Index #10: Last Five Quarters

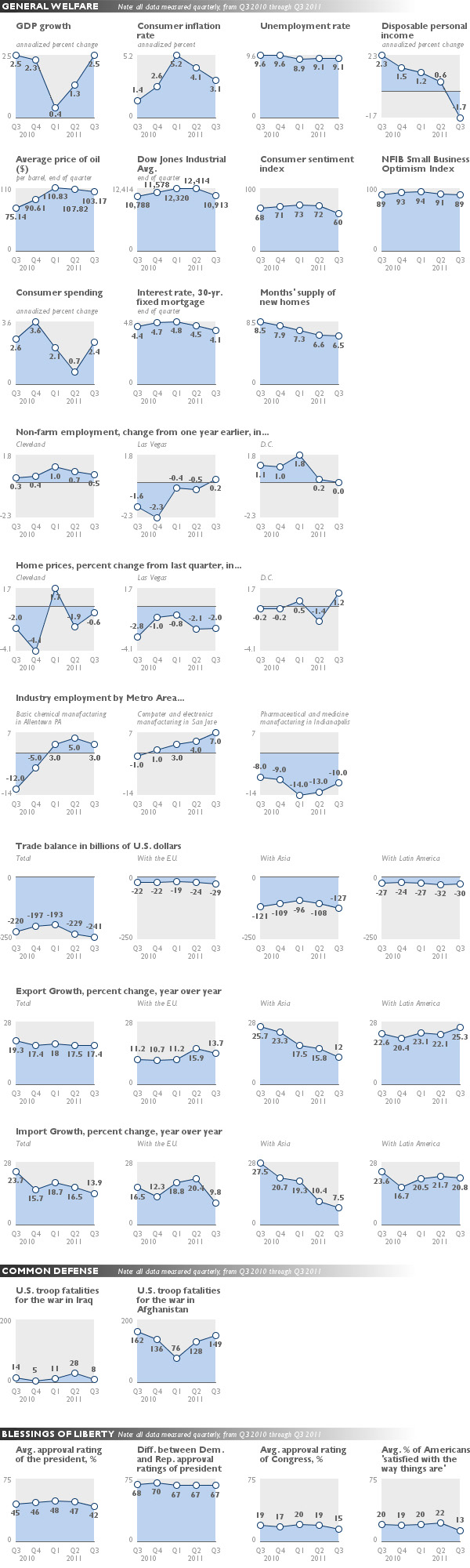

Concerns about the economy have escalated since mid-summer, with consumer confidence plummeting, approval ratings for Congress and the president sagging, and dramatic protests arising in New York and other major cities. In the tenth “How We’re Doing” Index, a team of scholars at the Brookings Institution has looked at the past five quarters to assess the trends behind this public discontent. Continued weakness in the U.S. economy and the global concerns that preoccupied the recent Group of 20 meeting have had effects at the national and local levels. Continue reading below chart »

Related Materials:

Video: Domenico Lombardi discusses the new index »

Past How We’re Doing indexes »

U.S. gross domestic product rose at a solid 2.5 percent in the third quarter, driven by gains in consumer spending, but the national unemployment rate remained at a dismal 9.1 percent. Disposable personal income fell, and consumer confidence declined to its lowest level since early 2009. According to Gallup polling, the percentage of Americans who say they are satisfied with the way things are sunk to a two-year low of 13 percent.

In contrast, emerging economies have been resilient, making international trade – especially with China – a flash point in Congress and the Republican presidential debates. The Senate recently passed legislation that could impose higher tariffs on some Chinese products, and China announced new commitments on currency flexibility at the G-20 meeting. A meaningful appreciation of the yuan could, in fact, facilitate trade rebalancing between China and the United States. So far, strong growth in China and India has driven the International Monetary Fund’s projection of a still-high rate of growth (4 percent) for the global economy this year.

In Europe, the picture is more complicated. The market turmoil that started as a fiscal and banking crisis in a few peripheral countries now threatens the continent’s larger economies. A new unity government in Greece will be tasked with implementing the provisions of a rescue package that will impose unpopular austerity measures, while Italy is forming an emergency cabinet to carry out, under IMF monitoring, tough policy measures to stabilize market pressure. It remains unclear whether these steps will be enough to reverse the crisis and prevent harmful ripple effects in the United States and elsewhere. It was made clear in Cannes that the Europeans still need to clarify important aspects of their strategy.

One potential impact on the U.S. economy as Europe’s growth falters is declining exports. Thanks in part to a depreciating dollar, U.S. trade deficits with Europe, Asia and Latin America have expanded in the past year. Local economic trends reflect the diverging fortunes of our international trading partners. In Indianapolis, a hub for U.S. pharmaceutical exports to Europe, the industry has shed a significant number of jobs over the past year. In Allentown, Pa., by contrast, jobs in basic chemical manufacturing are growing again thanks to strong demand from Latin America. In Silicon Valley, rising computer and electronic exports to Asia fueled that industry’s 7 percent job growth in the third quarter.

These national and local dynamics should highlight priorities for federal, state and local policymakers. National leaders still need to reach a budget accord and revitalize the current account rebalancing agenda agreed upon by the G-20 by stepping up pressure on China to increase its net imports and follow through on its commitments. They also need to continue to press the Europeans to address a crisis that may further slow badly needed investment and job creation.

Local officials, meanwhile, should collaborate with business and civic leaders to enhance export-related services and infrastructure, to help their firms better connect to faster-growing foreign markets. At the moment, the United States must look abroad to sustain and accelerate its still-fragile economic recovery.

See also:

» State of Metropolitan America—portraying the demographic and social trends that shape our nation’s metropolitan areas

» GovWatch—tracking the progress and performance of our institutions in economic recovery

» MetroMonitor—a barometer of the health of America’s 100 largest metropolitan economies

Sources:

GDP growth:

U.S. Bureau of Economic Analysis

Unemployment rate:

U.S. Bureau of Labor Statistics

Disposable personal income:

U.S. Bureau of Economic Analysis

Consumer inflation rate:

U.S. Bureau of Labor Statistics

Dow Jones Industrial Average:

Yahoo! Finance

Average price of oil:

Energy Information Administration

Consumer sentiment:

Reuters/University of Michigan survey of consumers

Small business optimism:

NFIB Small Business Optimism Index

Consumer spending:

U.S. Bureau of Economic Analysis

Months’ supply of new homes:

U.S. Census Bureau

Interest rate on 30-year fixed mortgage:

Freddie Mac

Metro area employment rates:

U.S. Bureau of Labor Statistics

Metro area employment by industry:

Brookings analysis of Moody’s Analytics,U.S. Bureau of Economic Analysis, and U.S. International Trade Statistics data.

Metro area home price growth:

Case-Shiller Index

International trade data:

U.S. International Trade Commission

U.S. combat fatalities, Iraq and Afghanistan:

icasualties.org

Approval ratings of president and Congress:

Gallup

Percent of Americans “satisfied with the way things are”:

Gallup

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).