Below is a viewpoint from the Foresight Africa 2023 report, which explores top priorities for the region in the coming year. Read the full chapter on economic recovery and growth.

An analysis of sub-Saharan Africa’s (SSA) challenging economic situation confirms the following: There is no silver bullet for recovery; it is a long road ahead. But the good news is we have walked this path before and know the way. In these times of economic challenge, promptness and clarity of decisions will shorten the road to recovery and build confidence, which is essential. Economic problems do not age well, and the damage is compounded when allowed to fester.

An analysis of sub-Saharan Africa’s (SSA) challenging economic situation confirms the following: There is no silver bullet for recovery; it is a long road ahead. But the good news is we have walked this path before and know the way. In these times of economic challenge, promptness and clarity of decisions will shorten the road to recovery and build confidence, which is essential. Economic problems do not age well, and the damage is compounded when allowed to fester.

Increased inflation in SSA, doubling in certain countries, is significantly fueled by rising food prices caused by insecurity, climate change, and supply chain disruptions from the Russia-Ukraine war. Policymakers, while executing contractionary anti-inflation campaigns, must provide incentives for increased domestic food production, agroprocessing, and value chain interventions, as well as storage facilities. Producing and processing what we eat has direct economic impact and secures the lives of an estimated 140 million food-insecure Africans. Furthermore, harnessing the power and ingenuity of the youth for agriculture will address increasing unemployment in the region.

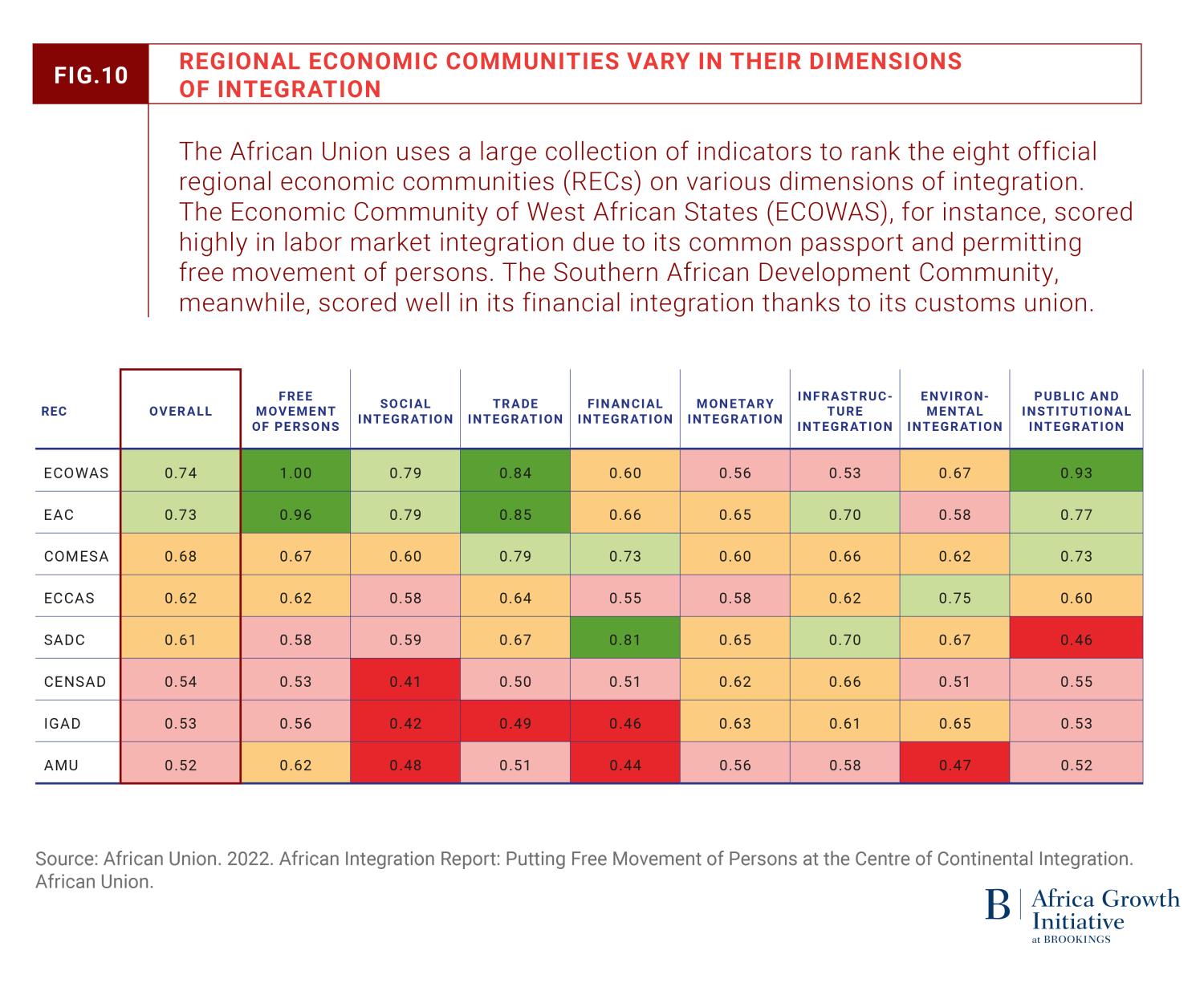

The promise of the African Continental Free Trade Area (AfCFTA)—including accelerating structural transformation and increasing shared prosperity—is real but requires intentionality. Increasing the capacity for real-time cross border digital payments and settlements in SSA currencies is critical for the realization of this promise. As a financial services company, present in 35 SSA countries, Ecobank has invested in enabling settlement of transactions in real time across our operating countries, fulfilling our economic and financial integration mandate. Continuing to unlock policy bottlenecks, including convertibility limits, will boost intra-African trade.

Technology continues to be an effective enabler of multi-sectoral growth in SSA, promoting homegrown solutions, attracting investments, and enabling businesses to scale. While recognizing its additionality for the private sector, we should not ignore the transformational opportunity it provides for government, in revenue and data collection, efficient resource allocation, and accountability. Policymakers should encourage and increase investments in technology and promote innovation.

SSA’s debt burden has been on an upward trajectory. The situation was compounded during the pandemic as countries borrowed to keep their economies afloat. Currency depreciations have increased the debt service burden. Prompt fiscal consolidation necessitating discipline, revenue mobilization, prioritized spending, and greater efficiency in public spending is a must. Indeed, broad application of subsidies is no longer sustainable. When necessary, in the interest of the most vulnerable, subsidies must be targeted, timebound, transparent, and closely monitored. In these challenging times, even the friendliest donor partner is struggling, therefore SSA countries would have to bring more self-help initiatives to the table.

Our greatest asset in SSA remains our people, without whom recovery would be illusory. A phenomenon common to all SSA countries is the hemorrhaging of talent, constituting the middle class. This voluntary emigration is largely triggered by the fierce competition for talent globally. SSA countries must be intentional about incentivizing talent to remain competitive. It has taken SSA considerable time and effort to rebuild its middle class, which it is now at risk of losing. The long-term effects are sure to be devastating.

SSA countries have a great opportunity to build forward better and sustainably, incorporating greener strategies into recovery plans, being inclusive across gender, age, and ethnicity, and involving the private sector. The financial services industry is a critical enabler of economic recovery. Policymakers must engage industry players to design more accommodative policies enabling the industry to effectively meet the needs of the people.

At Ecobank, we are conscious that the challenging economic times provide an opportunity to once again manifest our raison d’etre and the reason we are trusted by the continent and its friends—our DNA is Pan-African and being true to our mandate makes us encourage Africans to dream, while we accompany them to succeed and create value across the continent. As mentioned earlier, producing what we eat is critical for our recovery. Ecobank therefore allocates capital to agricultural production and agro-processing for domestic consumption and export. Recently, we formed a partnership with Mastercard’s Farm Pass platform to digitize agricultural value chains in Africa and empower millions of smallholder farmers through digital and financial inclusion.

Ecobank has experienced firsthand the transformational effect of technology— to scale, go beyond borders, accelerate change, as well as collect and mine data, among others. The Group therefore runs an annual innovation challenge to promote homegrown African solutions leveraging technology and providing incubation opportunities and financial support as part of the Ecobank Fintech Fellowship. We also seek opportunities and finance digital transformation projects for governments embarking on digital transformation and automation projects, particularly targeting processes that unlock the provision of public services. Our focus on technology continues to yield results including the engagement with younger Africa. Our Fintech Partnership is playing a defining role in developing Africa’s fintechs and providing an attractive alternative for Africa’s youth. The Ecobank’s Pan-African banking sandbox offers an amazing opportunity for fintechs to access Ecobank’s APIs to build and test their products. We also provide an online marketplace as well as a unique gateway to our 33 operating countries in Africa.

We are intentional about attracting and retaining talent, either through our Management Trainee Program, the Ecobank Academy, the Innovation Race, which encourages inhouse innovations through an effective rewards and incubation system, compensation and benefits policies, and the flexible technology-enabled work arrangements.

On a greener and more sustainable path to recovery, Ecobank is distilling from its experience from raising from the markets $350 million by issuing tier 2 sustainability bonds last year. Even though the market has evolved, the experience remains valuable as we plan the funding for a greener and more sustainable recovery.

Finally, we continue to engage all critical stakeholders in structuring appropriate responses to address certain of the debt sustainability challenges on the continent. Ecobank as well as its peers will need to make their advisory and structural capacity available as we work our way to recovery. For banks, as we consider various options, it is paramount that the banking system and customer funds are preserved.

Commentary

The banking sector as a partner in Africa’s recovery: A perspective from Ecobank Group

August 16, 2023