This report is part of the Series on Financial Markets and Regulation and was produced by the Brookings Center on Regulation and Markets.

September 6, 2008 arguably marked the beginning of the acute phase of the 2008 financial crisis. On that date, the U.S. government announced that housing giants Fannie Mae and Freddie Mac would be taken over by the government and, in the process, receive significant public support.

Few if any of the officials who undertook this momentous bailout would have predicted that almost eleven years later, Fannie and Freddie would still be wards of the state, caught in a limbo between their private status as a for-profit corporation and a public status as a revenue generator for the government.

On September 5, 2019, the U.S. Treasury, in consultation with the Department of Housing and Urban Development and the Federal Housing Finance Agency (FHFA, the regulator of Fannie and Freddie) submitted a Housing Reform Plan to the president. The centerpiece of the plan is to end the conservatorships and to provide a path to define, tailor, and pay for the government’s support of a secondary market in housing finance.

The plan also endorses an earlier legislative proposal from the FHFA to increase competition to Fannie and Freddie. As the FHFA earlier put it, “the Enterprises’ current duopoly undercuts competition in the market” such that the solution is for “Congress [to] authorize additional competitors and provide FHFA chartering authority similar to that of the Office of the Comptroller of the Currency.” The result would be, in the FHFA’s view, to “reduce market reliance” on the GSEs, “enhance market stability,” and “benefit home buyers.”

The idea of increasing competition in the marketplace for risk management and loan guarantees is an attractive one and a goal that the FHFA, Congress, and the industry should take seriously. But virtually everything else about this proposal undercuts the realization of these three goals. In this essay, I will discuss—with reference to both the Comptroller of the Currency and the more appropriate historical analogue, the Federal Reserve Banks—why the FHFA should look at other ways to inject market discipline into the GSEs’ business model.

Would Competition Among GSEs Result in Improved Underwriting Standards?

A stated but unexamined assumption of this proposal is why increasing the number of GSEs would necessarily improve the competitive landscape in ways that would put risk into the private market place. Assuming that there would be market appetite for the charters the FHFA would offer, the number of government-sponsored enterprises would increase. But to what end? Would they compete on price to attract business, innovation to create new mortgages, or ways to extract rents from the taxpayer, given that the government is still on the hook to provide if all went south? Would the increase in number of mortgage guarantors mean we would see entities develop superior risk management, managerial acumen, or balance sheet management, such as hoped for “enhanced market stability” might be plausible?

Probably not. The problem with housing finance isn’t that there are not enough options for mortgage brokers who seek to offload risk to third parties. The problem is whether government-subsidized housing guarantors are crowding out private-market competitors due to expectations that American taxpayers—not private shareholders—are the ultimate bearers of these risks.

The problem is whether government-subsidized housing guarantors are crowding out private-market competitors due to expectations that American taxpayers—not private shareholders—are the ultimate bearers of these risks.

In good times, a flood of newly chartered mortgage guarantors would mean subsidized risk shifting such that FHFA-stamped-for-approval housing guarantors would enjoy the ride up, while taxpayer would take the hits going down. It would be a race to the bottom as more and more firms seek to monetize on the perception—however much the FHFA or Treasury might deny it—that the taxpayer will bear those losses.

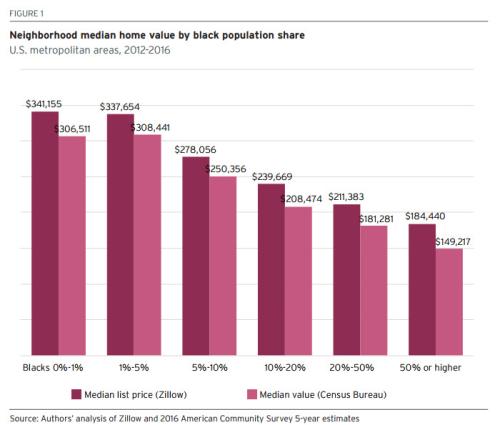

Let’s look at one important slice of the work that the GSEs do—guaranteeing mortgages for multifamily housing. As we see in Figure 1, GSE guarantees are far from choking out competition: they amount to only 40% of total multifamily debt outstanding. They are unquestionably a major presence in these markets—perhaps too much. But the risks that ten—or twenty—or one hundred—other GSEs would crowd out the other 60% is more likely than that these GSEs would be content with the 40% market share they already have.

Source: Federal Reserve

The Problem of Bank Supervision in the United States

The lack of clear evidence that sponsoring new GSEs would increase competition is not the only problem with the proposal. It also threatens to add ever more institutional complexity to one of the thorniest of problems in the U.S.: the dizzying array of bank regulators. FHFA’s analogue is the Comptroller of the Currency, a national banking authority set up at the end of the U.S. Civil War to thread a needle between the need to govern the value of the U.S. currency and the fear and loathing that many politicians had shown in the 19th century for central banking.

Put aside for a moment whether the National Bank Era was one of success in U.S. financial history—most scholars agree that it was not, but this is not a unanimous view. The real problem with the idea of having the FHFA charter additional financial institutions to offer federal guarantees on mortgages is that it will create regulatory duplication and overlap. The U.S. is already choking on institutional redundancy in its financial regulatory system. Dodd-Frank created three new federal financial regulatory agencies. We have more than a dozen such agencies responsible for the regulation, supervision, and enforcement of our financial laws. This makes us unique: no other country in the world regulates finance in such an institutionally complex way.

The Treasury plan would not, by itself, make FHFA into a more muscular bank supervisor than it already is. After all, Fannie and Freddie remain the juggernauts in residential and commercial banking already. But if financial institutions see charter options grow, we can reasonably expect two outcomes. First, shareholders will see opportunities to play one government regulator off of another, pushing regulators into a race toward regulatory leniency. Second, the sheer proliferation of the FHFA’s supervisory load will make it look more like a banking supervisor and less like the housing finance supervisor it already is.

There are concerns for systemic risk, too. Giving FHFA increased chartering authority would significantly extend FHFA into banking. This is true because mortgage finance is a key part of the banking system, and a key part of potential instability in that system. As Don Kohn, former Vice Chair of the Fed’s Board of Governors and current member of the Bank of England’s Financial Policy Committee, warned in 2014, “the fragmented U.S. system, with each agency protecting its prerogatives and listening to its regulated industry,” may have “more problems spotting and making recommendations for change than other regulatory structures.” Giving the FHFA a much more sizable role to play in banking will only exacerbate these problems.

Warning from History: The Experience of Federal Reserve Banks

A final risk to the decentralized approach FHFA Director Mark Calabria envisions is that housing policy in the United States will become incoherent to the point where common, coordinated action becomes virtually impossible. The Great Depression’s monetary policy response provides an excellent a sobering word of warning about the kind of experiment that Calabria has in mind.

In 1913, Congress passed the Federal Reserve Act as a second attempt to get a central bank in the United States without actually creating a central bank. (Recall that the first attempt was the flawed National Bank Acts that created the national banks and the Comptroller of the Currency, a model on which Calabria hopes to base his expanded vision for the FHFA.) Rather than creating a Bank of the United States, as earlier generations had done twice before, the model was, in the words of one contemporary observer, to create “twelve central banks” scattered unevenly throughout the United States. (I go into much more detail about the Reserve Banks in this Brookings report.)

The experiment in decentralizing a national monetary policy failed almost as soon as it began. These Reserve Banks began competing with each other for business, precisely as this housing model might hope. In one striking example, both the Federal Reserve Banks of Boston and Chicago both opened branches in Havana, Cuba, something the Federal Reserve Bank of Atlanta thought illegal.

This competition only sowed seeds of confusion about what the federal government meant to accomplish with the Reserve Banks. Secretary of the Treasury Andrew Mellon, himself the ex officio chairman of the Federal Reserve System, had to resort to pleading with the Reserve Banks to stop investing in the debts of the national government. Many of the heads of the Reserve Banks refused: they were investing for earnings, and the paper of the federal government was some of the best to be had.

In this structural void, only the power of personality could exercise control over so dysfunctional a system. Benjamin Strong, Governor of the Federal Reserve Bank of New York, filled that void, but when he died in 1928, no one could succeed him. The result was a zigging and zagging monetary policy that was only barely coordinated, resulting in more severe than necessary contraction in parts of the country.

Fortunately, one of the most enduring changes of the New Deal Era was to mostly eliminate the confusion that these twelve GSEs had created. The Federal Reserve Banks are still with us, but Congress centralized monetary policy into a federal agency, the Federal Open Market Committee, and made it so that the nation’s monetary policy could speak with one voice.

Simplify, Simplify, Simplify

FHFA and Treasury’s proposals are not fully formed yet. This early stage of the debate is all the more reason to abandon this line of reform thinking before a bad idea takes root. We need a debate on GSE reform and that the politics of housing make that debate a complicated endeavor. Creating a more institutionally complex financial regulatory system and extending the reach of federal guarantees into the market place are not the answer. We need more regulatory simplicity, not less; we need less government guarantees to private market initiatives, not more.

The author did not receive financial support from any firm or person for this article or from any firm or person with a financial or political interest in this article. He is currently not an officer, director, or board member of any organization with an interest in this article.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).