Delays in government payments hinder economic activity

Using data on the 27 European Union countries, Cristina Checherita-Westphal of the European Central Bank, Alexander Klemm of the International Monetary Fund, and Paul Viefers of the German Institute for Economic Research find that when governments delay paying their bills, private sector profits decline and bankruptcies increase, ultimately stunting economic growth.

Expanded Medicaid coverage increases incidence of poor-health behaviors in pregnant women

Dhaval M. Dave of Bentley University, Robert Kaestner of the University of Illinois, and George L. Wehby of the University of Iowa find that the Medicaid eligibility expansions of the 1980s and 1990s were associated with less weight gain during pregnancy and a higher incidence of prenatal smoking among women with low levels of education. Specifically, a 12 percentage-point increase in eligibility increased smoking rates by 0.7 to 0.8 percentage-points and reduced weight gain during pregnancy by 0.6%. The authors note that this could be because women who are insured take greater risks, or because they spend less of their money on healthcare, and therefore have more to spend on cigarettes.

Asset price deflation more harmful than goods and services price deflation

Using 140 years of data across 38 countries, Claudio Borio, Magdalena Erdem, Andrew Filardo, and Boris Hofmann of the Bank for International Settlements suggest that, with respect to economic growth, concerns over goods and services price deflations are overstated. Instead, they find that asset price deflations―particularly house prices― have been much more harmful historically.

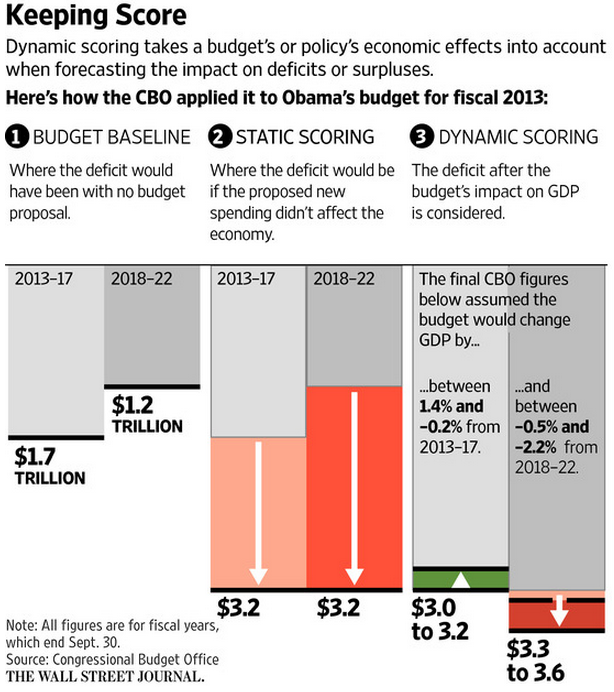

Chart of the week: Dynamic Scoring

Quote of the week: Increases in the fed funds rate not likely to follow path seen in previous recoveries

“Let me first be clear that the FOMC does not intend to embark on any predetermined course of tightening following an initial decision to raise the funds rate target range… Rather, the actual path of policy will evolve as economic conditions evolve, and policy tightening could speed up, slow down, pause, or even reverse course depending on actual and expected developments in real activity and inflation. Reflecting such data dependence, as well as some historically unusual policy considerations…the average pace of tightening observed during previous recoveries could well provide a highly misleading guide to the actual course of monetary policy over the next few years.”

–Janet Yellen, Chair of the Federal Reserve Board

Be sure to join us on April 6th for a discussion featuring Brookings Fellow Philip A. Wallach’s new book To the Edge: Legality, Legitimacy, and the Responses to the 2008 Financial Crisis (Brookings Institution Press, 2015).

And if you haven’t already heard, Ben Bernanke is now a blogger. Please read all of his posts and sign up for the mailing list.

Commentary

Hutchins Roundup: Government Payment Delays, Deflation, and More

April 2, 2015