Ian Hathaway is a non-resident senior fellow at the Metro program and research director at the Center for American Entrepreneurship, which provided the financial support for this study. He thanks Inc. Magazine for providing the data.

Summary

- Introduction

- The literature on high-growth firms

- The Inc. 5000 high-growth firms

- The geography of the Inc. 5000 high-growth firms

- Regional factors associated with Inc. 5000 high-growth firm density

- Conclusion

Introduction

Each year, Inc. Magazine publishes its list of the fastest-growing businesses in America — the Inc. 5000. To qualify, companies must be independent, privately-owned, domiciled in the United States, and meet certain revenue thresholds. Of qualifying companies, those with the fastest three-year revenue growth rates are selected.

Inc. 5000 firms exhibit very high growth compared with their peers, which makes them vital to the economy. For example, the companies analyzed here increased revenue by 43 percent each year at the median and employment by 35 percent at the median. By comparison, the median business for the whole economy expands revenue by about three percent each year and doesn’t increase employment at all.1

In view of that, this post analyzes the Inc. 5000 data for the years 2011 to 2017, with a focus on those companies meeting the standard definition of high-growth established by the Organization for Economic Co-operation and Development (OECD).2 The industry representation of these companies, their geographic distribution across the U.S., and factors explaining regional variation of Inc. 5000 high-growth firm “density” are explored.

Overall, this analysis underscores the importance of high-growth firms to the economy, highlights the regions where those firms are most prevalent, and provides insight into some factors associated with the variation of high-growth businesses across regions.

The literature on high-growth firms

Dating back to the mid-1990s, economists have identified that a small number of high-growth businesses account for most job creation in the United States. According to this early work, just four percent of firms—the “gazelles”—accounted for 60 percent of job creation during the late-1980s and early-1990s.3 A more recent study by the Bureau of Labor Statistics produced findings of a similar magnitude, showing that 2.4 percent of firms accounted for 40 percent of new jobs from the mid-1990s to the late-2000s.4

Most recently, economists at the Census Bureau assessed firm growth by employment and revenue during the last few decades, using administrative data from official sources (business registry and tax data).5 This work demonstrated that firms achieving one-year growth rates in revenue above 25 percent account for 12 percent of firms but 50 percent of economy-wide revenue in a given year. Businesses achieving one-year employment growth above 25 percent account for 17 percent of firms yet 59 percent of job creation.

These findings, along with a sizable body of research literature spanning the U.S. and European economies, point to several stylized facts about high-growth companies:6

- They achieve high rates of growth in revenue or employment or both;

- They make substantial contributions to aggregate productivity growth;

- They tend to be small;

- They tend to be young;

- They tend to be concentrated in knowledge-intensive industries.

With this set of facts in mind, a novel dataset of high-growth firms—the Inc. 5000—is analyzed next.

The Inc. 5000 high-growth firms

In collaboration with Inc. Magazine and the Center for American Entrepreneurship, data from the Inc. 5000 lists spanning 2011 to 2017 are analyzed here. Of companies that qualify, those selected have the fastest three-year growth rates in revenue between the year prior and three years prior to that.7 For example, companies in the 2017 list are evaluated based on growth performance between 2013 and 2016, and so on.

The 35,000 company “entries” (seven years x 5,000 companies per year) is restricted to those meeting the OECD definition of “high-growth”—annualized revenue growth of 20 percent or more each year during a three-year period, or 72.8 percent over the entire three years.8 This yields more than 25,000 company entries over the seven years of Inc. 5000 lists, of which there are more than 14,000 unique companies.

The table below provides some descriptive statistics on the size, age, and growth rates of these Inc. 5000 high-growth companies (I5HGCs).

As the table shows, the average company has $37 million in revenue, 199 employees, three-year growth rates of 578 percent in revenue and 319 percent in employment, and is aged 8 years. When looking at the middle of the distribution (median), the companies are younger, smaller, and growth is less pronounced.

Turning to areas of economic activity, the chart below plots the 25,776 I5HGC entries by industry. (Note: these industry descriptions are provided by Inc. Magazine and do not fit standard government industry classifications such as NAICS.)

I5HGCs are concentrated in a relatively small number of industries. Six of the 26 industries account for 52 percent of I5HGC entries, and 80 percent of entries are in the top 13 industries. The three information technology industries—IT Services, Software, and Computer Hardware—account for 21 percent of I5HGCs. The other predominantly high-tech industry—Health (which includes biotechnology and medical technology)—accounts for another eight percent.

Taken together, the traditional high-tech industries account for 29 percent of all I5HGCs. That reveals two important insights. First, companies in these industries are much more likely than companies overall to be I5HGCs (they account for about five percent of firms across the entire economy).9 Second, that means more than 70 percent of I5HGCs are in non-high-tech industries. That’s an important point for policy: though high-tech firms are much more likely to be high-growth, not all high-growth firms are high-tech. In fact, the substantial majority are not.

Taken together, the I5HGCs have five defining characteristics:

- High rates of growth in revenue, employment, or both;

- High ratios of revenue to employment, both in terms of level and growth (high productivity and productivity growth);

- Relatively small in size;

- Relatively young in age;

- Concentrated in knowledge-intensive activities.

These characteristics are consistent with the broader research literature on high-growth firms, which is encouraging because the Inc. 5000 has two limitations: it doesn’t draw from the entire universe of qualifying firms (only those that apply), and the underlying data is not drawn from official government sources. So, while the Inc. 5000 is an imperfect measure of the “true” universe of high-growth private firms in America, it appears to be a fairly robust source for the study of them.

The geography of the Inc. 5000 high-growth firms

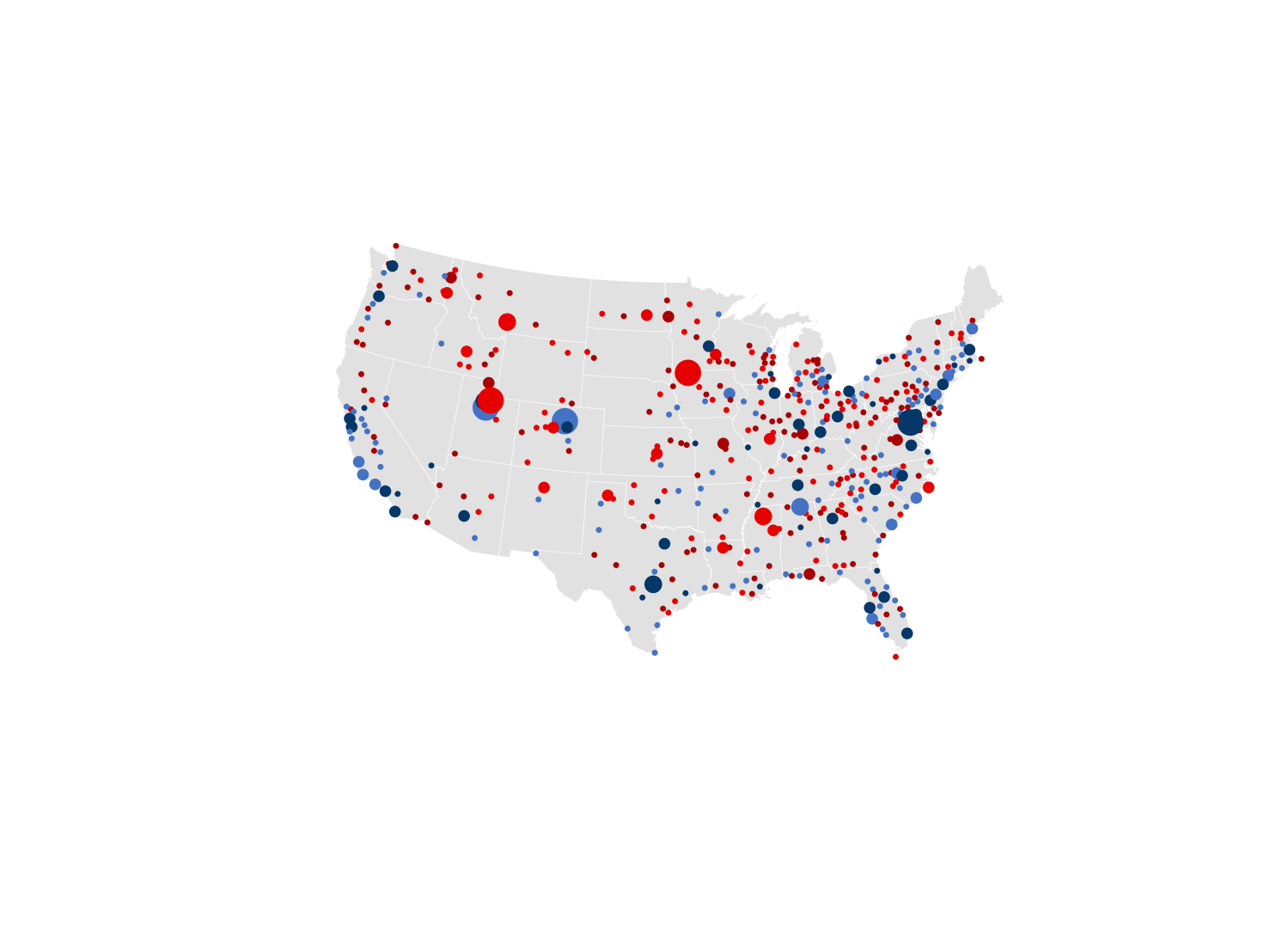

An analysis of the geographic location of I5HGCs reveals another concentration—this time by place. The figure below shows that nearly 98 percent of I5HGCs are located in metropolitan areas. Micropolitan and rural areas are headquarters to just two percent.

The pattern is clear: the substantial majority of I5HGCs are located in large metropolitan areas (those with one million or more residents). However, medium-sized metros (those between 250,000 and one million residents) make a meaningful contribution as well. In fact, on a population adjusted basis, medium-sized metros as a group have a higher “density” (I5HGCs per one million residents) than do large metros. This is evident by the concentration of medium-sized metros among the densest cities for I5HGCs.

Drilling down further, the figure below plots the top 25 metropolitan areas for I5HGC density. Of the top four metros, three are medium-sized—Boulder, Provo, and Huntsville. Only Washington (a large metro) is not.

The top 25 metros for I5HGC density have a good representation across metro sizes. Eight medium-sized metros made the list (Boulder, Provo, Huntsville, Charleston, Trenton, Cedar Rapids, Durham, and San Luis Obispo), as did three small metros (Columbia, Charlottesville, and Fargo). The 14 large metros include well-known hubs of high-tech and knowledge-intensive activities.

Though not shown here, 12 micropolitan areas have I5HGC density that would place them among the top 25 metros. This is largely on account of their small sizes, but a few have I5HGC entries in the double digits. Among the micropolitan areas with leading I5HGC density are Spirit Lake, Iowa.; Summit Park, Utah; Bozeman, Mont..; Oxford, Miss.; and Breckenridge, Colo. At 21 company entries, Bozeman had the most, followed by Summit Park’s 14 company entries.

Regional factors associated with Inc. 5000 high-growth firm density

To assess which factors are associated with regional I5HGC density, a linear regression analysis (OLS) was conducted. The explained or dependent variable is the number of I5HGC entries per one million residents (I5HGC density) during the period among the 303 US metropolitan areas for which a full set of control variables could be collected.

The impact of nearly two dozen explanatory or independent variables on I5HGC density were tested—each considered on the basis of a vast research literature.10 Most of these factors (20 of 23) held statistically significant correlations with I5HGC density, but failed to maintain those relationships when considered jointly with other factors.

For reasons of brevity, the results of the regression analysis will only be summarized here, highlighting the variables that have the deepest associations with I5HGC density across metropolitan areas during the period of analysis. For a more thorough discussion of the regression modeling and the results of that analysis, please see Appendix A to this report.

The simple regression model utilized explains about two-thirds of the variation of I5HGC across metros, which is a pretty good result for this type of analysis. Four variables are especially important:

- The share of workers with college degrees. A factor that has consistently been found to be important for driving regional entrepreneurship more broadly.11 Further, a deep pool of well-educated workers is particularly important here given the concentration of knowledge-intensive industries among the I5HGCs.

- The share of workers employed in high-tech industries. The concentration of an industry in a region is a predictor of entrepreneurship in that same industry and region—particularly for knowledge intensive and high-tech activities.12 So, it isn’t surprise to see this relationship here as many I5HGCs are in high-tech. Also, the most represented non-high-tech industries among I5HGCs are in areas that are critical inputs to high-tech production (or themselves have become high-tech in nature in recent years), which is relevant because high-tech suppliers exhibit strong geographic proximity to their high-tech customers.13

- The share of the population of prime entrepreneurship age (35 to 44 years). The relationship between the likelihood of starting a business and a person’s age exhibits an inverted-U shape—increasing as a person ages up to a point (as one gains more experience and wealth) but then declines thereafter (as one becomes more risk-averse and closer to retirement). Mid-career professionals are in that sweet spot, and empirical studies consistently establish that relationship.14

- The overall rate of business formation in the region. Researchers have well-established a wide and persistent variation of business formation rates across regions.15 Entrepreneurial regions tend to stay that way, and the evolution of a region becoming more or less entrepreneurial occurs slowly. This is partly due to culture (some areas are more entrepreneurial) and partly because of experience (entrepreneurs learn from themselves and from other entrepreneurs).

Overall, the results indicate that a well-educated workforce, a concentration of high-tech activity, a critical mass of mid-career professionals, and an experience-base and culture that is oriented towards entrepreneurship, may explain a sizable portion of the variation in I5HGC rates across metropolitan areas.

Conclusion

Given its availability, richness, and consistency with more comprehensive and official datasets on high-growth firms, the Inc. 5000 makes a valuable resource for improving our understanding of these vital sources of economic growth.

This analysis shows that I5HGCs have a similar size, age, and industrial composition as do high-growth firms in the broader literature. And, predictably from theory and empirics on modern economic growth theory, these knowledge-intensive firms are predominantly found in cities—in particular, large and medium-sized cities that have a high density of college-educated workers, high-tech activities, mid-career professionals, and a well-established culture and experience-base of entrepreneurship.

As the U.S. and many other aging nations look to sources of economic growth, this work indicates that they should place innovative, young, high-growth firms at the top of the list. As an extensive body of literature demonstrates, these companies, though relatively few in number, play a central role to economic growth overall.

Though these findings should be interpreted with some caution—the results are based on limited data, descriptive statistics, and simple multivariable correlation techniques—they suggest a few areas for policy consideration. These include the development of a well-educated workforce; the promotion of competitive high-tech and knowledge-intensive services industries; and the relevance of entrepreneurial support, mentoring, and knowledge-sharing initiatives.

Demographics should help, as an increase of prime entrepreneurship-aged individuals is on the horizon, but policymakers should also consider liberalized immigration policies—particularly for individuals who wish to come to the United States to start growth-oriented businesses, or those who choose to do so after being educated in American universities.

Finally, it is worth stressing that high-growth entrepreneurship is fundamentally a local phenomenon, which will occur primarily in cities for the foreseeable future. To that end, local officials in metropolitan areas should pursue a broad agenda of direct and indirect policies (housing, schools, amenities, transit, livability, etc.) that support these high-growth, knowledge-intensive companies and attract the people who found them.

-

Footnotes

- See for example, Haltiwanger, Jarmin, Kulick, and Miranda (2017), “High Growth Young Firms: Contribution to Job, Output, and Productivity Growth”, Measuring Entrepreneurial Businesses: Current Knowledge and Challenges; Decker, Haltiwanger, Jarmin, and Miranda (2014), “The Role of Entrepreneurship in US Job Creation and Economic Dynamism”, Journal of Economic Perspectives; and Acs, Parsons, and Tracy (2008), “High-Impact Firms: Gazelles Revisited”, Small Business Administration.

- OECD (2007), OECD-Eurostat Manual on Business Demography Statistics. The OECD definition also recommends including only companies with 10 or more employees in the base year as a second condition, which is not done here. This is due to the fact that base-year employment in the Inc. 5000 has a number of missing values, whereas revenue does not (a required input to the database).

- Birch and Medoff (1994), “Gazelles” in Solmon and Levenson (eds.), Labor Markets, Employment Policy and Job Creation; and Acs, Parsons, and Tracy (2008), “High-Impact Firms: Gazelles Revisited”, Small Business Administration, For a review of the literature, see Audretsch (2012), “Determinants of High-Growth Entrepreneurship”, OECD and Haltiwanger, Jarmin, Kulick, and Miranda (2017), “High Growth Young Firms: Contribution to Job, Output, and Productivity Growth”, Measuring Entrepreneurial Businesses: Current Knowledge and Challenges

- Clayton, Sadeghi, Talan, and Spletzer (2013), “High-employment-growth firms: defining and counting them”, Bureau of Labor Statistics.

- Haltiwanger, Jarmin, Kulick, and Miranda (2017), “High Growth Young Firms: Contribution to Job, Output, and Productivity Growth”, Measuring Entrepreneurial Businesses: Current Knowledge and Challenges.

- Audretsch (2012), “Determinants of High-Growth Entrepreneurship”, OECD.

- To qualify for the Inc. 5000, companies must be independent, privately-owned, domiciled in the United States, have revenue exceeding $2 million in the previous year, and revenue three-years prior to that in excess of $100,000.

- OECD (2007), OECD-Eurostat Manual on Business Demography Statistics. The OECD definition also recommends including only companies with 10 or more employees in the base year as a second condition, which is not done here. This is due to the fact that base-year employment in the Inc. 5000 has a number of missing values, whereas revenue does not (a required input to the database).

- Hathaway (2013), “Tech Starts: High-Technology Business Formation and Job Creation in the United States”, Kauffman Foundation.

- For a summary of this literature, see Parker (2009), The Economics of Entrepreneurship, Cambridge University Press. Also see Acs and Armington, (2006), Entrepreneurship, Geography, and American Economic Growth, Cambridge University Press. These excluded regional variables include: the foreign-born percent of the population; median household income; unemployment rate; Gini coefficient (a measure of income inequality); voter participation rate; venture capital per capita; natural amenities (weather, topographic variation, proximity to water); net migration rate; university share of employment; industry diversity of employment (HHI); non-employer firms per capita; personal income per capita growth (5-year); population change (5-year); business formation rate thirty-years prior; and log of population.

- For a summary of this literature, see Chatterji, Glaeser, and Kerr (2013), “Clusters of Entrepreneurship and Innovation”, National Bureau of Economic Research.

- See Porter (1998), On Competition, Harvard Business School Publishing; Gilbert, McDougall, and Audretsch (2008), “Clusters, Knowledge Spillovers and New Venture Performance: An Empirical Examination”, Journal of Business Venturing; Gilbert, McDougall, and Audretsch (2006), “New Venture Growth: A Review and Extension”, Journal of Management; Chatterji, Glaeser, and Kerr (2013), “Clusters of Entrepreneurship and Innovation”, National Bureau of Economic Research.

- For more on this, see Chatterji, Glaeser, and Kerr (2013), “Clusters of Entrepreneurship and Innovation”, National Bureau of Economic Research.

- For a summary of this literature, see Parker (2009), The Economics of Entrepreneurship, Cambridge University Press. See also Wadhwa, Aggarwal, Holly, and Salkever (2009), “The Anatomy of an Entrepreneur”, Kauffman Foundation.

- For more on this, see Acs and Armington, (2006), Entrepreneurship, Geography, and American Economic Growth, Cambridge University Press; and Chatterji, Glaeser, and Kerr (2013), “Clusters of Entrepreneurship and Innovation”, National Bureau of Economic Research.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).