Teacher compensation currently occupies a prominent position in education policy discussions due to well publicized teacher strikes over the past year. Trends in teacher wage gaps indicate a steady widening since 1996, reaching a weekly teacher wage gap of $1,137 in 2017 between teachers and those with comparable degree attainment. This concerns more than just teachers. A 2018 poll found that 78% of American adults believe teachers are paid too little.

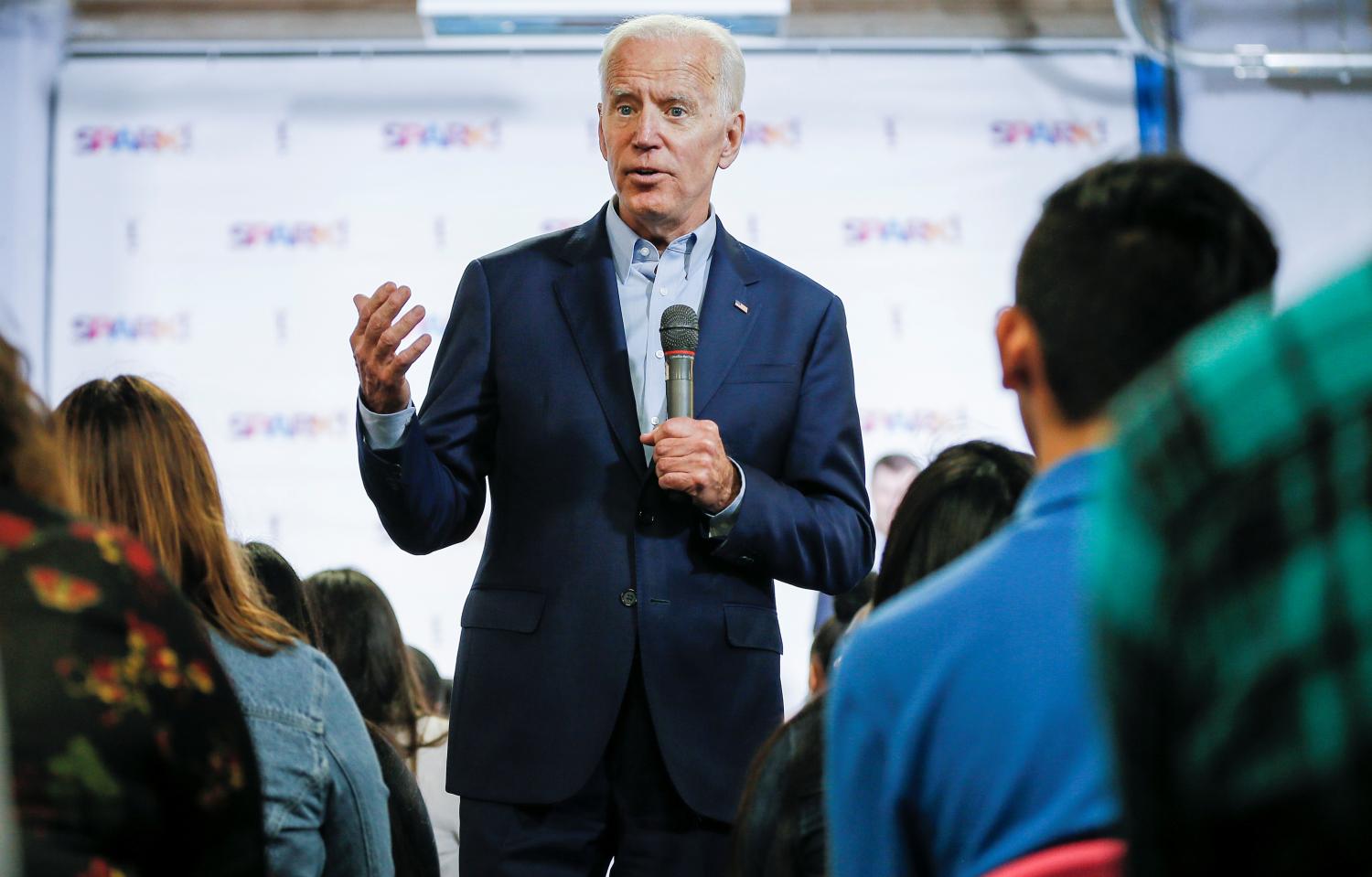

Now, as we march toward the 2020 general election, presidential candidates are latching onto this widespread concern. Earlier this week, former Vice President Joe Biden announced a new education plan that includes substantive support for teachers, and he is not the only one talking about it. These candidates’ ideas invite discussion about whether and how the federal government could intervene to improve teacher compensation—an issue that has historically been left to states. So let’s take a look at how this federal intervention could play out, starting with the leading ideas from Democratic candidates.

The Kamala Harris proposal: Salary support for all teachers

In March, Sen. Kamala Harris announced her proposal to increase the salaries of teachers by an average of $13,500 in order to address teacher turnover and quality. Over a 10-year period, the program is projected to cost $315 billion in federal funds, compensated by an increased estate tax for the top 1% of taxpayers. The federal government would incentivize state contributions by issuing a 3-to-1 federal match.

Supporting teachers’ salaries would be a new enterprise for the federal government, and it is not clear how this could play out. Though the proposed salary support is indirect (the money would be given to states, which then allocate across teachers), Harris’ plan indicates a desire to provide funds to states corresponding to teachers’ individual qualifiers (reflecting credentials, experience, etc.). Yet, setting individual support levels is potentially fraught, getting the federal government entangled with bargaining processes that now occur at the state and local levels. Also, increasing teacher salaries en masse would almost certainly affect state pension plans, the majority of which already face long-term solvency problems, as they must cope with an unanticipated surge in long-term benefit payouts corresponding to higher teacher salaries.

In spite of these potential complications, increasing teacher salaries overall could increase the attractiveness of teaching relative to other occupations. In the mid-20th century, teaching was a frequent choice of top-performing college graduates, though as labor movements have opened career prospects outside of historically feminine professions (like teaching and nursing) teaching has become relatively less attractive. The ability to more reliably attract stronger teachers could theoretically justify the proposal’s steep price tag.

Still, critiques remain. Prominent teacher labor economist Dan Goldhaber, for example, calls Harris’ proposal “a solution that is a mile wide and an inch deep.” Teacher shortages are primarily localized to disadvantaged schools and in certain subjects (i.e., science, math, and special education). Targeted support to these areas is critical to support the teacher labor market; benefits to increased salaries for other teachers would be modest. A more targeted approach along these lines is common in some of the other Democratic ideas about supporting teachers.

The Joe Biden proposal: Expand salary supports through Title I

On Tuesday, Biden announced his education plan, which recommends tripling the federal government’s Title I budget allocation to help support teachers’ compensation in districts serving high concentrations of high-need students (for the record, Sen. Bernie Sanders also proposes tripling Title I funds and setting all teacher salaries at no less than $60,000, though the two are not directly tied in his plan). Biden’s plan only sets the guideline for districts to offer “competitive” teacher salaries, and is not clear how all of the proposed Title I money is intended to be allocated (the proposal spans a number of other recommendations like investing in early childhood programs, improvements to school facilities, and placing more mental health counselors in schools). Though the specifics are lacking, the idea of using Title I as a tool to support teacher salaries represents an important development and is worth examining further.

Title I funds are typically associated with supplemental classroom expenses like instructional coaches, technology support staff, or English learner specialists that could be particularly useful in high-needs schools. Yet, the most common use of Title I funds across schools is to support the hiring of teachers—so the Biden proposal would not be much of a departure from the status quo.

But we need to be careful here. According to my reading of current rules, Title I funds are intended to be used specifically to provide better education for students from low-income families; and only schools with at least 40% of students identified as low income can spend Title I funds on instructional expenses that benefit the whole school. This means many districts would include schools both above and below this threshold, and therefore, any raises would need to be targeted specifically to those in relatively high-need schools, effectively differentiating teacher pay in districts. The suggestion to differentiate pay by school is different than simply hiring additional staff. While the latter simply takes the prevailing contract as given, the former would require amendments to many local contracts to allow for different salaries (currently, only about a third of the largest districts offer differential pay in high-needs schools).

Perhaps the most meaningful differences between the Biden approach and the Harris proposal are beyond the payment logistics. While Harris attempts to make the teaching profession as a whole more desirable, Biden’s targeted Title I approach prioritizes making teacher jobs in high-needs schools more appealing—both overall and in comparison to other teaching jobs. This could counter the well-documented tendency of less-qualified and less-effective teachers to work in such contexts. (It’s worth noting Harris also proposes to offer adjusted salary increases to teachers serving in high-needs schools, though it is unclear how this will be achieved and is certainly a less prominent component of her plan.)

All told, while Biden’s Title I may not have the breadth of impact of Harris’ proposal, it would likely be a far more feasible path that still achieves many of Harris’ objectives.

The Center for American Progress proposal: Tax credits for teaching in high-needs schools

The Center for American Progress (CAP), a left-leaning, D.C.-based think tank, offered a proposal to support teachers in which the federal government would provide an annual $10,000 refundable tax credit to teachers working in high-needs schools. This approach would be targeted like Biden’s Title I approach above, but instead of using Title I eligibility, CAP identifies high-needs schools as those in which 75% or more of students are eligible to receive free or reduced-priced lunch. Using this threshold to identify high-needs schools, about 57% of U.S. teachers would be eligible for the program, leading the proposal to cost roughly $15 billion annually.

The CAP approach could be the least invasive way for the federal government to support teacher salaries without impacting the bargaining situation at the state and local level. An occupation-based tax credit like this would not be new for the federal government, though it significantly expands the current benefits available to teachers in the tax code. State pension calculations and local bargaining dynamics would likely not see any direct impact either. Another benefit of using the tax code: Tax expenditures are less likely to be renegotiated annually in budget discussions and may therefore be a more stable benefit for teachers over time.

Too far? Not enough?

Using the federal government to intervene in teacher salaries—regardless of the form that intervention takes—would be met with resistance from a number of sides. Some may resist the federal government’s role in public education writ large, while others will say the narrow focus on teacher salaries alone does not go far enough to bolster support for other types of general education funding that are sorely needed. And, of course, others will be supportive of higher salaries but urge additional elements of compensation reform.

In general, though, most agree that paying teachers more is a step in the right direction, and Democrats seem eager to champion the idea. This is an issue worth watching, as how this plays out on the campaign trail could impact the federal government’s role in K-12 schools in ways not seen before.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).