Cities across the United States and around the world are facing increasingly frequent severe weather events. Many local governments and public utilities are overexposed and underinsured for these risks. They are also coping with aging and failing infrastructure systems that increase the potential for catastrophic losses.

One way for cash-strapped local governments to increase both protection and insurance against disasters is through a new financial tool called resilience bonds. In a new report, my co-author James Rhodes and I lay out how these would work.

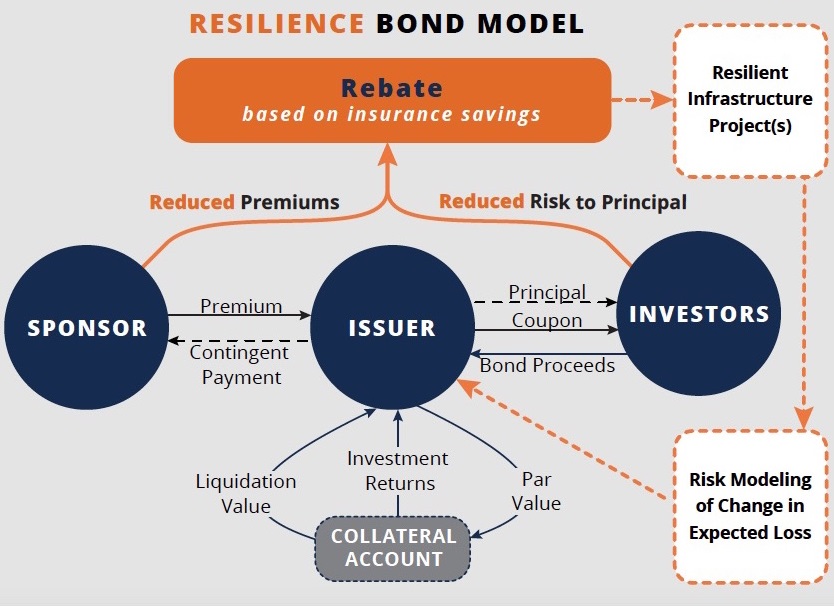

The idea is to link insurance coverage that public sector entities can already purchase (such as catastrophe bonds) with capital investments in resilient infrastructure systems (such as flood barriers and green infrastructure) that reduce expected losses from disasters. This connection between insurance and infrastructure is important because just as life insurance doesn’t actually make you physically healthier, catastrophe bonds do not reduce physical risks and only payout when disasters strike.

The linkage is designed to reduce risks, akin to how quitting smoking or exercising regularly lowers life insurance costs. In the case of resilient infrastructure, investing in coastal protection or seawalls helps avoid physical and financial disaster. Resilience bonds combine these two different types of investments by modifying traditional catastrophe bonds to provide insurance savings that can be captured as rebates to invest in resilient infrastructure projects.

Why does this matter for cities? Five reasons:

- Federal and state disaster relief funds are already stretched thin. In 2014 alone, eight U.S. weather-related disasters exceeded $1 billion in losses each. More expensive disasters mean local governments can no longer afford to rely exclusively on traditional sources of disaster relief.

-

Rapid response funding is a top priority. Many communities wait years for funding commitments to materialize after major disasters. Unlike most traditional property insurance policies, resilience bonds can be structured to provide rapid response funds in the wake of a disaster.

-

Availability and affordability of insurance is a growing problem. Following Superstorm Sandy, traditional property insurance premiums skyrocketed. Entities like the New York Metropolitan Transportation Authority went to the catastrophe bond market for more cost-effective and affordable coverage. In 2013, the MTA secured $200 million in coverage for future Sandy-like storm surge events.

- Meeting insurance compliance requirements is getting more complex. Like mortgage lenders that demand proof of flood insurance, cities and public utilities are often required to hold different types and amounts of insurance to meet regulatory requirements. Resilience bonds can help meet these compliance obligations while creating a pathway for long-term savings and risk-reduction.

- Resilient infrastructure is especially difficult to finance with traditional revenue and payback models, because the benefits are often diffuse and realized far into the future. Capturing more value from these projects is essential for their success. Resilience bonds can serve as a tool to incentivize performance-based design for risk reduction and facilitate timely completion to enable direct value capture.

- The recent climate change agreement in Paris highlighted how cities around the world have committed to investing to increase resilience. But a successful resilient infrastructure project means a community was not devastated. These kinds of “invisible successes” pose a challenge for public investments. Linking insurance and infrastructure investment offers a new path forward for governments to monetize these successes, make better use of taxpayer dollars, limit the growing pressure on public disaster assistance, and leverage the capital markets to both expand insurance coverage and increase protection for vulnerable communities.

For more on the RE.bound program visit:

www.refocuspartners.com

Commentary

Financing infrastructure through resilience bonds

December 16, 2015