Almost everything we know about the Nobel Prize may be wrong. Let us then address some illusions, while indulging on another.

1. Was Tinbergen awarded the first Nobel Prize in Economics? No, strictly speaking. Because there is no such thing as a Nobel Prize in Economics. Alfred Nobel did not envisage it, or endow any. Instead, well over 70 years after Alfred Nobel passed away, a financial institution in Stockholm stepped in, inaugurating the Bank of Sweden Prize in Economic Sciences (in memory of Alfred Nobel). In 1969, Jan Tinbergen, at age 66, became the first recipient of the Bank of Sweden Prize in Economic Sciences, shared with Ragnar Frish.

2. So, did Tinbergen, at age 66, and Frish jointly receive a real Nobel Prize? Actually, believe it or not, yes (with a twist): Nico Tinbergen, Jan’s younger brother, was awarded the (bona fide) Nobel Prize for Medicine four years later, when he was also 66. He shared his Nobel in medicine with Karl von Frish, who was not Ragnar Frish’s brother (and with Konrad Lorenz)…

3. When an economist has been awarded alone the Bank of Sweden Prize in Economic Sciences in Memory of Nobel, then has such economist always received the full award without having to share a cent? No, again. When the University of Chicago Professor Robert Lucas won the Nobel in Economics in 1995, he had to give half of his $1 million prize money to his ex-wife because of a clause in their divorce settlement.

As CNN.com states now: “If there were a Nobel Prize for Foresight or Timing, she should be nominated, based on a clause in their divorce settlement from seven years earlier: ‘wife shall receive 50 percent of any Nobel Prize.’ The clause expired on October 31, 1995. Had Lucas won any year after, he would have kept the whole million.”

Clearly, Lucas’ first wife had aptly applied his path-breaking theory of Rational Expectations.

Lucas was in good company. Albert Einstein’s Nobel Prize money went to his ex-wife as part of their (ex-post) divorce settlement.

4. Tuesday we heard that for the first time a woman economist won the Prize in Economics. Wrong. One of the 2009 Economics Prize recipients is Elinor Ostrom, who is actually a political scientist. She is one of the pioneers in Public Choice theory, in introducing economic tools in political science, and in addressing the tragedy of the commons and the wonders of collective action.

5. A dead person cannot receive a Nobel Prize. Mistaken, again. The alleged coiner of the notion of the “planned economy,” and co-drafter of legislation that paved the way of the so-called “welfare state,” actually received a bona fide Nobel Prize (not the Economics Prize), after his death. I am talking about the former U.N. Secretary-General Dag Hammerskjold, who received the Nobel Prize for Peace in 1961 after he was killed in a plane crash in Africa. The Nobel Prize rules were amended in 1974 to ban posthumous prizes.

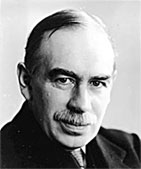

6. So where does this leave us all in Economics today? Is it out of the question then that Lord John Maynard Keynes could have received the Economics Prize this year? Traditionalists, who go according to strict rules, say “No way”—because Keynes has been long dead in the long run. Or in any run.

6. So where does this leave us all in Economics today? Is it out of the question then that Lord John Maynard Keynes could have received the Economics Prize this year? Traditionalists, who go according to strict rules, say “No way”—because Keynes has been long dead in the long run. Or in any run.

Wrong again? Stockholm may not have realized that in essence Keynes today is more alive than ever. The unprecedented mega-trillion stimulus plans in many countries, the social welfare, housing and infrastructure investments, the growing role of the State in the economy, both by owning formerly private assets as well as regulating, have revived Keynes in ways that were regarded unthinkable two years ago.

Ending on a serious note, as I have been arguing, this new overarching role of government poses fresh governance challenges around the world. They have been largely ignored so far. If today we could only speak to Lord John Maynard Keynes, contradicting some of his interpreters, he would remind us of the importance of sound and reformed public finances, of removing many market distortions, of sound governance.

As the global economy is stabilizing, and the recession is virtually over, so are the excuses of inaction on the governance front.

Commentary

Nobel Prize in Economics: Illusions From Tinbergen to Keynes

October 15, 2009