The importance of growing Africa’s agriculture exports

The African Growth and Opportunity Act (AGOA), signed into law in 2000, is the key underpinning to U.S.-Africa trade and investment. AGOA has been extended and reauthorized on four occasions (2004, 2006, 2007, and 2012) with strong bipartisan support and is set to expire in September 30, 2015. Congress is considering reauthorizing AGOA for another 15 years, from 2015-2030. This piece examines the opportunities for growing agriculture exports for Africa.

The African Growth and Opportunity Act (AGOA), signed into law in 2000, is the key underpinning to U.S.-Africa trade and investment. AGOA has been extended and reauthorized on four occasions (2004, 2006, 2007, and 2012) with strong bipartisan support and is set to expire in September 30, 2015. Congress is considering reauthorizing AGOA for another 15 years, from 2015-2030. This piece examines the opportunities for growing agriculture exports for Africa.

There is much room for growth, particularly in the agriculture sector, where exports remain low at less than 3 percent of total exports under AGOA. So, AGOA should be reformed to support growth in agricultural exports. In fact, while under AGOA, by 2014 agriculture exports to the U.S. increased by over 400 percent to $261 million, but still remain small in absolute terms.

Expanding opportunities for sub-Saharan African agriculture exports to the U.S. will produce a range of benefits:

- It will help drive growth and employment in the agriculture sector in sub-Saharan Africa, which is responsible for 30 percent of GDP and 70 percent of employment. This growth will also create employment opportunities for woman, as they comprise about 50 percent of the agriculture labor force in the region.

- The labor intensity of agriculture in sub-Saharan Africa means that policies to promote growth in the agriculture sector will be most effective at reducing poverty.

- Growth in the agriculture sector will help address growing youth unemployment in sub-Saharan Africa.[1] This is particularly important given sub-Saharan Africa’s so-called youth bulge, in which increasing numbers of young people are entering the job market this decade.

- It will diversify U.S. trade with sub-Saharan Africa, which is currently dominated by oil and gas exports.

The following policy brief outlines the opportunities for growing agriculture exports under AGOA and provides a series of recommendations for achieving this goal.

The African Growth and Opportunity Act so far

AGOA provides exports from sub-Saharan Africa preferential access to the U.S. market. The U.S. also provided preferential access for sub-Saharan Africa exports under its Generalized System of Preferences (GSP), a program that applies to exports from most developing countries. The GSP expired in 2013, but under AGOA GSP preferences remain available for AGOA-eligible countries. AGOA, combined with the GSP, provides duty-free access to the U.S. for 6,400 product lines from 38 countries in sub-Saharan Africa. Of total U.S. imports from AGOA countries, around 70 percent enter under AGOA.

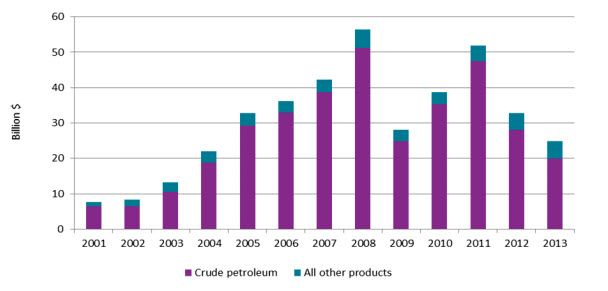

From 2001 to 2013, exports under AGOA increased from $7.6 billion to $24.8 billion but declined over 50 percent in 2014 to $11.6 billion mainly due to reduced petroleum exports to the U.S. Anecdotal and survey-based evidence has found that African businesses view AGOA as very important for their trade with the U.S. Since AGOA was signed in 2001, sub-Saharan Africa’s economic growth has averaged over 5 percent.

By enabling increased trade, AGOA supports local businesses and their integration into the global economy. AGOA has also stimulated foreign investment in sub-Saharan Africa, often by companies taking advantage of the new market access opportunities in the U.S. For instance, U.S. retailers such as Gap, Target, and Old Navy source goods in Africa for export to the U.S.

AGOA is also an important tool for achieving broader U.S. goals such as promoting market reforms and building democracy. These goals are achieved through its role in strengthening growth opportunities in sub-Saharan Africa broadly. In fact, in order for a country to be eligible to receive AGOA’s trade preferences, compliance with the following conditions is necessary:

- The country must be making progress towards a market-based economy, enhanced rule of law, elimination of trade barriers and systems to combat corruption, and the protection of worker’s rights.

- The country must not be engaging in activities that undermine U.S. national security.

- The country must not be engaging in gross violations of human rights.

AGOA-eligible countries in sub-Saharan Africa are making significant economic reforms that are improving their capacity to grow and providing new opportunities to deepen their economic relationship with the U.S. The 2015 World Bank Ease of Doing Business Report found that sub-Saharan Africa accounted for the largest number globally of regulatory reforms that reduced the cost of doing business. Democratic governance is also on the rise in sub-Saharan Africa. According to a Freedom House report, the largest gains in freedom over the last five years have been in sub-Saharan Africa.

Notwithstanding the growth in U.S.-African trade since AGOA, there remains significant scope to increase its depth and range. For instance, Africa exports 10 times as much to Europe as it does to the U.S. The European “equivalent” trade scheme—the Everything but Arms initiative—has a higher utilization rate than AGOA and is estimated to have generated almost twice as many exports than AGOA. The conclusion by the European Union of Economic Partnership Agreements with a number of countries in sub-Saharan Africa is also providing enhanced market access.

Failure to renew AGOA will reduce U.S.-Africa trade with particular losses in some sectors. For instance, in terms of agriculture trade, compared to a 2025 baseline, not renewing AGOA will cause exports of meat to decrease by over 60 percent, and milk and dairy by over 10 percent.

The composition of U.S.-Africa trade

As Figure 1 demonstrates, U.S. trade with Africa is dominated by crude petroleum exports, which account for approximately 90 percent of all U.S.-Africa trade. The impact of AGOA on crude oil exports to the U.S. has been limited as these products were entering the U.S. duty free under the GSP anyway.

Figure 1: U.S. imports under AGOA, 2001-2013

Source: USITC DataWeb/USDOC.

Source: USITC DataWeb/USDOC.

Since 2011, exports of crude oil to the U.S. have declined and the most recent 2014 data shows a continuation of this decrease due to increases in the U.S.’s production of oil. Given this trend, failure to grow sub-Saharan Africa’s non-oil exports to the U.S. could see a significant deterioration in the overall economic relationship.

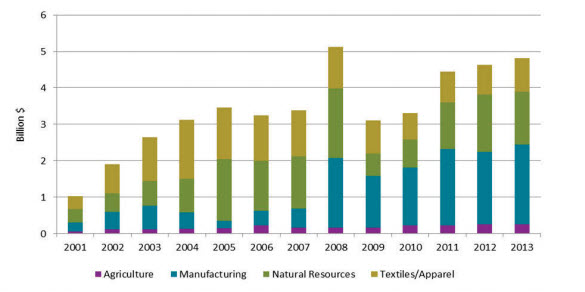

The following graph disaggregates exports to the U.S. other than crude oil. Growth here has been significant, from around $1 billion in 2001 to over $4.7 billion in 2013, peaking at over $5 billion in 2008 just prior to the financial crisis.

Figure 2: U.S. imports under AGOA, excluding crude petroleum, 2001-2013

Source: USITC DataWeb/USDOC.

Note: “Agriculture” includes all agricultural products; “manufacturing” includes electronics, machinery, transportation equipment, chemicals, miscellaneous manufacturing, and special provisions items; “natural resources” includes energy products (except crude petroleum), minerals and metals, and forest products; and “textiles/apparel” includes textiles, apparel, and footwear.

As Figure 2 shows, the most significant impacts of AGOA on non-petroleum exports have been in apparel, which grew over 250 percent from $355 million in 2001 to over $907 million in 2013. Exports of apparel are also, however, down from their peak of $1.13 billion in 2008 as cost-competitive apparel manufacturers in East Asia have gained market access in the U.S. This trend has been due to the phase out of the World Trade Organization (WTO) Multi-fiber Agreement in 2005, which capped exports of textile and apparel, as well as the phase out of other restrictions on textile exports from China under its WTO accession agreement.

On the manufactured goods side, the growth in manufacturing exports has also been very significant and is accounted for almost entirely by growth in motor vehicle exports.

Agriculture exports to the U.S. have grown significantly since AGOA, from $59 million in 2001 to $261 million in 2014. The main exports of agriculture products to the U.S. are cocoa paste and powder, citrus fruits, edible nuts, wine, unmanufactured tobacco, and vegetables. As noted above, despite this increase in agriculture goods, exports trade remains small in absolute terms.

Notwithstanding the growth in sub-Saharan Africa agriculture exports to the U.S., as a share of non-oil exports to the U.S. under AGOA, agriculture has declined from 6.2 percent in 2001 to 2.2 percent in 2014. Yet this is true for all non-oil exports (except for motor vehicles) from sub-Saharan Africa to the U.S., whose export shares have also declined despite increased exports, reflecting the growth during this period of crude oil exports to the U.S.

Addressing the remaining barriers to agriculture exports

The U.S. retains various trade barriers on a range of agriculture goods that, if reduced, would likely lead to increased exports. This includes products such as sugar, meat, dairy, vegetables, processed fruit and other processed goods such as dried garlic and apricots. In addition to focusing on the obstacles below, the U.S. could also look to where it can streamline its import procedures, reducing costs and delays to market.

Tariff rates

Most agriculture exports from sub-Saharan Africa already enter the U.S. tariff-free. There are, however, a number of products where the U.S. retains high tariffs, such as sugar and cotton, and that, if reduced, would stimulate further trade. According to one study, complete elimination of tariffs on agriculture exports from sub-Saharan Africa would increase exports over $105 million compared to what it would otherwise be in 2025, with large gains in areas such as sugar and fish exports. Moreover, the impact of removing all tariffs would only reduce U.S. production by $9.6 million.

Tariff rate quotas

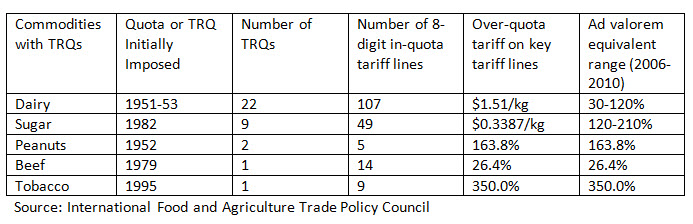

Tariff rate quotas (TRQs) are another area where significant trade barriers remain for agriculture exports from sub-Saharan Africa to the U.S. A TRQ is a lower-level tariff for a specific volume of imports over a given period and a higher tariff for import volumes over the quota. The U.S. maintains 46 TRQs on seven commodities: sugar, tobacco, dairy, beef, peanuts, cotton, and green olives.

Except for imports of sugar and cotton, imports under AGOA that are in-quota enter the U.S. at zero tariffs. The following table lists U.S. TRQs on the main agriculture commodities of export interest for sub-Saharan Africa.

Table 1. U.S. tariff rate quotas

As this table shows, over-quota tariffs on exports of agriculture products from sub-Saharan Africa are high, ranging from 26 percent for beef to 350 percent for tobacco imports. These rates make exports of over-quota agriculture products uncompetitive in the U.S. As a result, access to quotas is key to growing agriculture exports.

The share of in-quota TRQs allocated to AGOA-eligible countries is very low. This is because the allocation of quotas among the U.S.’s trading partners reflects historical trading patterns and quota access deals under U.S. free trade agreements. The lack of access to quotas locks out African agriculture producers from U.S. markets.

U.S. quotas on agriculture exports exist on a range of products that African producers already export to Europe and where their revealed comparative advantage suggests that they could successfully export to the U.S. if access to quotas was expanded. This would include goods such as dairy products, sugar, peanuts, and beef (assuming sanitary and phytosanitary (SPS) issues are overcome—see below).

There are a number of ways that the lack of access to quotas can be addressed. Some reallocation of quotas can be done by the administration. However, the scope for action depends on U.S. commitments in its FTAs and at the WTO. In other cases, quotas on particular agriculture exports are not fulfilled each year, but there is no mechanism that would allocate these quotas to countries that are AGOA-eligible. A number of agriculture imports into the U.S. also have an “other” category for quotas allocated on a first-come, first-serve basis which could be reserved for AGOA-eligible countries.

SPS trade issues

In order to enable African exporters to maximize the opportunities under AGOA, a range of other non-tariff barriers to agriculture exports need to be addressed. Major obstacles here are the SPS issues that raise the cost of African exports enough to offset any additional competiveness gained through lower tariffs. Congress should not lower U.S. SPS standards. The key here is to work with African governments and producers to help them meet U.S. standards.

The U.S. Department of Agriculture through USAID already provides some technical assistance aimed at meeting SPS standards. This could be strengthened by specifically requiring the involvement of the Department of Agriculture in maximizing opportunities for agriculture trade under AGOA. This work should be incorporated into the trade hubs established by USAID to assist sub-Saharan Africa maximize the opportunities AGOA presents.

Recommendations:

Tariffs

- Reduce to zero all tariffs on agriculture exports from AGOA-eligible countries.

Quotas

- Eliminate quotas on agriculture exports from AGOA-eligible countries; or at least from those countries in sub-Saharan Africa that are least-developed countries (LDCs). This move would be consistent with U.S. obligations under the U.N. Millennium Development Goals and would fulfill a key demand from these countries in the WTO Doha Round negotiations.

- Allocate additional quotas for agriculture exports to AGOA-eligible countries. This could be done in addition with a move to duty-free quota-free access for sub-Saharan African LDCs or as a stand-alone extension of market access to all AGOA-eligible countries. Such additional quotas could be re-allocated from unused quotas of other countries or from the “other” category.

- Create additional quotas for agriculture exports from AGOA-eligible countries.

Trade and capacity building

- Task the Department of Agriculture with a specific role in helping AGOA-eligible countries meet U.S. SPS standards.

Download the PDF version »

Editor’s note:

The blog initially listed as shea butter, yogurt, ghee, cashew nuts, sugar cane products, sugar-containing cocoa products, oilseeds, shrimp and prawns, bananas, and other fruit and vegetables such as mangos as products facing trade barriers to U.S. markets. The brief has been subsequently updated to reference “sugar, meat, dairy, vegetables, processed fruit and other processed goods such as dried garlic and apricots” as examples of these exports.

[1] Deon Filmer and Louise Fox et al. “Agriculture as a Sector of Opportunity for Young Africans”, in Youth Employment in Sub-Saharan Africa (Vol. 2): Full Report (World Bank Group 2014)

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Reforming the African Growth and Opportunity Act to grow agriculture trade

February 23, 2015