Fostering increased levels of exports continues to be an important component of states’ economic development strategies. Exports helped bring the United States out of the Great Recession, with particularly rapid growth in certain states and metropolitan areas.

Fostering increased levels of exports continues to be an important component of states’ economic development strategies. Exports helped bring the United States out of the Great Recession, with particularly rapid growth in certain states and metropolitan areas.

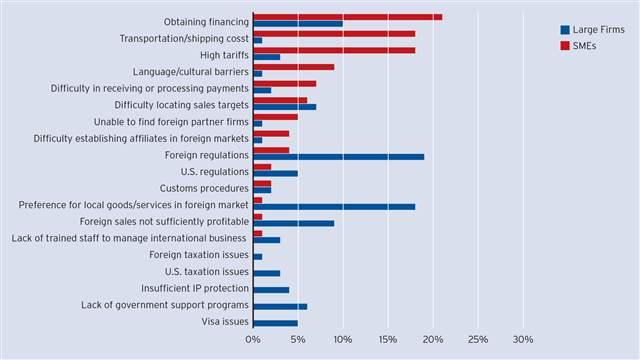

Despite these recent gains, many companies remain reluctant to enter into foreign markets. This is especially true of small and medium-sized enterprises (SMEs), which have long been content to conduct business exclusively within the United States. However, as emerging markets expand and demand for U.S. products and services grows, SMEs would be remiss in continuing to avoid exporting.

Unfortunately, access to capital remains a sizable obstacle for SMEs looking to become exporters. Although the federal government has worked to address export finance challenges, these interventions have proven imperfect solutions, particularly given the growing uncertainty surrounding the future of such efforts. Meanwhile, several other critical challenges have yet to be resolved, including a lack of awareness about existing export finance programs, financial instruments that are poorly designed for SME needs, and the private-sector financing gaps faced by SMEs.

Given these challenges, states interested in bolstering exports have an important role to play in improving SME access to export financing. This brief argues that states can draw on three complementary approaches to address the SME export financing shortfall:

- Raise awareness among SMEs and financial institutions regarding the various instruments and sources of export financing that are currently available

- Adopt additional financial instruments to alleviate financial constraints for SMEs interested in global trade

- Create new finance entities to improve SME access to export financing