“Poverty has always been the lot of the great majority of mankind. It has been only within the very recent past that geographic exploration and scientific development have encouraged the human family seriously to entertain the idea that life could be so organized and conducted as to achieve general well-being.” (1) So began the first of four volumes in an expansive Brookings Institution project known formally as “The Distribution of Wealth and Income in Relation to Economic Progress,” and informally as the capacity studies, published in the mid-1930s and intended to illuminate the causes of the Great Depression and propose remedies for preventing another one.

BROOKINGS REseARCH ON THE GREAT DEPRESSION

In 1934, five years after the crash of the U.S. stock market and the onset of the Great Depression, the American economy was turning around as gross national product and employment began to rise again. During this period, scholars at the Brookings Institution had been engaged in analyses of President Franklin Roosevelt’s New Deal programs that, to varying degrees, were critical of the federal response to the crisis. Brookings President Harold G. Moulton, who had been supportive of the Roosevelt administration’s initial efforts to respond to the depression through austerity measures, became opposed to the deficit spending on public works and employment programs that became the hallmarks of the New Deal. The authors of a 1935 Brookings study of the National Recovery Administration, for example, concluded that the agency impeded economic recovery after the Depression, while a study of the administrative problems in the Agricultural Adjustment Administration (AAA), completed in 1936 but released the following year, was met by Agriculture Secretary Henry Wallace with the comment, “We’ve been doing so much wishful thinking around here, we’d benefit from an independent audit.” (2)

The critical analyses of specific administration policies to address the economic shocks were one thing, but a larger question of the day was, what caused the Great Depression in the first place, and how could another one be prevented? It was in this context that the Institution took up the four-part capacity studies, which have been characterized as “the most important theoretical work that the institution undertook during the Depression.” (3)

“MALADJUSTMENTS” IN THE ECONOMIC SYSTEM

In the early twentieth century, there was a belief, and evidence, that poverty was related to underused capacity in the economy—both in terms of physical manufacturing plants and human labor. As Edwin Nourse—lead author of the first volume in the study, “America’s Capacity to Produce”—wrote,

The period in which we and our fathers and grandfathers have lived, running back to the so-called Industrial Revolution, has on the whole been one of great economic progress, especially for the countries of Western Europe and the United Sates. At the same time it has been characterized by a great deal of idleness of productive plant and by widespread unemployment. Evidently we have not succeeded in utilizing our opportunities fully, and thus poverty has persisted where apparently it might be been reduced, if not removed. This has caused the question to be raised again and again whether existing conditions as to the distribution of national income were responsible for maladjustments in the economic system which retarded economic progress. (4)

Nourse, an agricultural economist who wrote the 1937 AAA report, would later become the first chairman of the president’s council of economic advisers in 1946.

What was the cause of this “idleness,” this “maladjustment in the economic system” that harmed the economy? To answer this question, Nourse and his colleagues reviewed a long-standing debate concerning the role and proper amount of saving, for both individuals and society as a whole. The authors described the existence of a “division of thought” on saving, between “those who extolled saving and yet more saving as the prime force to be relied upon in advancing our economic well-being” and those “who conceived that saving was in fact being overdone and that diverting more of the social income into the channels of consumers’ purchasing power was the surest way to promote a better functioning of the economic system.” (5) In other words, was too much saving restricting consumption and thus hampering economic activity?

In the nineteenth century, “the possibility of over-saving appeared ridiculous” because “the new capital that was created resulted in increased productive efficiency, which in turn yielded more and cheaper goods for consumers generally.” (6) However, by the early twentieth-century, economists began to view “excessive saving” as responsible for periodic gluts in the markets and resulting depression. In 1918, future Brookings chief Harold Moulton, then an economics professor at the University of Chicago, argued that “the very process of saving, in a pecuniarily organized society, tends to check the demand for the expansion of capital goods” because increased saving meant less demand for consumer goods, which meant that it’s unprofitable to expand capital goods. (7) And thus existed an underutilization of both labor and business capital in the years leading up to the stock market crash of 1929 and ensuring Great Depression.

What was to be done? “Obviously,” Nourse and colleagues wrote, “it is a matter of great importance in modern industrial society that we learn where between these conflicting views the truth lies. … Only on the basis of real understanding of the motivating forces in economic progress can the nation’s accomplishments in the years ahead be commensurate with the opportunities within our reach.” (8)

And thus was born the capacity studies—over 1,200 pages of analytical research and deep analysis, by seven authors contained in four volumes: “America’s Capacity to Produce” (1934); “America’s Capacity to Consume” (1934); “The Formation of Capital” (1935); and “Income and Economic Progress” (1935). The latter two volumes were authored by Moulton alone. Described as “the most ambitious effort to gain an empirical understanding of, and to chart a way out of, the depression,” (9) the studies drilled deeply into the inner workings of the American economy.

Capacity to produce

In the study of production capacity, Nourse and colleagues examined in great detail the productive capacities of a variety of industries, including coal and coke; petroleum; minerals; textiles and clothing; automobiles and tires; food—including meat packing and flour-milling; paper making; iron and steel; electric power utilities; railroads; merchandising; banking; and the labor force. In a section on “Boots and Shoes,” for example, the authors concluded that “When allowance is made for the special problems which impede the full use of shoe manufacturing equipment [reviewed in penetrating detail], as well as the tendency toward overstatement of capacity, there be little doubt but that the shoe industry had come much closer [in the 1920s] to attaining the full production of which it was capable under existing conditions as respects organization and methods of work …” (10) On the other hand, the authors revealed that the automobile industry demonstrated a “more serious and more sustained margin of non-utilization which has appeared since 1923.” (11)

Nourse and co-authors concluded that the U.S. “productive system as a whole was operating at about 80 per cent of capacity in 1929 and slightly less than that if we take the average of the five years 1925-29.” (12) They noted that while America couldn’t have achieved 100 percent capacity, it could have gone up to 95 percent, or a 19 percent increase. “Our economic society lacked almost 20 per cent of living up to its means,” they wrote. (13) Increasing production capacity by 19 percent “would have constituted a very substantial achievement. … This would have permitted of enlarging the budgets of 15 million families to the extent of $1,000 each. … We could have produced $608 worth of additional well-being for every family up to the $5,000 level. Or we could have brought the 16.4 million families whose incomes were less than $2,000 all up to that level.” (14)

Capacity to consume

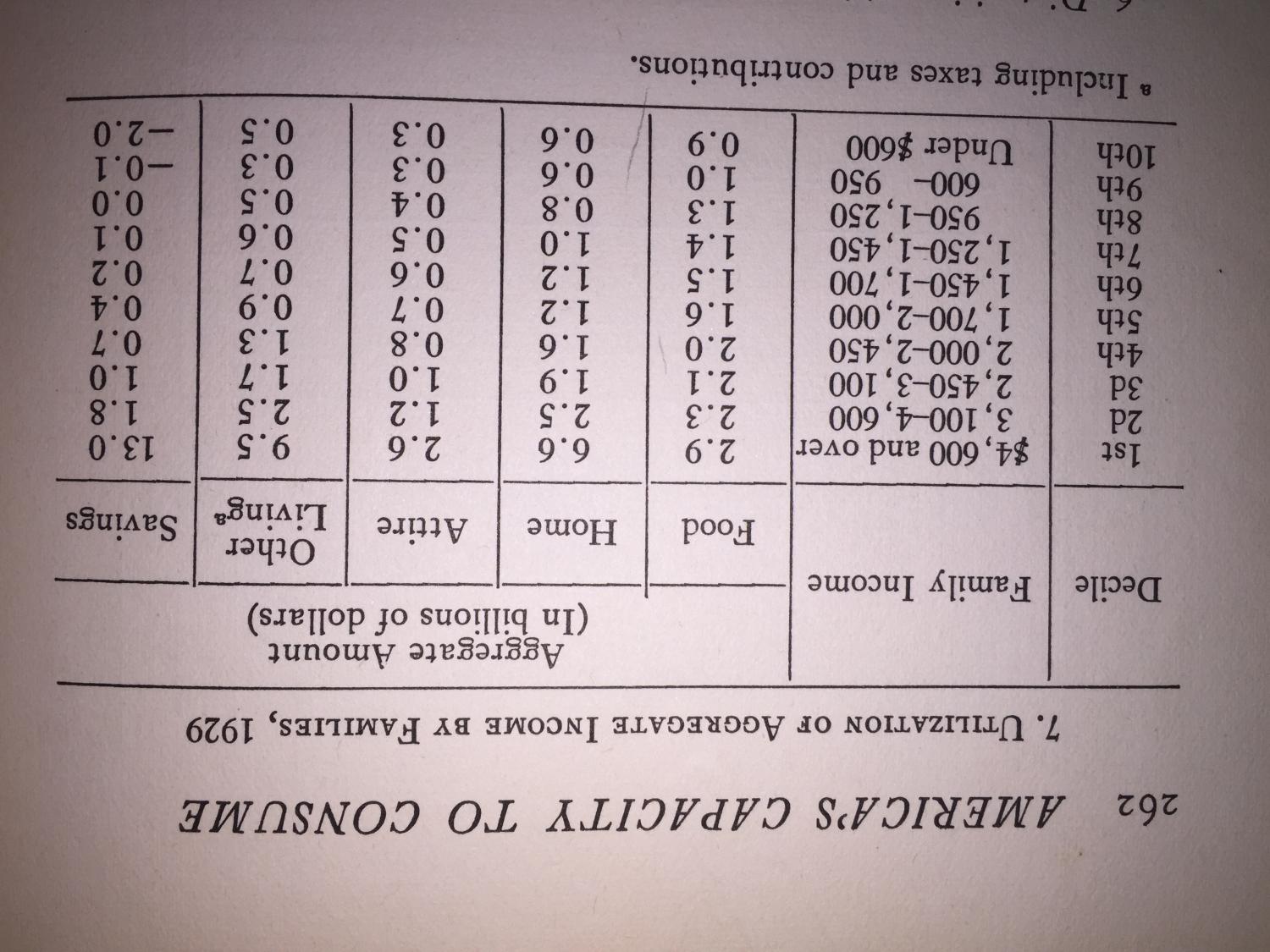

In “America’s Capacity to Consume,” the capacity studies’ second volume, Maurice Leven, Harold Moulton, and Clark Warburton turned to the flow of income, the income “which determines the capacity of the people to purchase the consumption goods which are annually produced, and also to provide the savings which are essential to the formation of new capital.” (15) This part of the project examined, again in great detail, elements of national income such as geographic distribution between farm and non-farm populations; trends in family, individual, and corporate saving; and the different kinds of expenditures of American families. In 1929, the authors found, the top 10 percent of American families by income (those over $4,600 dollars), were responsible for one-third of the total amount of consumptive outlays in America. This included spending on food, housing, clothing, savings, and “other living.” Those in the top decile spent 11 times as much on housing than the bottom decile, and saved 13 percent of their income—far more than any other group. (16)

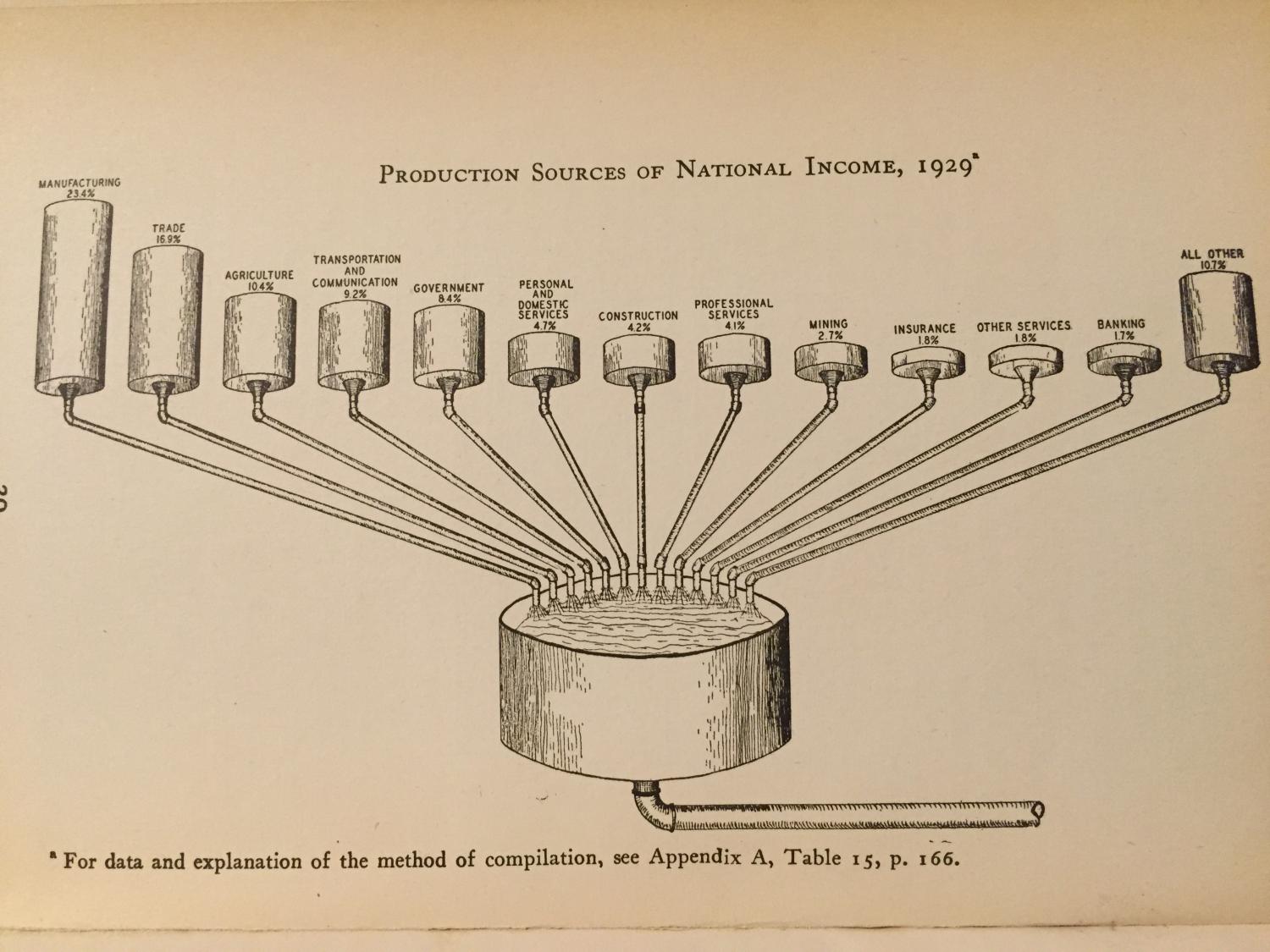

Leven and colleagues also detailed the “broad classes of economic activity,” as of 1929. Their chart, below, showed that manufacturing contributed the largest amount to national income at 23 percent, while only 10 percent (“it is surprising to note,” they wrote), came from agriculture. Government contributed 8.4 percent. (17)

At the conclusion of the consumption capacity volume, Leven and colleagues came to a number of findings, among them: the U.S. was not living beyond its means in the 1920s; income inequality was rising; and that the “unfulfilled consumptive desires of the American people are large enough to absorb a productive output many times that achieved in the peak year 1929.” (18)

Conclusions from the capacity studies

Moulton summarized the overall problem in the fourth volume, “Income and Economic Progress”:

Our study of the productive process led us to a negative conclusion—no limiting factor or serious impediment to a full utilization of our productive capacity could there be discovered. Our investigation of the distribution of income, on the other hand, revealed a maladjustment of basic significance. Our capacity to produce consumer goods has been chronically in excess of the amount which consumers are able, or willing, to take off the markets; and this situation is attributable to the increasing proportion of the total income which is diverted to savings channels. The result is a chronic inability … to find market outlets adequate to absorb our full productive capacity. (19)

He added that, in 1929, 23 percent of national income was going to 1 percent of the population, and a large proportion of their income was going into saving and corporate surplus that was being used in “less fruitful or positively harmful uses.” The unused capacity of the nation could have met “the unsatisfied wants” of the vast majority—over 90 percent—of the U.S. population, Moulton concluded. So how to solve this “basic maladjustment”? “All the world loves a panacea,” Moulton wrote, but then added that “there is no single formula by which desired results can be brought about.” Continuing, he said that:

The ultimate distribution of the national income is brought about through an elaborate process of pricing goods; determining wages and salary payments; disbursing premiums and bonuses; accumulating surplus and determining other aspects of corporate fiscal policy; operating profit-sharing, insurance, and pension schemes, both public and private; and carrying out an elaborate system of taxation and government expenditure. (20)

In his 1991 history of Brookings at 75, James Allen Smith underscored that the studies did not point to a redistribution of wealth, but that they looked to improvements in business efficiency that would have salutary effects. He observed that “Far from expounding a radical redistributionist argument … the studies were in keeping with the most conservative traditions of scientific management. The Brookings volumes contended that if business firms could be made more efficient, prices could be lowered, real wages would consequently rise, and living standards would improve for everyone.” (21)

Moulton ended the capacity studies with optimism tempered by caution in a chapter titled, “Economic Progress and the Democratic Ideal.” He concluded that the best distributive policy that could achieve economic progress was “the gradual but persistent revamping of price policy so as to pass on the benefits of technological progress and rising productivity to all the population in their role of consumers.” Such an approach could find the correct balance between business and labor interests, between the profit motive and consumers, and achieve the full capacity of American resources, technology, knowledge, and labor. “There is general faith that we will come out of the depression and rise in due time to levels of prosperity better than the best attained in the past,” Moulton believed. In the end, he returned to the trials suffered by Americans in the Great Depression, with a hopeful note:

In putting the old common necessities of food and clothes and housing within reach of the millions who are now underfed, ill-clad, and housed only in the tenement of the city slum or the shack of the country slum, we have an ample and accessible field of business enlargement. With capital resources ample and labor abundant to the needs of an increasingly automatic machine technique, we are confident that this goal is practically attainable if only our distributive system is readjusted along the general lines which have been set forth. (22)

Thanks to Brookings Senior Research Librarian and archivist Sarah Chilton for her comments.

NOTES

- Nourse, Edwin G., and others, “America’s Capacity to Produce” (Institute of Economics, The Brookings Institution, 1934), p. 1.

- Lyon, Leverett S. and others, “The National Recovery Administration: An Analysis and Appraisal” (Institute of Economics, The Brookings Institution, 1935); Nourse, Edwin G. and others, “Three years of the Agricultural Adjustment Administration” (Institute of Economics, The Brookings Institution, 1937).

- Critchlow, Donald T., “The Brookings Institution, 1916-1952: Expertise and the Public Interest in a Democratic Society” (Northern Illinois University Press, 1985), p. 122.

- Nourse, p. 6.

- Nourse, p. 6.

- Nourse, p. 7.

- Nourse, pp. 10-11.

- Nourse, p. 14.

- Smith, p. 30.

- Nourse, p. 224.

- Nourse, p. 235.

- Nourse, p. 418.

- Nourse, p. 425.

- Nourse, p. 429.

- Leven, Maurice, Harold G. Moulton, and Clark Warburton., “America’s Capacity to Consume” (Institute of Economics, The Brookings Institution, 1934), p. 2.

- Leven, p. 262.

- Leven, pp. 18-19.

- Leven, pp. 125-127.

- Moulton, Harold G., “Income and Economic Progress” (Institute of Economics, The Brookings Institution, 1935), pp. 45-46.

- Moulton, p. 159.

- Smith, James Allen, “Brookings at Seventy-Five” (Brookings Institution Press, 1991), p. 30.

- Moulton, pp. 155-165.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Brookings’s analysis and recommendations on the Great Depression of the 1930s

October 24, 2016