With the 2020 president election just over a year away, Brookings scholars are producing a wealth of research on topics related to the issues. To mark the launch of Policy 2020—a new resource for voters that provides fact-based, data-driven, non-partisan information on policy matters—below are some interesting charts about policy issues and voting.

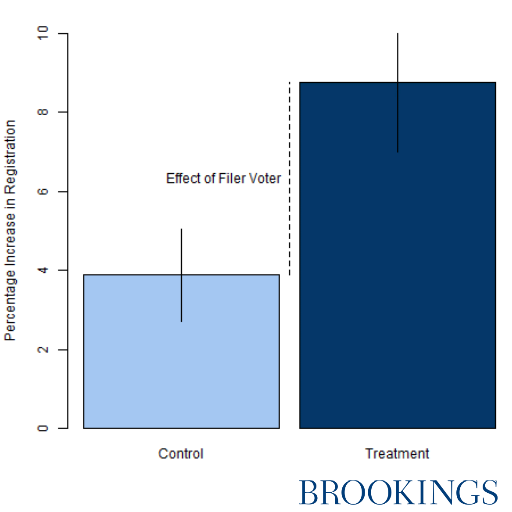

VOTER REGISTRATION AT TAX TIME COULD INCREASE VOTER TURNOUT

Vanessa Williamson, a senior fellow in Governance Studies, has studied how to increase voter registration by letting citizens register when they file federal taxes. Her research has shown that Americans see paying taxes as a civic responsibility and that “tax time may be an especially effective time to encourage lower-income citizens to register.” As one of the Big Ideas for Policy 2020, her report goes into detail about implementation and its relevance for the upcoming election. (You can read more about Americans’ relationship with taxes in her book, Read My Lips: Why American are Proud to Pay Taxes.)

VOTERS FAVOR GOVERNMENT REFORM

Looking back at 2016, Paul C. Light, a nonresident senior fellow in Governance Studies, argues that a defining issue in that election was government reform and rebuilding. “Public demand for government reform used to rise and fall with the party in power—that is, Democrats favored very major reform when Republicans controlled government, while Republicans favored very major reform when Democrats held sway,” he says. However, recent polls have shown that only 9 percent of Americans believe that government “doesn’t need much change at all,” with 63 percent saying it needs “very major reform.”

A MAJORITY OF AMERICANS SUPPORT A TAX ON MILLIONAIRES

As economic inequality continues to rise, Senior Fellow Isabel Sawhill and Christopher Pulliam from the Center on Children and Families examine Americans’ views on inequality and responses to various proposals to address it. Recent research shows that 67 percent of Americans favor a tax on millionaires, but policymakers do not seem responsive. Instead, they write, “recent work suggests that elected officials are more responsive to economic elites and business interest groups compared to mass-based interest groups and the average citizen.”

Commentary

Charts of the Week: Issues in elections

October 18, 2019