China devalued its currency to a five-year low against the U.S. dollar on Wednesday, sending global stock markets tumbling. The devaluation so far has been minor, from an exchange rate of 6.2 to the dollar last summer to 6.55 now. So, why are markets so jittery?

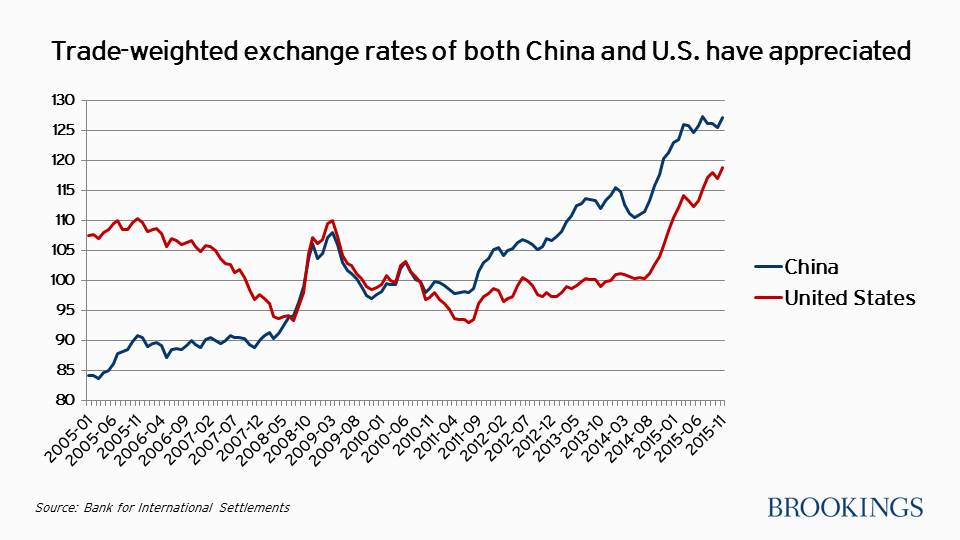

First, look at what China says it is trying to do. Last month China’s central bank started publicizing a trade-weighted index of its exchange rate to highlight the fact that the currency has appreciated a lot. Ten years ago there was broad agreement that China’s currency was seriously undervalued. Since 2005, China’s trade-weighted exchange rate has appreciated about 50 percent, according to the index calculated by the Bank for International Settlements.

The trade-weighted index takes account of the fact that China has major trade with the euro area and Japan, so that movements in the yuan’s value relative to the euro and the yen (and other currencies) are relevant. Over most of that period there was no trend in the dollar’s trade-weighted value. But starting in the summer of 2014, the dollar has appreciated steadily, and many analysts expect this to continue as the Federal Reserve raises interest rates while monetary policy remains looser in Europe and Japan.

Until recently, China followed the dollar up. If the dollar continues to appreciate against other currencies, however, China does not want to continue to follow it. Hence the recent communications focusing on the trade-weighted index and the commitment to maintain a fairly stable exchange rate in that sense.

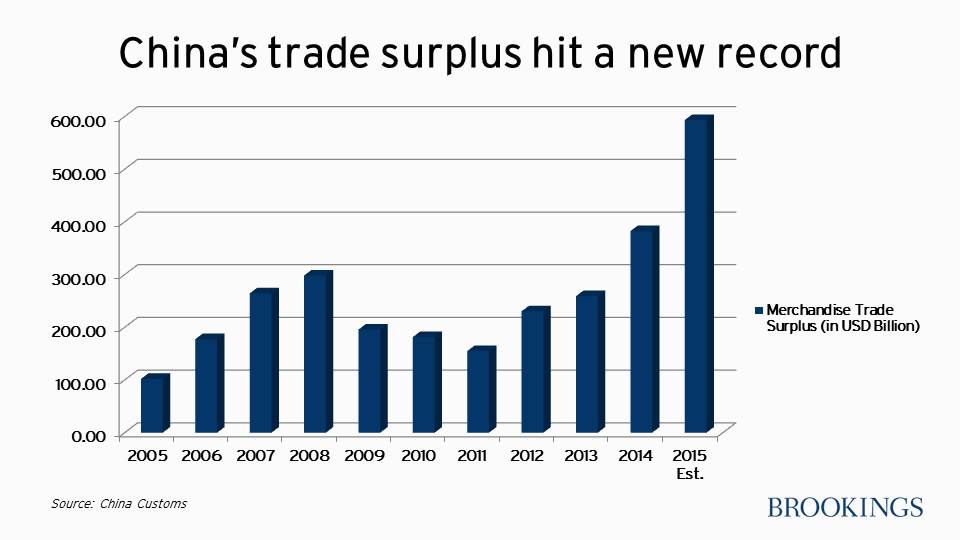

Second, despite these pronouncements, when China fixes the RMB-to-dollar rate at lower levels, as on Wednesday, many in the market take it as a signal that that rate will continue to depreciate. In the offshore market there is continuing pressure for the currency to depreciate. China’s officials may in fact want some trade-weighted depreciation in order to stimulate their slowing economy. However, China’s trade surplus increased to about $600 billion in 2015, the highest ever recorded by any country. On the basis of trade, it is hard to argue that China has any competitiveness problem or that there is any justification for devaluation.

A third issue is that China is facing large capital outflows as its economy slows and as its stock market corrects from bubble levels. Despite the large trade surplus and extensive capital controls, China had to spend hundreds of billions of dollars of reserves in 2015 in order to limit depreciation of the currency. The authorities may want to stabilize the trade-weighted exchange rate—but if capital outflow pressures become too great, they may not be able to.

All of this creates a lot of uncertainty. For a long time the slow appreciation of the Chinese currency against the dollar was a source of stability in the world. Now that anchor is gone. It is natural to be nervous about the new regime and how well the authorities can implement it.

Commentary

Anchor aweigh? China’s currency devaluation and the global economy

January 6, 2016