Over the past few weeks we’ve discussed how advanced industries—those industries that invest heavily in research and development and technical workers—are responsible for a large number of good-paying jobs and are leading the post-recession jobs recovery. But these industries also improve living standards by creating better products and services at more affordable prices. Previously we documented large drops in the relative prices paid by consumers for certain technology-rich products and services. Here, we examine broader trends in the prices of products produced in advanced industries compared to the prices in the rest of the economy.

At a time when real median income in the United States remains stagnant, innovation and competition keep prices low and raise purchasing power. Via this route, advanced industries have delivered meaningful gains in the standard of living of consumers.

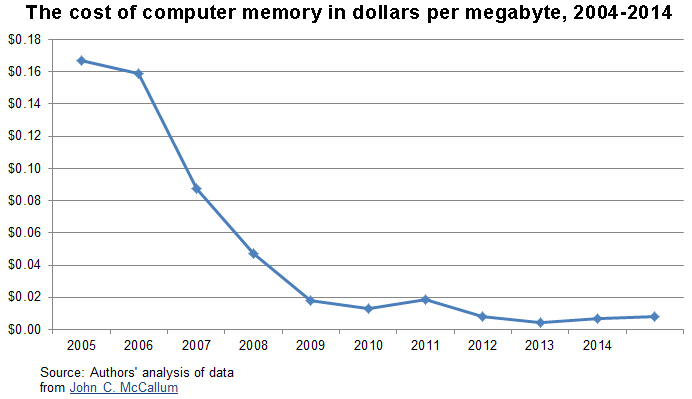

For example, computer scientist John McCallum has compiled data on the price of a megabyte of computer memory storage going back to 1957. It’s a spectacular decline. As recently as 2004, memory was 20 times more expensive.

Information technology isn’t the only advanced industry to see price declines. Despite the addition of over $1,400 in technology to the average automobile over the last decade, cars have declined in price by 1 percent a year. Over the same period the price of child care, health care, and education more than doubled.

Why the difference? Advanced industries employ technology and highly skilled workers and sell products and services that are exposed to global competition. These two characteristics—skill and exposure to competition—work to boost investment and innovation, as new entrants offering higher-quality products at reduced costs threaten to overtake incumbent firms. The lower prices benefit consumers.

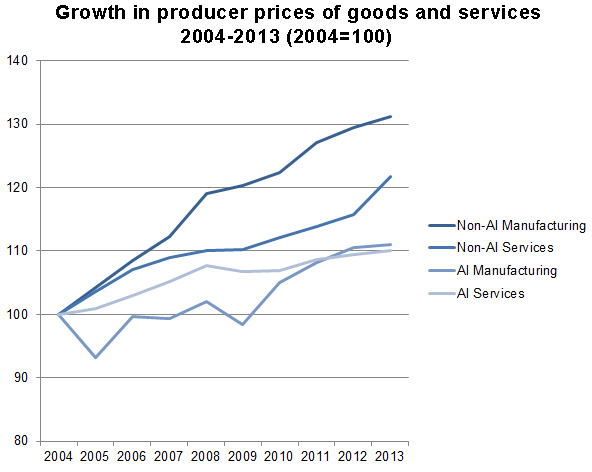

Moreover, the cost savings have been significant. Over the last decade the prices of advanced industry manufactured goods (e.g., automotive, aerospace, electronics) have grown annually by about 1 percent, roughly one-third the rate of manufactured goods in the rest of the economy (such as textiles or furniture). Similarly, the cost of advanced industry services (e.g., software, medical labs) has grown half as fast as the cost of non-traded services (including retail, health care).

Source: Bureau of Labor Statistics, Producer Price Index, 2015.

What does this mean for the typical household dealing with income growth that has been stagnant in inflation-adjusted terms? Had inflation been higher, real income would have been lower, and indeed inflation would have been significantly higher if not for innovation in advanced industries. In fact, if non-advanced industries had kept prices in check as well as the advanced sector did, real median earnings growth would have flipped from 1 percent negative to 12 percent positive from 2004 to 2013, all things equal.

It is important to note that these data show the prices U.S. producers receive from revenue, so an imported Toyota or Samsung smartphone isn’t counted. If prices of imported advanced industry goods are falling even faster, these data understate the impacts of advanced industry production on household finances in regard to the prices paid for goods.

In sum, the pace of innovation in America’s advanced industries sector is delivering important, under-recognized benefits to American households. Spurring entrepreneurship and innovation more broadly—making non-advanced industries more advanced—would go a long way to boosting the living standards of ordinary Americans.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Advanced industries drive down prices, making income more valuable

March 27, 2015