Pass-through business income highly concentrated among top earners

Analyzing administrative tax data from 2011, a group of five U.S. Treasury and three academic economists find that the share of U.S. business income accounted for by pass-through businesses—which face lower average tax rates—has more than doubled since 1980, and that this income is substantially more concentrated among high income earners than is C-corporation income. The authors note that if this shift toward pass-through business structures had not occurred, the average tax rate on business income would have been four percentage points higher in 2011, generating an additional $100 billion in revenue.

Increasing top individual tax rate to 50% has a modest impact on income inequality

Bill Gale of the Urban-Brookings Tax Policy Center, Melissa S. Kearney of the University of Maryland, and Peter R. Orszag of Citigroup find that increasing the top individual tax rate to 50 percent and redistributing all of the revenue gains to the lowest 20 percent of income earners would have “an exceedingly modest” effect on income inequality. This suggests that if reducing income inequality is the goal, increasing top tax rates alone will not suffice.

Severe recessions have a lasting impact on economic output

Using data on 23 countries over the past 40 years, Robert Martin of Barclays Investment Bank, Teyanna Munyan of Vanderbilt University, and Beth Anne Wilson of the Federal Reserve Board find that, following severe recessions, economic output remains below its pre-recession trend for an extended period of time. The authors conclude the gap between output and potential output following recessions is primarily closed by downward revisions to potential output over several years, rather than through faster economic growth.

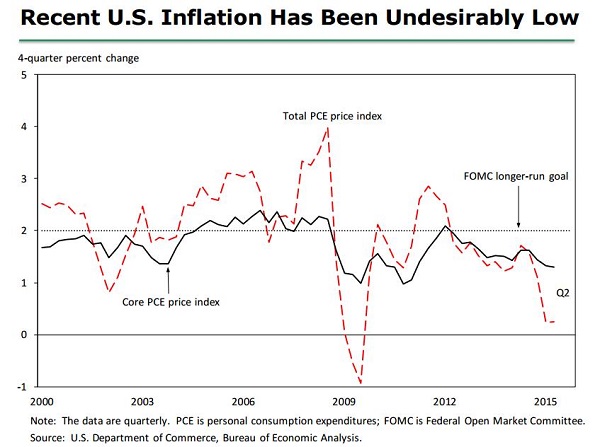

Chart of the week:

Quote of the week: SF Fed’s Williams: slowing pace of economic and employment growth is desirable

As we make our way back to an economy that’s at full health, it’s important to consider what constitutes a realistic view of the way things will look. The pace of employment growth, as well as the decline in the unemployment rate, has slowed a bit recently…but that’s to be expected… As the next year unfolds, what we want to see is an economy that’s growing at a steady pace of around 2 percent. If jobs and growth kept the same pace as last year, we would seriously overshoot our mark. I want to see continued improvement, but it’s not surprising, and it’s actually desirable, that the pace is slowing.

– John C. Williams, President and CEO, Federal Reserve Bank of San Francisco

Our colleague, Ben Bernanke, will be interviewed by Judy Woodruff of the PBS NewsHour about his new book, “The Courage to Act: A Memoir of a Crisis and Its Aftermath,” on Thursday, Oct. 8, at 7 p.m., at Sixth & I in Washington, D.C. For details, click here.

Commentary

Hutchins Roundup: business taxes, top tax rates and inequality, and more

October 1, 2015