A convergence of factors in information technology and capital markets have helped propel a boom in venture capital-backed startups in recent years. While well-established regions such as San Francisco-Silicon Valley, Boston-Cambridge, and New York account for the lion’s share of startup activity and funding, significant evidence suggests that a non-trivial amount of early stage capital is dispersing geographically throughout the United States.

As startups begin to proliferate beyond the traditional technology centers, regional and national leaders are increasingly looking to these companies as a source of economic growth. As they do, officials are confronted with the reality that innovation-driven entrepreneurship differs markedly from traditional small business activity, which means that cultivation strategies are radically different.

In this regard, regional development leaders need to recognize that ideas, talent, capital, and a culture of openness and collaboration are all vital to regional startup communities, which are best thought of as innovation ecosystems involving complex interaction among entrepreneurs, investors, suppliers, universities, large existing businesses, and a host of supporting actors and organizations.

Among the latter set of entities, startup “accelerators” are one of the newest, and most widely touted, and it is these somewhat misunderstood organizations that are the subject of this discussion. Accelerators have become increasingly popular elements of the regional growth infrastructure, and are viewed as playing a key role in the scaling-up of growth-oriented entrepreneurial ventures—including by federal, state, and local government. For those reasons, they are worthy of assessment.

What are startup accelerators?

Startup accelerators support early-stage, growth-driven companies through education, mentorship, and financing in a fixed-period, cohort-based setting. While they are often grouped with other early stage support and investing organizations, such as incubators, angel investors, seed-stage venture capitalists, and even co-working spaces, these are all distinct things.

Susan Cohen, a professor of entrepreneurship at the University of Richmond and a leading scholar on startup accelerators, provides a comprehensive definition of the concept:

Broadly speaking, [accelerators] help ventures define and build their initial products, identify promising customer segments, and secure resources, including capital and employees. More specifically, accelerator programs are programs of limited-duration—lasting about three months—that help cohorts of startups with the new venture process. They usually provide a small amount of seed capital, plus working space. They also offer a plethora of networking opportunities, with both peer ventures and mentors, who might be successful entrepreneurs, program graduates, venture capitalists, angel investors, or even corporate executives. Finally, most programs end with a grand event, a “demo day” where ventures pitch to a large audience of qualified investors (Cohen, 2013).

Notice that the broad goal of accelerators—to support the development of early-stage growth-oriented business ventures—applies to existing ecosystem actors that have been around for decades, namely incubators and angel investors. Both seek to help startups during a vulnerable stage in their company lifecycle, and many of their supporting features overlap with those of accelerators.

In later work, Cohen and Hochberg (2014) further refine the definition of a startup accelerator as “a fixed-term, cohort-based program, including mentorship and educational components, that culminates in a public pitch event or demo day.” In short, four elements make accelerators distinct from other supporting institutions: they are fixed-term, cohort-based, mentor-driven, and culminate in a graduation or demo day.

This definition of accelerators will be used throughout this analysis and proved critical during the data collection process. In fact, of the nearly 700 U.S.-based organizations reviewed for this analysis that were categorized as an “accelerator” or “accelerator/incubator,” either through self-identification or through the identification in various databases (Pitchbook, Seed-DB, Global Accelerator Network, and Accelerate), fewer than one third could be confirmed to fit this more restrictive definition.

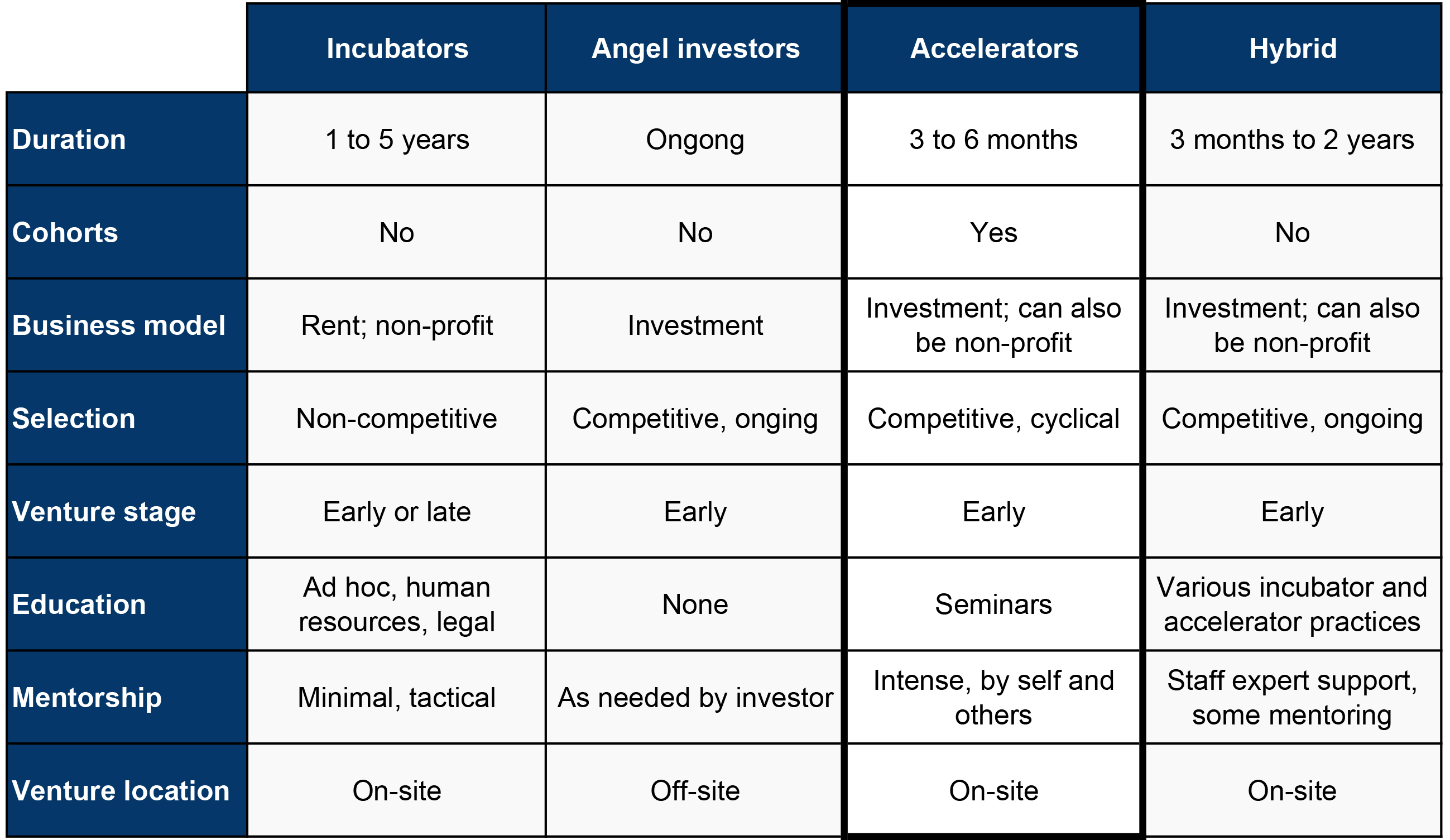

That’s a critical point, because as Figure 1 illustrates, the incentives and business models for these actors are not always the same. By far the most convoluted organizations are those this assessment labels “hybrids”—firms that often refer to themselves as “accelerators” or “accelerators and early-stage venture capitalists” or similar terms. These businesses more resemble what might be called “angel investors plus” (typical angel investor services plus something else, such as on-site office space and support services), than true accelerators. Like accelerators and other early stage investors and support organizations, these firms have been proliferating substantially in recent years, which adds to the confusion.

Key differences between incubators, angel investors, accelerators, and hybrid early stage investors

Source: Cohen (2013) and author’s adaptions

Source: Cohen (2013) and author’s adaptions

Why startup accelerators

Accelerators have clearly taken hold in recent years, as evidenced by their numerical growth, geographic dispersion, and more importantly, by the numbers and value of startups they have worked with. But it bears asking: What is it that accelerators do that makes them so different from other early stage investors and support organizations? And also what makes them so apparently valuable to the startups that are falling over each other to be in their ranks?

In a recent conversation (more on that below), Brad Feld, a co-founder of TechStars, a global accelerator program, likened the accelerator experience to immersive education, where a period of intense, focused attention provides company founders an opportunity to learn at a rapid pace. Learning by doing is something that all company founders eventually go through, but it’s a highly inefficient process that drags out over time. The point of accelerators, suggests Feld and others, is to accelerate that process—speeding-up the learning cycle in a time-constrained format. In this way, founders compress years’ worth of learning into a period of a few months. Finally, when an accelerator program is active, it concentrates a lot of activity in a particular community in one place—generating vibrancy around innovation, and giving various ecosystem actors exposure to one another in a dynamic environment.

Accelerated learning-by-doing and concentrated activity are clearly part of what accelerators offer, but it is worth looking at the academic evidence as well. To be sure, the relative newness and novelty of accelerators means that little systematic research exists on the impact of accelerators on participating companies and on the broader startup community. However, three papers in particular stand out as contributing to our understanding.

Hallen, Bingham, and Cohen (2014) compared graduates of some accelerator programs with a matched set of comparable companies that didn’t participate in an accelerator program. They found that the top programs do in fact accelerate the time for reaching key milestones, such as time to raising venture capital, exit by acquisition, and gaining customer traction. However, these positive effects dissipate when looking at a broader sample of accelerators. Many programs do not accelerate startup development, and in some cases may be harmful.

Winston-Smith and Hannigan (2015) compared graduates of top accelerators with a set of similar startups that instead raised angel funding from leading angel investment groups. They found that the accelerator graduates were more likely to receive their next round of financing significantly sooner and were more likely to be either acquired or to fail, than were comparable companies funded instead by top angel investor groups. This indicates that top accelerators may be more beneficial to startups than top angels—a key comparison.

Fehder and Hochberg (2015) find that accelerators have a positive impact on regional entrepreneurial ecosystems, particularly with regard to the financing environment. In particular, they find that metropolitan statistical areas (MSAs) where an accelerator is established subsequently have more seed and early-stage entrepreneurial financing activity. Furthermore, this activity appears not to be restricted to accelerated startups themselves, but spills over to non-accelerated companies as well—occurring primarily from an increase in investors.

To summarize, accelerators can have a positive effect on the performance of the startups they work with, even compared with other key early-stage investors, such as leading angel investment groups. However, this finding is not universal. So far, positive effects have been only attributed to leading accelerators. Outside of those, the impact of participation in an accelerator may be ambiguous—or perhaps even negative.

In terms of the impact on the local startup community, early evidence shows that accelerators may have a big effect on attracting seed and early-stage financing, as well as additional investors to a community, including outside of the accelerated companies. This could bring additional spillover benefits to the wider regional economy. Previous research has found that attracting venture capital to a region has a positive impact on broader employment growth and entrepreneurship more broadly.

It may be for this reason that policymakers have taken notice. Beyond the myriad of efforts at the state and local level to boost growth-driven entrepreneurship and entrepreneurial ecosystems, at the federal level the Obama administration has done its share by pursuing initiatives like Startup America and the JOBS Act.

Additionally, the Small Business Administration has adopted an aggressive strategy to bolster the proliferation of accelerator programs and other startup ecosystem models throughout the country with its Growth Accelerator Fund Program. With its inception in 2014, the SBA awarded $2.5 million in cash prizes to a group of 50 such organizations. The program expanded in 2015, offering $4 million in cash prizes to 80 organizations throughout the country.

Startup Accelerators in the United States

Given the apparent benefits of top accelerators, it is worth pulling together some basic facts on their rise in the United States.

Y Combinator launched the first accelerator program in 2005, followed closely by TechStars, founded in 2006. Both programs have evolved over the years—Y Combinator consolidated its bi-coastal programs to a single Silicon Valley location in 2009 (and in fact as of recently, has transformed into a later-stage investor), and TechStars has grown to 21 programs worldwide since first launching in Boulder, Colorado. Yet still, they remain arguably the two premier accelerator programs—or at least among the very best.

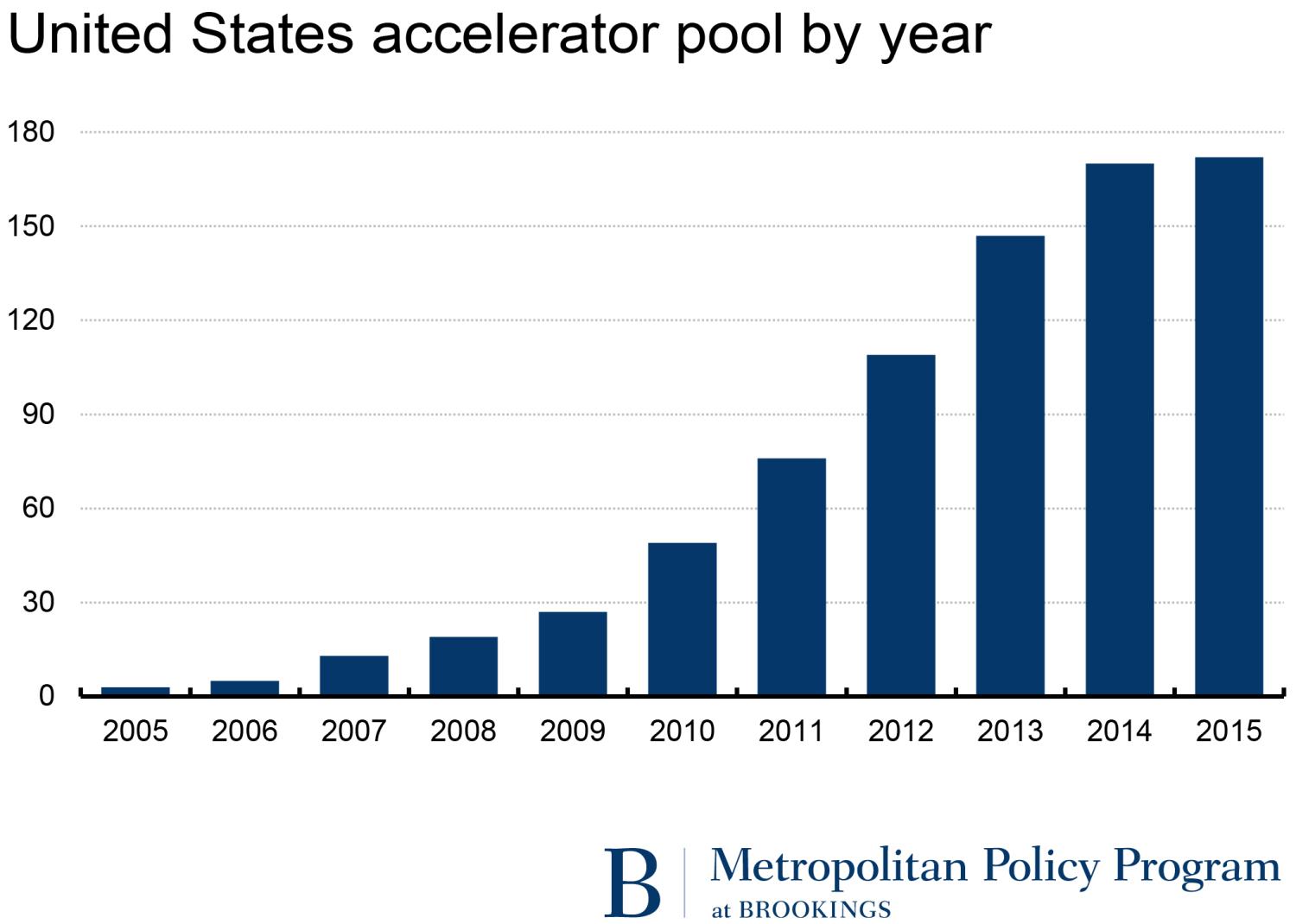

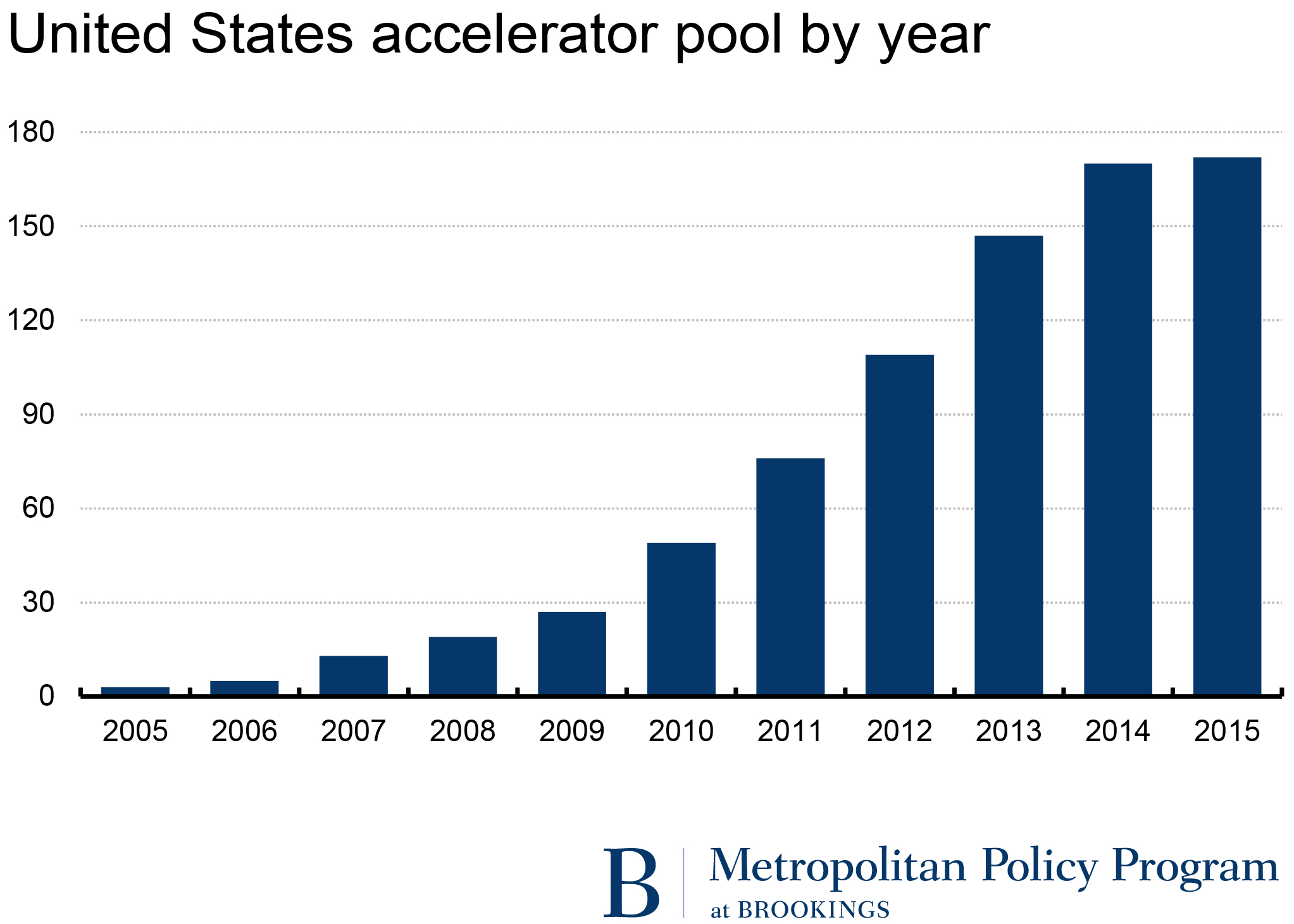

Growth in U.S.-based accelerators—as it did for startups, early-stage capital, and venture investment more broadly—really took off after 2008. They grew from 16 programs that year to 27 in 2009 and to 49 in 2010, before eventually reaching 170 programs in 2014 and holding mostly steady. All told, the number of American accelerators increased an average of 50 percent each year between 2008 and 2014.

Source: Pitchbook data, primary research, author’s calculations

Source: Pitchbook data, primary research, author’s calculations

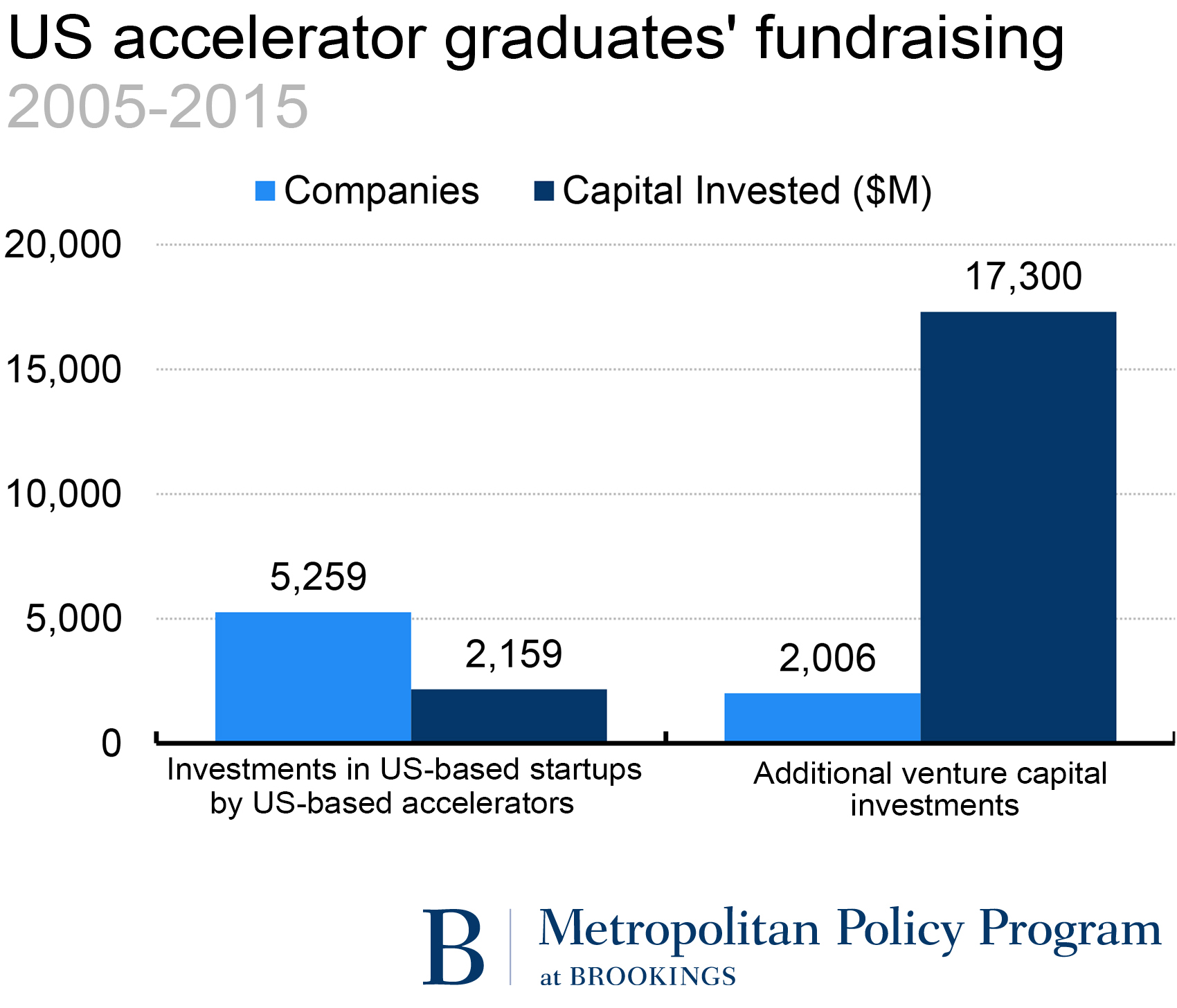

To look at the funding trends involved with accelerators, the list of accelerators was merged with the Pitchbook venture capital database. During the 2005 to 2015 period, these 172 US-based accelerators invested in more than 5,000 U.S.-based startups with a median investment of $100,000. These companies raised a total of $19.5 billion in funding during this period—or $3.7 million per company on average—reflecting both the relatively small investments made in these early-stage companies by accelerators, and the fact that many go on to raise substantial amounts of capital later on. Both figures—the number of companies and the amount of capital raised—will increase in the years that follow, as accelerator programs continue to turn out companies, and recent graduates work their way through maturity.

Source: Pitchbook data, primary research, author’s calculations

Source: Pitchbook data, primary research, author’s calculations

More importantly, accelerator-backed companies are gaining traction. During the periods of completing- or recently-completing accelerator programs, the median and average valuation of these companies was $5.5 million and $7.1 million, respectively. However, those that went on to raise additional venture capital had a median valuation of $15.6 million and an average of $90 million. In 2015 alone these numbers were $30 million and $196 million, respectively. Indeed, some very well-known companies belong to this group, including those dubbed “unicorns” (private companies valued at $1 billion or more), such as AirBnB, Dropbox, and Stripe, among others.

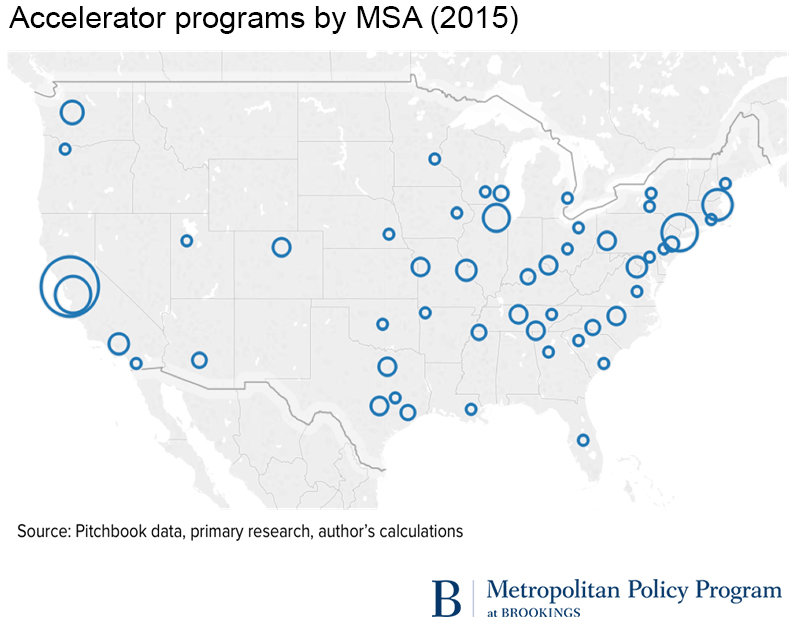

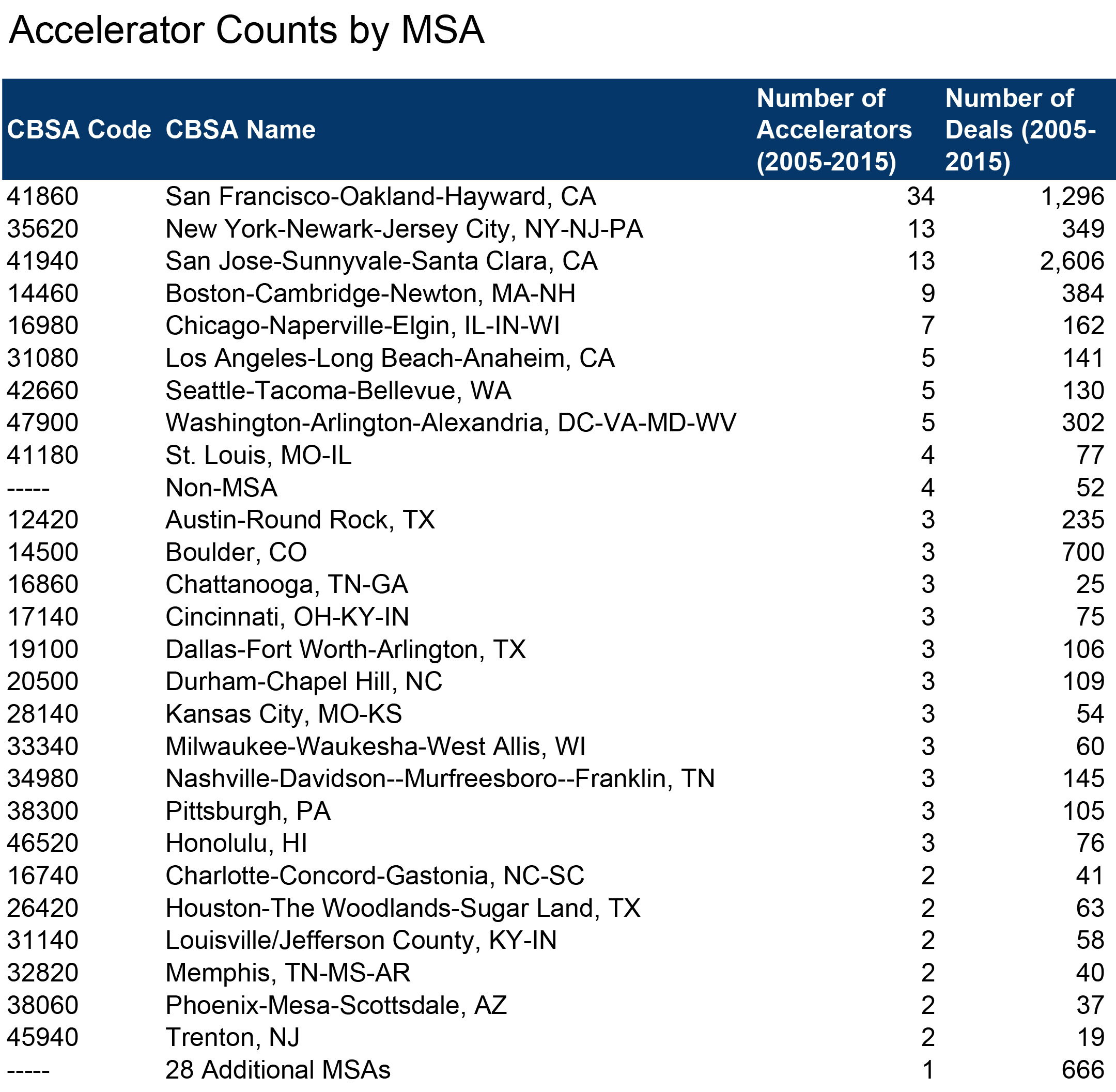

In terms of their geography, accelerator programs are unsurprisingly concentrated in the well-known technology startup hubs and major cities of San Francisco-Silicon Valley, Boston-Cambridge, and New York. These three regions account for about 40 percent of all accelerators in the United States, and almost two-thirds of accelerator-funded deals between 2005 and 2015.

However, a good amount of activity is occurring outside of these prime tech hubs. In fact, fully 54 metropolitan statistical areas and four non-metropolitan regions spread across 35 states and the District of Columbia have accelerator programs today. A number of surprises show up in terms of cities with more than two accelerators, including Chattanooga, Nashville, Cincinnati, Milwaukee, and Honolulu.

Colorado might be the most interesting area. The birthplace of accelerator pioneer TechStars, Colorado has accelerators in far-flung places like Durango and Telluride, and Boulder is home to CanopyBoulder—an accelerator program focused on the budding cannabis industry in that state.

Source: Pitchbook data, primary research, author’s calculations

Source: Pitchbook data, primary research, author’s calculations

Best practices for startup accelerators

Given the potential—but not the guarantee—of significant benefits from accelerators on local startup ecosystems and wider economic growth, it bears considering what works: What traits and conditions make accelerators effective?

Recently, Brad Feld sat down to discuss the accelerator concept, and importantly, accelerator best practices.

Feld provides a number of useful perspectives, given his experience with accelerators, and so it’s worth noting a few of Feld’s “dos” and “don’ts” for accelerator design and operation:

Along these lines, Feld suggests strong accelerator organizations:

- Understand what an effective mentor is and knowing how to effectively engage with them throughout the program’s duration

- Have a good rhythm for the program that is absorbable by founders—don’t go too fast or too slow

- Create awareness of the stress and conflict points among and between the various participants (companies, founders, mentors) that will inevitably occur throughout the program, and strategically channeling those into learning opportunities embedded in the program itself

- Build a culture and network around the accelerator that feeds on itself and perpetuates a lifetime process of learning

At the same time, problems arise when accelerators:

- Fail to have a clear view of the mentor dynamic—not helping mentors understand how they can be effective in working with companies

- Fail to set expectations at the outset around what the accelerator can do, and what is sensible given a company’s individual situation

- Fail to focus on the people, rather than idea (at TechStars the mantra is people, people, people, idea—the idea is the price of admission, the key thing is the people), because it is the people that matter most and will be lasting, while the idea will morph a lot

- Fail to understand how to scale their program (how fast do you want to grow? What is your strategy? To expand geographically? To expand the number of programs?)

- Fail to have a point of view about what they are trying to accomplish. Simply emulating what other accelerator programs are doing, for example, fails to understand that there is more than one approach

Useful for accelerator creators and managers, these watchwords should also be considered by state and local policymakers, university officials, and economic development leaders who are increasingly investing in or otherwise engaging in the establishment of new accelerators in U.S. cities.

Conclusion

In sum, the accelerator phenomenon is beginning to come into focus.

Amid substantial buzz, the systematic information available about the impact of startup accelerators is as yet thin and fragmentary. Much research needs to be done to better understand the effectiveness of these programs and the broader impact they have on startup communities—particularly as national and regional authorities look to them as tools for economic growth.

With that said, however, early evidence points to the potential for substantial benefits. Done well, these programs can be effective at helping some of our most high-potential companies reach goals more quickly and assuredly. Perhaps more importantly, they have been shown to attract more investors and focus energy on the nascent startup communities that have been spreading throughout the United States, which will no doubt be critical for boosting high-impact entrepreneurship and hard-to-come-by growth in the future.

References and Recommended Reading

Cohen, Susan (2013), “What Do Accelerators Do? Insights from Incubators and Angels,” Innovations, 8:3/4, pp. 19-25.

Cohen, Susan and Yael V. Hochberg (2014), “Accelerating Startups: The Seed Accelerator Phenomenon,” working paper.

Deering, Luke, Matt Cartagena, and Chris Dowdeswell (2014), Accelerate: Founder Insights Into Accelerator Programs, FG Press.

Fehder, Daniel C. and Yael V. Hochberg (2014), “Accelerators and the Regional Supply of Venture Capital Investment,” working paper.

Feld, Brad (2012), Startup Communities: Building an Entrepreneurial Ecosystem in Your City, Wiley.

Hallen, Benjamin L., Christopher Bingham, and Susan Cohen (2014), “Do Accelerators Accelerate? A Study of Venture Accelerators as a Path to Success,” Academy of Management Annual Meeting Proceedings.

Yael V. Hochberg (2015), “Accelerating Entrepreneurs and Ecosystems: The Seed Accelerator Model,” in Innovation Policy and the Economy, Volume 16, Josh Lerner and Scott Stern editors, National Bureau of Economic Research.

Stross, Randall (2013), The Launch Pad: Inside Y Combinator, Portfolio.

Winston-Smith, Sheryl and Thomas J. Hannigan (2015), “Swinging for the fences: How do top accelerators impact the trajectories of new ventures?”working paper.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).