Editor’s Note: Mark Muro is one of the principal authors of the paper, Beyond Boom & Bust; he is a senior fellow and policy director at the Metropolitan Policy Program at Brookings.

In the absence of significant and timely energy policy reform, the recent boom in US clean tech sectors could falter.

Driven by private innovation and entrepreneurship as well as critical public sector support in the form of tax credits, grants, and loan guarantees, several clean energy technology (or “clean tech”) segments have grown robustly in recent years while making progress on cost and performance.

Despite this recent success, however, nearly all clean tech segments in the United States remain reliant on production and deployment subsidies and other supportive policies to gain an expanding foothold in today’s energy markets. Now, many of these subsidies and policies are poised to expire—with substantial implications for the clean tech industry.

This report aims to take stock of the coming changes to federal clean tech subsidies and programs (Part 1); examine their likely impact on key clean tech market segments (Part 2); and chart a course of policy reform that can advance the US clean tech industry beyond today’s cycle of boom and bust (Part 3).

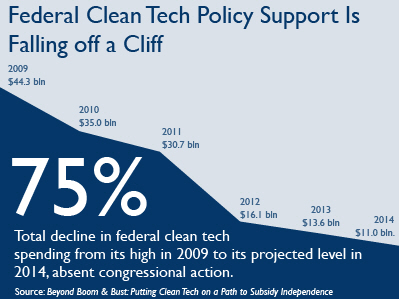

Along the way, this report provides a comprehensive analysis of the spending trajectory of 92 distinct federal policies and programs supporting clean tech sectors over the 2009 to 2014 period. As this analysis illustrates, an era of heightened clean energy spending supported by the American Recovery and Reinvestment Act of 2009 (ARRA) is now coming to an end, coinciding with the expiration of several additional time-delimited tax credits and programs. As a result, key portions of the clean tech industry can now anticipate substantially reduced federal support.

At the same time, market subsidies are being cut in several European markets, reducing export opportunities for US clean tech manufacturers and leading to oversupply and declining margins, even as pressure mounts from both low-cost natural gas at home and foreign clean tech manufacturers abroad.

US clean tech sectors therefore face a combination of new challenges. Without timely and targeted policy reform, several sectors are likely to experience more bankruptcies, consolidations, and market contraction ahead.

And yet the demise of the current clean tech subsidy system need not be disastrous. In fact, it may provide an opportunity for needed reform and further industry growth, albeit one that must be carefully approached by both policy makers and business leaders.

Many of today’s existing subsidies and clean energy programs, after all, are poorly optimized, characterized by a boom and bust cycle of aid and withdrawal, or in need of thorough revision thanks to either recent progress in the price and performance of subsidized technologies or the mounting fiscal burden imposed by some programs.

The end of the present policy regime therefore offers the opportunity to implement smart reforms that not only avoid a potential “clean tech crash” but also accelerate technological progress and more effectively utilize taxpayer resources. Well-designed policies that successfully drive innovation and industry maturation could provide US clean energy sectors a more stable framework within which to advance towards both subsidy independence and long-term international competitiveness.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).