Firms facing credit constraints more likely to reduce employment and wages

Alexander Popov of the European Central Bank and Jörg Rocholl of the European School of Management and Technology find that German firms facing credit constraints reduced employment and wages more than other firms. This finding suggests that policies focused on easing credit constraints can have a significant labor market impact in the aftermath of a credit contraction.

Regular macroeconomic projections would increase effectiveness of Fed policies

In an International Monetary Fund working paper, Alichi et al. argue that the Federal Reserve could improve the effectiveness of its policies by abandoning its current “dot” plot forecasts and instead regularly publishing a macroeconomic baseline forecast and alternative scenarios. The authors also argue that, given current economic conditions, the optimal Fed policy would be to delay liftoff until mid-2016, modestly overshooting the inflation target.

Fiscal multipliers largest during deep recessions

Giovanni Caggiano and Valentina Colombo of the University of Padova, Efrem Castelnuovo of the University of Melbourne, and Gabriela Nodari of the University of Verona find that fiscal multipliers during periods of expansion are not statistically different from multipliers during recessions. However, after accounting for the strength of the business cycle, they find that fiscal multipliers are actually larger in recessions.

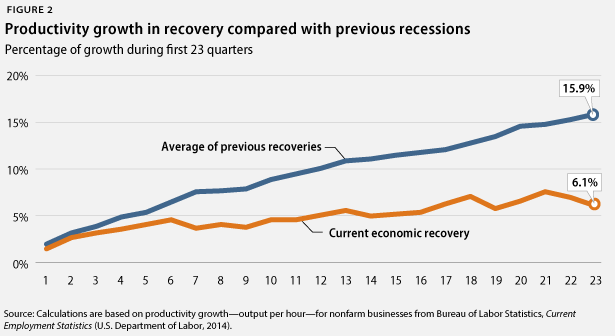

Chart of the week: Slow productivity growth

Quote of the week: ECB has not overstepped its mandate in suggesting structural reforms to member countries

You are now engaging in political debate, telling countries what reforms to implement. Hasn’t the ECB stretched its mandate in order to maintain price stability?

…We frequently get the advice that we should just concentrate on our core business—monetary policy. But, in a currency union like the euro area, individual countries have lost the flexibility provided by an exchange rate of their own. They must thus become more resilient to crises and external shocks. Sound governance and effective institutions are of key importance. That applies, among other things, to labor and product markets, or courts and administration. They are needed for a more efficient monetary policy in a currency union and therefore we tell governments that structural reforms are important. Here, our interest is not in how countries implement these reforms, that is up to them. What interests us is if they are successful, as this impacts the monetary union as a whole.

—Peter Praet, Member of the Executive Board of the European Central Bank

Commentary

Hutchins Roundup: Credit constraints, Fed projections, and more

July 2, 2015