Now that tax filing season is well under way, millions of Americans are about to begin receiving refunds. For many low-income taxpayers, two key tax code provisions—the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC)—will keep them and their families from falling into poverty.

What makes the EITC and ACTC special is that they are refundable—that is, after offsetting taxes owed, filers receive the remainder of the credit in their refunds. As a result, the tax credits effectively boost the take-home pay of low- and moderate-income working families. According to the U.S. Census Bureau’s Supplemental Poverty Measure (SPM)—a more nuanced measure of poverty that accounts for things like tax payments, work expenses, and in-kind benefits not reflected in the official measure—these tax credits lowered the national poverty rate by 3 percentage points in 2015, equivalent to lifting 9.2 million people above the poverty line.

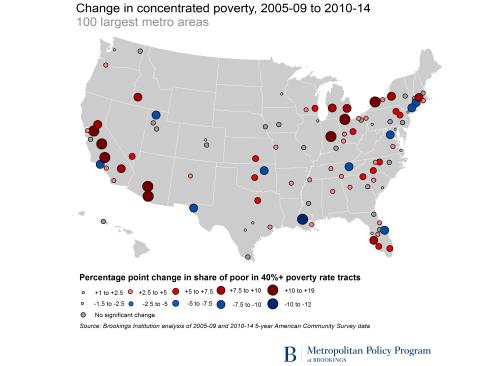

Our analysis of newly released SPM data from the Census Bureau shows the anti-poverty impact of the EITC and the ACTC across the country (Map 1). In a number of states, including Arizona, Nevada, and Texas, the credits reduced poverty rates by larger-than-average margins between 2013 and 2015 (note that we combine three years of data to get a sufficient sample size for state-level estimates). Without the EITC and ACTC, the poverty rate in each of these states would have been almost 5 percentage points higher. In Texas alone, the two tax credits helped lift about 1.2 million residents, including 650,000 children, out of poverty. (For detailed state statistics, see this table.)

While it is not possible to parse SPM data below the state level due to sample size limitations, our newly updated EITC Interactive provides detailed IRS data—down to the ZIP code level—on how EITC filers (and EITC dollars) are distributed across places. Drawing from administrative data compiled by the IRS Stakeholder Partnerships, Education and Communication office, the EITC Interactive also provides a wide range of additional information about the EITC-filing population, including other tax benefits they received (like the ACTC) and whether they made use of volunteer or paid tax preparation services.

Detailed, local-level data like these play an important role in informing the work of organizations and programs that provide outreach and assistance to eligible low-income families to help them claim tax credits. In turn, these efforts help maximize the anti-poverty effect of the EITC and ACTC. The data can also be a valuable resource for state and federal policymakers as they consider changes to the tax code that may affect low-income taxpayers and their families—particularly as states across the country consider enacting, expanding, or reducing state versions of the EITC, and as the new Congress and administration weigh options for pursuing federal tax reform.

For instance, the congressional district estimates available through the interactive show that every district in the country is home to thousands of lower-income workers who benefit from these credits. Put differently, because of the EITC and ACTC, at tax time every district receives significant investments in its low-income working families and the communities in which they live (Map 2).

Consider that the average amount of the EITC claimed in tax year (TY) 2014 was almost $2,500. Furthermore, nearly 60 percent of EITC filers also claimed the ACTC, which boosted their refunds by another $1,300 on average. This means that the average congressional district received $196 million in TY2014 through these two credits.

Research shows that these credits represent not just significant investments in families and communities, but also effective ones. Beyond its anti-poverty impact, the EITC brings a host of short-term and long-term benefits to its recipients, from increased adult workforce participation to improved child health outcomes and educational attainment. And the benefits of these credits extend to more than just the family that receives them: EITC and ACTC dollars help support local jobs and businesses, as families tend to spend their refunds on necessities like groceries. The magnitude of this support can be significant: for example, researchers studying the local effects of the EITC in California found local economic impacts up to twice the amount of EITC dollars received.

Resources like the SPM and the IRS-SPEC data presented through the EITC Interactive offer important insights for policymakers, researchers, practitioners, and advocates—insights into what the tax code does well for working families, and how those effects are felt in communities across the country. As policymakers consider reforms to the tax code that could have significant national and state-level impacts, such insights should inform the coming debate to ensure the tax code continues to work for working families.

Commentary

Mapping Working Family Tax Credits and Their Anti-Poverty Impact

February 21, 2017