What’s the latest thinking in fiscal and monetary policy? The Hutchins Roundup keeps you informed of the latest research, charts, and speeches. Want to receive the Hutchins Roundup as an email? Sign up here to get it in your inbox every Thursday.

Upcoming webinar: The 11th annual Municipal Finance Conference will be held July 18-20, 2022, as a virtual event. Visit this page for more information, including agenda and registration, and email Stephanie Cencula ([email protected]) with any questions.

Policy response boosted incomes significantly at the bottom during pandemic

Policy responses during the COVID-19 recession mitigated large income declines, particularly for those at the bottom of the income distribution, find Jeff Larrimore of the Federal Reserve Board and co-authors. Using administrative U.S. tax data, the authors found that accounting for taxes and transfers lowered the proportion of adults experiencing a large income decline in 2020 (greater than 10%) by 16.2 percentage points, from 33.4% to 17.2%. The effect was particularly large for those in the bottom income quintile, where accounting for taxes and transfers reduced the share experiencing a large income decline by 27.6 percentage points, from 44.0% to 16.4%. The authors found that unemployment insurance benefits and stimulus checks explained 95% of these stabilizing effects, while tax and transfer programs other than UI explained just 5%. Public policy, the authors conclude, stabilized incomes over the entire distribution, with those at the bottom of the distribution experiencing the largest benefits.

STEM summer programs propel high-achieving high schoolers to elite universities

Sarah Cohodes of Columbia, Helen Ho of Harvard, and Silvia Robles of Mathematica conducted a randomized control trial to investigate a STEM summer program for high-achieving high school students from underrepresented minorities. They find that being offered a spot in one- and six-week programs increased the share of students graduating on time from a four-year college with a degree in STEM by 12.8 percentage points and 16.7 percentage points, respectively, and increased the overall college graduation rate by 8 percentage points. The authors show that almost all the gains in graduation rates resulted from students selecting more competitive universities, with admission rates to elite universities rising by 10% to 17%. Among freshmen STEM majors, those who attended the six-week program graduated with STEM degrees 5.7 percentage points more often than their peers. This paper is the first to show experimental evidence that summer programs for underrepresented minorities have a positive impact on STEM achievement.

Low-wage workers are increasingly dissatisfied with their jobs

The gap between the job satisfaction of low-wage workers (the bottom third of the income distribution) and professional workers (the top fifth of the income distribution with a college degree) increased during the pandemic, find Elizabeth Johnson and Ashley Whillans of Harvard Business School. Using nationally representative Gallup survey data from 2019-2021 and controlling for worker demographics and location, the authors document declines in low-wage workers’ job satisfaction, a persistent gap between the satisfaction rates of low-wage and professional workers, and an 0.1 increase in this gap (on a scale from 1 to 4) over the three-year period. Additionally, the authors find that pay is the most important determinant of job satisfaction for low-wage workers and that its importance increased during the pandemic. The authors conducted their own survey of 400 managers to explore the role of manager psychology in explaining this job satisfaction gap. They find that managers overestimate low-wage workers’ job dissatisfaction, leading them to believe these workers would be less committed to their jobs and thus deserving of lower pay.

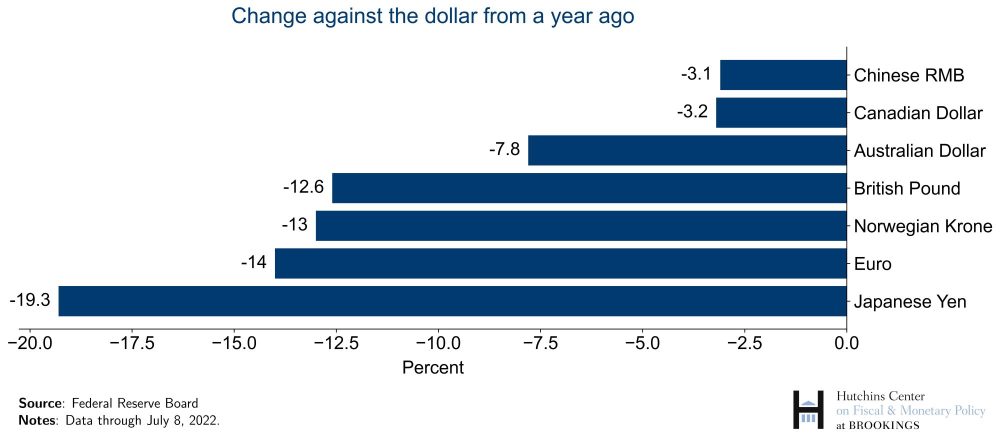

Chart of the week: U.S. Dollar Strengthens Relative to Other Currencies

Chart data courtesy of the Federal Reserve Board

Quote of the week:

“We are closely monitoring recent events where risks in the system have crystallized and many crypto investors have suffered losses,” says Lael Brainard, Vice Chair of the Federal Reserve Board.

“Despite significant investor losses, the crypto financial system does not yet appear to be so large or so interconnected with the traditional financial system as to pose a systemic risk. So this is the right time to ensure that like risks are subject to like regulatory outcomes and like disclosure so as to help investors distinguish between genuine, responsible innovation and the false allure of seemingly easy returns that obscures significant risk. This is the right time to establish which crypto activities are permissible for regulated entities and under what constraints so that spillovers to the core financial system remain well contained.”

The Brookings Institution is financed through the support of a diverse array of foundations, corporations, governments, individuals, as well as an endowment. A list of donors can be found in our annual reports published online here. The findings, interpretations, and conclusions in this report are solely those of its author(s) and are not influenced by any donation.

Commentary

Hutchins Roundup: Pandemic Policy, STEM Programs, and More

July 14, 2022