Lower capital gains rates eroded distributional impact of U.S. tax code

Adam Looney of the Treasury Department and Kevin B. Moore of the Federal Reserve Board find that, although the distribution of after-tax wealth is slightly less unequal than pre-tax wealth, the U.S. tax code has become less effective in reducing wealth inequality over the past decade. Looney and Moore note that this is primarily due to the reduction in top capital gains tax rates, as unrealized capital gains are heavily concentrated at the top of the wealth distribution.

Clean energy tax credits primarily benefit high-income households

Analyzing the distributional impacts of four federal “clean energy” tax credits, Severin Bornstein and Lucas W. Davis of the University of California, Berkeley, find that these credits have gone primarily to higher-income households. Specifically, the top 20% of earners received about 60% of all clean energy tax credits, with the bottom three quintiles receiving only 10% of the credits. The authors conclude that tax credits are less attractive on distributional grounds than market-based mechanisms to reduce greenhouse gases.

Given strong dollar and anticipated interest rate hikes, emerging market economic growth expected to remain subdued

Pablo Druck, Nicolas E. Magud, and Rodrigo Mariscal find that, although strong U.S. growth is good for emerging economy growth, an appreciating U.S. dollar mitigates this positive impact. In addition, interest rate growth in the U.S. has a negative impact on emerging economy growth. The authors conclude that, based on the anticipated increase in U.S. interest rates and the continued strength of the dollar, emerging economy growth is expected to remain subdued.

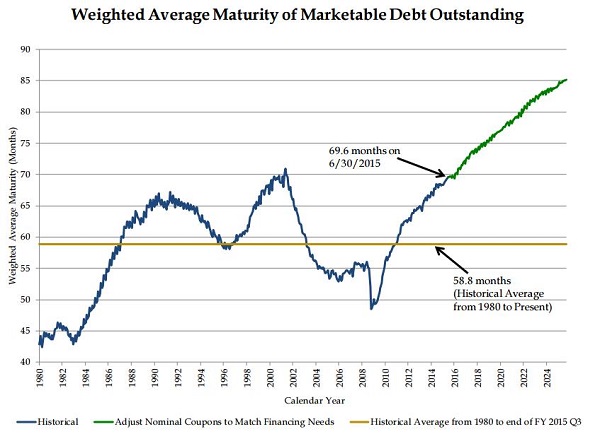

Chart of the week: Maturity of US government debt is above historical average and expected to climb

Quote of the week: Fed does not need to be overly dependent on the “gyrating needle of monthly data” in its decision making

As the Committee approaches what I consider a historic decision, I am not expecting the data signals to point uniformly in the same direction. I don’t need this. I’m prepared to see mixed data. Data are inherently noisy month to month and quarter to quarter. Given the progress made over the recovery and the overall recent tone of the economy, I for one do not intend to let the gyrating needle of monthly data be the decisive factor in decision making.

– Dennis Lockhart, President of the Federal Reserve Bank of Atlanta

Commentary

Hutchins Roundup: Capital gains taxes, clean energy tax credits, and more

August 13, 2015