A longstanding question remains at the heart of the fight against corruption: Are bribes “grease” or “glue”? Can they help entrepreneurs circumvent burdensome business regulations, and enhance efficiency by allocating services to those with the greatest willingness to pay? Or is corruption purely a costly impediment to entrepreneurship?

In a new paper, co-authors Caroline Freund, Mary-Hallward Driemeier, and myself examine the relationship between demands for bribes and the time it takes to comply with various regulatory requirements, such as obtaining construction permits and operating licenses, using firm-level data from the World Bank Enterprise Surveys of 107 countries. We test the “grease-the-wheels” hypothesis that (1) bribe requests should be negatively correlated with wait times and, moreover, that (2) corruption should be especially beneficial in countries where regulation is burdensome and for firms with a high willingness to pay.

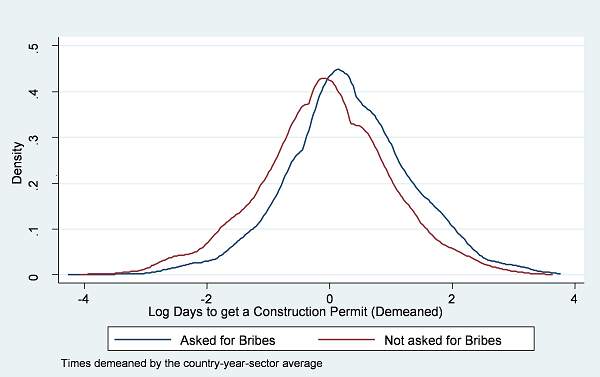

We find that de facto policy implementation times vary enormously across firms. The kernel density graph shown in Figure 1 depicts the distribution of wait times for firms that were asked for bribes (the blue line) and those that were not (the red line). While there is substantial overlap, the distribution of wait times for firms that were asked for bribes lies to the right of that of firms that did not report such requests. That is, firms that were asked for bribes waited longer than firms that were not.

Figure 1. Time it takes to get a construction permit

How much longer do firms confronted with demands for side payments have to wait? Regression analysis suggests that such firms take approximately 1.5 times longer to get a construction permit, operating license, or electrical connection; and 1.2 to 1.4 times longer to clear customs, all else equal. We rule out the possibility that the explanation for these delays is that firms that reported demands for bribes are somehow special (they could for example be more likely to complain, make more complex products, be targeted by bureaucrats, or have deeper pockets) by comparing wait times incurred by the same firm across different applications.

Overall, our econometric analysis rejects the idea that corruption is somehow more beneficial for firms who are more likely to pay, or in countries where regulations are more burdensome. Put simply, it rejects the hypothesis that corruption “greases the wheels.”

Commentary

Does Bribery Speed Up Bureaucracy?

February 20, 2015