Americans owe about $1.5 trillion on their student loans–more than they owe on their credit cards. The increase in total student debt, stories of families struggling with six-figure loans, and the response of politicians to anxiety about student debt among young voters have turned student debt into a high-profile issue. To inform that conversation, here are five facts about student loans drawn from an event – Student loans: A look at the evidence – hosted by the Hutchins Center on Fiscal and Monetary Policy at Brookings.

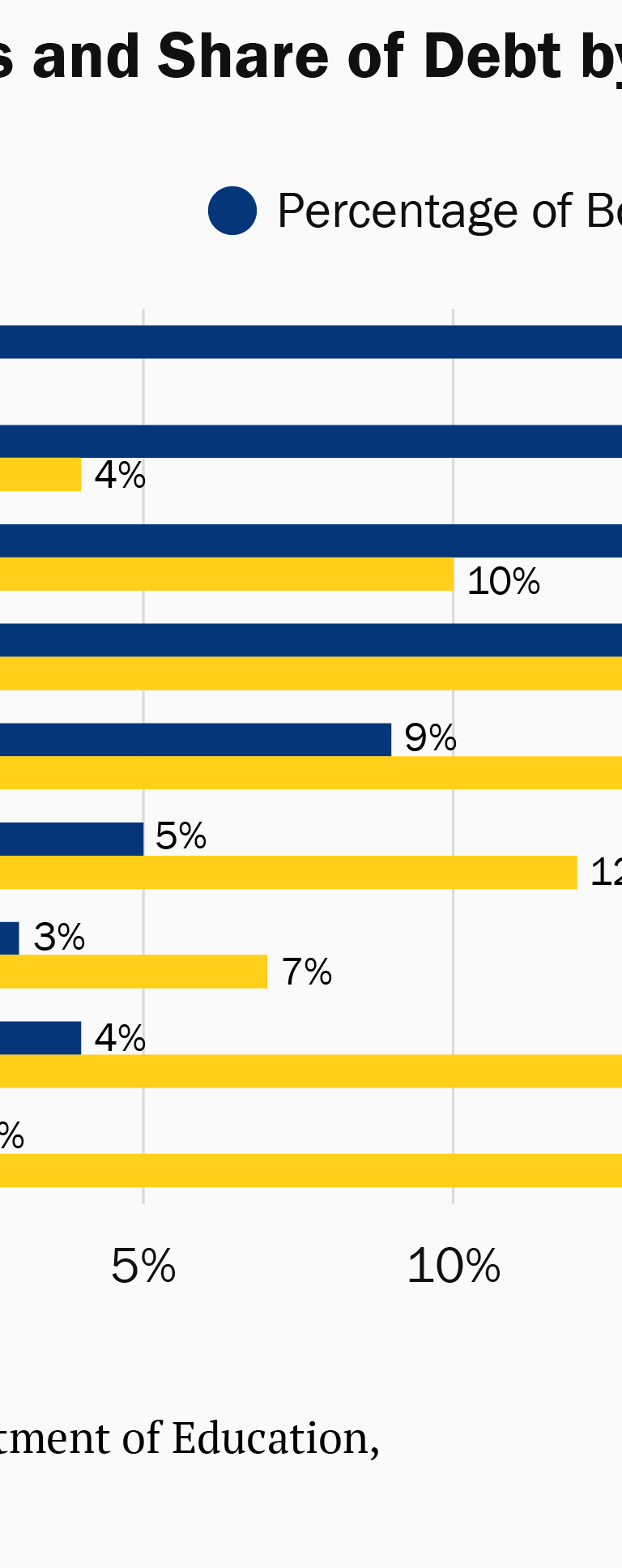

1. Six percent of borrowers owe a third of all the outstanding debt.

A very small fraction of all student loan borrowers have very large loans. Six percent of borrowers owe more than $100,000 in debt, with 2 percent owing more than $200,000. This 6 percent owes one-third of the outstanding $1.5 trillion of debt. At the other extreme, 18 percent of borrowers owe less than $5,000 in student loan debt. They collectively owe 1 percent of the debt outstanding.

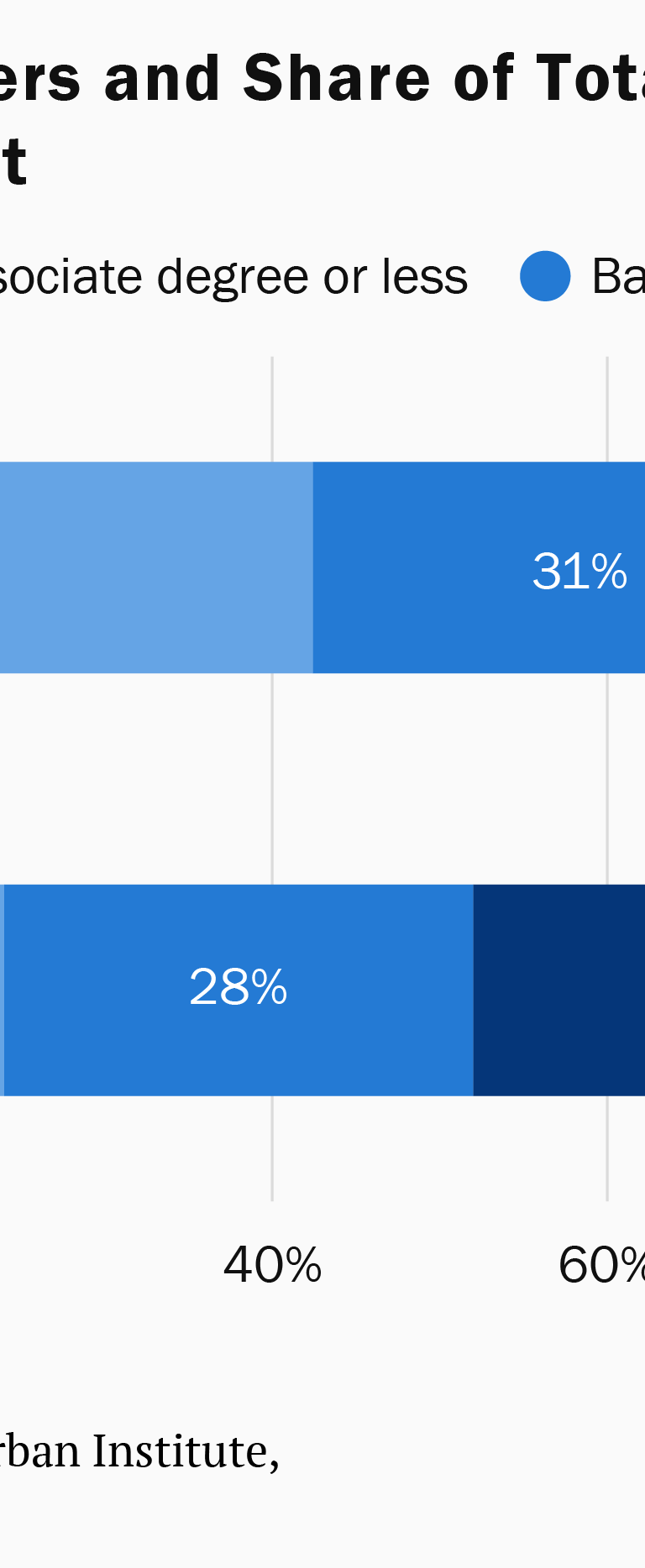

2. About one quarter of student loan borrowers, who have about half the debt outstanding, borrowed for graduate school.

Out of all households with student debt, only 26 percent are headed by an individual with a graduate degree. While only a small share of households with student debt have a graduate degree, loans associated with graduate degrees account for 50 percent of the total outstanding student loan debt. In contrast, 42 percent of households with student debt are headed by someone without a bachelor’s degree; they only account for ¼ of the total outstanding debt.

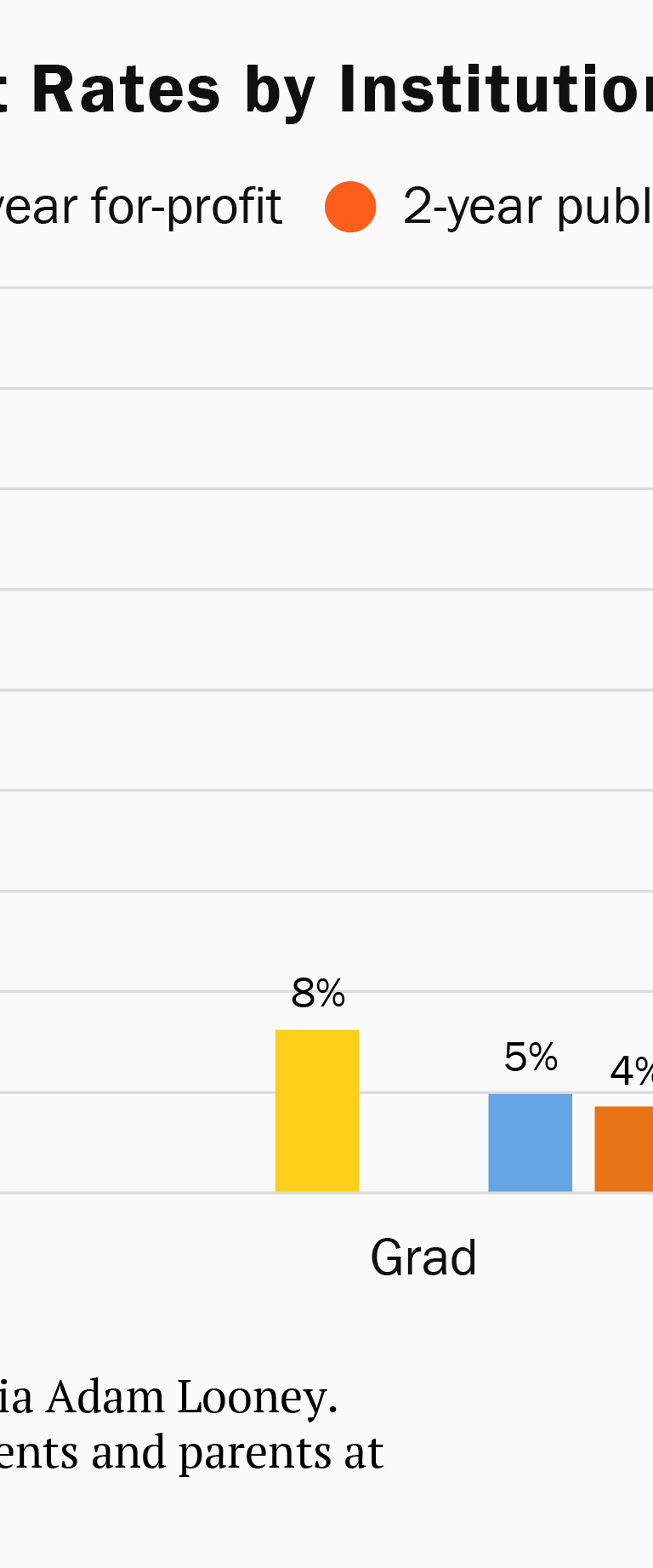

3. Individuals who owe the most are not the individuals who default on debt.

Borrowers with graduate degrees have the lowest default rates despite accounting for about half of all student debt. Higher default rates are more common for students who went to for-profit institutions. Forty percent of borrowers from for-profit two-year programs default on their loans within five years of entering repayment, and 32 percent of those who went to for-profit four-year programs defaulted in this same time frame. Among students who went to public community colleges, about 25 percent default within five years of entering repayment. Defaults are much less frequent among those who borrowed to go to public or private non-profit four-year schools.

4. Most bachelor’s degree recipients graduate with little to no debt.

Thirty percent of all bachelor’s degree recipients graduate with no debt, and another 23 percent graduate with less than $20,000 in loans. Fewer than 20 percent of all borrowers owed more than $40,000. Among for-profit schools, nearly half of all borrowers owed more than $40,000, but only 12 percent of those who attended four-year public colleges owed the same amount.

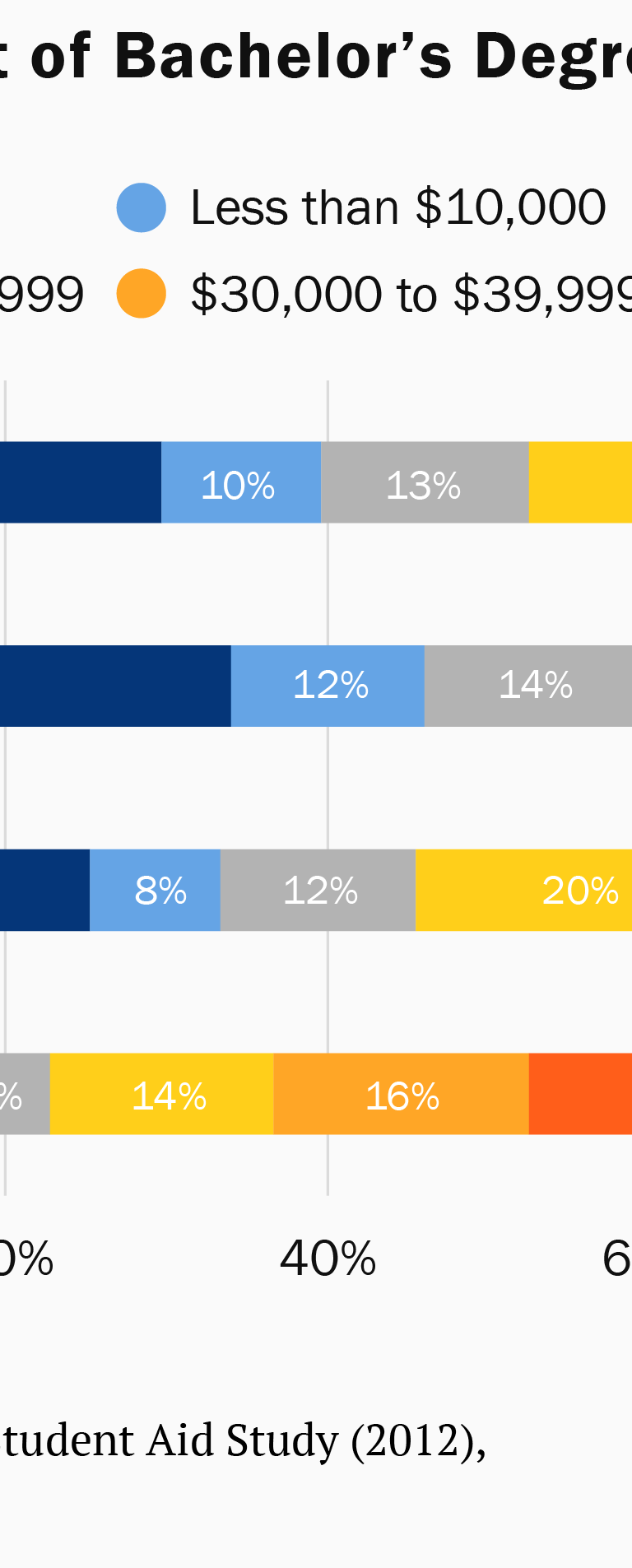

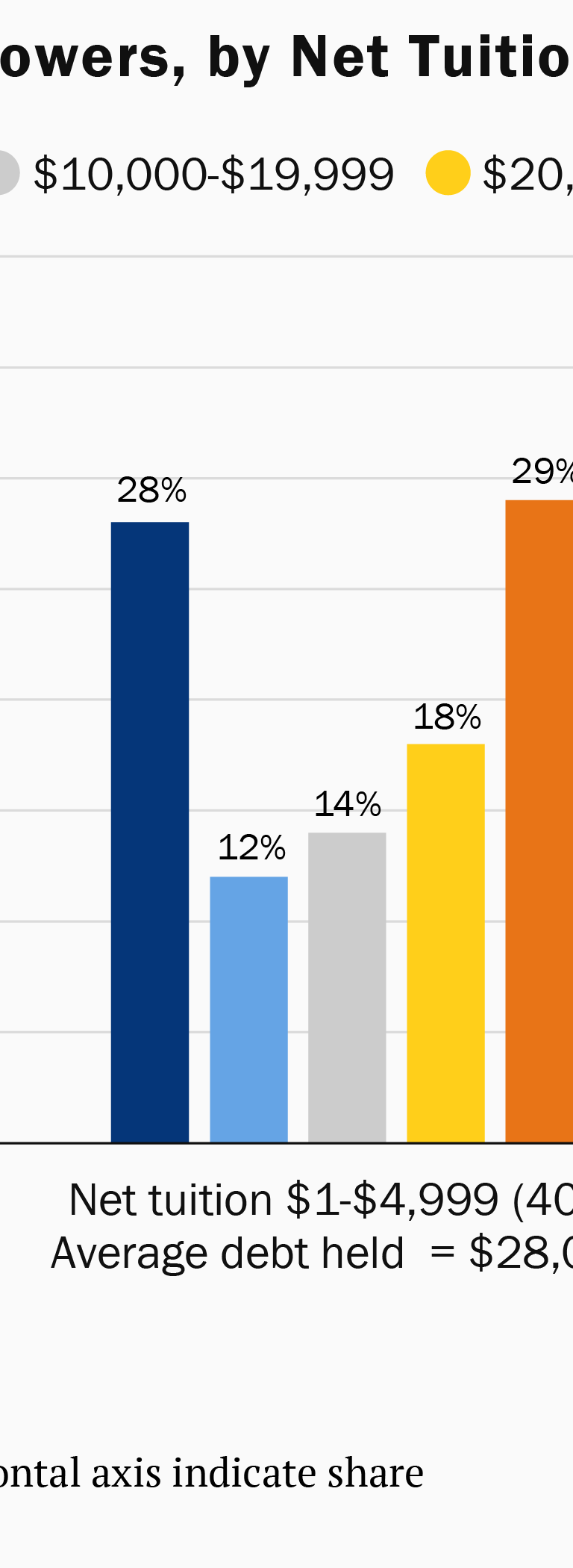

5. Even if financial aid covers the whole tuition bill, many students still borrow to cover living costs.

Many students borrow to not only cover their tuition and fees but also to get cash to finance the cost of living while they are in school. An Urban Institute analysis conducted using the National Postsecondary Student Aid Study finds that student borrowing patterns among those for whom all tuition is covered by scholarships and grants (no net tuition) are similar to those who have to pay tuition. For students at public universities and colleges with no net tuition, 22 percent borrow $30,000 or more; on average, they borrow $24,000. In comparison, 23 percent of those who pay average net tuition of more than $5,000 borrowed $30,000 or more; on average, they borrow $28,000.

The Brookings Institution is committed to quality, independence, and impact.

We are supported by a diverse array of funders. In line with our values and policies, each Brookings publication represents the sole views of its author(s).

Commentary

Five facts about student loans

November 12, 2019