After eight years of painful bailout programs, this week Greece is leaving behind, at least technically, the era of bailout programs dictated by creditors. However, despite optimistic views expressed both by the Greek government—Prime Minister Alex Tsipras included—and some Eurozone officials, many believe that the country has, to paraphrase the Eagles’ “Hotel California” song, checked out but it can never leave.

From CNBC to Reuters to Politico EU to CNN Money, recent international news coverage on Greece cites the usual culprits and causes for pessimism, emphasizing weaknesses in the economy that were not tackled as part of three consecutive bail-out programs. These include: inefficient public administration, the black market economy, corruption and tax evasion, slow and inefficient justice, and numerous administrative obstacles to exports and investments. Other shortcomings of the three bailout programs include a heavy propensity toward implementing austerity measures. These are all, at least to an extent, valid flaws.

Yet rarely does the international press cite my top pick—overtaxation—a phenomenon with disastrous repercussions for Greece’s future. Let me explain why by presenting a few graphs.

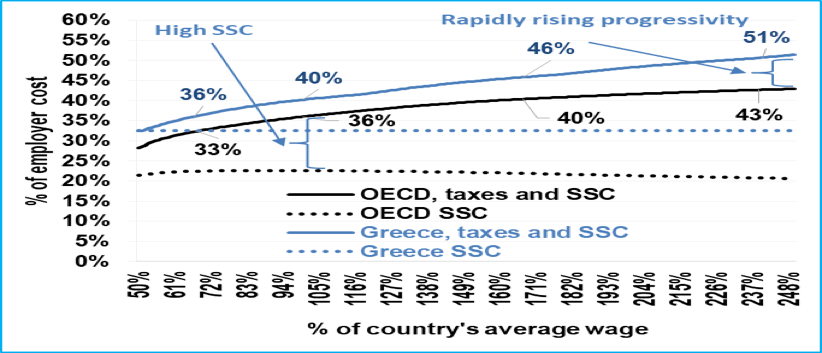

Figure 1

Figure 1 depicts higher taxes plus higher social security contributions (SSCs). Both are higher than the OECD average and become highly progressive as wages become higher. But even low-income employees pay the high and non-rewarding SSCs. In sum, such a social welfare tax makes it extremely costly for a company or an employer to hire and so they avoid doing so. When an employer does hire, the “disposable wage” should be low to compensate for sky-high taxation and SSCs. As a consequence, domestic demand will be weak, which in turn dampens growth and employment prospects.

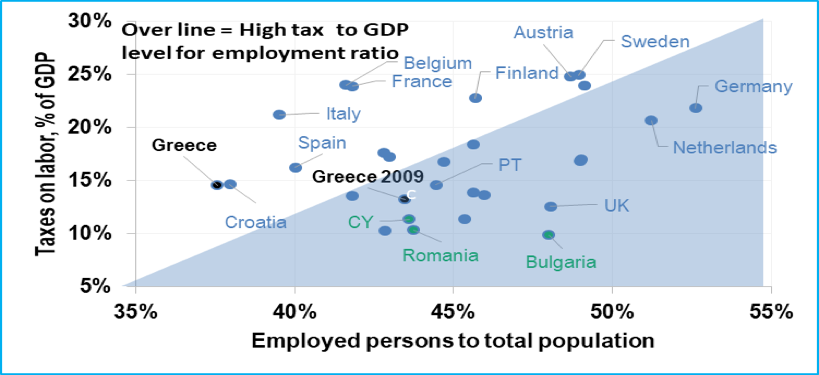

Figure 2

Despite high progressivity, tax revenues are low. This is not because of tax evasion, but mainly because of the high and progressive tax wedge: There are few employees, and even fewer at higher incomes, that used to pay the majority of the personal income tax. Now that the tax base has moved in large part to lower levels, tax revenues are beginning to replenish. Figure 2 shows this unfortunate combined result when the share of formerly employed workers is of low as a percentage of the total population together with a shortfall in tax revenues. See also how the situation has deteriorated since 2009! It follows that the government, to achieve the promised 3.5 percent primary surplus of GDP, will choose to double down on taxes. Indeed, the Syriza government seems to do that with some enthusiasm, as overtaxation and a primary over-surplus above 3.5 percent aligns with the leftist ideology of extended income redistribution.

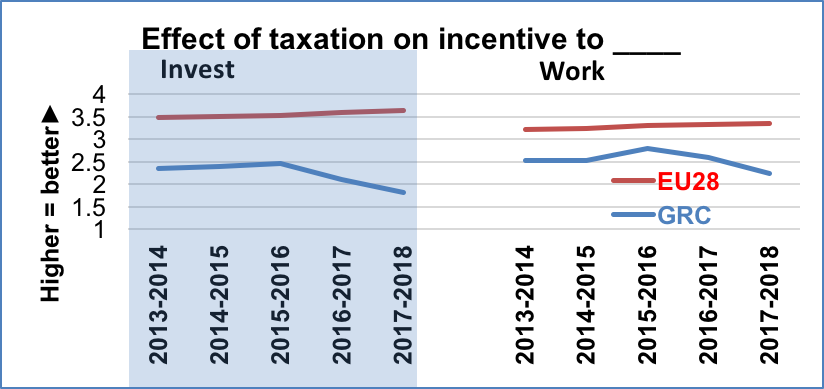

Figure 3 shows the dramatic impact of taxation on incentives to work and invest.

So, Greece now has universally high taxes and SSCs per employed person—a fact that has eroded the tax base in many markets. If one adds the well known institutional weaknesses regularly cited by the international press, creditors, and experts, then it is easy to explain the huge amount of sand in the wheels of growth.

Thus, the much vaunted debt burden is not the biggest obstacle to recovery—the worst culprit is overtaxation and sky-high, non-rewarding SSCs. Together, they cancel any possible increase in disposable income, erode the taxable productive base of the economy, reduce hiring, and push wages down.

Excessive taxes and SSCs also destroy the incentives for work and new investments, thus leading almost half a million mostly young people to migrate, which worsens Greece’s demographic problem. And, last but not least, they give a tremendous boost to the black market economy as economic agents try to evade sky-high taxation. It is worth saying that for a daily earning of 100 euros, a professional has to pay 45 euros income tax, 28 euros toward SSCs, 10 euros in solidarity tax, and a “tax-payment in advance” for the next year that evaporates the remaining 17 euros (no kidding). And we expect this country to recover by attracting foreign investments?

Paradoxically, when the EU expressed solidarity in support of a multi-billion bailout, most Greeks were against joining the euro. Now, in the absence of bailout money, the majority of the Greeks are in favor of euro. It is like “Hotel California”. The Eurozone is “…such a lovely place.” But maybe this is only because there is no other place to go.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Greece is in ‘Hotel California’: Checked out but it can never leave

August 22, 2018