This post discusses my monthly update of the Barnichon-Nekarda model. For an introduction to the basic concepts used in this post, read my introductory post (Full details are available here.)

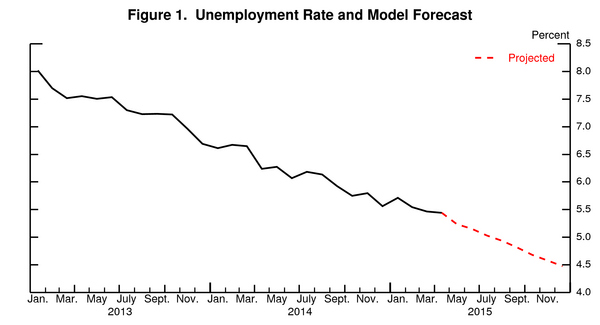

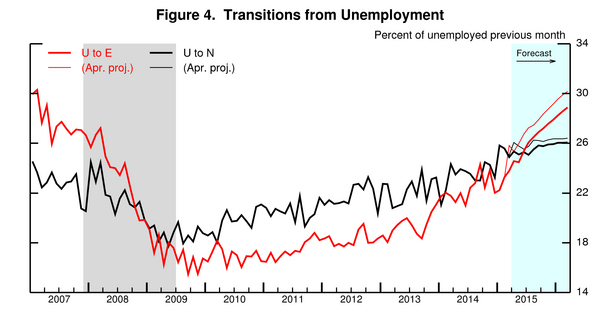

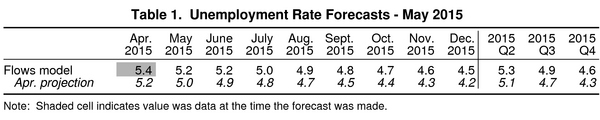

In April, the unemployment rate dropped by 10 basis points to 5.4%, while the model was anticipating a larger (25 basis points) decline. The miss was in worker’s job finding rate (hiring): the model was expecting a very strong rebound in hiring that only partially materialized (figure 4). However, the outlook remains very positive, and the model continues to predict that a large drop in unemployment is imminent; expecting a 20 basis points drop for May and a jobless rate of 5.2 percent. Going forward, the contour of the forecast is broadly unchanged with a steady decline in unemployment over the next 6 months.

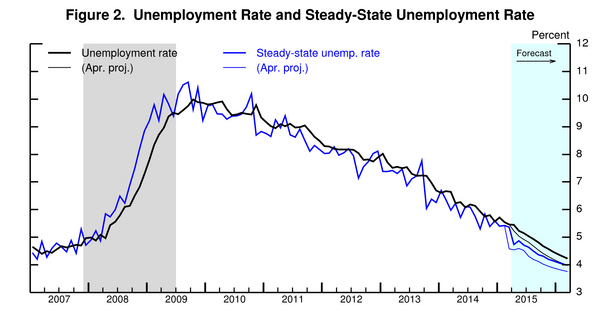

The model’s forecast can be easily understood by looking at the projected behavior of the “steady-state” unemployment rate. The steady-state unemployment rate, the rate of unemployment implied by the underlying labor force flows—the blue line in figure 2— stands currently at 4.7%, 0.7 percentage point lower than the actual unemployment rate. Our research shows that the actual unemployment rate converges toward this steady state. With a steady-state unemployment rate so much lower than the actual rate, this “steady-state convergence dynamic” will push the unemployment rate down strongly, implying a steady decline in unemployment going forward.

To forecast the behavior of steady-state unemployment, the model propagates forward its best estimate of how the flows in and out of unemployment will evolve over time. Following months of good news on the job openings front, the model anticipates strong growth in the job finding rate (U-E) over the next few months (figure 4), which will push down the steady-state unemployment rate, and will lead to a steady decline in the unemployment rate strongly over the next 6 months.

To read more about the underlying model and the evidence that it outperforms other unemployment rate forecasts, see Barnichon and Nekarda (2012).

Commentary

Unemployment to drop to 5.2% in May; to reach 4.8% by September

June 4, 2015