Higher energy subsidies crowd out public spending on health and education

Among low- and middle-income countries, Christian Ebeke and Constant Lonkeng Ngouana of the International Monetary Fund conclude that, where energy subsidies are 1 percentage point of GDP higher than average, public spending on health and education is 0.6 percentage points lower. This crowding out effect is strongest in countries with high debt-to-GDP ratios, weaker institutions, and in countries that are net oil importers.

Restrictive housing policies hold back economic growth

Using data on 220 U.S. metropolitan areas, Chang-Tai Hsieh of the University of Chicago and Enrico Moretti of the University of California, Berkeley, estimate that, between 1964 and 2009, restrictive housing policies kept Americans from moving to highly productive cities such as New York and San Francisco, reducing yearly GDP growth by 0.3 percentage points and reducing U.S. output in 2009 by 13.5 percent compared to what it would have been otherwise.

State tax codes increase income inequality

Using data spanning 1984 to 2011, Daniel H. Cooper of the Federal Reserve Bank of Boston and Byron F. Lutz and Michael G. Palumbo of the Federal Reserve Board find that the federal tax code substantially reduces income inequality, but state taxes, on average, exacerbate inequality slightly – with substantial variation across states. Among the 50 states, Minnesota’s tax code reduces inequality the most and Tennessee’s increases it the most.

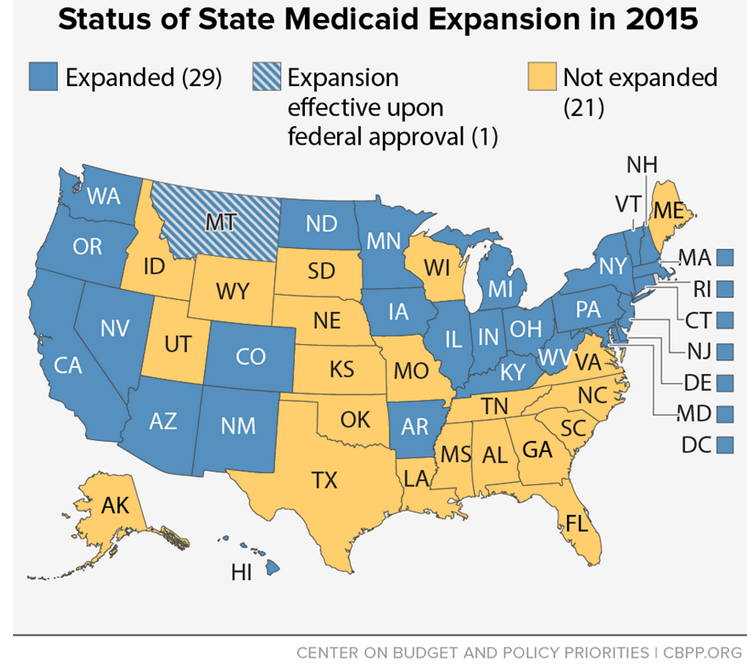

Chart of the week: So far, 28 states and the District of Columbia have expanded Medicaid Coverage

Quote of the week: ECB sees “little indication” of emerging financial imbalances

While we are monitoring developments closely, at the moment there is little indication that generalized financial imbalances are emerging. As a matter of fact, the two most important indicators of growing financial imbalances – real estate prices and credit growth – show only tentative signs of turning upwards. What this underlines is that following a major financial crisis accommodative monetary policy does not necessarily blur a prudent assessment of risk. On the contrary, it can help produce a more regular pricing of risk, which may have become too high and adverse to productive risk-taking.

—Mario Draghi, President of the European Central Bank

Commentary

Hutchins Roundup: Energy subsidies, restrictive housing policies, and more

May 21, 2015