Growth in loans-to-deposits ratio and house prices are best leading indicators of banking crises

In an ECB working paper using data on 11 EU countries between 1980 and 2013, Patrizio Lainà and Juho Nyholm of the University of Helsinki and Peter Salin of Goethe University Frankfurt find that growth of the loans-to-deposits ratio and house prices are the best leading indicators of European banking crises. The indicators performed best with a lead time of 3 years, but were useful anywhere from 1 to 4 years prior to the crisis.

Great Recession could improve public health through a lasting reduction in alcohol consumption

Using individual-level longitudinal data from Iceland’s Health and Wellbeing survey, Tinna Laufey Ásgeirsdóttir of the University of Iceland, Hope Corman and Kelly Noonan of Rider University, and Nancy Reichman of Rutgers University find that while most health-compromising behaviors fell during the Great Recession, most, with the exception of alcohol consumption, returned to their pre-crisis trend during the recovery. Because alcohol consumption did not return to its pre-recession upward trend, the authors suggest that this could have a lasting impact on public health.

Investment in oil and gas drilling increases employment

In an IMF working paper, Mark Agerton, Peter Hartley, Kenneth B. Medlock III, and Ted Temzelides of Rice University conclude that investment in oil and gas drilling, as measured by rig-count, has a positive impact on employment. The authors calculate that for each additional rig put in place, 37 jobs are created immediately, with an additional 224 created in the long run.

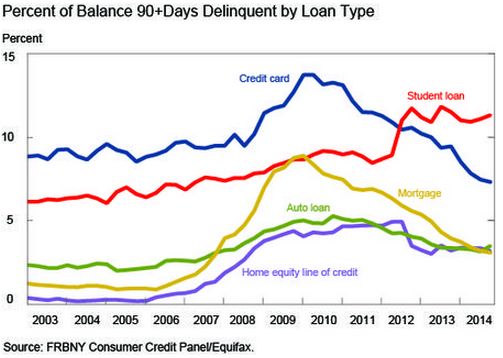

Chart of the week: Student loan delinquencies remain elevated as delinquencies from other loan types continue to fall

Quote of the week: Central bank control of macro-prudential policy is essential

“Macro-prudential policy and monetary policy rely on separate tools and aim to achieve different objectives. Yet, they need to be coordinated, which is a non-trivial task given that financial and business cycles could be desynchronized. For these reasons… macro-prudential policy should also be under the responsibility of central banks.

Finally, let me repeat the warning that without an effective macro-prudential policy, advanced economies will not be able to ensure financial stability. It is therefore an important endeavor to keep fighting for the appropriate policies to smoothen the financial cycle and to sufficiently tame finance in order to avoid crises that threaten the future of our economies.”

– Vítor Constâncio, Vice President of the European Central Bank

Commentary

Hutchins Roundup: Leading Indicators, Oil and Gas Investment, and More

February 19, 2015