In Phoenix on Tuesday, President Obama announced new plans for the federal government’s role in housing finance, with particular emphasis on changing the role of Fannie Mae and Freddie Mac and also shifting mortgage risk more to the private sector. For a number of years—both before and after the start of the recession and housing market decline in 2008—Brookings experts have proposed ideas and recommendations for many of the key challenges in federal housing policy, some of which are presented below.

Shifting Mortgage Risk to the Private Sector

Nonresident Senior Fellow Robert Pozen called Obama’s proposal a “mixed message” in terms of which entity bears the risk for faulty mortgages. While shifting risk primarily to the private sector would “be a significant improvement over the current situation,” writes Pozen, it could be undermined by exemptions to the risk retention requirements of the Dodd-Frank Act.

… the exemptions from the risk retention requirement will undermine the president’s efforts to shift the risk of mortgage defaults from the federal government to the private sector. Most home mortgages in the U.S. will not require the lenders to retain the risk of mortgage default, and most will not require the borrowers to make a down payment of more than 10%.

The crux, argues Pozen, is the amount of the borrower’s down payment. Of particular interest is the fact that while many in the U.S. have felt that a 20% down payment would depress the mortgage market:

most private lenders in Canada insist on a 20% down payment for home mortgages. And the Canadian housing market is booming—without a tax deduction for interest on home mortgages. Indeed, the rate of home ownership in Canada is higher than that rate in the US.

Read Pozen’s explanation at the interplay of lending risk and down payments.

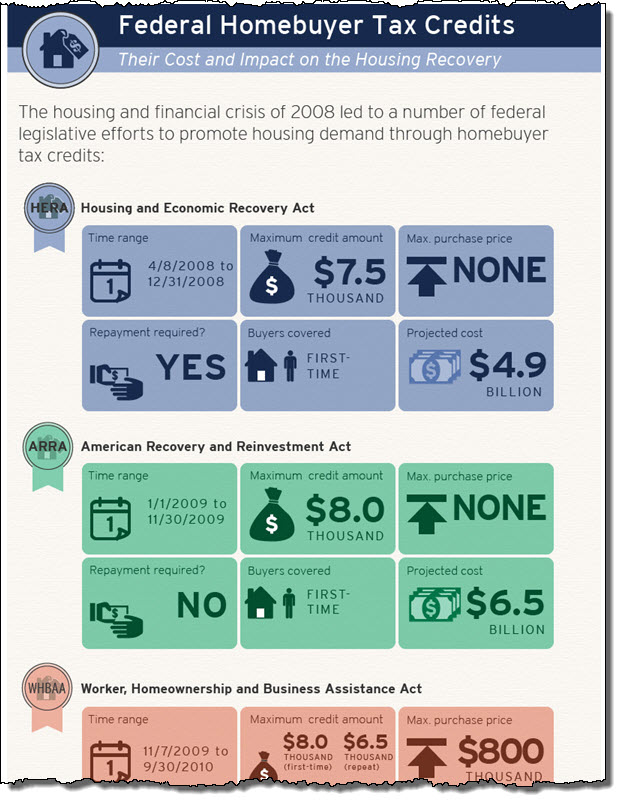

Federal Homebuyer Tax Incentives

In June, Karen Dynan, Ted Gayer and Natasha Plotkin collaborated on an evaluation of federal homebuyer tax incentives passed in the wake of the 2008 recession and housing market downslide. They found that:

In June, Karen Dynan, Ted Gayer and Natasha Plotkin collaborated on an evaluation of federal homebuyer tax incentives passed in the wake of the 2008 recession and housing market downslide. They found that:

The various tax and incentive programs designed to help arrest the collapse of the housing market during the Great Recession provided, as expected, a modest short-term boost to housing demand, but some of these effects were reversed after the expiration of the credits.

Reforming Fannie Mae and Freddie Mac

The president proposed to “wind down” the two lending giants, a move that has been discussed since the start of the 2008 crisis and especially since the two government-sponsored enterprises (GSEs) were taken over by the federal government. Fellow Doug Elliott has written that the effort in the Senate to reform the GSEs and housing finance is a “very important task” and that

We have to find a sensible way to reduce the government’s role in the housing market while ensuring that the market works even in uncertain times and that subsidies are properly directed to those groups that warrant the help.

Read why, at the time he wrote that (in June), Elliott was skeptical of any “serious action anytime soon.” Elliott, by the way, has detailed the scope of the federal government’s multi-TRILLION dollar role in guarantees and loans going to the private sector, especially housing in his book Uncle Sam in Pinstripes: Evaluating U.S. Federal Credit Programs (Brookings, 2011). If you want a primer on federal lending and how the U.S. government interacts with citizens in this crucial way, and to find out his recommendations to increase taxpayers’ value for this activity, check out this book.

Read why, at the time he wrote that (in June), Elliott was skeptical of any “serious action anytime soon.” Elliott, by the way, has detailed the scope of the federal government’s multi-TRILLION dollar role in guarantees and loans going to the private sector, especially housing in his book Uncle Sam in Pinstripes: Evaluating U.S. Federal Credit Programs (Brookings, 2011). If you want a primer on federal lending and how the U.S. government interacts with citizens in this crucial way, and to find out his recommendations to increase taxpayers’ value for this activity, check out this book.

Federal Government’s Role in Housing Finance

President Obama and some policymakers are, essentially, seeking to redefine the government’s role in the housing market, while at the same time maintaining the goals of expanding home ownership, facilitating affordable housing, and even encouraging renting where and when appropriate.

In a 2011 Brookings volume edited by Martin Neil Baily, expert authors reviewed the government role in housing finance and had proposed a series of ideas to achieve much of what President Obama proposed in Phoenix. Their ideas included ways to shift risk; to reform Fannie and Freddie; to regulate mortgage securitization; and to limit moral hazard in the sector.

In a 2011 Brookings volume edited by Martin Neil Baily, expert authors reviewed the government role in housing finance and had proposed a series of ideas to achieve much of what President Obama proposed in Phoenix. Their ideas included ways to shift risk; to reform Fannie and Freddie; to regulate mortgage securitization; and to limit moral hazard in the sector.

The Future of Housing Finance: Restructuring the U.S. Residential Mortgage Market (Brookings 2011), has an excellent review chapter, authored by Doug Elliott, on the history of the federal government’s role in housing finance, including background on Fannie Mae and Freddie Mac. Visit the book’s page and look for the “Sample Chapter” link, or download it here (PDF). “In sum,” Elliott wrote:

there is a broad consensus among the authors that the federal government’s role in supporting housing finance was too broad and deep even before the housing crisis caused the government’s market share to skyrocket. They are all searching for a way to retain whatever government role is necessary to maintain the stability and smooth working of the housing finance market, while pulling back in those areas where the private sector can take over.

The volume was the product of an earlier conference where then-Secretary of the Treasury Tim Geithner and also former Federal Reserve Chairman Alan Greenspan delivered keynote addresses.

Visit our topic page for

comprehensive Brookings research on housing and mortgage finance

.

Commentary

Reforming the Federal Government’s Role in Housing Finance

August 8, 2013