will be 0.1% to 0.2% higher than they had been forecasting. J.P. Morgan economists estimate that the spending in the budget deal will boost the level of GDP over the next two years between 0.1% and 0.2%, and increase in the growth rate of GDP in 2016 by the same amount. That may not sound like much, but every little bit helps.

Now one sometimes hears, particularly from Republican members of Congress and presidential candidates, that big government—particularly government spending and borrowing—is a damper on economic growth. But there’s little evidence that today’s government spending and federal budget deficits are hurting the economy. (Another line of argument is that regulation and uncertainty are discouraging businesses from hiring and investment, but that’s a subject for another time.) Interest rates remain extraordinarily low. Profits, by almost every yardstick, are high. Corporations have unusually large amounts of cash. There’s just no reason to believe government spending right now is crowding out private investment. That’s not a permanent condition, of course. Big government deficits when the economy is firing on all cylinders can have unwelcome effects.

But for now, finally, government at all levels is giving the economy a boost—and that’s a good thing.

Commentary

Fiscal drag abates, and budget deal will reduce it further

October 29, 2015