This post discusses my monthly update of the Barnichon-Nekarda model. For an introduction to the basic concepts used in this post, read my introductory post (Full details are available here.)

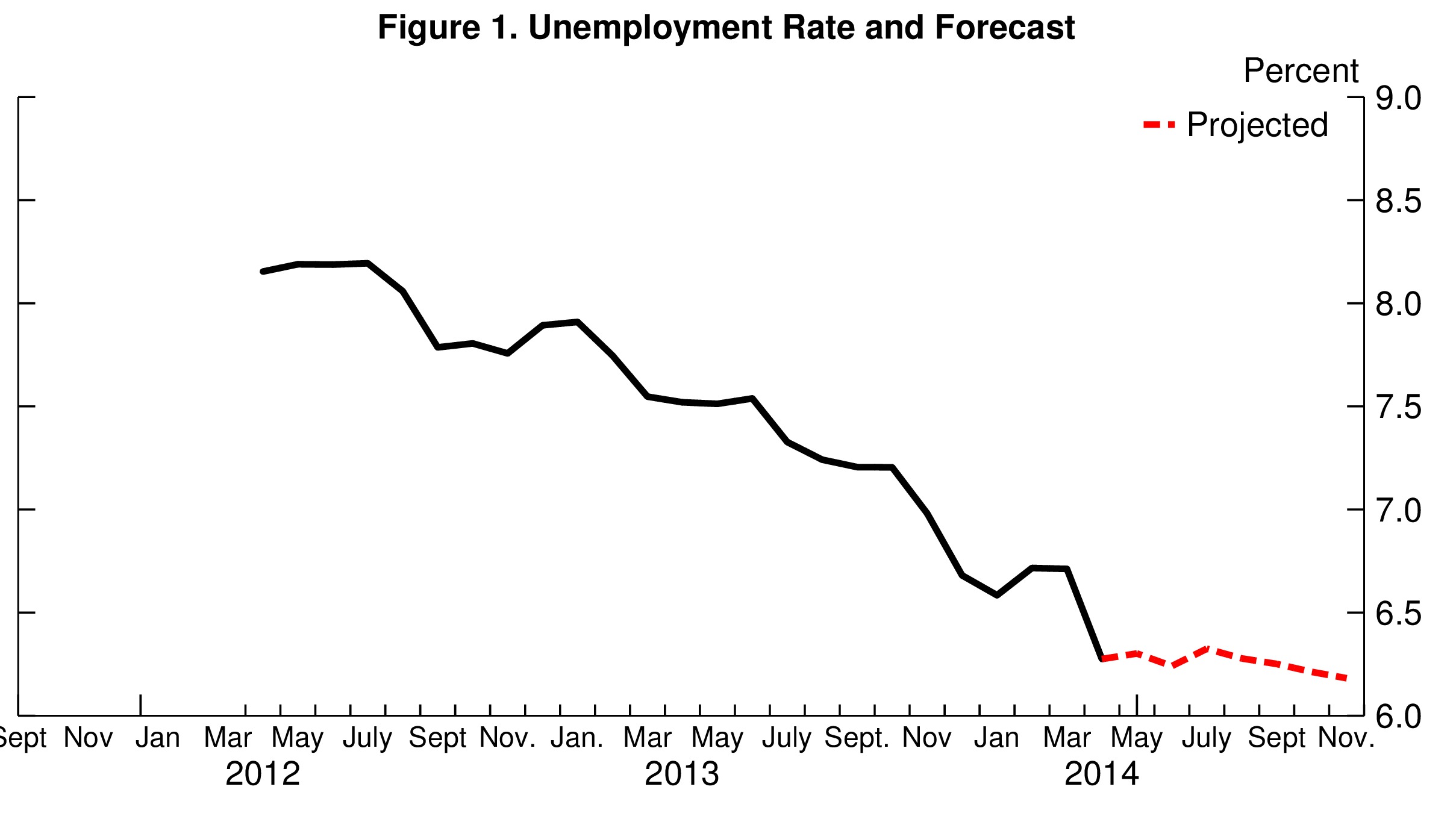

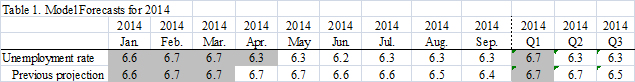

Following the dramatic decline in unemployment in April, I now see no further improvements in the unemployment rate over the next 6 months, with a jobless rate steady at 6.3% until September (figure 1).

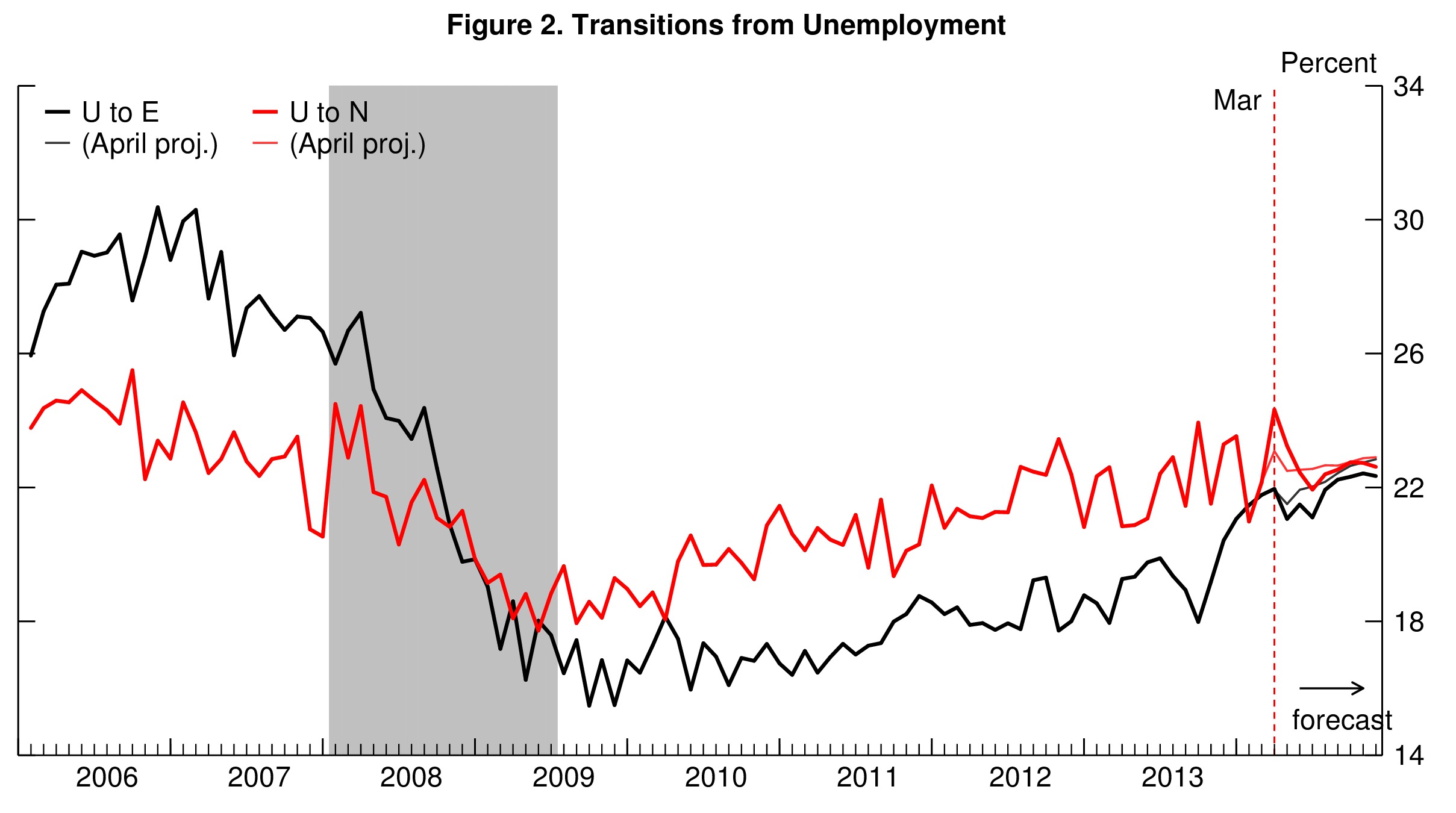

In April, the unemployment rate took an unexpected plunge and dropped from 6.7% to 6.3%, while our model anticipated no change. The decline was driven by a large increase in the Unemployment to Nonparticipation transition (UN) rate (figure 2), i.e., by an increase in the number of job seekers leaving the labor force. While it is a priori hard to tell whether this jump reflects a real phenomenon or whether it is just an artifact of sampling noise, the model’s forecast can give us some elements of an answer, because the forecast is based on past behavior of the worker flows, and therefore on “typical” movements in the flows. The fact that the model reverts the jump in UN over the next few months (figure 2) thus suggests that the April report was particularly noisy and hard to interpret.

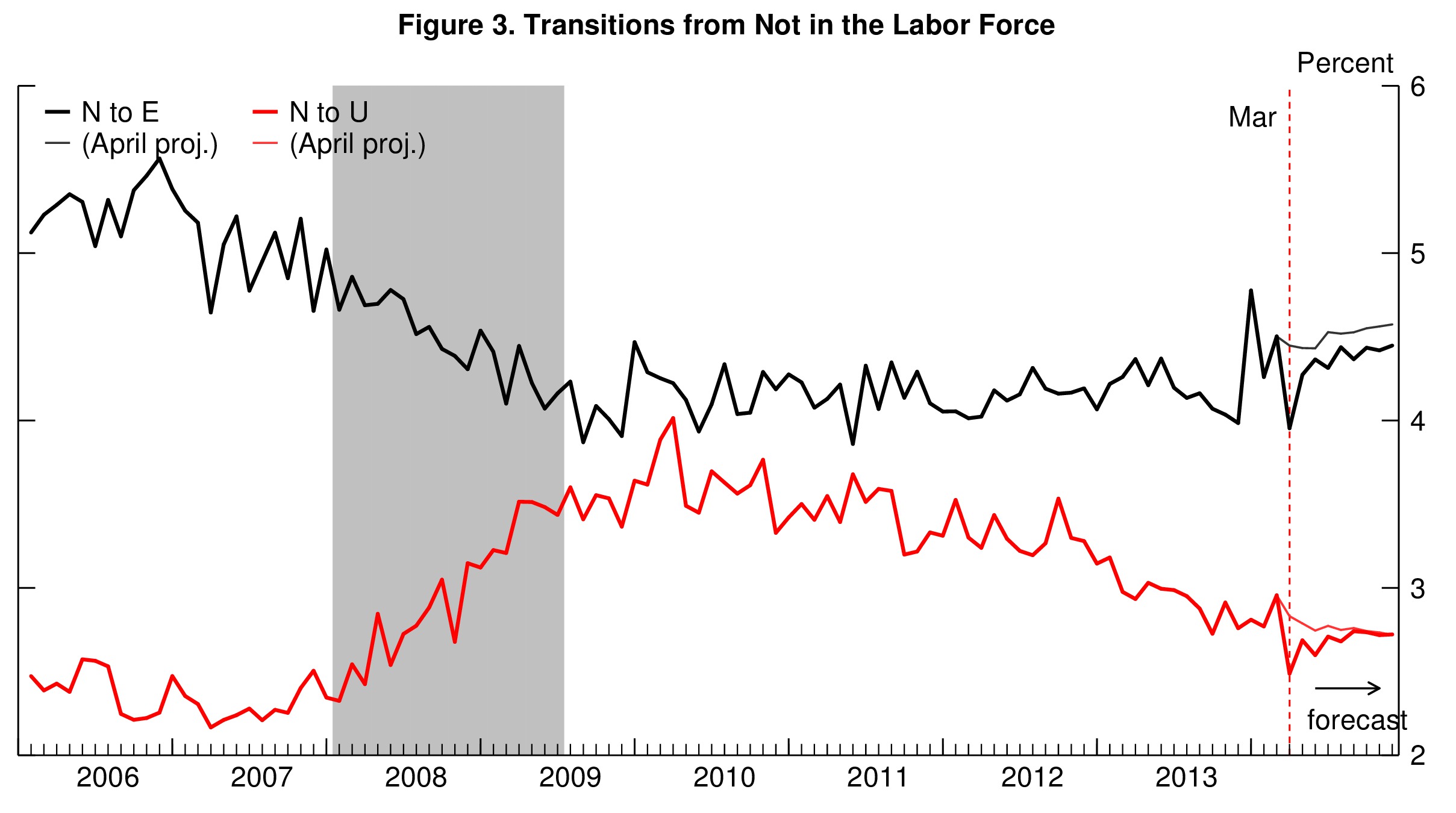

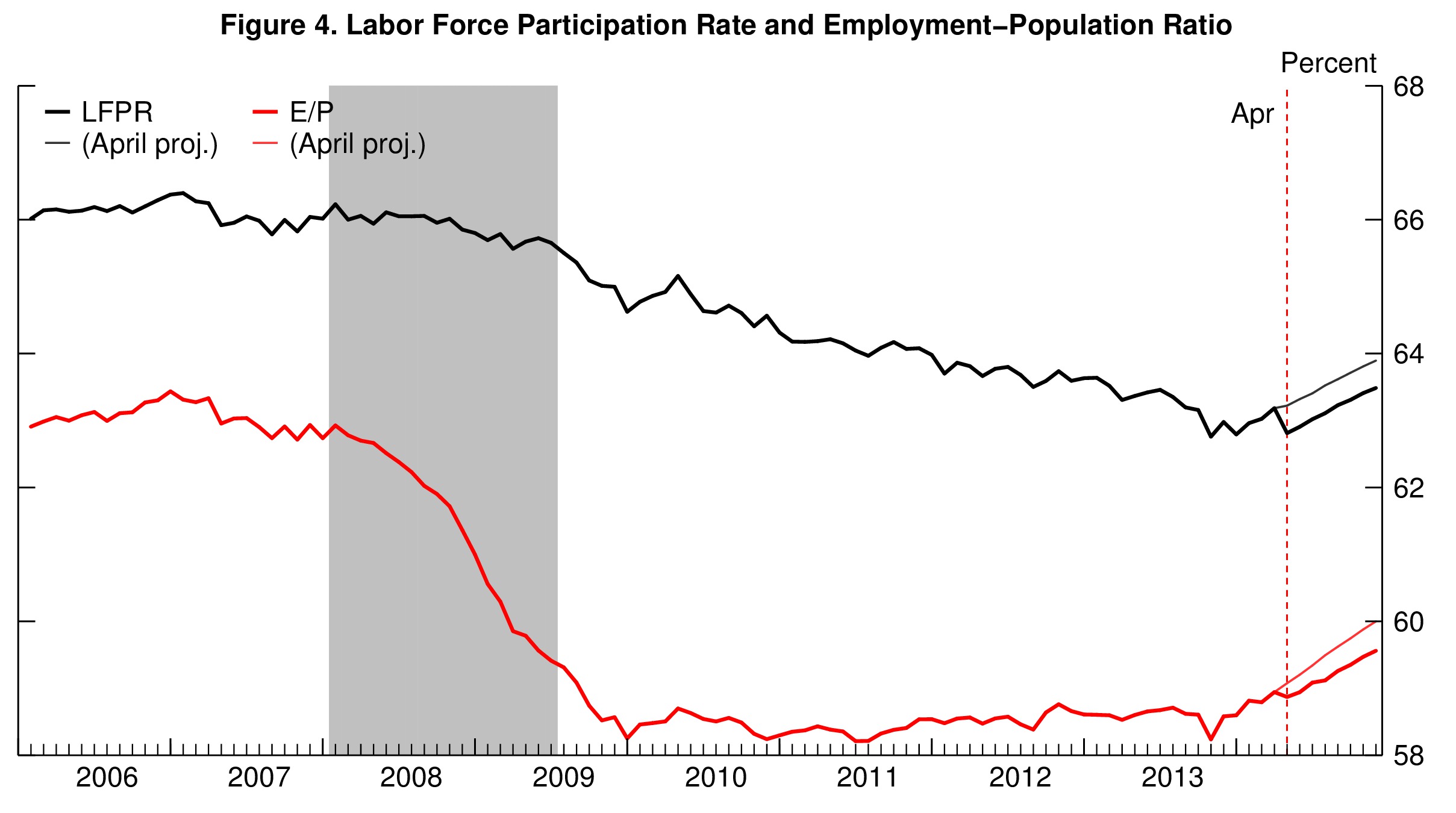

Interestingly, two other flow rates displayed surprisingly large movements: the Nonparticipation to Employment (NE) transition rate and Nonparticipation to Unemployment (NU) transition rate both dropped substantially (figure 3). While these changes had little effects on the unemployment rate as the two changes compensated each other (a lower NE rate implies a higher unemployment rate, while a lower NU rate implies a lower unemployment rate), they are responsible for the abrupt drop in the labor force participation rate in April (Figure 4). Again, the model’s forecast suggests that some of these movements reflect sampling noise as the model partially reverts the drops over the next few months. Again, the behavior of the worker flows suggests that the April report was particularly noisy.

Looking forward, the model sees no further improvements in the unemployment rate over the next 6 months, with a jobless rate steady at 6.3% until September.

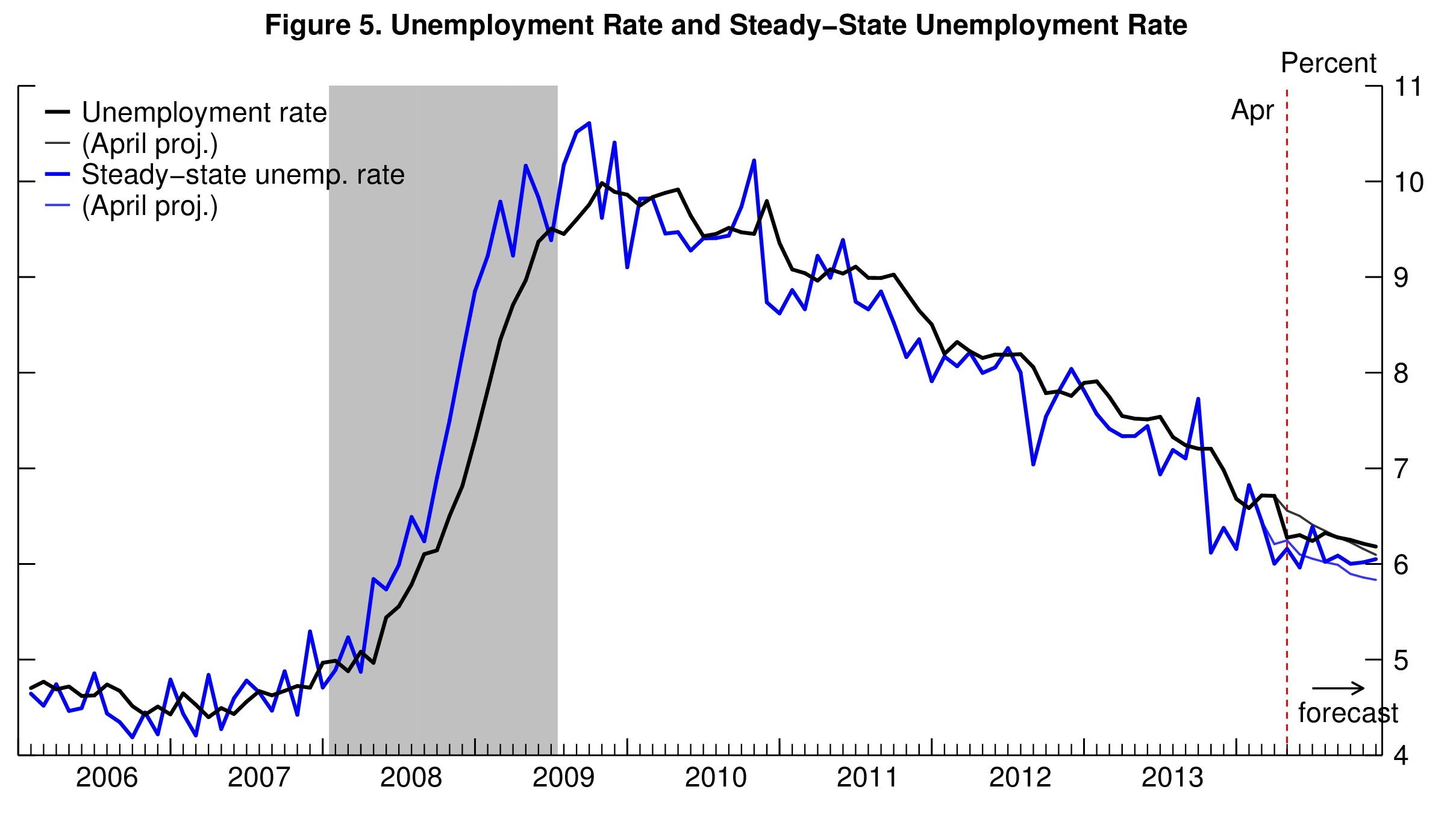

This model’s forecast can be easily understood by looking at the projected behavior of the “steady-state” unemployment rate. The steady-state unemployment rate, the rate of unemployment implied by the underlying labor force flows—the blue line in figure 5— stands currently at 6.2%, just 0.1% lower than the actual unemployment rate. Our research shows that the actual unemployment rate converges toward this steady state. With a steady-state unemployment rate only slightly below the actual rate, there is no strong “steady-state convergence dynamic” pushing the unemployment rate down. Instead, the behavior of the unemployment rate is dictated by the behavior of the steady-state unemployment rate. The model anticipates the steady-state unemployment rate (SSUR) to remain roughly flat over the coming months with a steady-state rate still at 6.2% by September (figure 5), implying no downward movement in unemployment rate over the next 6 months.

To forecast the behavior of steady-state unemployment (and hence of the actual unemployment rate), the model propagates forward its best estimate for how the flows in and out of unemployment will evolve over time. As already mentioned, the model sees the jump in the UN rate as transitory (this is also true for the NU and NE rates, although, as discussed, their joint effect on steady-state unemployment is small) and reverts its effect over the coming months. This force alone would work to increase steady-state unemployment going forward, but it is compensated by expected improvements in the EU and UE rates, which work to push unemployment down. All in all, steady-state unemployment is thus likely to remain roughly steady.

To read more about the underlying model and the evidence that it outperforms other unemployment rate forecasts, see Barnichon and Nekarda (2012).

Commentary

Unemployment to Remain Steady Following Dramatic Decline in April

June 5, 2014