African countries have taken significant steps to counter the health, social, financial, and economic impacts of the pandemic since recording their first cases of COVID-19 in February 2020. As of this writing, the continent, which is home to 17 percent of the world’s population, accounts for only 3.3 percent of recorded COVID-19 cases and 4 percent of deaths.

At the same time, the region has not fared as well, relatively, when it comes to the economic impacts. Indeed, recovering from the reductions in trade, stalled economic activity, capital flight, and depletion in reserves will require a lot more than most African countries can afford. The United Nations Conference on Trade and Development (UNCTAD) estimates that the continent will require $200 billion to address the financial and socioeconomic impacts of the global pandemic. Moreover, the costs are expected to span decades, according to a recent study by the United Nations Development Programme (UNDP) study on the long-term effects of the pandemic on African economies.

In normal times, African countries would raise the funds to kick-start their economic recovery by availing themselves of concessional finance, commercial borrowing, or increasing domestic resource mobilization. In this global pandemic, though, these options are either unavailable or inadequate. Africa continues to face difficulty in accessing requisite amounts of concessional finance for three reasons. First, traditional donors are themselves reeling from the pandemic and are, thus, unlikely to commit or disburse additional resources: Bilateral aid slumped by 19 percent in 2020. Second, COVID-19 has pushed millions of middle-class families worldwide back into extreme poverty, creating a new category that has been dubbed the “new poor.” This trend will intensify competition for scarce and limited development assistance. Third, 54 percent of African countries are classified as middle-income and, as such, will not have access to concessional financing. Moreover, loans are ill-advised since the pandemic has worsened Africa’s preexisting external debt vulnerability. Economic contraction, reversed development, increasing levels of unemployment, and growing poverty make it harder to mobilize additional domestic resources without compromising lives and livelihoods.

COVID-19 has reversed decades of consistent development gains in Africa. Without additional and urgent financial assistance, African countries run the risk of not getting back on track to attain the Sustainable Development Goals (SDGs). A RAND study estimates that failure to contain the pandemic in developing regions like Africa could cost the global economy $153 billion annually, with the United States ($16 billion), the European Union ($40 billion), and China ($14 billion) bearing the brunt. Thus, addressing the pandemic in Africa is a global imperative. The globalized nature of the ongoing pandemic and the urgent need to revive economies and prevent undue suffering demands a collective global response.

G-7 finance ministers met on March 19 and agreed to support a “sizeable” increase in the International Monetary Fund’s special drawing rights (SDRs) to help provide additional resources to fight the pandemic. SDRs represent a basket of five currencies—the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling—used by IMF member countries to supplement their official reserves and augment global liquidity. While the merits and demerits of using SDRs to address COVID-related liquidity concerns have been the subject of spirited scholarly and policy debate, it is very clear that SDRs are the most efficient and effective way to provide the additional resources African countries so desperately need. An increased allocation of SDRs could have a profound financial and psychological effect across the African continent. In addition to strengthening reserves positions, it will also build confidence among producers and investors, while revitalizing economic growth. This increase, expected to amount to $500 billion, will expand allocations for all countries according to their IMF quotas.

Collectively, though, African countries will receive $32.2 billion, 6.4 percent of the proposed allocation—a clearly inadequate amount. Consequently, many are calling for the more affluent countries to make their share of the allocations available to lower-income countries. If only the G-7 countries participate, we estimate that Africa’s share would increase to over $160 billion (as shown in Table 1).

Table 1. Illustrated redistribution of G-7 SDR allocations to low-income countries

Sources: IMF SDR Quota allocations; author’s calculations

If the increased allocations are distributed to African countries according to SDR quota size, Africa’s middle-income countries will receive 81 percent of the new allocations (Table 1). Such a result will be a welcome boon for countries that are climbing the rungs of the development ladder but are finding it increasingly difficult to access concessional financing. The picture is slightly different when we consider new allocations as a proportion of GDP: 7 of the top 10 recipients are low-income countries, confirming the extent to which these allocations would be impactful, even in Africa’s smaller economies. Furthermore, as illustrated below, debt-stressed African countries and those making most progress with human development indicators will be among the top beneficiaries.

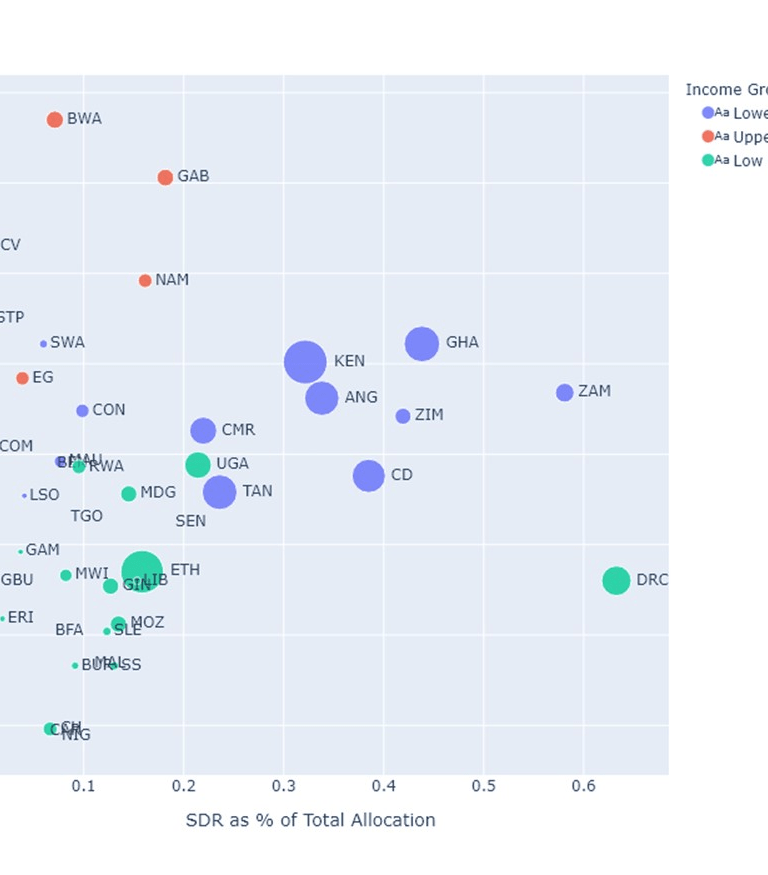

Figure 1. African beneficiaries of allocated and redistributed SDRs

Sources: World Development Indicators, World Bank; IMF SDR Allocations; author’s calculations

Figure 2. Human Development Index and SDR allocations

Sources: Human Development Index, UNDP; IMF SDR Allocations; author’s calculations

Using SDRs to increase reserves for African countries is not just a financial or macroeconomic issue, it is fundamentally about giving African countries a helping hand for rapid, equitable, and sustainable economic development. We must look beyond liquidity to see how to address pervasive and persistent development financing issues that have plagued the continent for decades. Undoubtedly, expanded reserves will provide African countries some much-needed fiscal breathing space. It will also enable African governments to devote more attention to essential social investments in health, education, and resilient livelihoods. Countries will also be able to focus on employment creation and value chain reengineering that would afford millions of Africans the opportunity to earn their way out of poverty through self-owned businesses and the adoption of transformative technology.

African countries have demonstrated their capacity to redirect windfall gains for social investments in the past. As part of the heavily indebted poor countries (HIPC) debt relief initiative in the late 1990s and early 2000s, many African governments significantly increased pro-poor and social spending. The proposed SDR expansion could have a similar salutary effect on Africa with countries fostering economic transformation via strategic investments. However, for success, we must pay particular attention to the thorny, but essential, matter of governance—both regional and global. Globally, steps must be taken to ensure that these windfall gains are not spent servicing external debt. The Debt Service Suspension Initiative (DSSI) and other pandemic-related debt relief initiatives should be expanded and extended. Also, mechanisms must be put in place to prevent opportunistic schemes that abuse financial markets and international courts to deprive African countries of the full benefit of the proposed initiative. It is worth noting that, after receiving debt relief in the early 2000s, a number of “vulture funds” purchased outstanding African debt for a fraction of their value and then successfully sued African governments for the full value. This must not be allowed to happen again.

The SDR proposal recognizes the magnitude and urgency of the development challenges African countries are facing. Going beyond the G-7 to include other development partners like China, Saudi Arabia, and South Korea will provide African countries with substantially more resources to tackle the pernicious effects of COVID-19 and to build forward better. Laying the foundation for a more resilient and less dependent Africa is good for the global economy and bodes well for stability and sustainability. Invariably, this would help African countries take the necessary steps to get back on track to attain the SDGs.

Commentary

How special drawing rights could help Africa recover from COVID-19

March 24, 2021